- COW crypto recently reached an ATH in volume.

- The price has also set a new record.

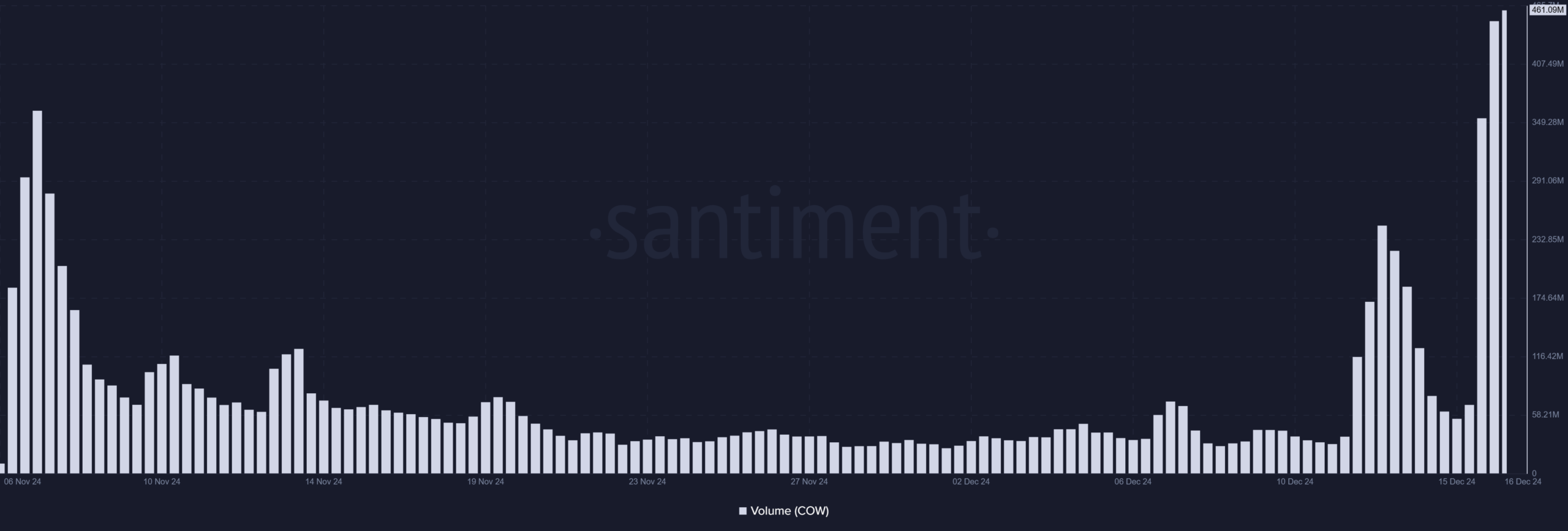

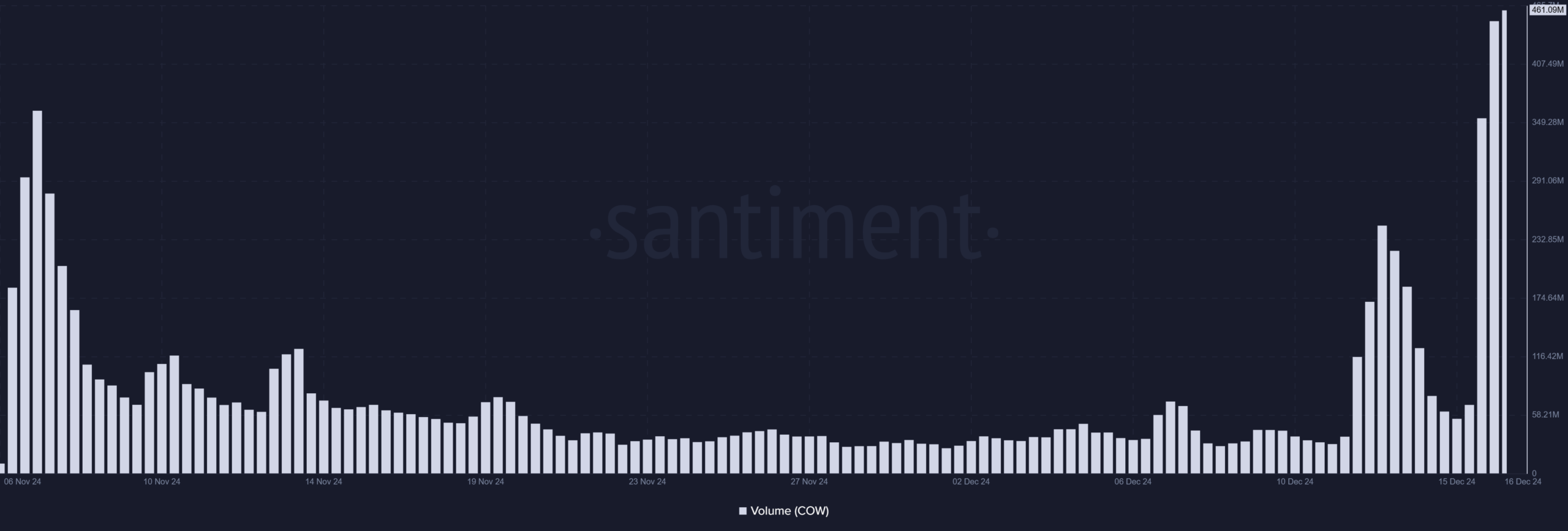

CoW protocol [COW] has reached a major milestone, with trading volume skyrocketing to an all-time high. This increase surpassed the previous peak of $361 million in November, reflecting increased user engagement.

In addition to the volume spike, COW’s stock is up more than 50%, indicating strong bullish momentum as it nears $1.00.

CoW Protocol is witnessing a significant volume spike

The CoW protocol has recently experienced a remarkable increase in trading volume, increasing sixfold in a short period of time.

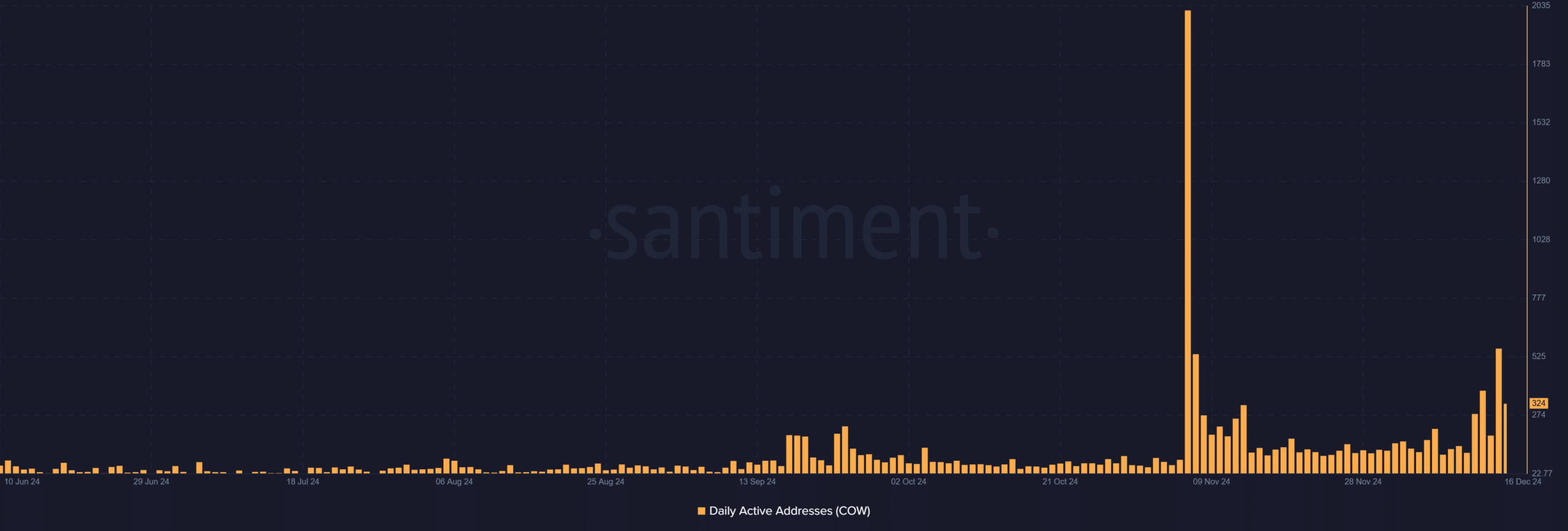

According to the data of Santimentthe protocol’s daily volume rose from its base level to over $461 million on December 16.

Source: Santiment

Further analysis showed that this was a record high. The previous ATH of $361 million, now the second ATH, came in November.

Increased activity levels often indicate increasing user engagement or liquidity injections, which can lead to further price increases.

COW crypto eyes a new peak?

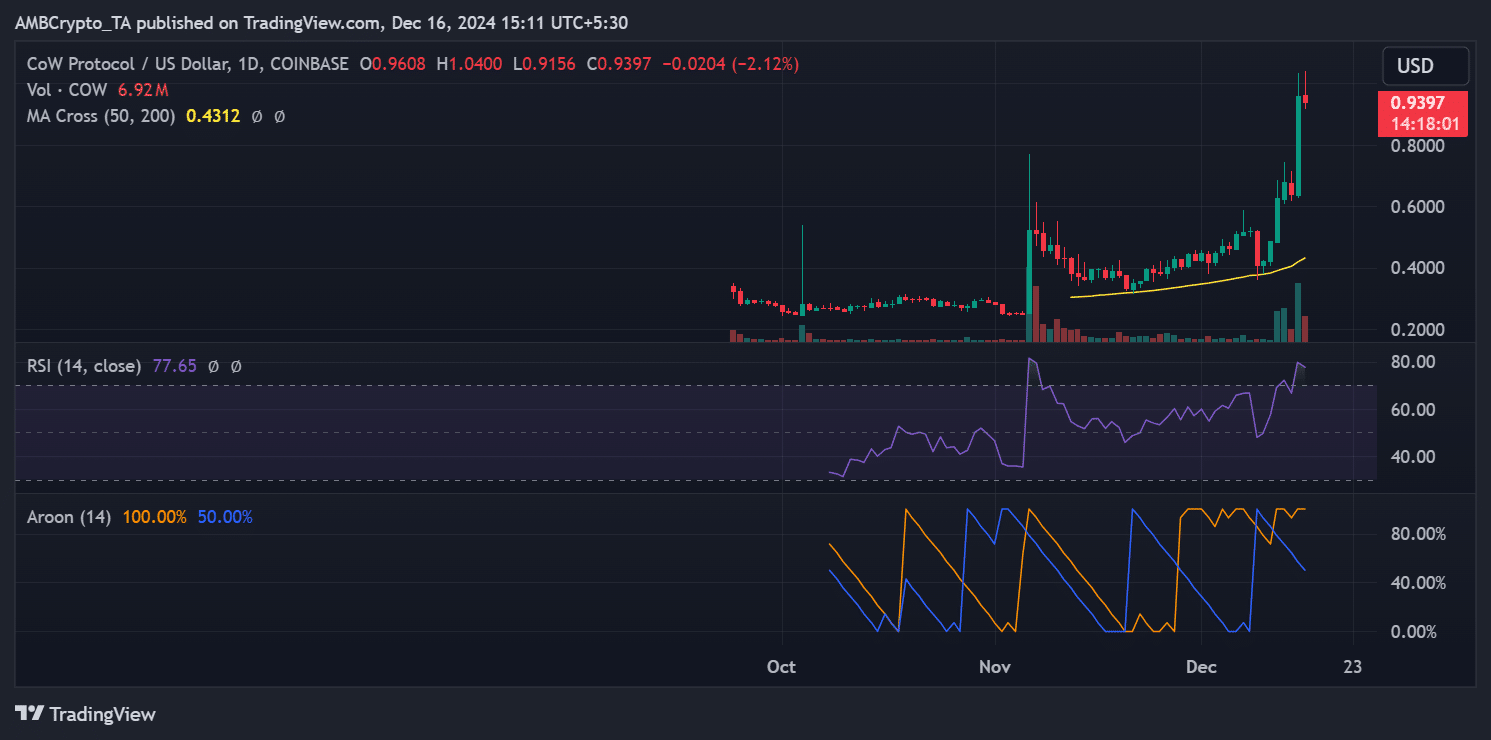

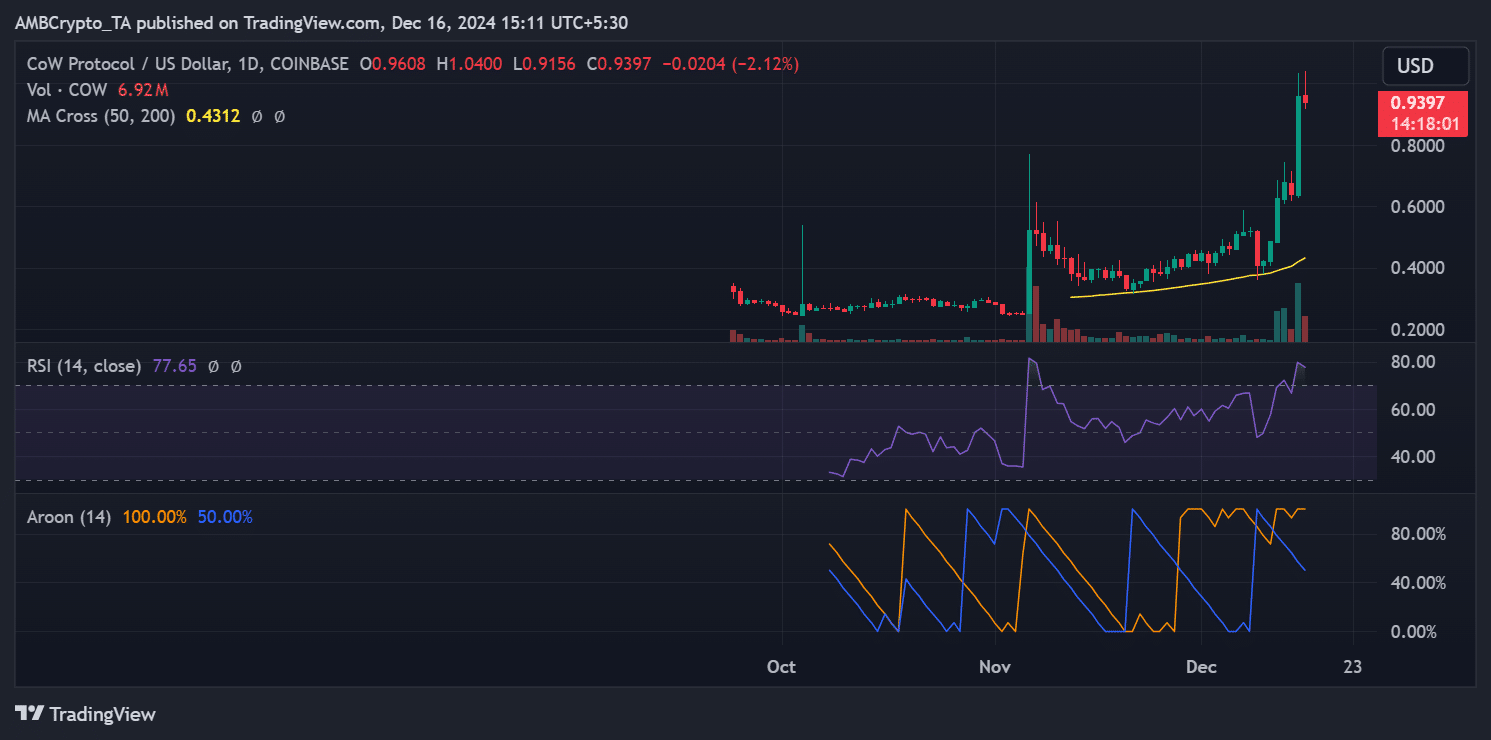

In addition to the increase in volume, CoW’s price has shown a sharp upward trajectory, rising more than 50% in recent sessions. On the daily chart, the CoW broke above the $0.60 level and is now hovering around $0.93.

This price spike was accompanied by a significant increase in trading volumes, indicating strong bullish momentum.

Notably, the Relative Strength Index (RSI) has entered overbought territory at 77.65, indicating increased buying pressure.

The Aroon indicator further highlighted a bullish trend, with the Aroon Up reaching 100% and showing strong upward momentum, while the Aroon Down remained suppressed.

Source: TradingView

A sustained close above $1.00 could pave the way for CoW Protocol to test its all-time high.

Conversely, any retracement could initially find support at the 50-day moving average around $0.43, followed by the psychological level of $0.60.

Involvement is increasing

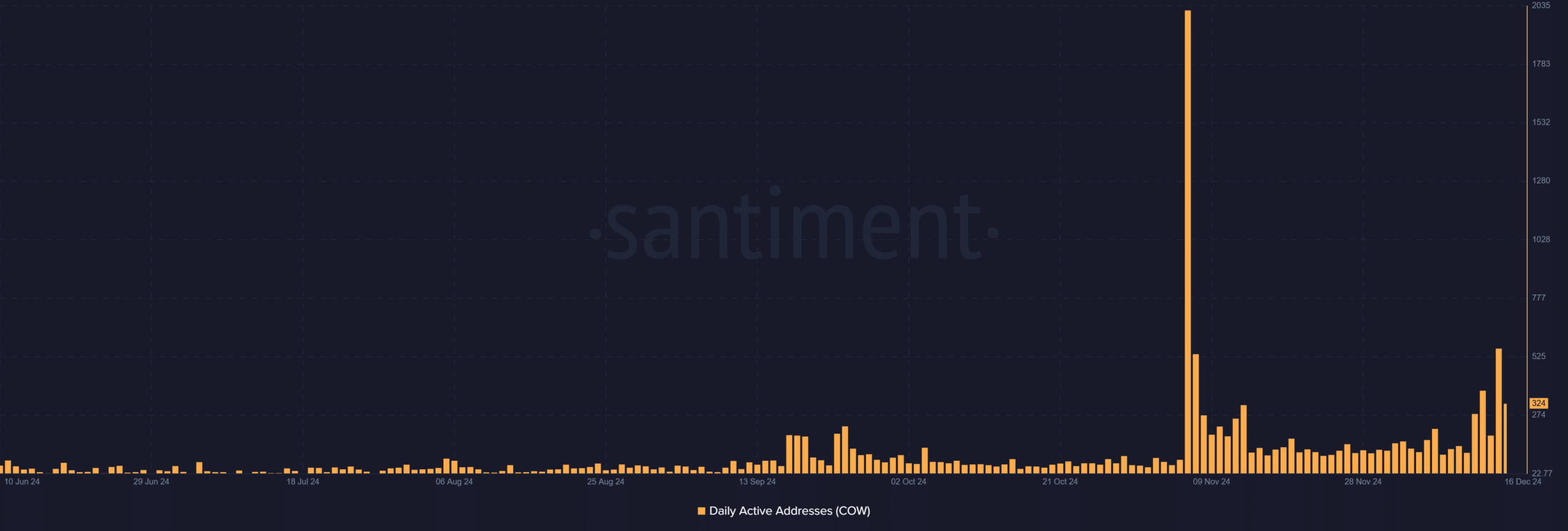

The volume spike aligned with an upward trend in daily active addresses, further supporting bullish sentiment.

After months of relatively quiet on-chain activity, active addresses increased sharply, indicating a growing user base. Santiment data showed the figure peaked significantly around December 15 before declining slightly.

This uptick underlines increased network participation, likely driven by the recent increase in price and trading volume.

Source: Santiment

However, the peak is mild compared to the volume. Analysis showed that the highest number of daily active addresses was in November, when the number peaked until 2015.

What this convergence means

The convergence of rising trading volume, rising active addresses, and significant price increases created a bullish outlook for CoW Protocol.

The continued activity suggested that market participants were optimistic about its long-term potential.

However, investors should pay attention to possible short-term corrections due to the RSI indicating overbought conditions.

Read the CoW protocol [COW] Price forecast 2024–2025

If trading volumes remain consistent and daily active addresses continue to grow, CoW Protocol could reach new all-time highs before the end of December 2024.

Market observers will be watching these numbers closely for signs of continued upside momentum or possible reversals in the coming days.