NFT

In Venezuela, humor plays an important role, either as a form of protest or as a way of understanding reality.

In November 2021, humor and nonfungible tokens (NFTs) were combined with the launch of the Comedy Monsters Club (CMC) project. The project was led by Roberto Cardoso, better known by his former stage name ‘Bobby Comedia’, and co-founded with brothers José David Roa and David Roa.

The project was advertised as the only comedy club to use NFT collectibles as membership. However, the hype would soon turn into confusion for the project’s investors.

A seductive story

Comedy Monsters reached the NFT-curious Latin American audience through the well-known Venezuelan comedians.

Cardoso and his co-founders have appeared in publications such as Forbes Mexico and on popular shows and comedy podcasts such as Nos Reiremos de Esto And Escuela de Nada.

Listen to an episode of Escuela de Nada titled “How to Make Money With NFTs”, pseudonymous NFT collector Nairobi first found out about the suspected comedy club. Later they would decide to join the CMC community and purchase an NFT of their own.

“In that conversation, you can really identify the sales pitch of the project,” explains Nairobi.

During the episode, the hosts interview José David, co-founder of Comedy Monsters, a self-proclaimed “NFT expert.” In the conversation, José David uses his own example of an early investor in Bored Ape Yacht Club, who reportedly made more than $300,000 from the sale of one of his NFTs.

His get-rich-quick story is followed by the mantra “do your own research,” often used to suggest that previous statements by so-called experts should not be taken as financial advice.

“For someone new to the NFT ecosystem, this can lead to false expectations,” Nairobi said.

CMC officially launched in November 2021 with an offering of 10,100 NFTs. The starting price for each was 0.1 Ether (ETH), valued between $400 and $500 at the time of sale. The monsters would not be revealed to their owners until all NFTs were sold.

Cardoso told Cointelegraph that the comedy club’s goal was “to provide as many experiential, material and economic benefits as possible” to its members.

However, beyond the novelty of the project proposal, it was never clear how CMC would maintain or increase the value of its NFTs. In a small section on the website consisting of just three sentences, the creators explain the tokenomics behind the project.

“The rarer it [the NFT] is, the more benefits it will have and the greater value it will certainly have,” it says.

Community “failure”

The period after the initial launch of an NFT collection can be critical to the success of the project. The value of the tokens will depend on the public’s continued interest in investing, putting pressure on projects to implement successful marketing strategies.

CMC’s founders were so concerned about selling their Monster NFTs that former members reported that the project’s creators put pressure on the community to help devise sales strategies to sell them.

“We were practically asked to come up with marketing strategies. There was also the alleged raffle of a Mutant Ape NFT within the community provided Comedy Monsters Club sold out in just 15 days,” Nairobi recalled.

The pressure on the community came on top of another major issue: inadequate implementation of the club’s roadmap.

The CMC roadmap consisted of five phases: the production of a podcast, a holder-exclusive comedy festival, games and lottery prizes in ETH, a foundation, and an affiliate in the United States.

Despite social media posts touting 2022 as a successful year for CMC, the community shared a very different experience. The project launched a podcast, but shut down after less than 20 episodes. CMC founders organized events, but they were not exclusive, and there were limited tickets for NFT holders. Even the lotteries eventually switched from ETH prizes to handing out CMC NFTs.

The project never reached its goal of a total sell-out. According to the smart contract, there are 2,320 holders, who own a total of 7,660 samples.

Cardoso said a significant but unspecified number of NFTs were used in publicity stunts and giveaways, and he blamed the 2022 crypto market crash for the project’s failure to sell out.

A rough estimate of the comedy club’s revenue shows that it could have made as much as $2 million to $3 million, based on estimates of the value of tokens sold at the time of CMC’s launch.

Today, the CMC smart contract shows a balance of 0 ETH, and there is only a little over $300 in ETH left in the project’s main wallet.

A “soft blanket-pull”

The community was never sure how the money was spent on the project’s roadmap or how much was taken by Cardozo and the Roa brothers, arguing for a possible soft back-pull.

Suspicion about the project’s reliability arose in early March 2022 when holders began complaining about the founders’ neglect of the community.

According to the testimony of several former CMC holders, the concerns started when David, the project’s appointed CEO, left the Discord group, followed soon after by his brother, José David. The community also reported that CMC holders asking questions on Telegram chats were blocked.

Cardoso told Cointelegraph that he actually signed a separation agreement with his former co-founders on November 9, 2022, leaving him to head the project as founder and CEO. Specific details of this agreement remained private.

In November, CMC holders and community members also noted a lack of transparency around the use of funds.

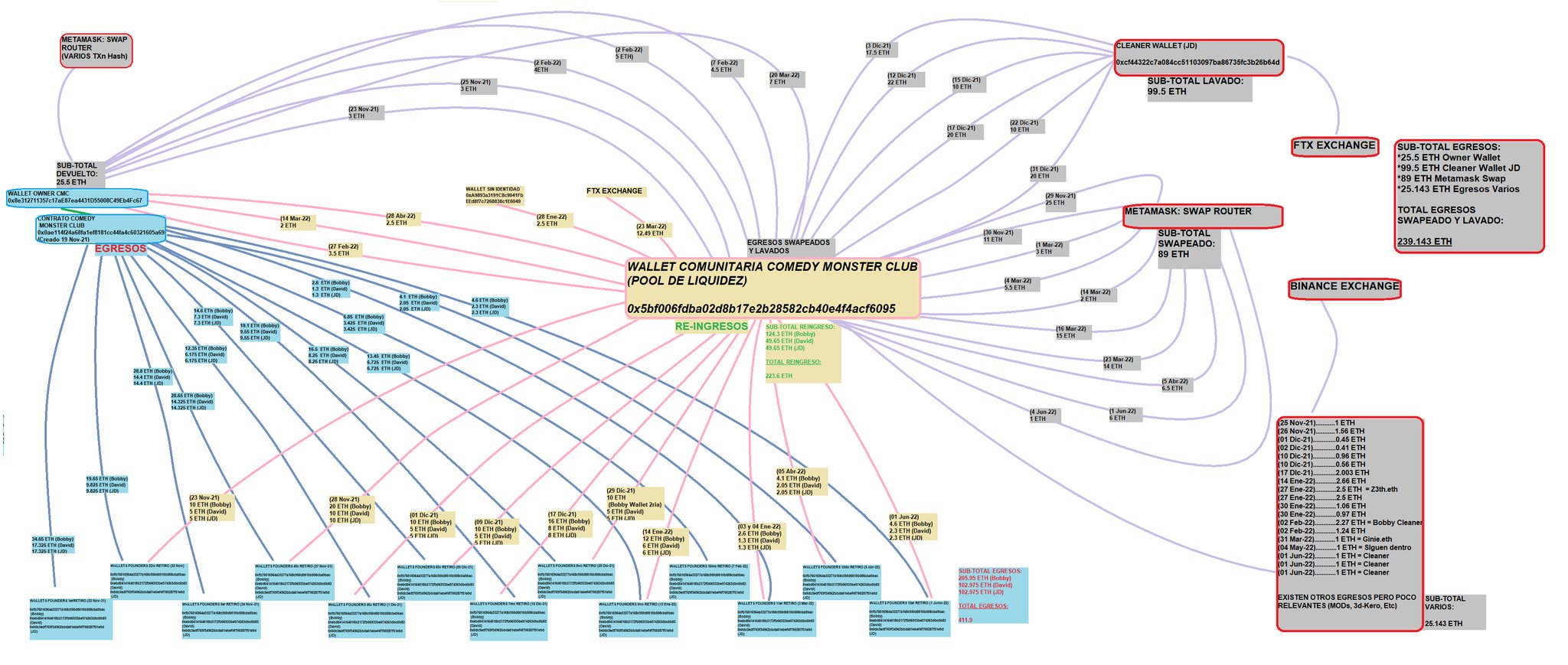

A pseudonymous CMC holder, RAMXx, went on to track the project’s funds on the blockchain. The public record revealed that 411.9 ETH — worth more than $1.18 million using the average price of ETH between November 2021 and June 2022 — was withdrawn from the project and traded using various cryptocurrency exchanges .

Map of project funds from RAMXx. Source: Twitter

Venezuelan Twitter user Victor Noguera also shared more information by revealing that his process tracks everything on the blockchain.

His investigation also revealed that the money was split between three wallets. The contract shows that two portfolios each received a 25% share, while a third received 50%, which the community assumed was managed by the Roa brothers and Cardoso, respectively.

Cardoso confirmed the wallet amounts to Cointelegraph: “All revenue from minting was split between three wallets. Logically, my previous co-founders and I had access to these wallets to run the club.”

With these findings, the community confirmed that the project did not have a community wallet, a tool commonly used in Web3 communities to allow holders to keep track of invested funds and serves as a treasury for a project’s roadmap.

The lack of a community wallet came as a shock to some CMC NFT holders, whose investment price is now just 0.015 ETH, or less than $30.

Cardoso confirmed the community’s findings to Cointelegraph, stating that the Monster NFTs were solely “a club membership with a step-by-step plan of benefits.”

“The resources or funds belong to those selling the token, not the community. There is no social contract that says the funds belong to the community or a ‘community’ wallet,” he explained.

The conversation about CMC’s irregularities reached social media in December 2022. A community moderator, Alfonzo González, recalled on a Twitter Space that the founders improvised a lot, which was coupled with a notable lack of transparency and unsustainable strategies for keeping up with the roadmap. .

The Gray Zone of NFTs

In today’s NFT industry, legal protections for users are still unclear. Since the Web3 space relies heavily on communities to create their own rules, users often get involved in projects with many promises but few obligations to their participants.

This is reflected in the formulation of goals and the clarification of deadlines – or lack thereof – in project roadmaps. Failure of founders to take accountability measures in the event that they fail to meet the project’s objectives and to ask the participants or holders for it can result in losses to the community if the project fails.

The only visible promise the creators of Comedy Monsters made to their community was a rough roadmap. The project had no deadlines and specific consequences if it failed to meet its goals. The entire project was based on the utility of the NFTs: providing real benefits, including international comedy events and other experiences, such as workshops.

According to Maria Londoño, a lawyer and co-founder of the NFT project Disrupt3rs, this ambiguity has led to serious miscommunication between the founders and the community.

“They made very vague promises, and there were attempts to reinforce them. However, there are no specified parties involved or deadlines for the pledges. There is no contractual obligation whatsoever that can be demanded,” she told Cointelegraph.

“Saying things like ‘This is likely to increase in value’ may sound like a promise or return on investment through speculation, but it could also be sheer ignorance,” Londoño added.

After the social media storm, Comedy Monsters Club remains active and offers events and workshops to their holders.

Cardoso said the project would continue despite the damage to the club’s image. “Part of it is to learn and improve,” he said.

Londoño also believes that the creators of Comedy Monsters Club ultimately underestimated the importance of making explicit rules and expectations for themselves and their holders:

“I believe that both parties (the creators and the community) were wrong in not setting and demanding clear rules. The community lost money and the creators their reputation. It is a lose-lose situation due to a lack of understanding that the rules of the traditional world still apply in Web3.”