Recently, China and Brazil made a deal to let go of the US dollar and trade in their own currencies. In fact, China already has similar currency deals with Russia, Pakistan and several other countries. This development gives us context to talk about how the US dollar’s global dominance has declined by a significant margin over the years.

According to the Bank for International Settlements (BIS) In 2010, the US dollar and the euro accounted for 63% of all foreign exchange trade. The role of the USD as a global reserve currency was particularly strong at the time.

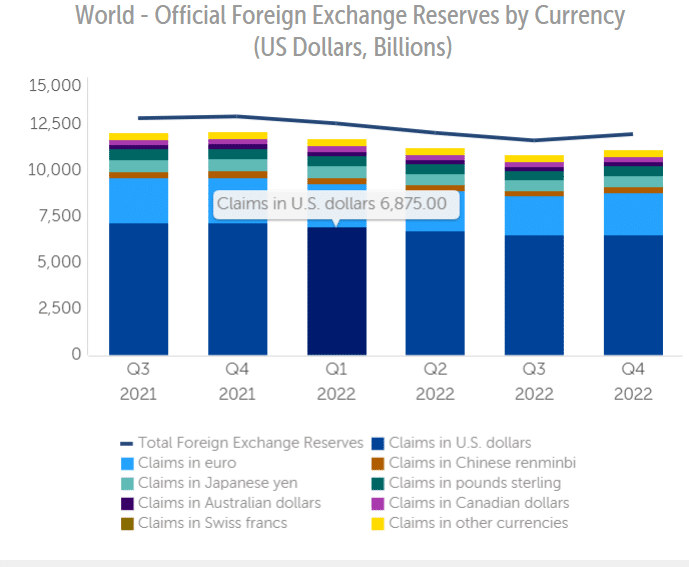

However, if we look at the official foreign exchange reserve figures for the fourth quarter of 2021 and 2022, we see that the dollar’s dominance has declined significantly. In other words, the USD’s position as the primary global reserve currency is not as strong as it once was.

For example, consider this chart –

Source: IMF

It goes without saying that countries’ confidence in the US dollar appears to be declining somewhat. In the aftermath of the war between Russia and Ukraine, sanctions against Putin’s country came to the fore. The imposition of sanctions on the Russian central bank resulted in the elimination of its reserves in USD, EUR and JPY.

From VanEckthe renowned global investment manager, the sanctions against Russia reduced the demand for USD, EUR and JPY currencies as reserve assets, “while increasing the demand for currencies that can perform the functions of reserve currencies”.

In a 2022 report, VanEck even laid out a framework that analyzed where Bitcoin’s value would end up if it were adopted as the world’s reserve currency.

The framework evaluated,

“Gold prices around $31,000 per ounce and potential Bitcoin prices around $1,300,000 per coin. Adjusting to greater strains on financial and monetary systems generates even higher prices.”

Not only investment managers, but even some venture capitalists believe that it cannot be easily ruled out that Bitcoin may become a global reserve currency in the distant future.

Consider This – Popular venture capitalist David O. Sacks, in a recent podcast with Anthony Pompliano, claimed,

“Essentially there are three currencies that have scaled up: one is the USD-US empire and then there is China, the renminbi. And there is Bitcoin and the crypto world. There are these three currencies that can grow big enough to become sort of a world reserve currency.”

The pertinent question here is, can Bitcoin beat gold to gain the confidence of central banks around the world? To answer that, we will first have to dive deep into the historical importance of gold.

Does Bitcoin Match the Gold Standard?

Recall that JP Morgan stated in his congressional testimony in 1912, “Gold is money. Everything else is honor.” It used to be undeniably true when gold was safely stored in vaults and paper money was issued based on the gold peg.

Well, by the end of World War II, the US controlled most of the world’s gold because it was paid for in gold by other countries during the wars.

At the Bretton Woods conference, it was mutually agreed to peg the world’s currencies to the US dollar, which in turn was pegged to gold. This system lasted until 1971 when most currencies moved to a floating exchange rate system that is still in effect today.

Despite the shift in the gold standard, central banks continue to hold significant gold reserves, holding about a fifth of all gold ever mined.

Source: Statistics

It is here that you may wonder why gold is considered a store of value. Primarily because of the limited supply of gold, which is both durable and very difficult to produce, unlike other metals.

If you pay close attention, there are four factors on which the value of gold is inherently based: supply, durability, ease of use and the story behind it.

What about Bitcoin then?

In recent years, several major institutions, including Tesla, Square, and MicroStrategy, have become involved in Bitcoin. This suggests that even traditionally conservative investors are starting to see Bitcoin’s potential as a store of value.

There are also more and more companies that accept Bitcoin as a payment method. This includes major retailers such as Microsoft, PayPal, and Overstock, among others. If more companies follow suit, it could help boost Bitcoin’s legitimacy.

Bitcoin is based on a technology that is immutable, making the digital asset sustainable in nature. In addition, the ease of using Bitcoin in the financial world as opposed to gold or the US dollar is beyond dispute.

As we know, the decentralized nature of Bitcoin enables seamless global transactions. Countries looking to reduce their reliance on the US dollar as a reserve currency could consider the king coin as a serious option.

Speaking of the story, the king coin has revolutionized the financial world. It is clear that the cryptocurrency investment adoption curve is also on an upward trend.

Source: FINOa

For example, according to Crypto.com, more than 10% of global internet users probably own some form of cryptocurrency. This just highlights the change in investor preferences around the world.

Source: Crypto.com

That said, one of the biggest challenges Bitcoin faces in its quest to become a reserve currency is its volatility. Something that can make it difficult for governments to rely on BTC as a stable store of value.

On the other hand, the hard limit on Bitcoin’s supply may make it challenging for the king coin to keep up with the demands of the global economy.

Additionally, thanks to crypto-related debacles (think LUNA, FTX), cryptocurrencies may find it hard to be in the government’s good books.

Simply put, the conversation around Bitcoin and its status as a reserve currency looks pretty shallow at the moment. In reality, other than stories, there are no statistics or data sets to prove that the king of the crypto world can catch up with the dollar.

In conclusion, only time will tell if Bitcoin can ever become a truly global currency and a viable alternative to the dollar as a reserve currency.