Crypto analyst Jamie Coutts emphasizes that blockchain technology will be applied regardless of the positivity or negativity of the cryptocurrency market.

“Today there will be five million crypto users per day, that will probably be a hundred million within five years,” he noted.

Blockchain is forging its unique path

Coutts claims that blockchain adoption rates remain consistently high regardless of the prevailing market cycle in the crypto space, be it a bull or bear market.

“The adoption of blockchain technology in the bear market/bull market continues unabated. Not being exposed to one of the biggest structural trends of the next decade could be costly.”

Meanwhile, a recent PwC report highlighted the growing importance of blockchain technology in tackling the growing problem of financial inclusion.

The report underlines the urgency of adopting blockchain more widely to combat this problem.

Learn more: What is market capitalizationN? Why is it important in crypto?

The Blockchain Challenges of Major Financial Institutions

PwC’s statistics reveal the increasing challenge of limited access to traditional banking and the ability to save money for a significant portion of the world’s population, making it more important than ever to embrace blockchain technology more widely.

Recently, Sergey Nazarov, co-founder of Chainlink, highlighted the obstacles banks currently face in their efforts to adopt blockchain technology.

Nazarov pointed out that the substantial financial and temporary investments of banks around the world in the traditional SWIFT payment system will make it challenging for them to move away from it.

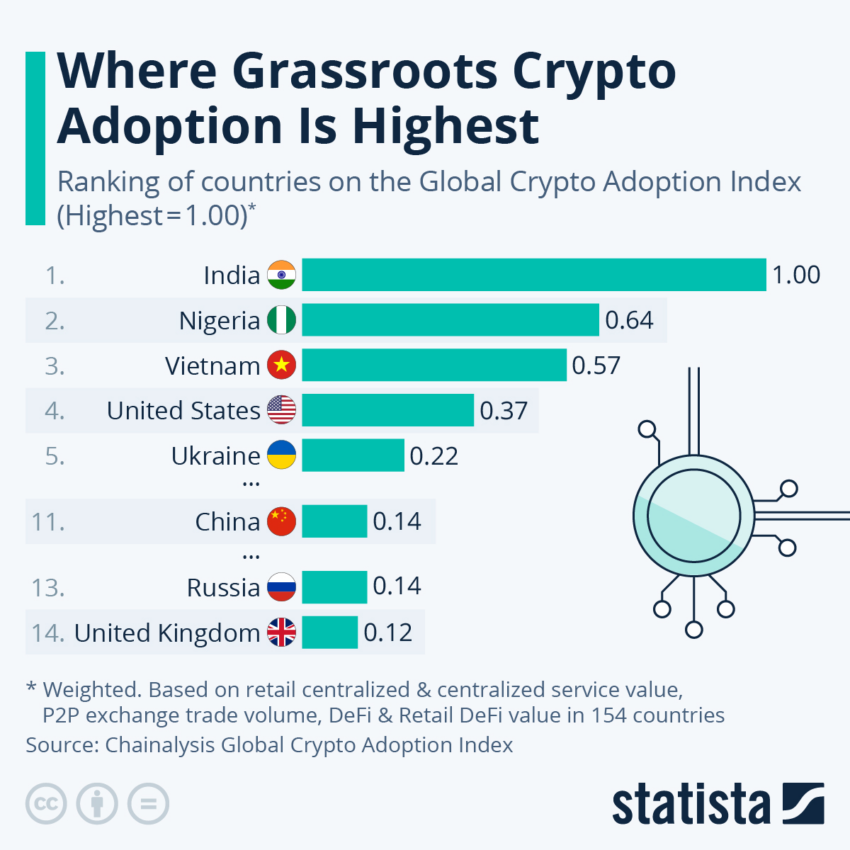

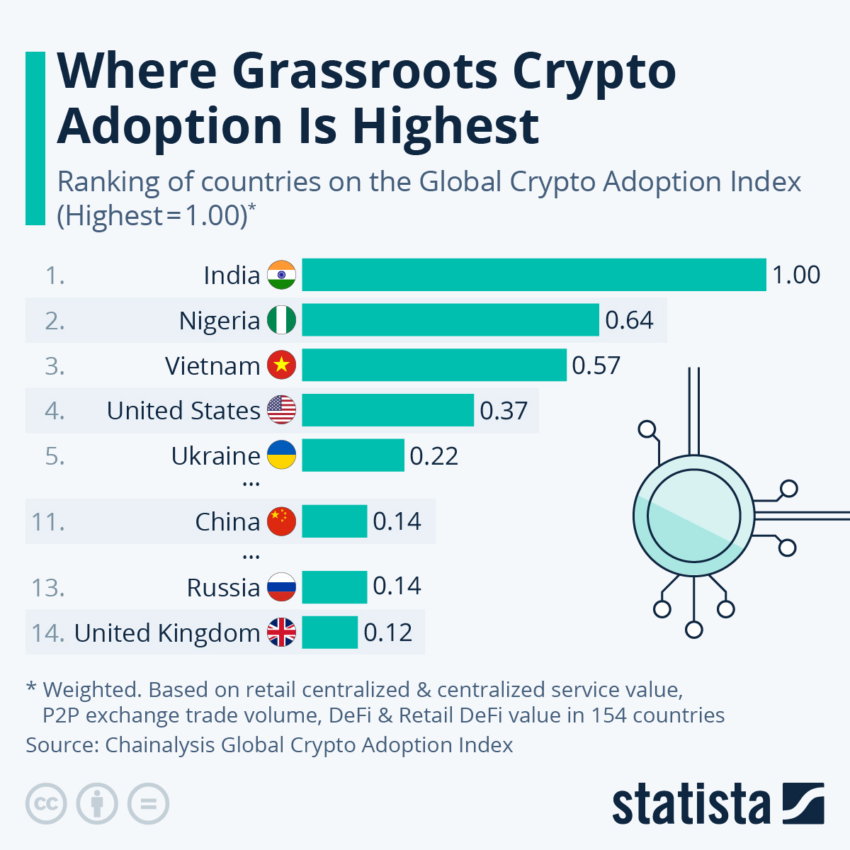

Conversely, the leading hotspots for global cryptocurrency adoption are not necessarily the most obvious choices.

Grassroots global crypto adoption by country. Source: Statista

India holds the number one position on the global crypto adoption index, with Vietnam, the Philippines, Ukraine and Kenya following closely behind.

Learn more: Blockchain Infrastructure Implementation: Challenges and Solutions