Posted:

- More than 400,000 UNI tokens have recently been sold.

- UNI has continued to decline and is trading below $5.

The 1Inch Investment Fund has acquired Uniswap [UNI] tokens a few months ago and has now chosen to sell its entire holdings. Will this have any effect on the UNI trend?

1Inch is divesting its Uniswap interests

As reported by Spot on chainthe 1Inch Investment Fund sold its shares in Uniswap on November 17. The tracked wallet revealed the sale of its entire supply, consisting of 416,924 UNI tokens worth approximately $213 million.

The tokens were sold at an average price of $5.11. Interestingly, the wallet had purchased some UNI tokens earlier in February, acquiring 299,849 tokens worth around $2 million at an average price of $6.67.

The recent sell-off suggests the possibility of a loss on this investment.

How it affected Uniswap’s flow on exchanges

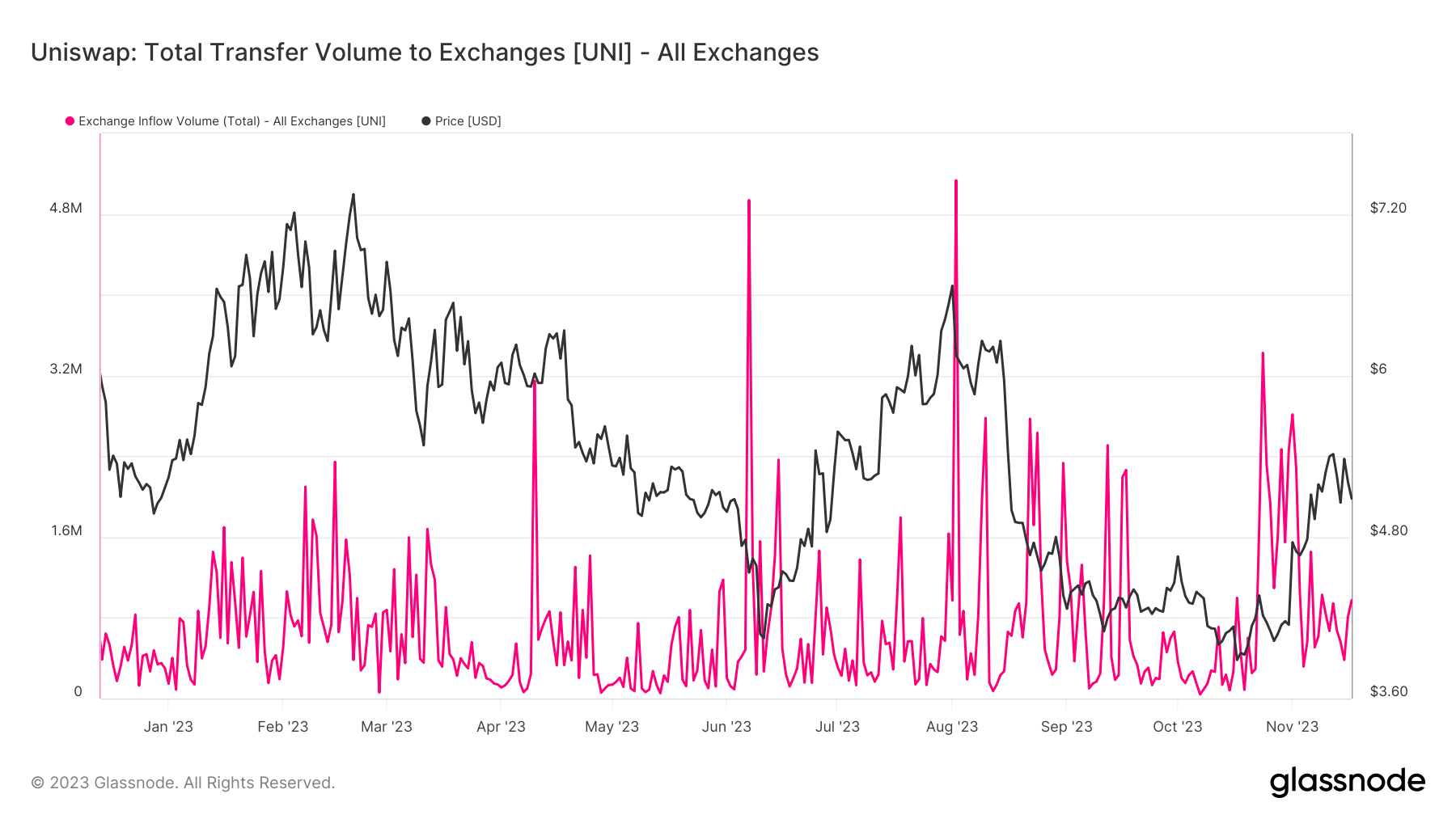

Although the levels observed earlier this month were not reached, the influx of Uniswap tokens in exchanges has seen a noticeable increase recently.

An examination of the inflow chart by AMBCrypto revealed a discernible upward trend in the number of UNI tokens entering the exchange. At the time of writing, the number of UNIs flocking to the exchanges was over 973,000.

An outflow analysis also showed that more than 803,000 tokens left the exchanges. This suggested that the inflow volume was only slightly greater than the outflow.

In other words, there were more sales than withdrawals from exchanges, albeit by a small margin. Notably, the sell-off by the 1Inch Investment Fund did not significantly impact the flow of UNI tokens.

UNI continues to decline

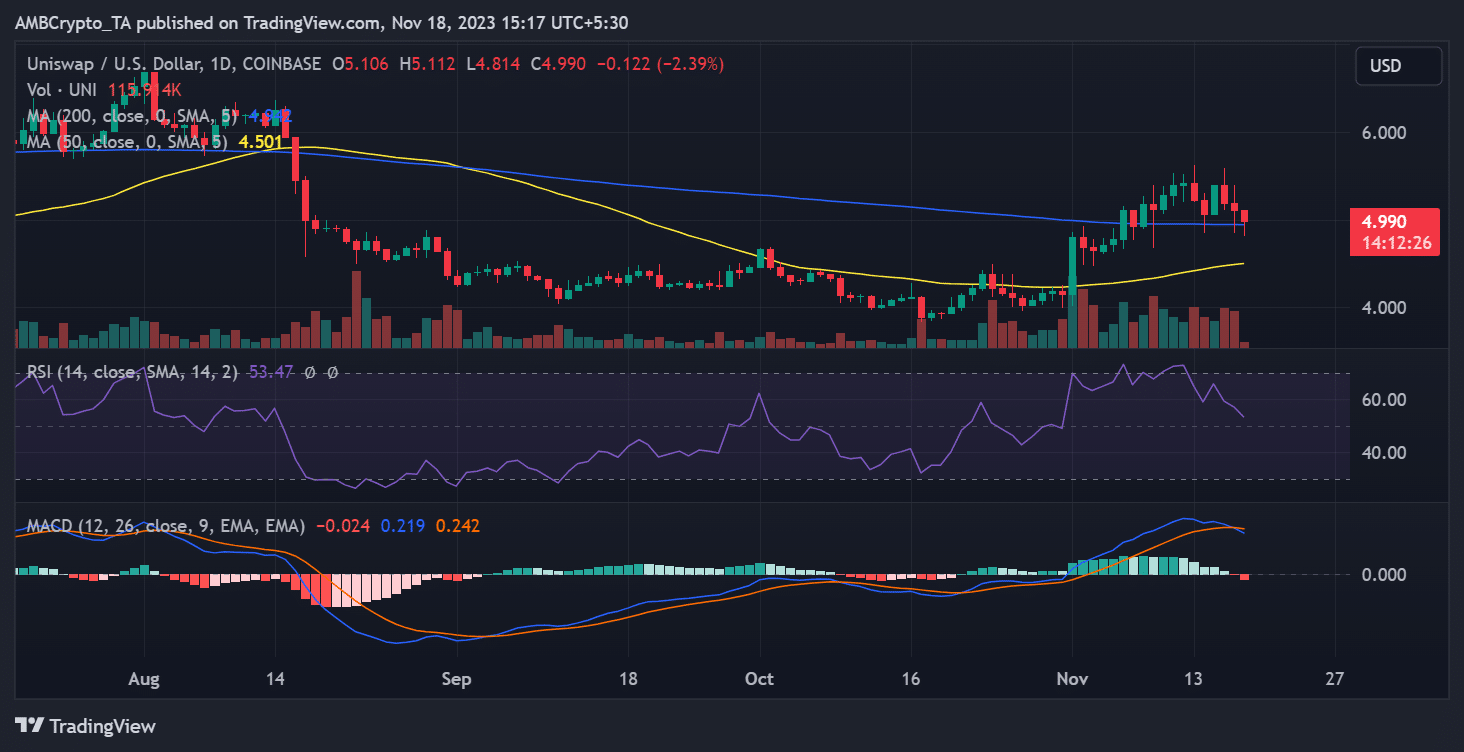

AMBCrypto’s analysis of the daily timeframe chart for Uniswap revealed a continued negative trend. The chart has shown a continuous downward trend for the past three days.

At the time of this report, Uniswap was trading around $4.9, reflecting a loss of over 2%. This current decline has contributed to a total drop in value of more than 7% over the past three days.

How many Worth 1,10,100 UNIs Today

Furthermore, the chart indicated that the price trend was now falling below the long-term average (blue line). The break below the blue line initially acted as support and indicated a weakening bull trend.

Moreover, the Relative Strength Index (RSI) confirmed this observation by indicating a decline in the bull trend.