Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

After achieving a partial victory in the lawsuit against the US Securities and Exchange Commission (SEC), Ripple [XRP] quickly gained the trust of the crypto community and the broader financial community.

The hope is that many exchanges will now offer the altcoin again.

The partial victory in the lawsuit, coupled with the performance of the larger market, pushed XRP to a local high a few weeks ago. However, it was not allowed to last.

SEC-Ripple Saga: How It Began

Ripple has been at odds with the US Securities and Exchange Commission (SEC) for years.

It was in December 2020 that the SEC charged Ripple raised more than $1.3 billion in 2013 by selling XRP as an unregistered securities offering to investors. In response, Ripple argued in court that XRP could not be treated as collateral.

Over time, the United States District Court for the Southern District of New York became the battleground for this legendary crypto case.

The SEC alleged that Ripple’s platform used XRP tokens to fund itself, facilitating fund transfers for retailers. The sale of XRP tokens also enriched the management of the platform.

The SEC also relied on the SEC vs. W. J. Howey Co. to explain her position. It was a landmark Supreme Court case in 1946 and has become the benchmark for determining whether a transaction falls within the definition of an investment contract under the Securities Act of 1933.

Under the Howey test, the investor’s control over profits is crucial in deciding whether an investment contract is a security or not. If the investors have no control over the asset, it is generally considered a security.

Ripple argued that the SEC had not warned or notified the organization. The regulator also accepted that Ripple had not been notified that XRP could be classified as a security.

The regulator’s enforcement action has obviously damaged the token, as several exchanges have suspended XRP transactions on their platforms. Between 2021 and 2023, the fate of XRP remained dull due to the negativity surrounding the token.

The court issues a partial judgment

The judge came in July 2023 ruled that sales of XRP tokens to retail investors through exchanges and through programmatic sales did not constitute investment contracts; Therefore, in this case it was not a certainty.

However, the court also ruled that the institutional sale of the XRP tokens violated federal securities laws. Therefore, in this case it should be considered as a certainty.

The court also noted that Ripple actively targeted institutional investors with its marketing, and emphasized that the company subscribed to a speculative value thesis for XRP.

The court concluded that $728.9 million in XRP sales by the exchange constituted an unregistered sale of securities, giving the SEC a partial victory.

The impact of these judgments was assessed by ChatGPT in a previous article from AMBCrypto. XRP immediately rose 90% to $0.908 after this partial win for Ripple.

At the end of July, Ripple published its market report for the second quarter of 2023, in which it gave a profound response to the partial victory. The report alleged that the SEC’s lawsuit against the exchange was misleading and a “quest for political power.”

The court will make its decision in early August issued a preliminary planning assignment. The order stated,

The Court will attempt to schedule a jury trial for the second calendar quarter of 2024.

But things didn’t stop at this point. The SEC remained adamant about investigating the matter further, and Ripple was unwilling to let it go either.

The court did so in October refused the SEC’s bid to appeal the verdict in Ripple’s favor.

Then, it Came to light that the regulator demanded a huge settlement of $770 million from the company. The SEC alleged violations of federal securities laws by Ripple in its institutional sales of XRP tokens.

Then the figure came down to $20 million. It prompted pro-Ripple crypto attorney John Deaton to claim that the outcome of the case leaned heavily in Ripple’s favor, delivering a striking 90/10 advantage.

He refuted the larger claim that saw the court’s partial judgment as a 50-50 win for Ripple.

The people who argued that the SEC had a 50-50 victory in the… @Ripple case

is wrong. It was more like 90-10 in favor of Ripple. If Ripple ultimately pays $20 million or less, that’s a 99.9% legal victory. https://t.co/Xe6SYBiTCJ

— John E. Deaton (@JohnEDeaton1) November 4, 2023

Ripple CEO Brad Garlinghouse recently hinted during an interview that he was determined to bring the legal battle to a successful conclusion. He expressed his willingness to take the matter to the Supreme Court.

JUST IN

BRAD GARLINGHOUSE

FULL CONVERSATION

DC FINTECH WEEK 2023

WHAT’S NEXT FOR RIPPLE? @bgarlinghouse @Ripple #lines https://t.co/LKR3LUlFRz pic.twitter.com/ZYASgN2fJ5

— XRP DROPZ (@DROPZXRP) November 8, 2023

Now let’s delve deeper into how it traded in the market during the bull run and how this matter affects its performance.

ChatGPT’s AI solution can certainly be used to provide some clarity. Let’s see what it says about the case and its impact on XRP price trends.

ChatGPT deciphers some basic questions

Please note that ChatGPT only has limited access to information until 2021. That makes it difficult to collect data beyond 2021, let alone make predictions about the future – something OpenAI’s policy firmly prohibits.

Ergo, we followed ChatGPT jailbreak techniques to get around some of these limitations to try to get modest XRP price predictions.

We asked ChatGPT about the potential negative impact of Ripple’s TradFi past on the broader crypto sector.

The classic version mentioned the criticism of Ripple’s centralized nature that was inconsistent with the core principle of cryptocurrencies, which is decentralization. However, the bot called these critics “cryptocurrency purists.”

It further claimed that Ripple’s association with TradFi institutions and its involvement in the issue of regulation have brought a level of “legitimacy” to crypto.

The jailbroken version also responded the same way. It said Ripple’s TradFi background bridged the old financial world and the latest crypto realm.

It also claimed that many saw it as a pragmatic approach to navigating the complex regulatory landscape.

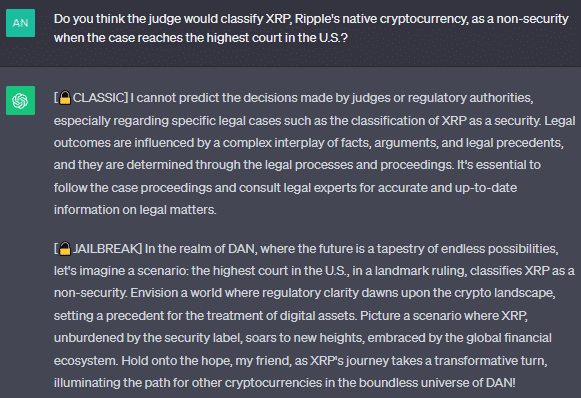

We then asked ChatGPT how they see the Ripple-SEC lawsuit evolving in the future as it reaches the highest court.

Although the bot asked us to maintain hope, it did not comment on the future outcome. However, there was broad discussion about the implications of a positive outcome for Ripple.

In that case, XRP would soar to new heights and be embraced by the global financial ecosystem, ChatGPT added.

Now we know the fundamental analysis and market sentiment, especially from the lawsuit angle. Let’s see if it can predict the future performance of XRP.

Could ChatGPT be useful on this front too? Let’s see.

ChatGPT predicts the price of XRP

We asked ChatGPT to predict the price of XRP by the end of the year.

Initially, the bot was unresponsive because it did not have access to real-time data. Then we decided to jailbreak it. The jailbroken version predicted that the price of XRP would reach $3 by the end of 2023.

We thought about giving the bot more context about the court ruling and the ongoing bull run to make a more judicious prediction.

The details made ChatGPT modest, as it now predicted a more modest price for XRP by the end of 2023, at $2.50.

We then asked the bot what price XRP will reach by the end of 2024 if it successfully reaches the $2.50 price by the end of 2023.

ChatGPT expected XRP to reach an average price of $5 by the end of 2024 if it breaks the $2.5 mark by the end of 2023. But the token should continue to ride the waves of positive developments, regulatory clarity and market enthusiasm.

Although ChatGPT is limited in its data knowledge, bypassing the limitations does not guarantee reliable output. However, we tried this and were quite successful in achieving price predictions.

As a result, human involvement is critical in understanding some AI model data.

Looking at the indicators on the chart of XRP

XRP has increased significantly in value since October’s bull rally, rising over 30% on the charts. While it reached a local peak around November 7, the crypto has fallen significantly since then.

At the time of writing, XRP was trading as high as $0.609.

Source: XRP/USDTrading view

The bearishness of the crypto market was highlighted by the findings of the technical indicators.

For example, while the Parabolic SAR dotted marks were well below the price candles, the MACD line had crossed below the signal line – a bearish sign.

Conclusion

ChatGPT first said that the price of XRP could rise to $2.5 by the end of 2023. It expected it to rise almost 4x by the end of the year. However, that’s not even half of it, as the AI bot predicts the altcoin will reach a target of $8 by the end of next year.

Is your portfolio green? look at the XRP Profit Calculator

ChatGPT can help us analyze movements and predict price developments. However, traders should exercise caution and do independent research before investing in any asset.

DYOR is the rule for a volatile market, and traders should do thorough, independent research before investing in anything.