- Cronos breaks out of a declining channel and is targeting a 50% upside if momentum continues.

- On-chain activity and cautious market sentiment support CRO’s current bullish trend.

Cronos [CRO] has attracted significant market attention with an impressive 25% increase in the last 24 hours, pushing the price to $0.137 at the time of writing.

With market capitalization rising to $3.64 billion, up 8.12% and 24-hour trading volume up over 62%, CRO’s bullish rally has attracted widespread market attention. However, the question remains: can CRO maintain this momentum and continue to rise?

Escape from a massive descending channel: what’s the next target?

CRO recently broke through a long-term bearish channel, a pattern that typically signals a potential reversal in bear markets. This breakout, which is clearly visible on the chart, suggests that downward pressure may have subsided and given way to a bullish reversal.

Given this breakout, the next major resistance target is at $0.204, a key psychological level that if reached could represent a significant 48% upside from the current price.

However, achieving this goal will require sustained buying pressure and increased momentum. Therefore, CRO’s ability to break and hold above nearby resistance levels will play a crucial role in determining whether this rally continues or stalls.

Source: TradingView

Technical CRO indicators point to further volatility

Technical indicators further emphasize CRO’s bullish trend. The recent moving average (MA) crossover, which saw the 9-day MA at $0.0964 break above the 21-day MA at $0.0838, confirms this momentum shift, indicating that buyers are gaining control.

Furthermore, the Average True Range (ATR) has risen sharply to 0.0103, reflecting increased volatility. This increased ATR suggests that CRO could experience significant price swings in the coming days, making it essential for traders to keep a close eye on support and resistance.

Source: TradingView

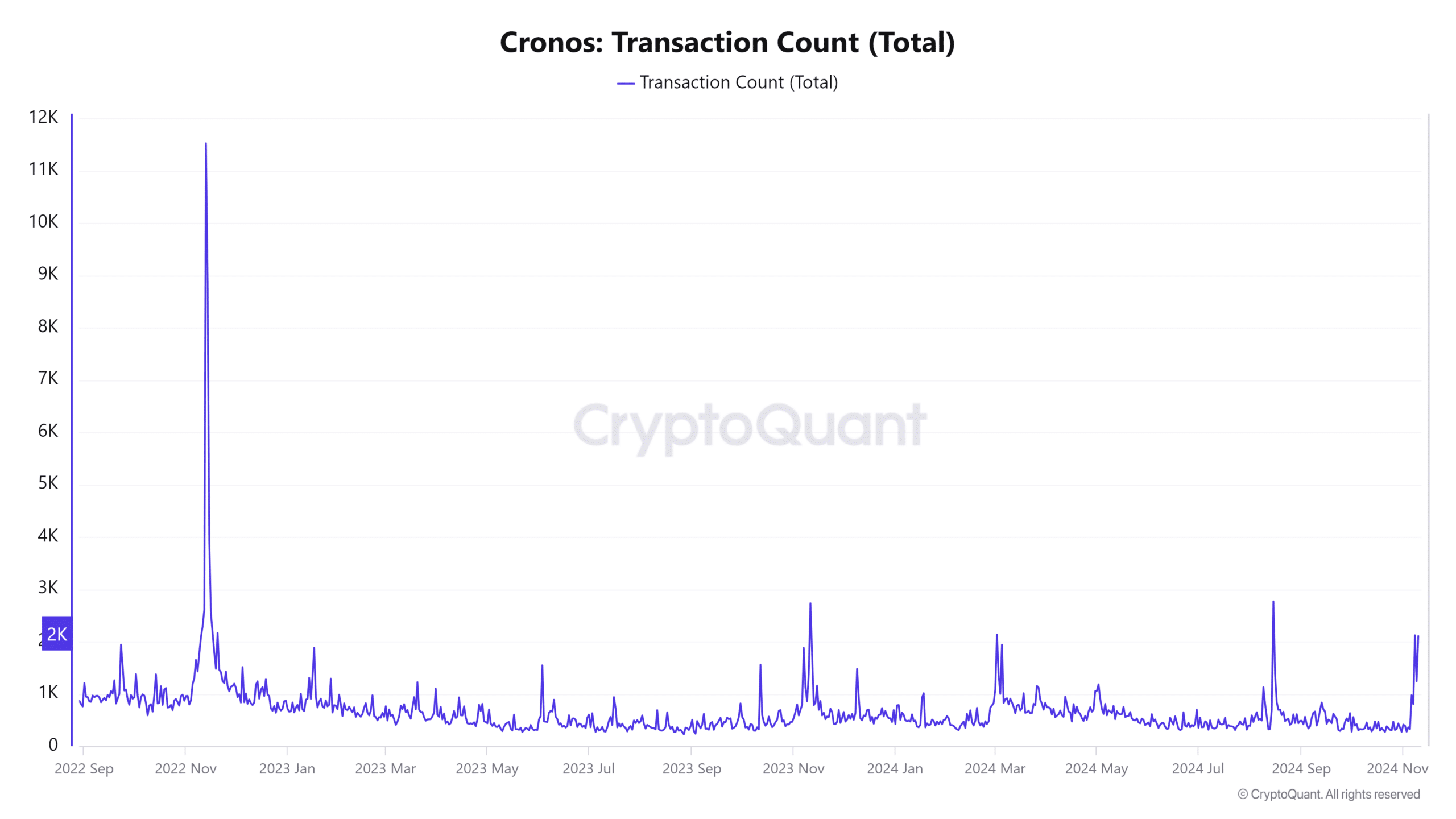

Statistics about the chain show increasing involvement

On-chain data shows that CRO network activity has also increased, reinforcing the bullish outlook according to CryptoQuant’s analyses. Active addresses grew by 1.44% over the past 24 hours, while the number of transactions increased by 1.47%, reaching a total of 2,317,000.

This increase in networking activity demonstrates greater engagement within the CRO ecosystem, a sign of growing trust and participation among users and investors.

Source: CryptoQuant

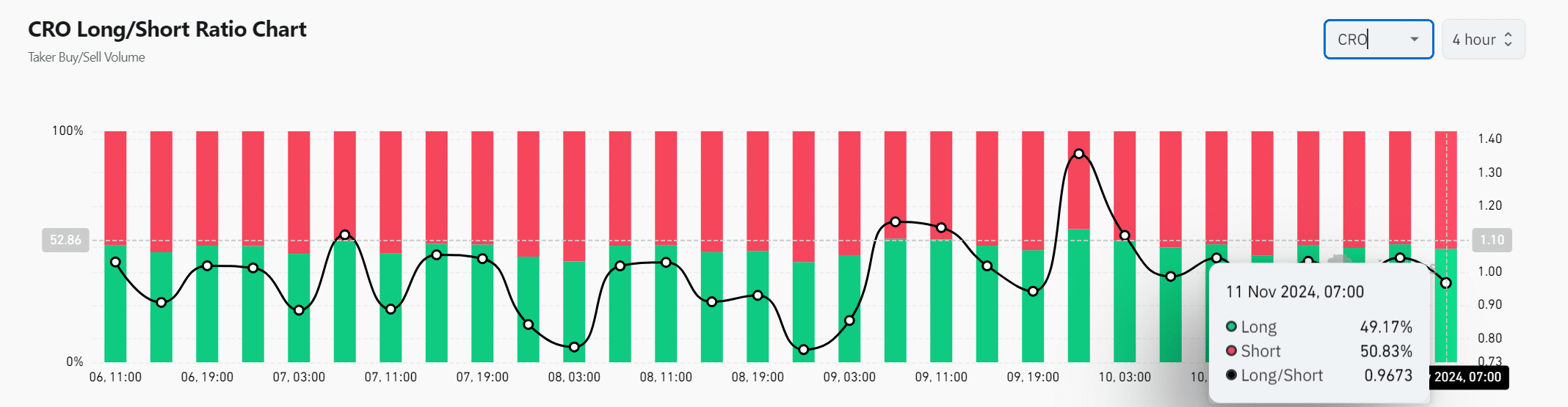

Market sentiment: The long/short ratio indicates cautious optimism

Market sentiment, as illustrated by the long/short ratio, is currently hovering around an even split, with 49.17% of positions long and 50.83% short. This balanced ratio reflects cautious optimism among traders, with a slight bias towards short positions, indicating some uncertainty about the sustainability of the rally.

However, a shift in sentiment could quickly lead to further gains if the ratio starts to favor long positions.

Source: Coinglass

Can CRO maintain its upward momentum?

With a strong breakout from a descending channel, positive technical indicators, rising on-chain activity and cautious market sentiment, Cronos appears poised for further gains.

However, the token’s ability to maintain its upward trajectory will depend on continued buying interest and resilience at critical resistance levels.

As volatility increases, CRO’s performance in the coming days will reveal whether this rally has staying power in the competitive altcoin landscape.