Family offices’ interest in crypto assets is increasing, according to a survey by the fourth-largest bank in the US by total assets, Citibank.

Citibank’s Global Family Office 2024 research report say that approximately 25% of participating family offices had “already invested or were planning to invest in digital assets.”

The survey attracted responses from 338 family offices, a third of which were located in North America and the rest in the rest of the world.

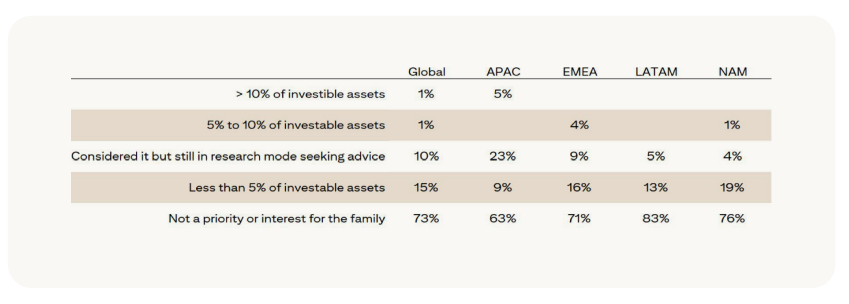

“The early adopter category (17%) is likely to grow in the coming years as they have already made some allocations to digital assets or crypto-related investments. A further 10% of family offices were ‘digital asset curious’, meaning they are considering an allocation but are still researching the topic or seeking advice.

Family offices in the Asia Pacific region were the most active in investing in digital assets, according to the survey.

“Asia Pacific led the way in digital asset adoption, with 37% of respondents investing or interested in investing. One in twenty family offices in that region reported more than 10% of investable assets in digital assets. Latin American family offices, on the other hand, were the least interested, with 83% not yet prioritizing an allocation to this area.”

The survey shows that around 24% of family offices are interested in investing directly in crypto assets, while 18% prefer crypto-linked investment products such as exchange-traded funds (ETFs).

“At the same time, two-thirds of participants were unsure which digital asset product they wanted to explore, underscoring family offices’ continued need for education about this emerging asset class.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/IM_VISUALS/Sensvector