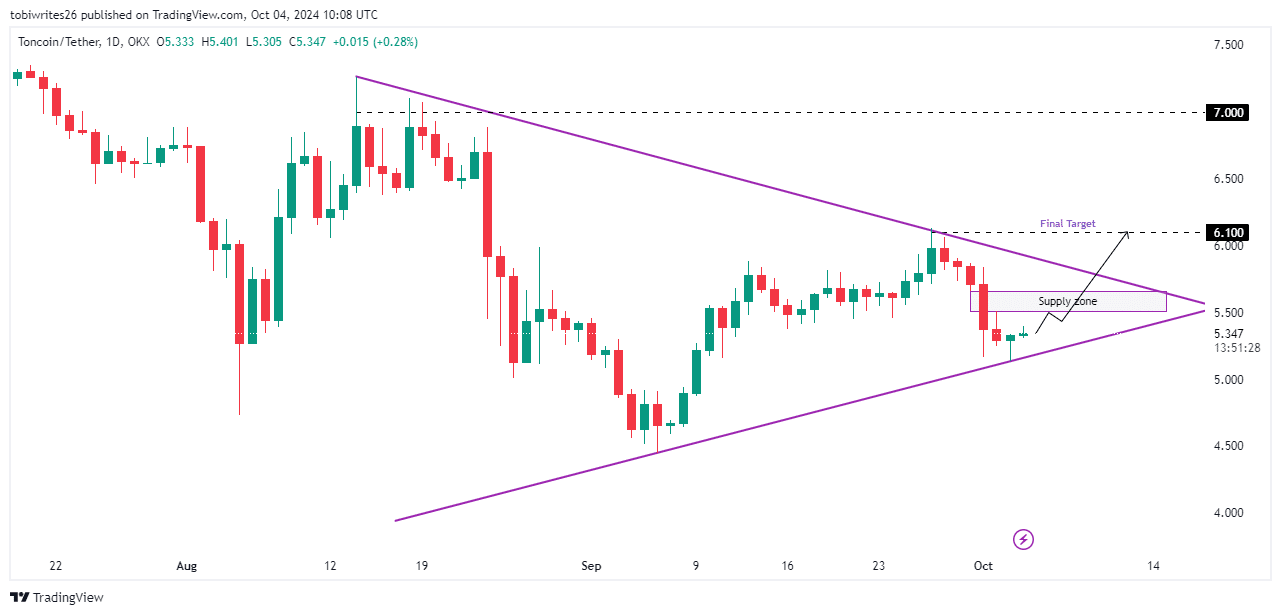

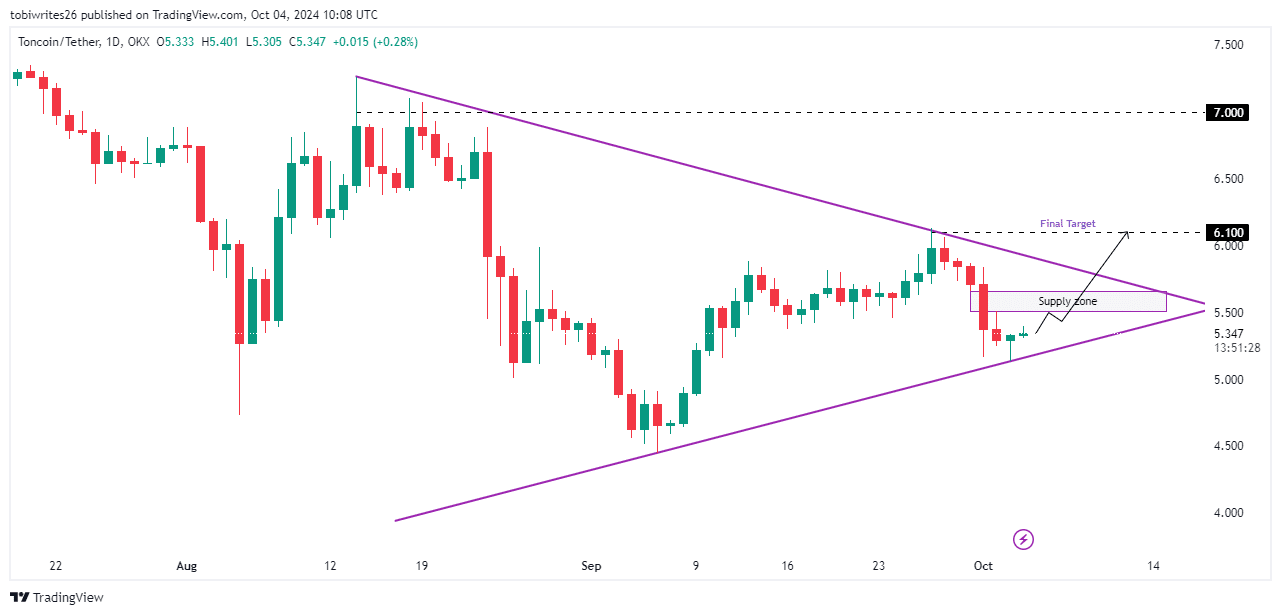

- TON navigated a large symmetrical triangle formation, suggesting a potential price move that could push the price towards $7.

- A short-term rally to $6 is conceivable, but dependent on overcoming substantial selling pressure.

After a market-wide downturn in which Toncoin experienced a change in price [TON] The value fell 8.0% to $5,135 over the past week, with the cryptocurrency showing signs of recovery. The price has risen 2.41% in the last 24 hours, supported by strong support levels, with the price trend appearing to be rising.

While TON is pursuing a short-term target of reaching $6.1, it faces potential risks that could hasten further declines. AMBCrypto provides an in-depth analysis of TON’s potential for a rally.

Evolving patterns in TON market dynamics

Previously, TON’s decline was largely attributed to a pullback from a resistance line and the breaking of an ascending trendline. However, the scenario has changed and now acts within a larger symmetrical triangle.

This symmetrical triangle, usually a bullish indicator, is where Toncoin is currently trading. The recent rise in market value is associated with the recovery of the support edge of this pattern, resulting in two consecutive daily bullish candles.

Despite the momentum of this rally, there are looming risks of a decline. TON is approaching a supply zone between $5,510 and $5,657, which could drive the price down further if support fails to maintain buying pressure.

Conversely, breaching this level could propel TON to a $6.1 target.

Source: trading view

AMBCrypto has analyzed whether this rally can be sustained and whether the short-term target of $6.1 is achievable.

Continued upside momentum in TON trading

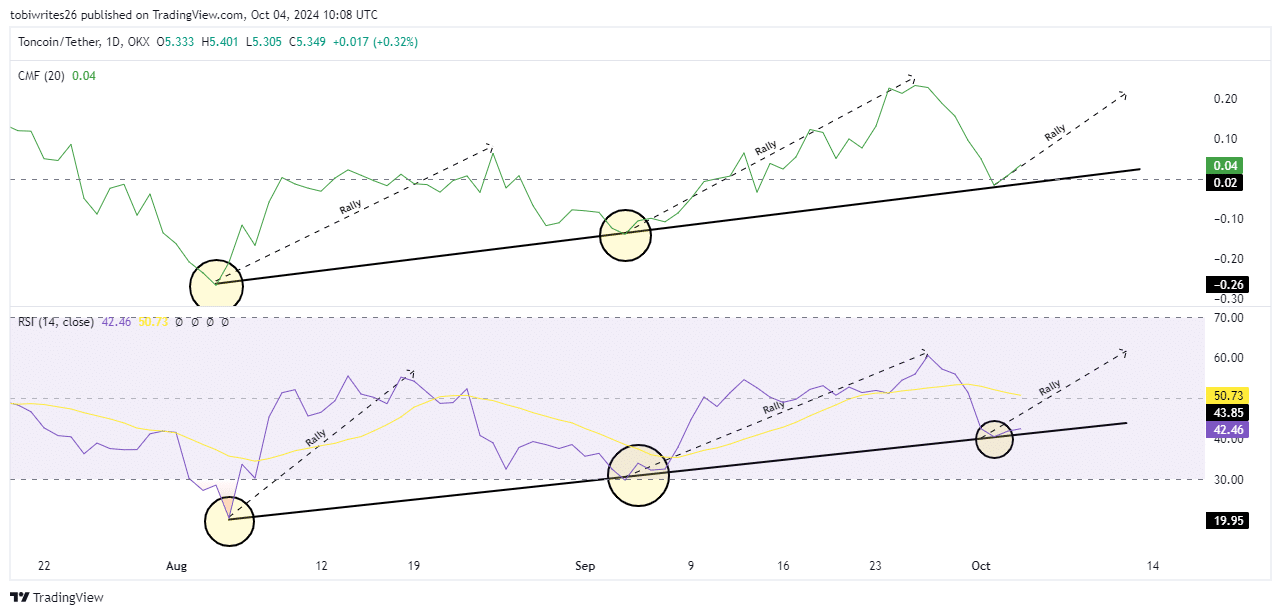

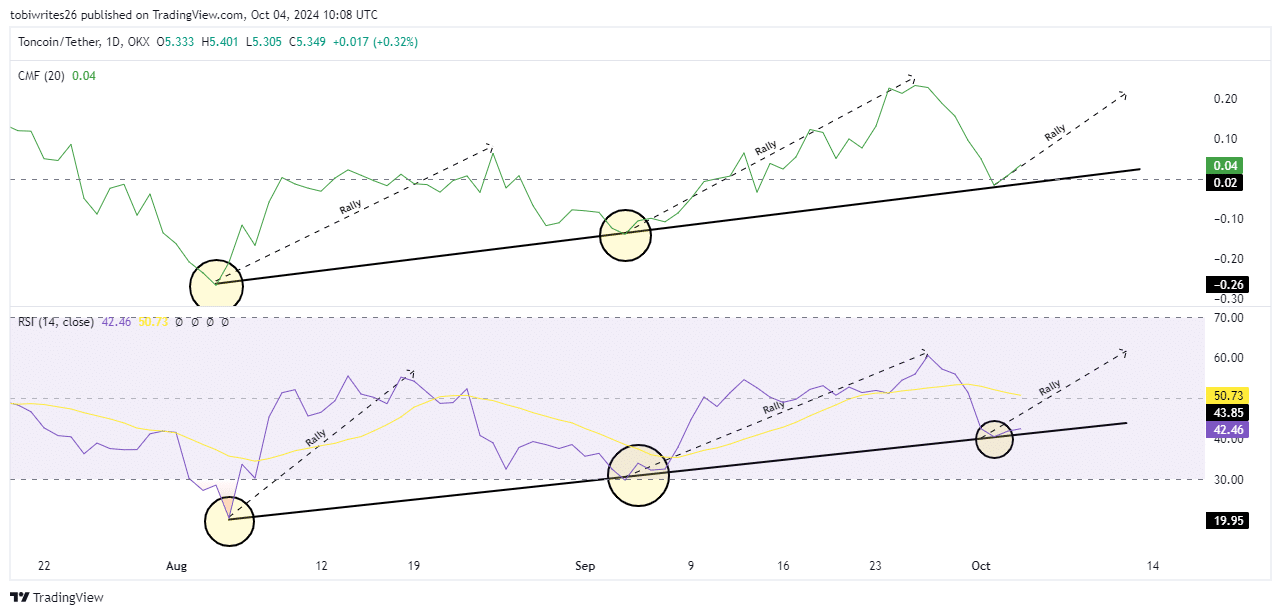

Recent trends indicate rising momentum among traders interested in acquiring TON, as evidenced by two key indicators: the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI).

The CMF is an important technical tool that assesses the flow of money into and out of an asset. A CMF value above zero that shows an upward trend indicates growing buying interest, a trend currently reflected in TON’s market activity.

Likewise, the RSI, which measures the speed and change of price movements, is in line with this uptrend. It currently stands at 42.54 and is rising, indicating that TON has peaked for a significant rally, especially once it crosses the 50 threshold.

Source: trading view

Given the inflow of liquidity and increasing bullish momentum, TON is more likely to breach expected supply levels.

Capital trends promote a bullish outlook for Toncoin

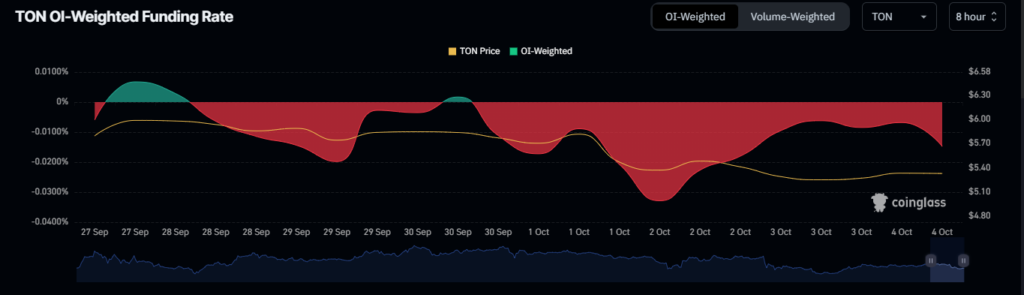

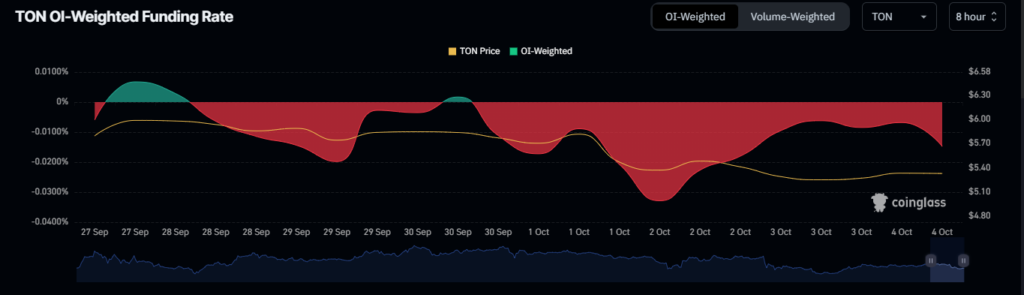

Using the Open Interest (OI) Weighted Funding Rate, AMBCrypto has determined that the prevailing market sentiment is decidedly bullish, indicating a strong bias of capital flow in that direction.

Read Toncoin’s [TON] Price forecast 2024–2025

The OI-weighted funding rate chart indicates that TON is gradually moving out of bearish territory, indicating an increase in the number of long position traders entering the market.

Source: Coinglass

Entering the bullish zone would confirm that TON is well positioned to achieve its short-term and long-term price targets of $6.1 and $7.0, respectively.