- Institutional players doubled down on ETH as CME Futures OI hit an all-time high of $2.5 billion

- With ETH gaining ground against BTC, will the momentum be sustainable this time around?

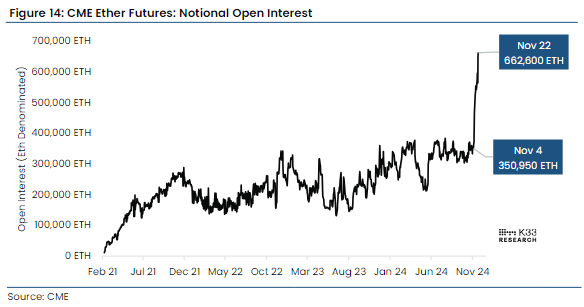

Institutional interest in Ethereum [ETH] more than doubled in November, with CME Futures Open Interest (OI) reaching an all-time high of 662,600 ETH (approximately $2.5 billion).

In fact, according to K33 Research, this indicated a sharp jump from 350,950 ETH on November 4, just before the US presidential elections.

Source: K33 Research

ETH is approaching BTC

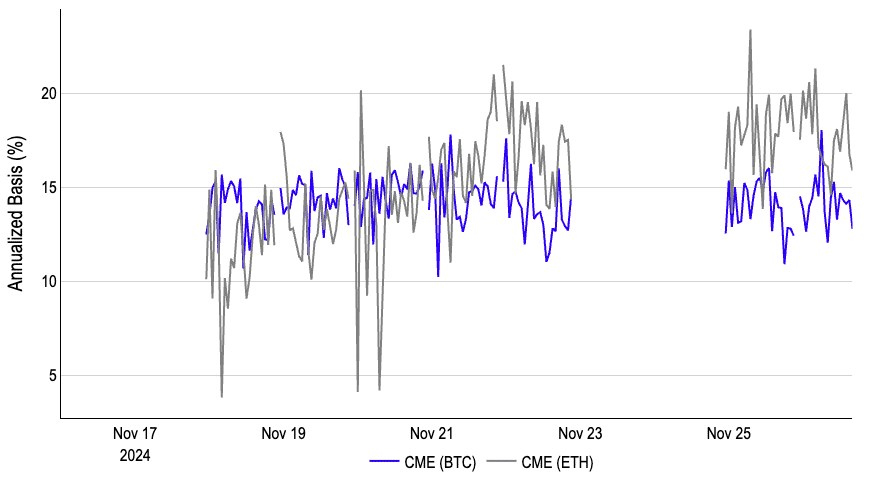

On November 25, CME ETH Futures volume climbed even higher. The annualized ETH basis – the premium hedge funds get when they buy US spot ETH ETFs and short ETH Futures – also rose.

This trend has since surpassed the BTC pattern since the US election, Coinbase research analyst David Han noted. Han declared,

“The CME ETH base has also recently expanded beyond BTC after lagging in recent months.”

Source: Coinbase

While the rise in institutional rates could be a net positive for ETH’s price, hedge funds’ hedging strategies could expose the assets to wild price swings accelerated by liquidations.

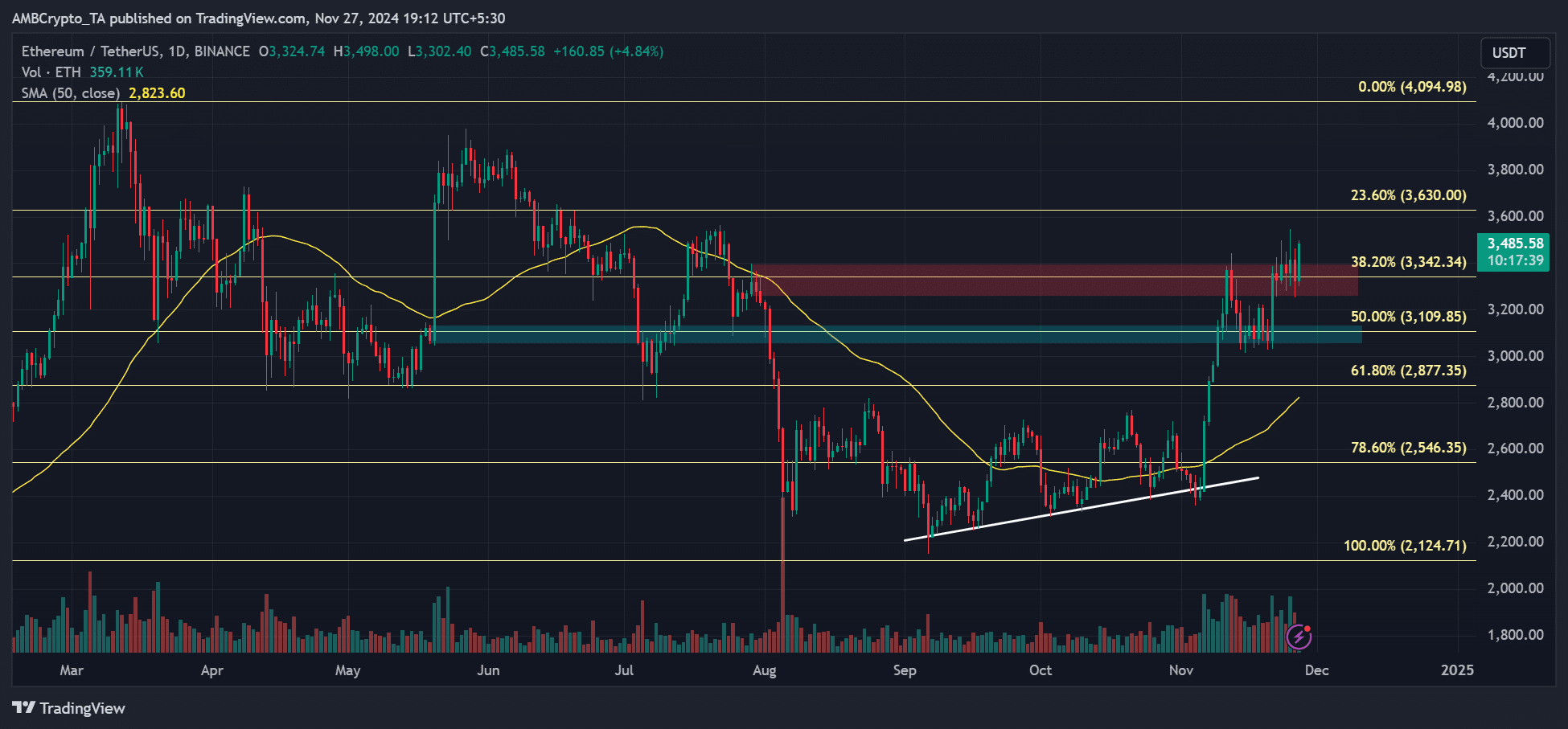

That said, ETH’s growing momentum against BTC was also evident in the ETHBTC ratio, with the same tracking the altcoin’s relative performance against BTC.

In fact, ETH has attracted more flows over the past seven days, as evidenced by the ETHBTC ratio increasing by almost 15%.

Source: ETH/BTC, TradingView

This meant that ETH has outperformed BTC in recent days, especially during BTC’s latest slump.

However, the trend could only be sustainable if the ETHBTC ratio decisively rises above the 50-day SMA (Simple Moving Average).

Read Ethereum [ETH] Price prediction 2024-2025

In early November we saw a false breakout, causing ETH to underperform thereafter. Will things be different this time, with the ETHBTC ratio flirting with the 50-day MA?

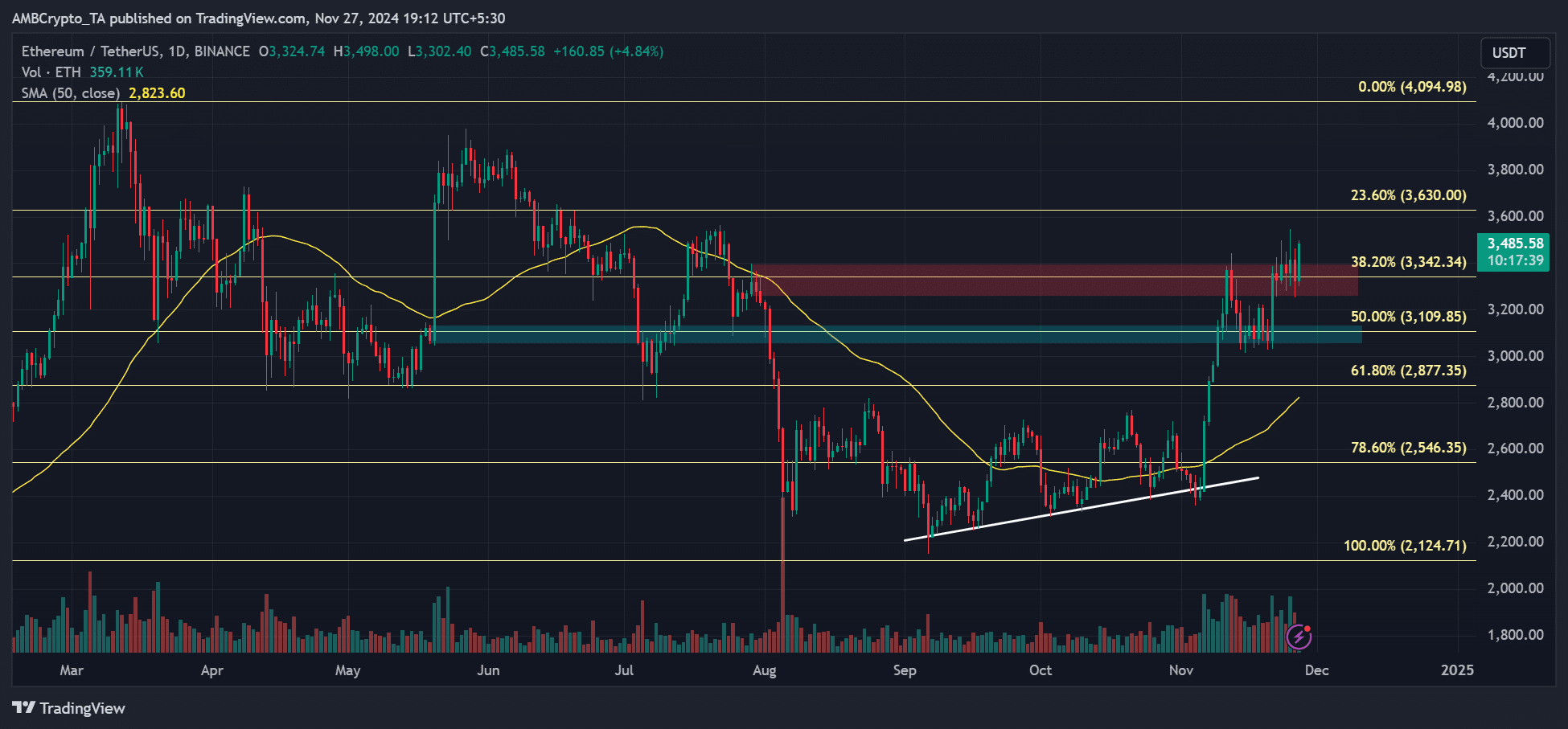

At the time of writing, ETH was valued at $3.4K, up 4% in the past 24 hours, with immediate targets at $3500 and $3600.

Source: ETH/USDT, TradingView