- NDB is now working to expand the use of local currencies to ‘de-dollarize’

- Bitcoin could be the next big reserve currency

120 foreign countries attended the BRICS International Municipal Forum a few days ago. Shortly afterwards, however, the New Development Bank organized its ninth annual meeting. The latter is in the news today after President Dilma Rousseff claimed that the NDB is working to expand the use of local currencies. In other words, the NDB is working on de-dollarization.

Hence the question: what does this mean for Bitcoin?

According to Rousseff it is

“One of the key focuses of the NDB is to increase the use of local currencies. We have decided that up to 30 percent of the bank’s total financing will be in local currency.”

An international movement?

The BRICS have been at the center of this de-dollarization movement in recent years. In fact, at last year’s 15th annual BRICS summit, there was strong support for a single ‘BRICS currency’. Brazilian President Lula Da Silva said at the time:

“It increases our payment options and reduces our vulnerabilities.”

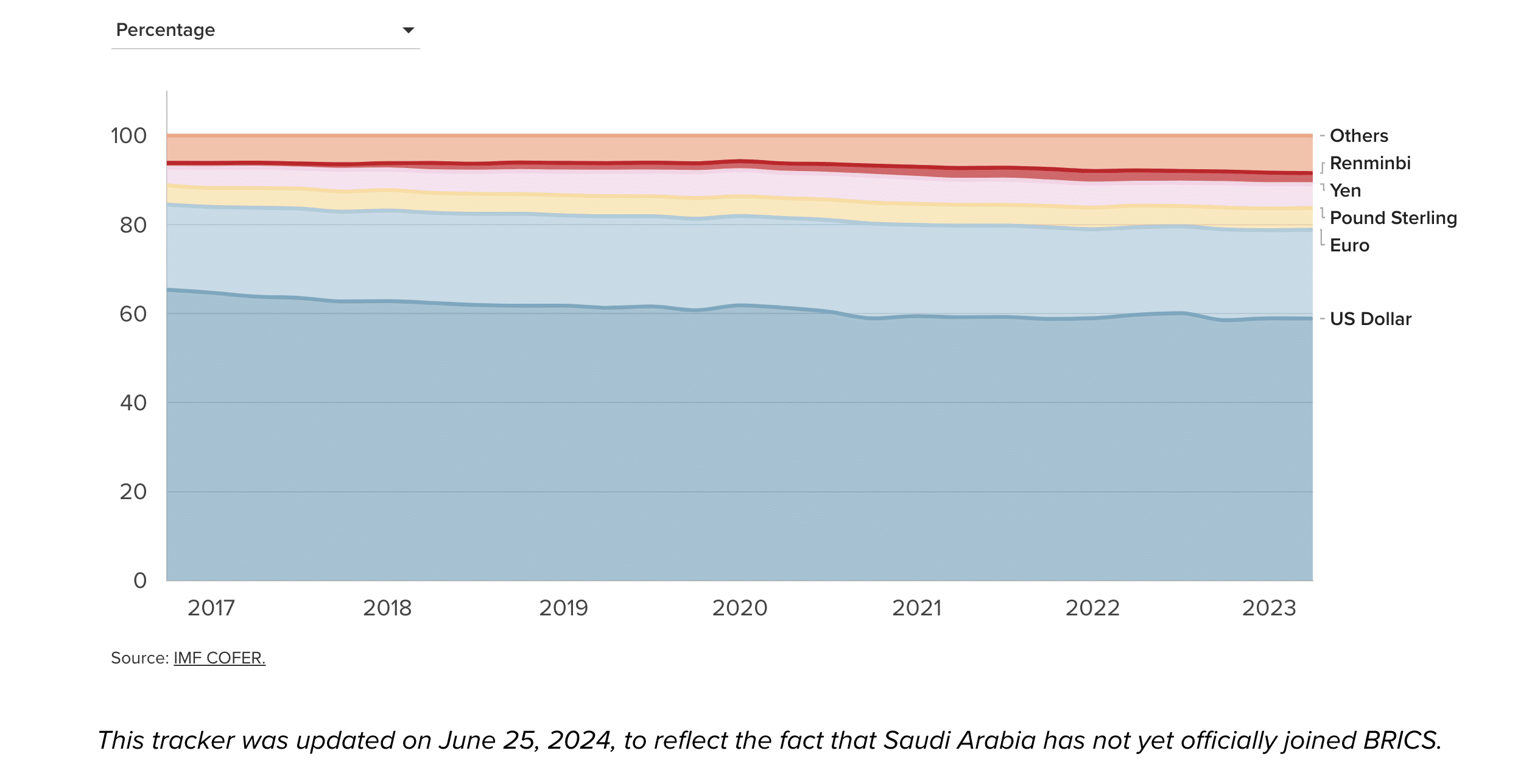

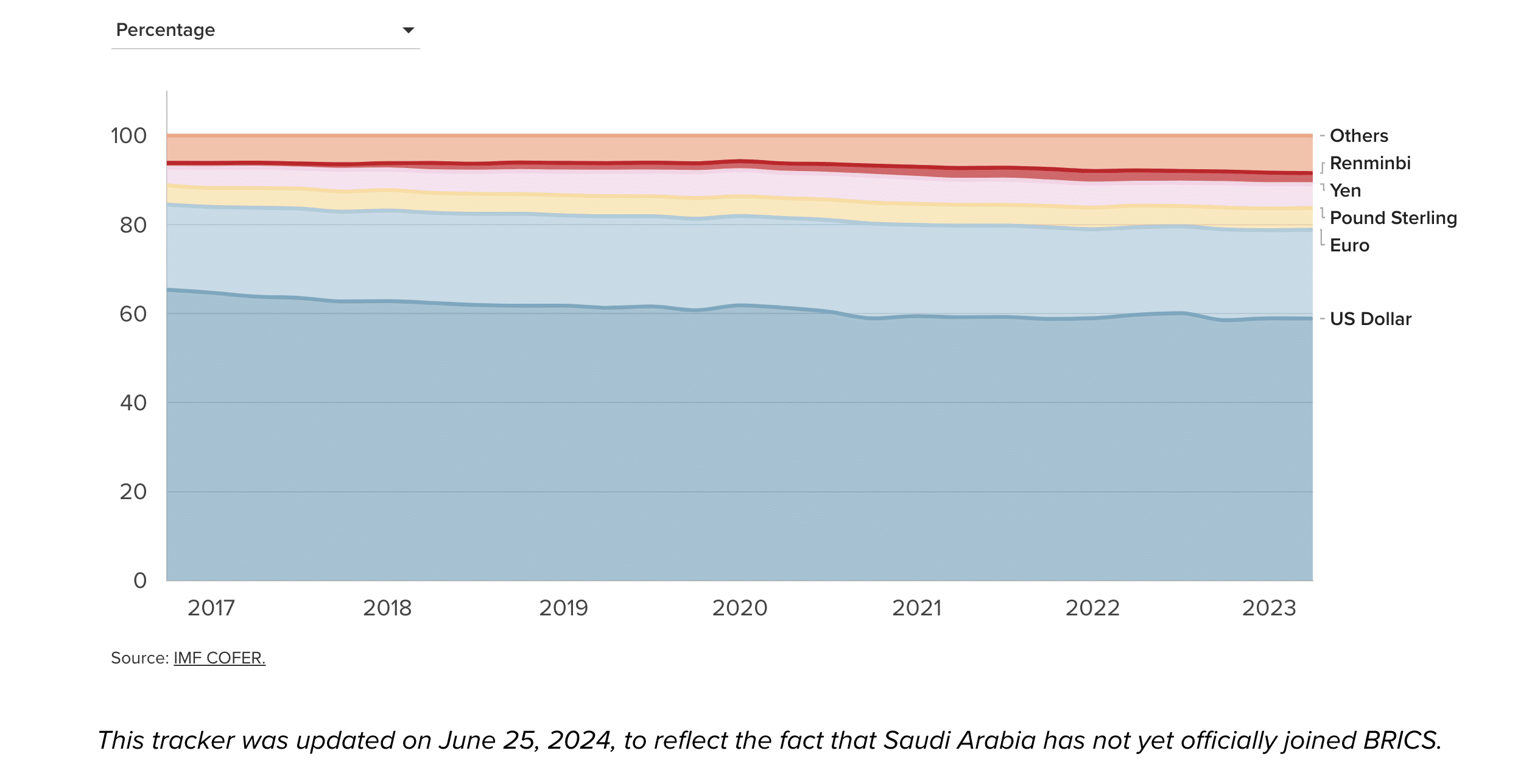

Here it is worth pointing out that most of the world is still a long way from de-dollarization. According to the Atlantic Council Dollar Dominance MonitorFor example, the US dollar still represents a 58% share of all global currency reserves. Likewise, it has an 88% share of all foreign exchange transactions.

Source: Atlantic Council

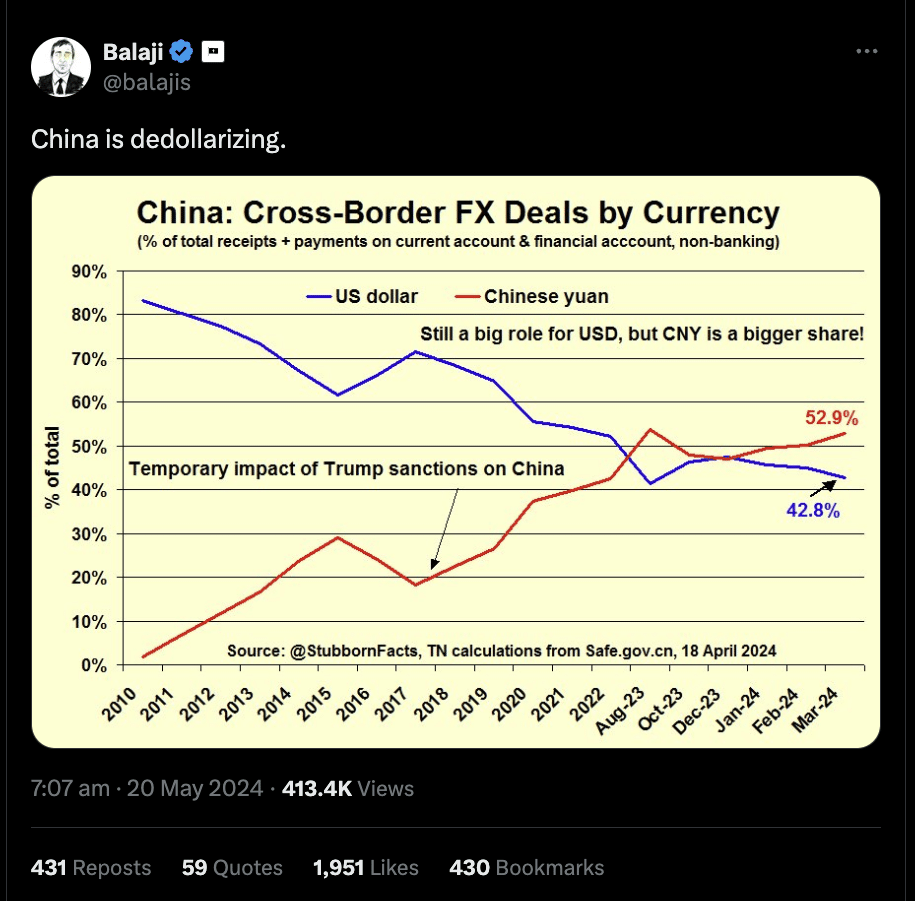

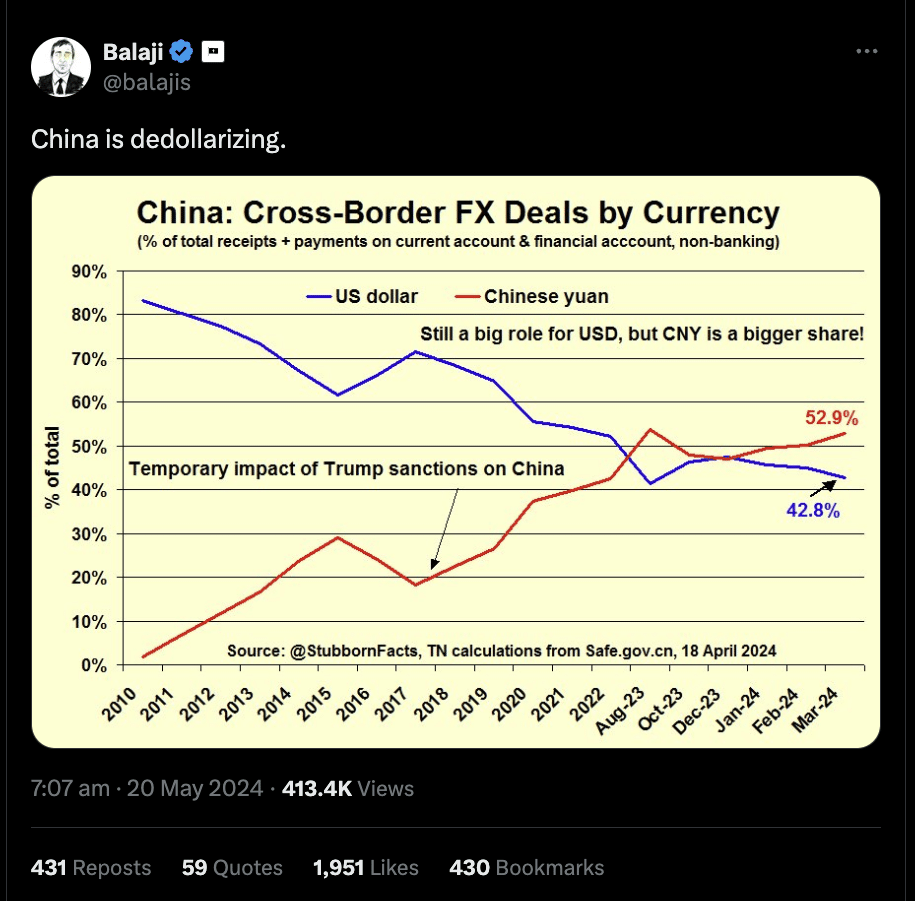

Simply put, de-dollarization will not happen in the short or medium term. This is despite the fact that China is steadily de-dollarizing itself, which benefits China.

Source:

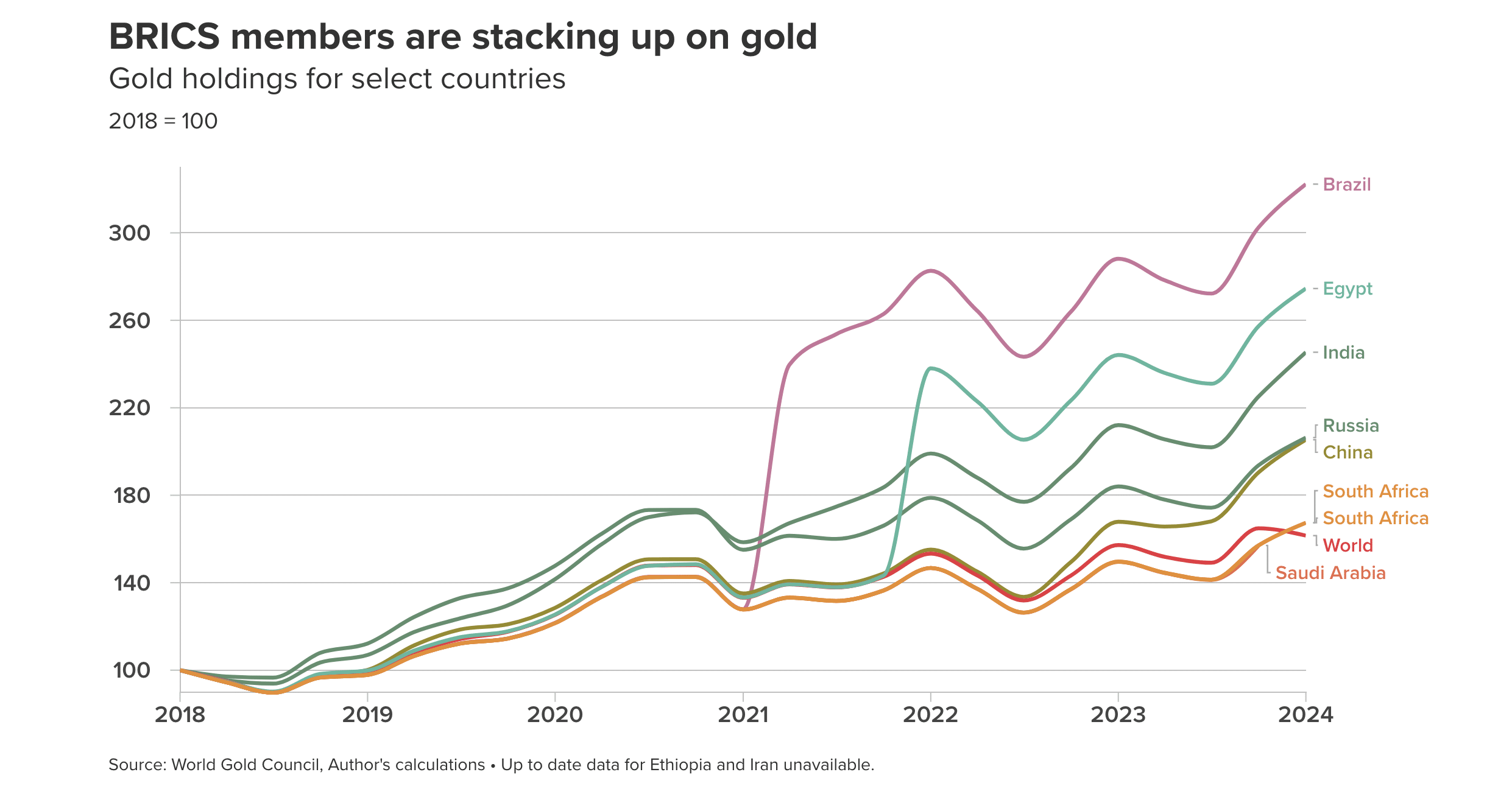

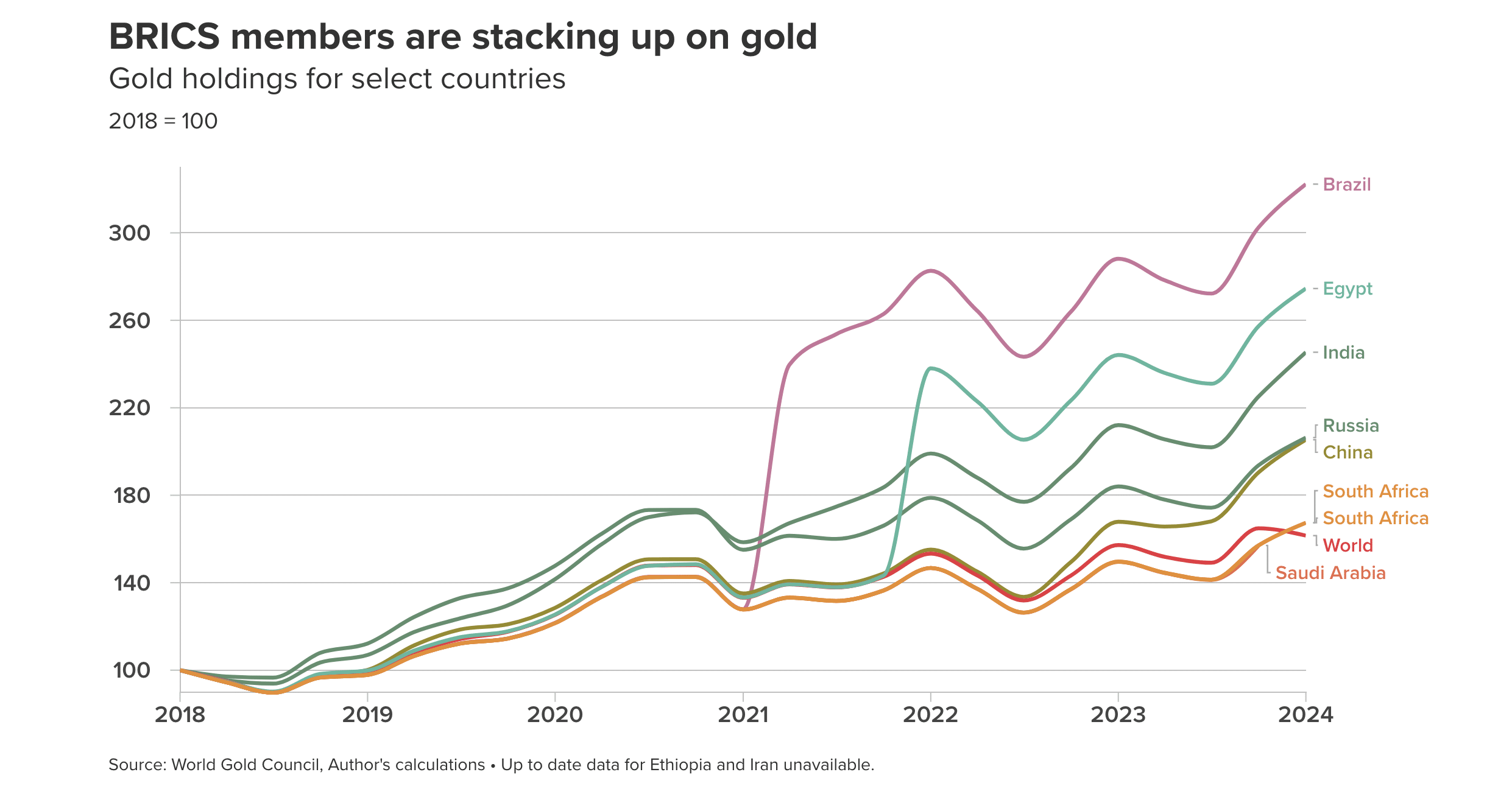

On the contrary, it could happen in the long run. Especially since the USD’s share of all global foreign reserves has fallen from 65.3% to 58.8% in the last eight years alone. Likewise, many countries, especially those associated with BRICS, have been accumulating gold despite rising prices.

Source: Atlantic Council

Gold’s status as a reserve and store of value has increased since 2019, especially since the COVID-19 pandemic. Subsequently, great interest has emerged in other asset classes that also have value characteristics. Bitcoin and cryptocurrencies in general are now seen as such an asset class.

Bitcoin to the rescue?

For example, Russia and Iran are already using Bitcoin and Bitcoin mining to mitigate the impact of international sanctions imposed against them. In fact, the former is also beta testing cryptocurrency exchanges to assess how cross-border crypto transactions will work.

As an organization, the BRICS was also keen to launch a gold-backed stablecoin, especially given previous discussions about a “BRICS currency.”

Beyond these interests, there is also great interest among many countries to follow El Salvador’s lead and accumulate Bitcoin as a treasury. When President Bukele announced this move in 2021, he also planned to “de-dollarize” the economy, despite criticism from the World Bank and the IMF.

However, 2024 is a different world, in which major institutions such as MicroStrategy and Metaplanet are also delving into cryptocurrencies. That’s not all, as Bitcoin and Ethereum ETFs are now among the most popular on Wall Street – a sign of institutional interest in this asset class.

All these developments together mean that crypto is waiting for the next big step up. If the BRICS countries are successful in their attempt to de-dollarize the dollar and if even a small percentage of USD liquidity moves into cryptos, the market could be changed forever.