An analyst who continues to build a following with macro crypto calls believes that Bitcoin (BTC) is almost ready to enter the parabolic phase of its market cycle.

Pseudonymous analyst TechDev tells his 490,300 followers on social media platform X that Bitcoin is showing technical signals that preceded steep rallies in the past.

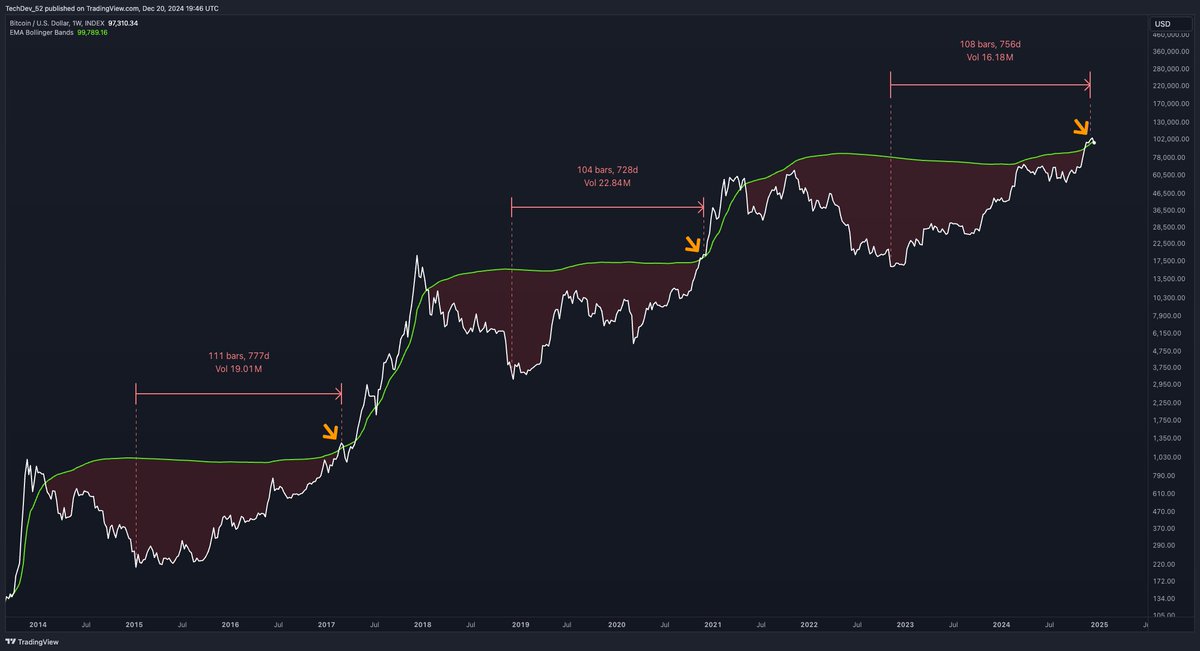

The trader shares a chart suggesting that Bitcoin has crossed the upper limit of its Bollinger Bands within a two-month time frame, after spending about two years recovering from a bear market low.

Traders use Bollinger Bands to identify potential periods of volatility increase and determine whether an asset is overbought or oversold.

TechDev’s chart also suggests that the two signals were present during the 2016 and 2020 market cycles – just before BTC produced parabolic spikes.

“This is where things have become exciting.”

Looking at BTC from a different perspective, TechDev says Bitcoin is in the early stages of a parabolic rise based on the crypto king’s logarithmic moving average convergence-divergence indicator (LMACD). The LMACD indicator is designed to reveal changes in the trend, strength and momentum of an asset.

“Paying attention to the high time frames (HTFs) provides the best opportunity to trade the cycles.

$30,000 was not the maximum because the HTF expansion had not yet ended.

$50,000 was not the maximum because the HTF expansion had not yet ended.

$70,000 was not the maximum because the HTF expansion had not yet ended.

$90,000 was not the maximum because the HTF expansion had not yet ended.

And HTF’s expansion is still not over.”

Based on the trader’s chart, he seems to suggest that Bitcoin will not experience a cycle top until the LMACD on the two-month chart reaches resistance at 0.12. BTC’s LMACD currently appears to be hovering at 0.04.

At the time of writing, Bitcoin is trading at $97,274.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney