- The altcoin market cap is recovering and the Altcoin Season Index suggests a bullish breakout is imminent.

- Chainlink is showing mixed performance, but open interest is increasing, indicating growing market interest.

After falling below $800 billion early last month, the total altcoin market cap is now starting to see a recovery since the beginning of the month of October.

Especially in recent days, the global market capitalization of altcoins has gradually increased, with a current valuation of $906 billion at the time of writing.

Alt season is here?

Amid these achievements, a crypto analyst known as Mustache on

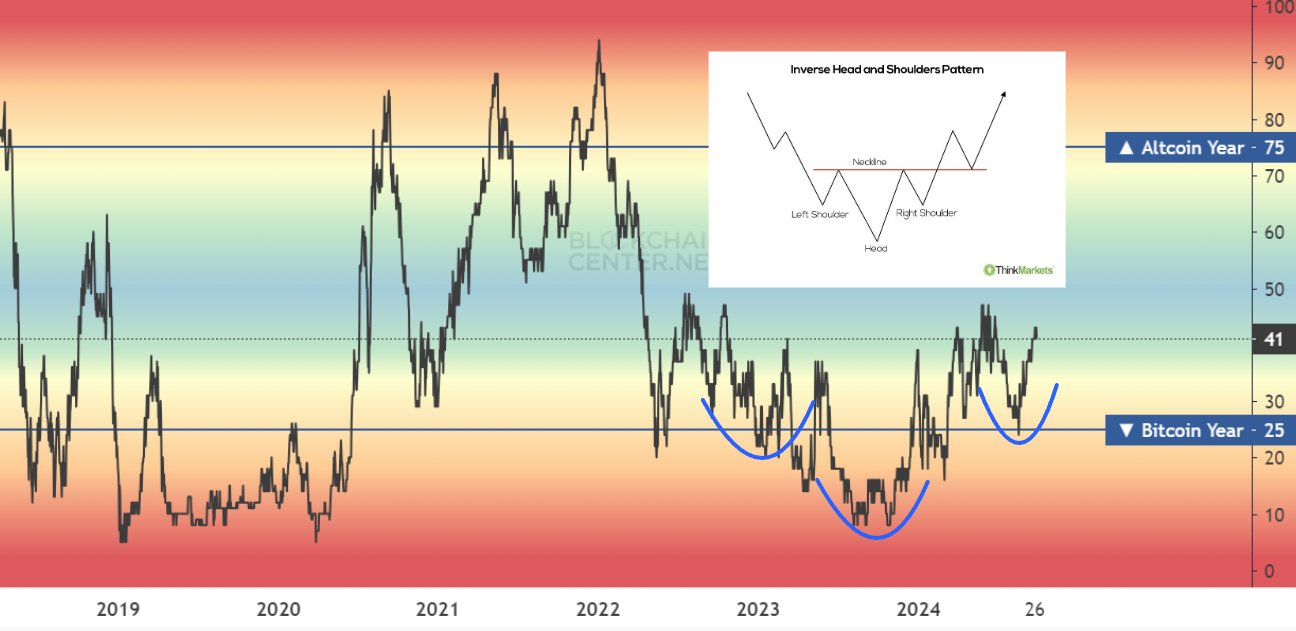

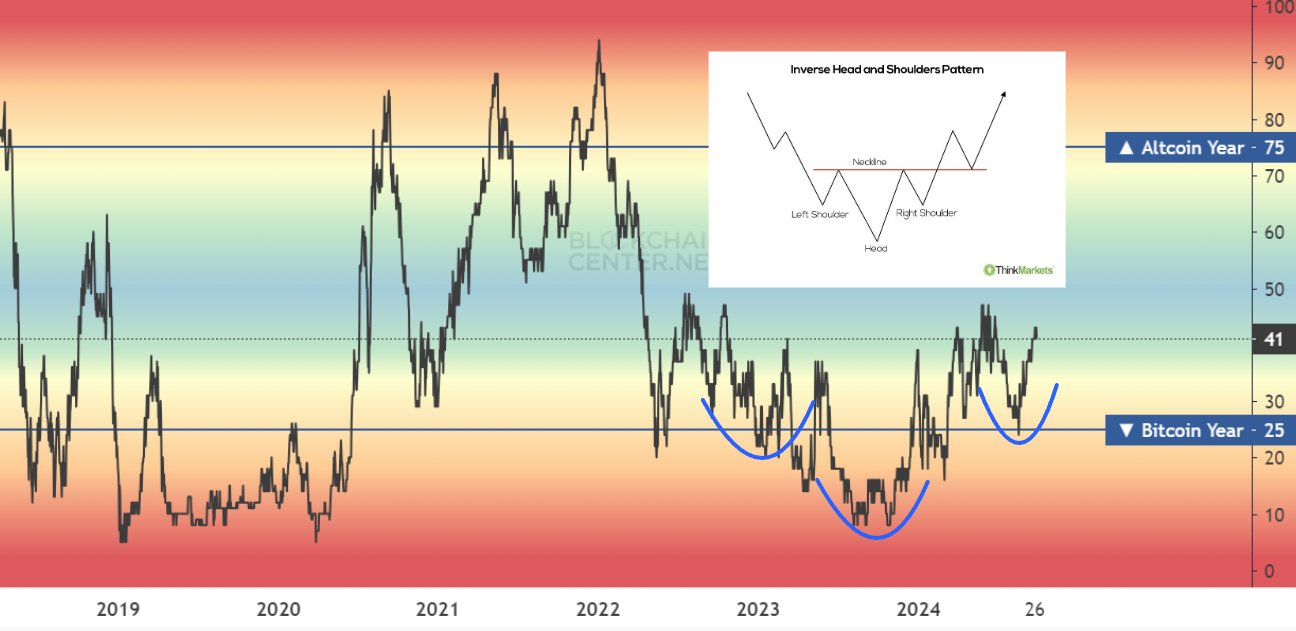

In a recent one afterMustache shared that the Altcoin season The index, which measures the relative performance of altcoins against Bitcoin, appears to be forming a bullish Inverse Head & Shoulders pattern.

Typically considered a strong indicator in technical analysis, this pattern is approaching a breakout point and could potentially pave the way for significant moves in the altcoin market.

Mustache emphasizes that the coming weeks and months could offer great opportunities for gains as the index completes its bullish formation and possibly initiates a trend reversal.

Source: Mustache on X

For context, in technical analysis, an Inverse Head & Shoulders pattern is considered a bullish signal, often indicating a reversal in a downtrend. The pattern usually consists of three valleys: a ‘head’ between two ‘shoulders’, with the head being the lowest point.

Once the price breaks the neckline formed by connecting the tops of the two shoulders, it often signals a possible upside breakout. For the altcoin market, this breakout could mark a shift from the current consolidation to a more expansive rally, which could yield significant gains for several altcoins.

Mustache’s observation regarding the Altcoin Season Index aligning with this pattern suggests that market sentiment could soon favor altcoins over Bitcoin, indicating a shift in capital flows.

However, while these technical indicators are encouraging, it is also crucial to look at the performance of individual altcoins to gauge the broader market movement.

Altcoin performance assessment: Chainlink as a use case

To understand the potential of an altcoin market recovery, it is important to analyze specific altcoins, such as Chainlink (LINK), which is among the top 20 cryptocurrencies by market capitalization.

Despite falling 5.5% in the past week, LINK maintains a generally bullish outlook, having risen 16.3% in the past month. Furthermore, LINK has shown positive movement over the past 24 hours, with its price up around 2% to $11.56.

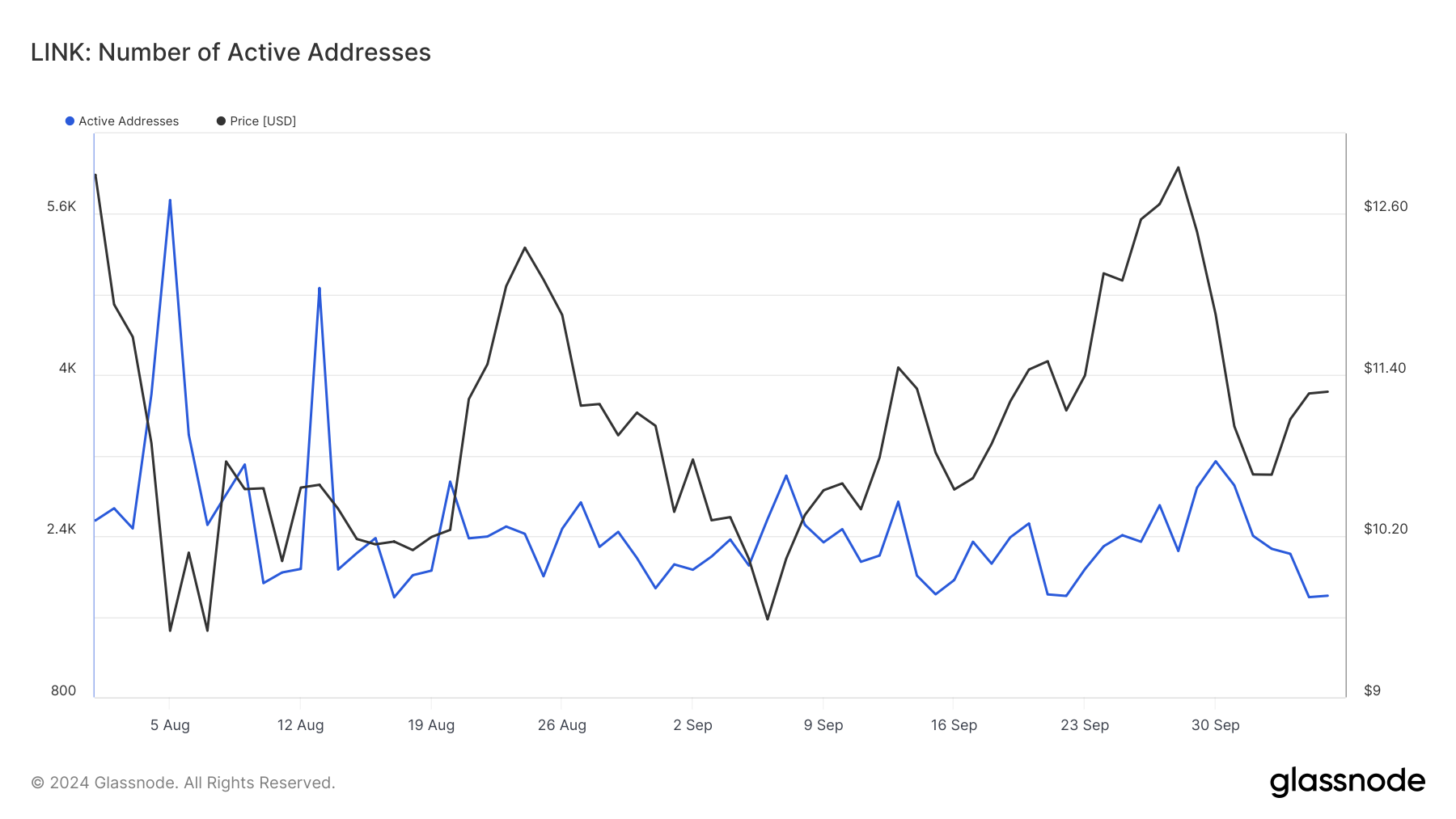

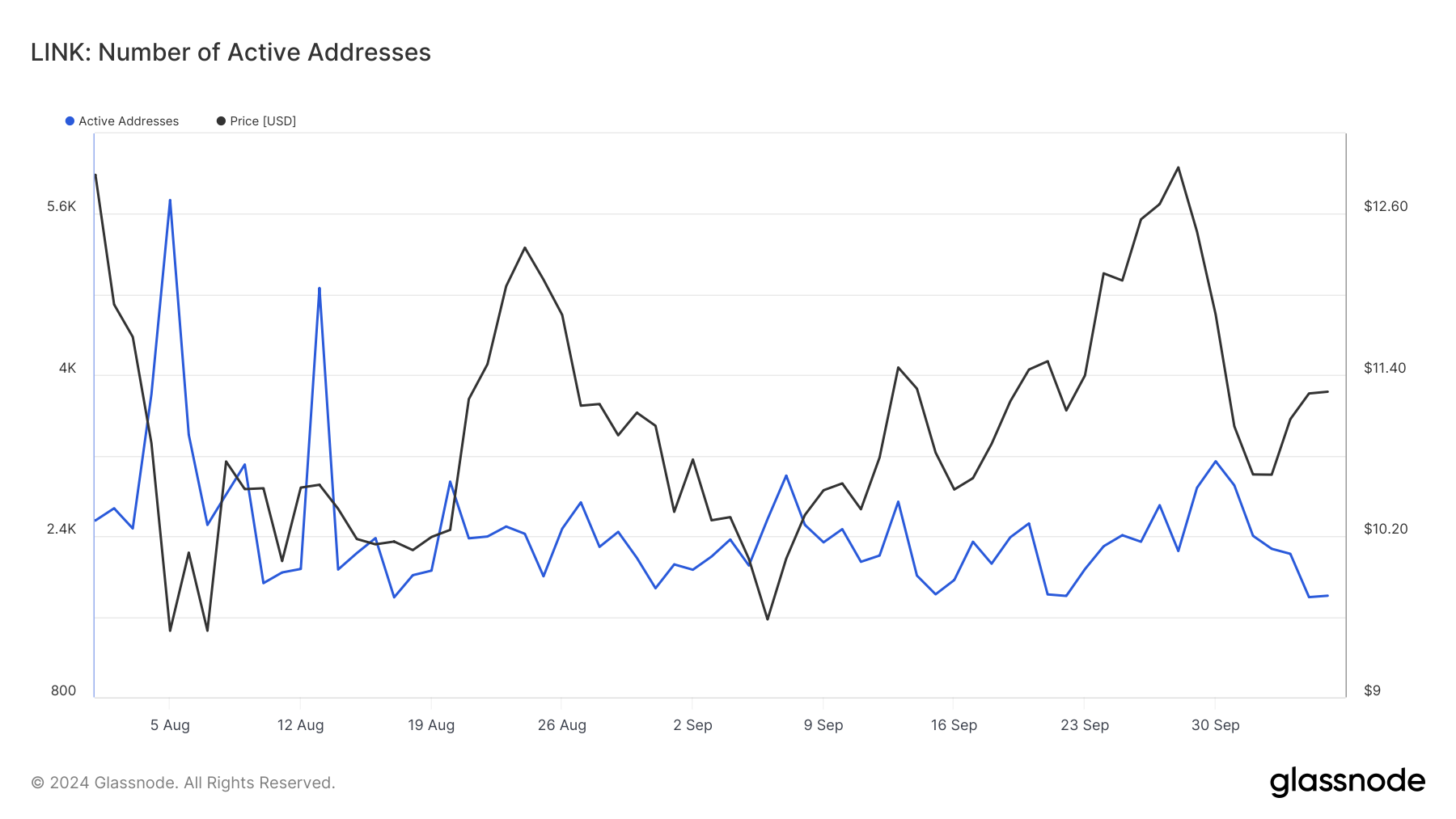

Delving into the fundamentals of LINK reveals key insights into the altcoin’s market sentiment and activity. Facts from Glassnode highlights a downward trend in LINK’s active addresses, a key metric indicating retailer participation.

Source: Glassnode

After reaching a high of 5,738 active addresses in August, the number has since dropped to around 1,809. This decline signals a reduction in retail activity and engagement, which may reflect broader trends in altcoin retailer participation.

However, LINK’s open interest offers a more optimistic picture. According to facts from Coinglass, LINK’s open stake rose about 4% to a valuation of $165.86 million.

Source: Coinglass

Read the one from Chainlink [LINK] Price forecast 2024–2025

Open interest volume, which tracks the total number of open positions on derivatives contracts, also rose 31.96% to $198.27 million.

The rise in open interest may indicate growing investor interest and greater confidence in the asset, potentially supporting the broader case for an upcoming altcoin season.