- Whale cohorts have tried to absorb the aggressive selling and seize the “dip.”

- However, they may not have reached a market bottom yet.

Bitcoin [BTC] is at a crucial crossroads as bulls struggle to break resistance after a September rally pushed prices close to $65,000.

The expected repeat of the late July cycle, which stood at $60,480 at the time of writing, did not occur, with bears retreating and bulls targeting the next resistance at $68,000.

Bearish pressure remains, raising fears of a deeper pullback; if the bulls falter, BTC could return to around $55K. However, a major event has created optimism and fueled speculation that this influx of demand could trigger a short squeeze.

Confidence in Bitcoin whales is rising

Whale cohorts who own 1,000 to 10,000 BTC have shown confidence in Bitcoin’s future gains, purchasing more than 50,000 BTC, worth approximately $3.14 billion, in the past 10 days.

Interestingly, this buying spree coincided with a period when Bitcoin was under pressure from short sellers after rising to nearly $63,000. TThese purchases prevented a significant pullback, pushing Bitcoin towards the $65,000 resistance.

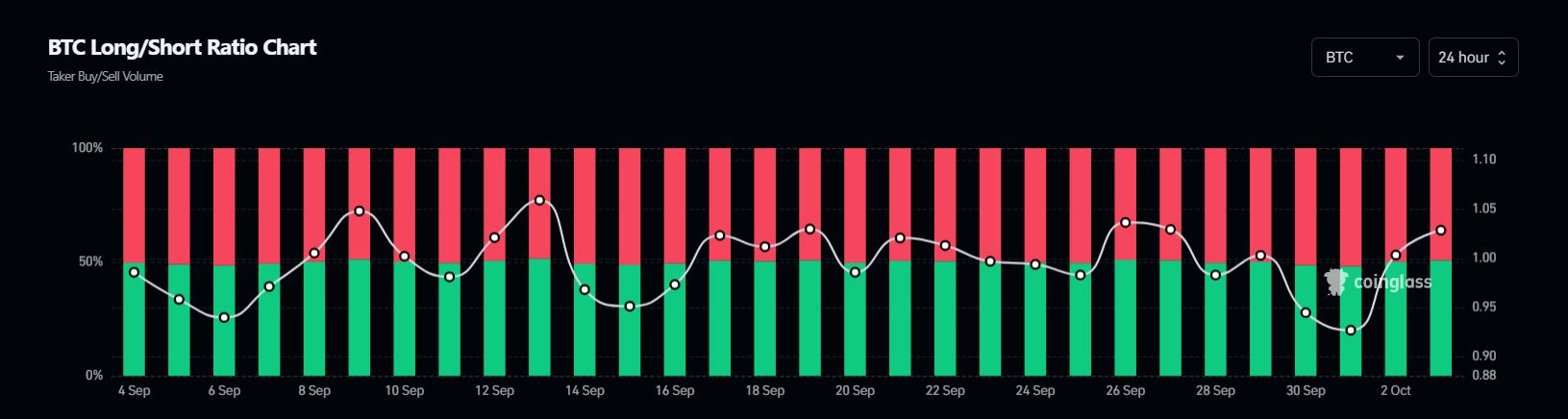

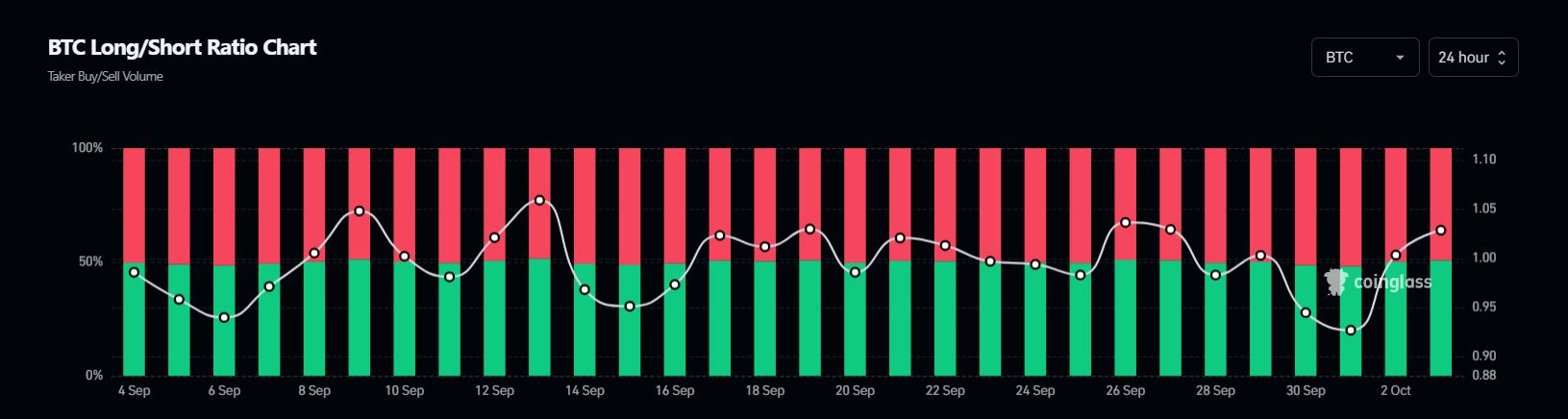

Source: Coinglass

Simply put, shorts regained control of the derivatives market during the mid-September rally, putting pressure on BTC for a pullback. However, the accumulation of whales absorbed this pressure, creating a situation ripe for a short squeeze.

If a similar trend occurs, short liquidations could be triggered, potentially becoming a catalyst for a significant recovery.

Endangering short positions

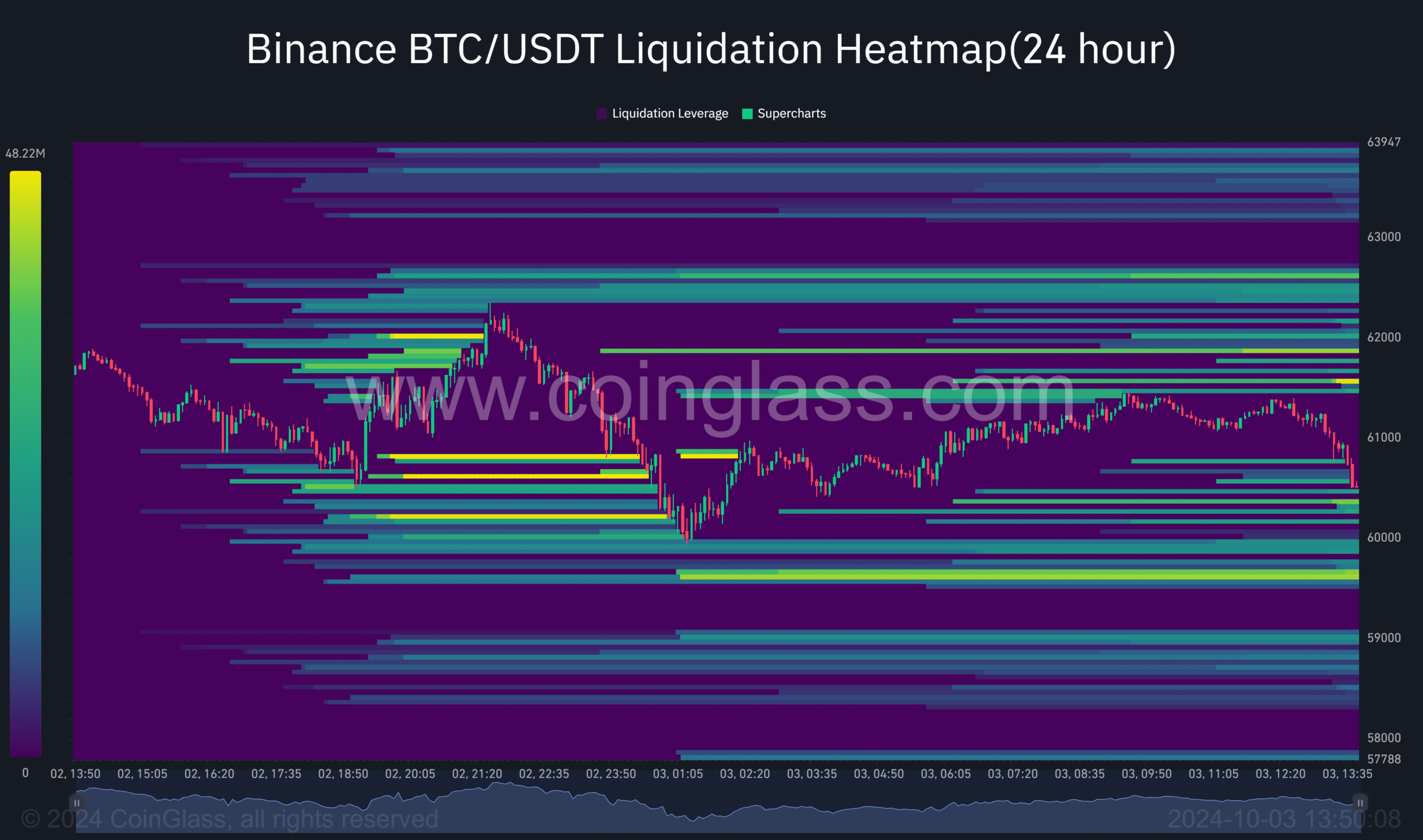

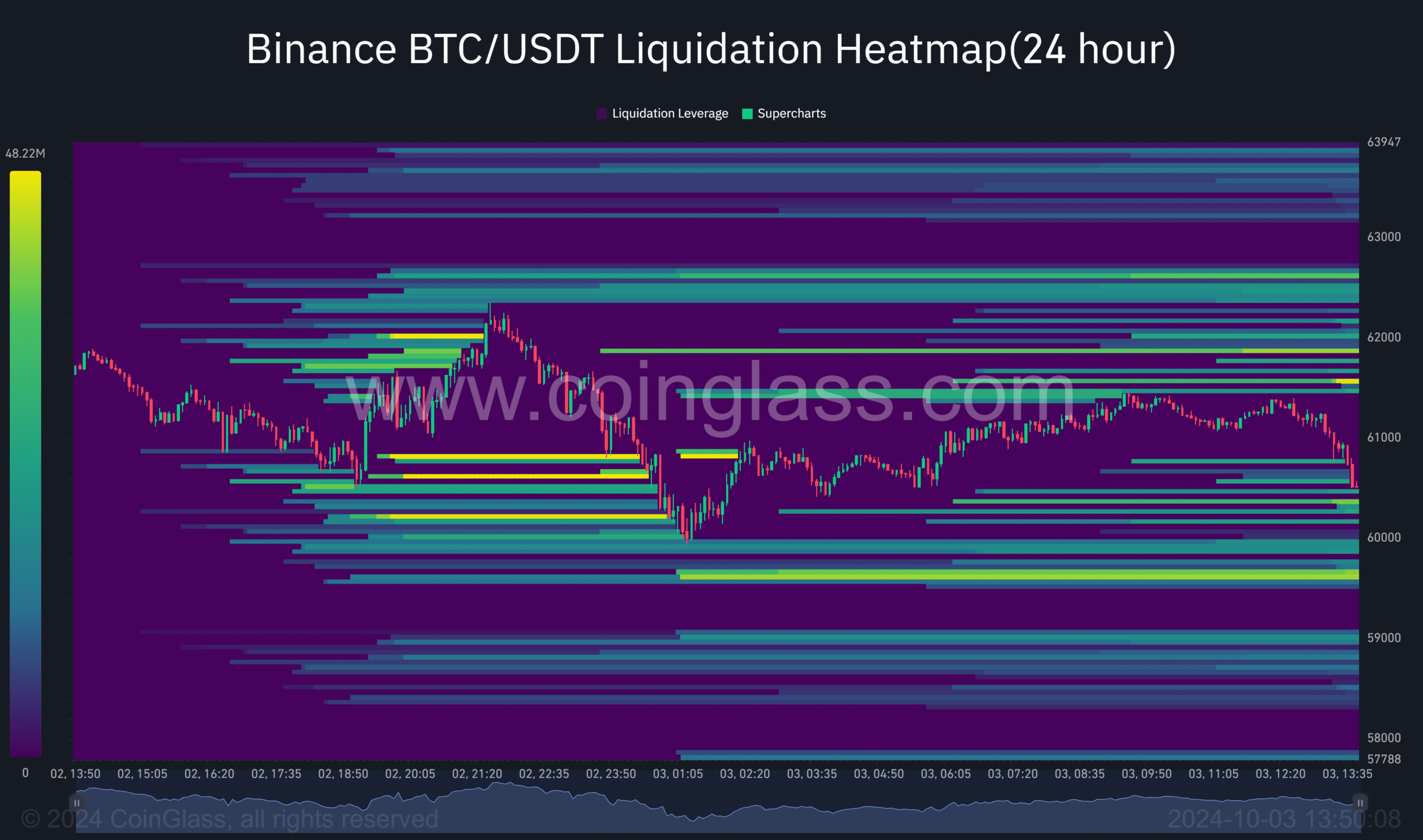

Currently, a recovery to $61,000 leaves us with a strong liquidity position, with a debt load of around $40 million. A close near that range would put short sellers at risk, causing their positions to close and BTC to soar.

Source: Coinglass

A “flip” would signal a market bottom

Typically, whales’ accumulation patterns are often consistent with Bitcoin testing at the bottom of the market.

According to AMBCrypto, a pullback to $60,000 was essential to shake off the price weak hands – those who acquired BTC at a previous support of $55K – prompting them to cash in their gains and exit the cycle.

The key now is to convert the $60,000 resistance into support, encouraging new buyers to enter the market. This shift would allow whales to target the bottom of the market and push BTC closer to $66,000.

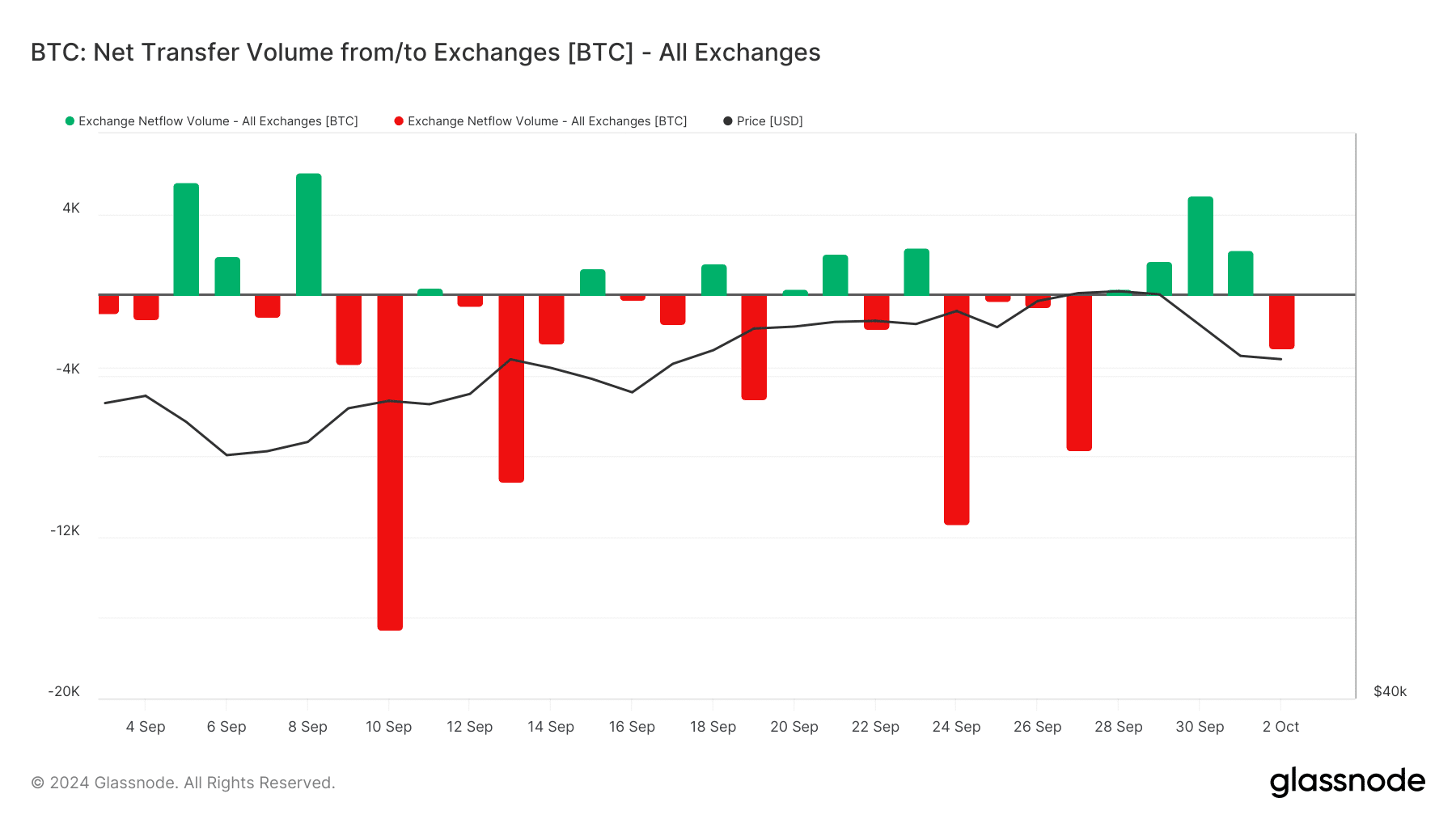

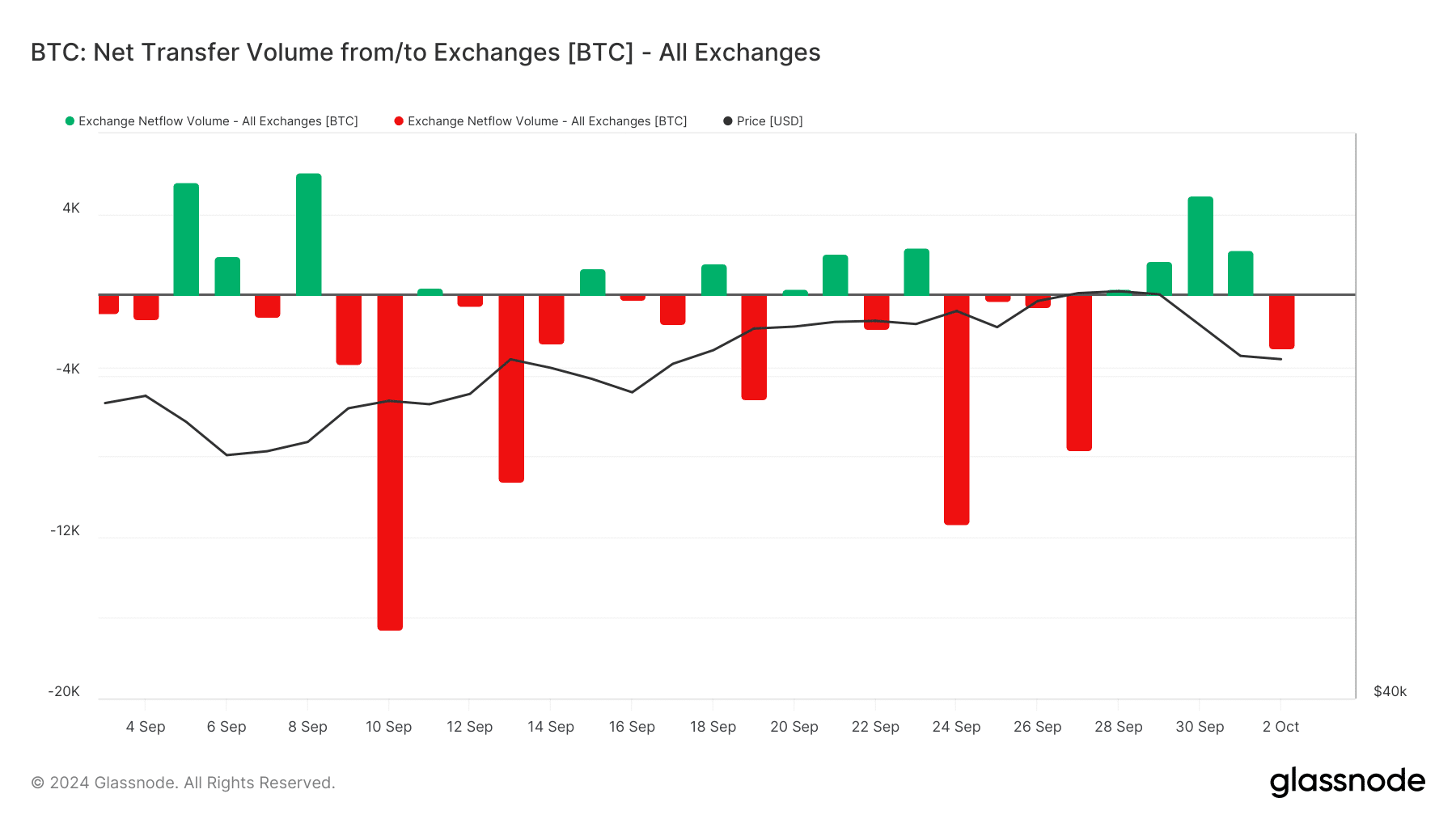

Source: Glassnode

While net outflows have come back under control after three days of rising BTC supply, suggesting $60,000 offers a strong buy-the-dip opportunity, a stronger push is needed to confirm a bull rally .

Read Bitcoin’s [BTC] Price forecast 2024-25

In short, if bulls take advantage of this price with aggressive buying and turn $60,000 into support, a recovery could drive BTC back to $66,000.

Otherwise, if bearish sentiment prevails without any party being able to absorb it BusyFear could lead to panic selling, allowing shorts to maintain control and potentially send BTC down to around $55,000 – paving the way for the next market bottom.