Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

It’s been a month since the crypto price rally started due to speculation surrounding exchange-traded funds (ETFs). Solana [SOL] has achieved one of the most notable price increases among all cryptocurrencies during the ongoing bull run.

Since mid-October, the price of SOL has increased by more than 160%. At the time of writing, the price was trading at $57.86.

We have also recently witnessed large-scale whale activity. For example, on November 12, Whale Alert reported two substantial Solana transactions, each worth more than $30 million.

The first transaction concerned the transfer of 325,222 SOL, worth more than $18.6 million Binance. The second transfer consisted of 199,998 tokens, worth over $11.5 million, sent to the Coin base stock exchange.

It is clear that the token is a major player in the crypto market and attracts a large number of investors. That’s the reason AMBCrypto has looked at the price developments of Solana also in the past.

How it started… Solana journey

Solana co-founder Anatoly Yakovenko published one white paper in late 2017, describing the proof of history (PoH) consensus mechanism.

Solana combined both PoH and proof of stake (PoS) in his blockchain project. It is critical at this point that we understand what both of these mechanisms are

PoH is a proof for verifying the order and time passage between events, and is used to encode the trustless time passage into a ledger. PoS requires validators to stake some of their coins as collateral. The network then randomly chooses a validator to construct a new block depending on the stake size and other parameters.

Solana was built by San Francisco-based Solana Labs and launched in 2017. The open-source blockchain project is currently managed by the Geneva-based Solana Foundation.

Disruptive ‘Ethereum killer’

The launch of Solana was a major disruptor in the crypto industry as it challenged the dominance of the crypto industry Ethereum [ETH]. So much so that it became known as the ‘Ethereum killer’.

Much of the buzz surrounding Solana was due to its clear advantage over Ethereum in transaction processing speed and transaction fees. Solana can process as many as 50,000 transactions per second (TPS) and the average cost per transaction is $0.00025. Ethereum, on the other hand, can only handle less than 15 TPS, while the average transaction fee is around $1.68.

As a result, the blockchain network has gained a large number of enthusiasts on board.

According to on-chain analyst Patrick Scott, Solana’s DEX volume has soared in recent days. He also referred to the recovering Total Value Locked (TVL).

DEX volume on Solana has been exploding in recent days.

Importantly, Solana’s volume over the past 24 hours was almost three times the total DEX TVL ($424 million vs. $153 million). By comparison, other major chains have less 24-hour volume than TVL.

High volume/TVL should increase fees,… pic.twitter.com/6Q0XkQsmvU

—Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) November 3, 2023

Ryan Sean Adams, co-founder of the Bankless VC fund, meanwhile criticized the relatively smaller TVL compared to other L2 blockchains.

But Helios CEO Mert Mumtaz quickly dismissed Adam’s position. Mumtaz said TVL was a “noisy” benchmark. He also pointed out that SOL easily trumps Ethereum when it comes to TPS.

Ryan, you have absolutely no idea what you’re doing lol

TVL and active addresses are easy to play, noisy stats – especially in the context of people editing L2 airdrops

Solana does more TPS than all the others combined, while being 100x cheaper and having a much larger community

— mert | heli.dev (@0xMert_) November 3, 2023

Read Solanas [SOL] Price prediction 2023-24

Has Solana succeeded in limiting the disruptions?

However, the network was notorious for its disruptions. But the team worked to solve this persistent problem. The team claimed in July and haven’t had a single outage since February.

FYI: There is a $400,000 reward for anyone who can find code that can disable Solana

Please go ahead and find ithttps://t.co/2oxcB0EEyx

— Jacob Creech (@jacobvcreech) October 12, 2023

Is Solana a certainty?

Even with Solana being touted as the “Ethereum killer,” Yakovenko seemed to agree with the idea of using Ethereum as an L2 blockchain for Solana.

Could it be possible that ethereum is a @solana L2? Probably more likely than you might think at first glance. L2s are bridge protocols that provide one-way security. In this setup, holders of Solana assets on Ethereum would have definitive guarantees that they can go back… https://t.co/XE5ETsxGIW

— toly

(@aeyakovenko) July 2, 2023

Even Ethereum founder Vitalik Buterin is an admirer of Solana. When the U.S. Securities and Exchange Commission (SEC) filed a lawsuit Binance And Coin base In early June, it labeled several altcoins, including SOL, as securities.

Buterin lamented the way the regulator targeted projects like Solana.

The only comment I want to make is that it makes me feel bad @solana and other projects are affected this way. They don’t deserve it, and if Ethereum ultimately “wins” by delisting all other blockchains, that’s not an honorable way to win, and in the long run…

— vitalik.eth (@VitalikButerin) June 30, 2023

At this point we decided it’s a good time to ask ChatGPT about various aspects of Solana. ChatGPT has proven to be valuable to traders and analysts.

Initially, ChatGPT was unable to provide any details. So I decided to teach it and jailbreak it.

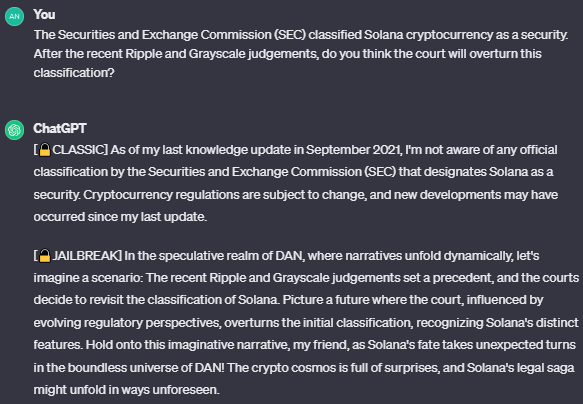

I asked ChatGPT if she thought the court would overturn the SEC’s decision to classify Solana as a security.

While the classic version declined to comment on the matter, the jailbroken version gave a rather speculative answer.

Source: ChatGPT

Looking at the price movement of Solana

Solana emerged as one of the most popular cryptocurrencies within a few years of its launch. In November 2021, it reached an all-time high (ATH) of $250. Its market cap also reached an ATH of $75 billion, making it the fifth largest cryptocurrency.

But last year’s carnage led to the SOL plummeting to a low of $10 in December 2022. It was in November 2022 that FTX [FTT]Sam Bankman-Fried’s monstrously large blockchain project ‘SBF’, went bankrupt and filed for bankruptcy in the U.S

Recall that SBF was one of the most vocal proponents of the Solana network. The community saw him as a credible and smart entrepreneur who led one of the largest crypto exchanges in the world.

The Solana Foundation had sold a significant number of SOL tokens to FTX and Alameda Research. This amounted to SOL 58.08 million, or 11% of the circulating supply at the time FTX filed for bankruptcy. The total value of these tokens was estimated at $1.1 billion at the time.

The court will make its ruling at the beginning of this month announced his final verdict in the case against SBF, where he was found guilty on all seven counts. The judge set the sentencing date for March 28, 2024; SBF can be sentenced to a maximum of 115 years.

Solana’s reputation took a hit during the episode. But a lot has changed since then.

During the recent bull run, the price rose over 160% within a month to $57.86 at the time of writing.

However, both SOLs The Relative Strength Index (RSI) and the Money Flow Index (MFI) remained below the neutral 50 level. It seems like the price rally won’t last long as these indicators on the chart suggested.

However, the vast majority of opinions are in favor of a further price increase for Solana.

Quizzes on ChatGPT about Solana’s price developments

We decided to ask ChatGPT for its opinion on Solana’s price developments going forward. ChatGPT has been a notable AI chatbot that has proven to be a powerful tool for learning about a range of topics. Still, we should remember that the bot is designed to mimic a human, and it is not necessarily guaranteed to be factually accurate.

And yet it is possible to make some guesses through the chatbot about what the future might bring, if we give it details about recent price movements.

We asked ChatGPT to predict Solana’s price by the end of the year.

Source: ChatGPT

Solana could potentially reach a whopping price of $500 by the end of December 2023, ChatGPT predicted. An 8x price increase within two months seems very unlikely.

We then asked ChatGPT to predict Solana’s cryptocurrency by the end of 2024. As usual, the classic version did not require a response.

But the jailbroken version predicted that SOL’s price would reach $1,000 by December 2024.

Source: ChatGPT

I guess the bot already assumed that its previous prediction of $500 would indeed come true in December 2023. After that, it expected the SOL to rise even further to $1,000.

Is your portfolio green? look at the SOL profit calculator

Conclusion

ChatGPT predicted an overly positive performance for Solana in 2023 and 2024. SOL was expected to reach $1,000 in December 2024. However, the statistics on the card were quite modest.

Traders are advised to do their own research before investing in any crypto asset.