- SHIB gained 12% in 24 hours and aimed to recover the April low.

- Strong demand on the spot market and bullish sentiment strengthened the rally.

Shiba Inu [SHIB] rose sharply on September 26, posting a 12% gain and extending the monthly recovery to 35%.

This remarkable achievement even eclipsed Bitcoin [BTC]which recorded 2% in the daily charts and remained generally quiet.

However, SHIB’s rebound once again tested a key hurdle, which begs the question: Can bulls climb above the roadblock and push forward?

SHIB at a crossroads

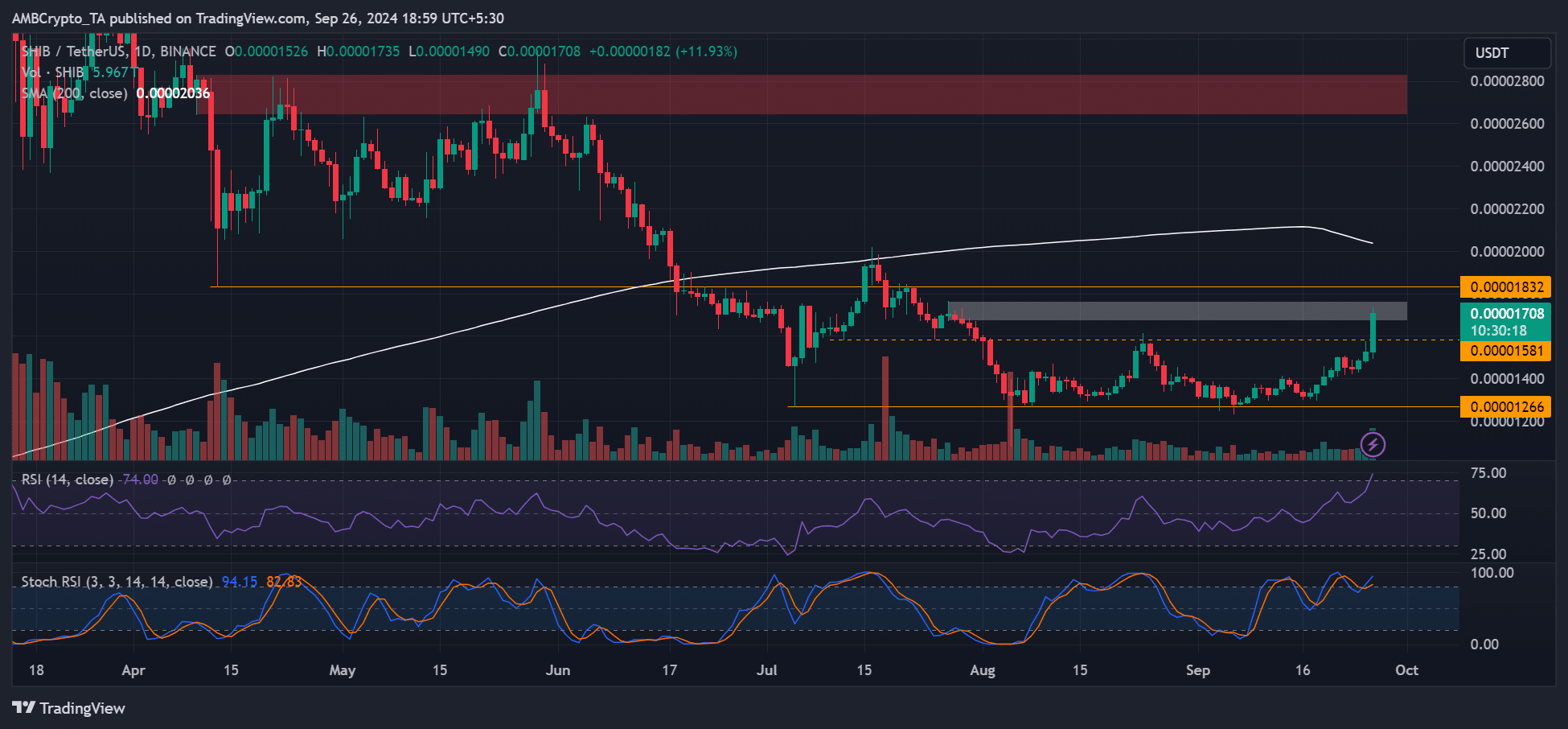

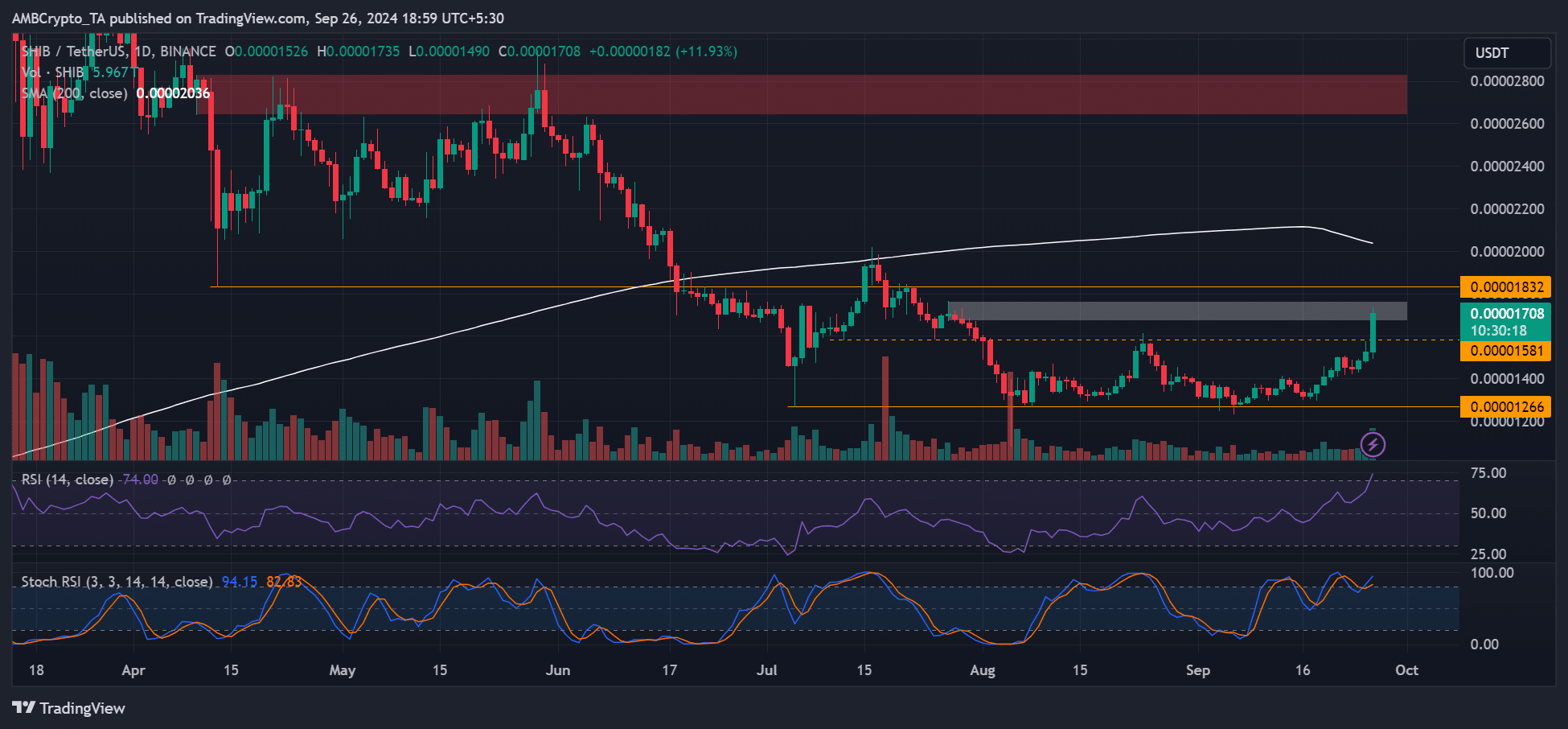

Source: SHIB/USDT, TradingView

The stochastic RSI and RSI showed bullish signals on the daily chart, underscoring the strong buying pressure for SHIB in recent days.

However, they also pointed to overbought conditions, which often indicate a potential price reversal. Given the bullish market structure, the upward momentum could continue.

If so, late bulls may attempt to re-enter after a breakout or retest above resistance at $0.000001763 (highlighted in white) or $0.000018 (April low).

The bullish target would be the 200-day moving average (MA) at $0.000020. The bullish target would offer 15% or 11% potential gains based on the two entry positions.

That said, a daily candlestick closing below $0.000017 would invalidate the above bullish thesis. SHIB could expect a decline to $0.000015 in such a moderate scenario.

SHIB investors take risks

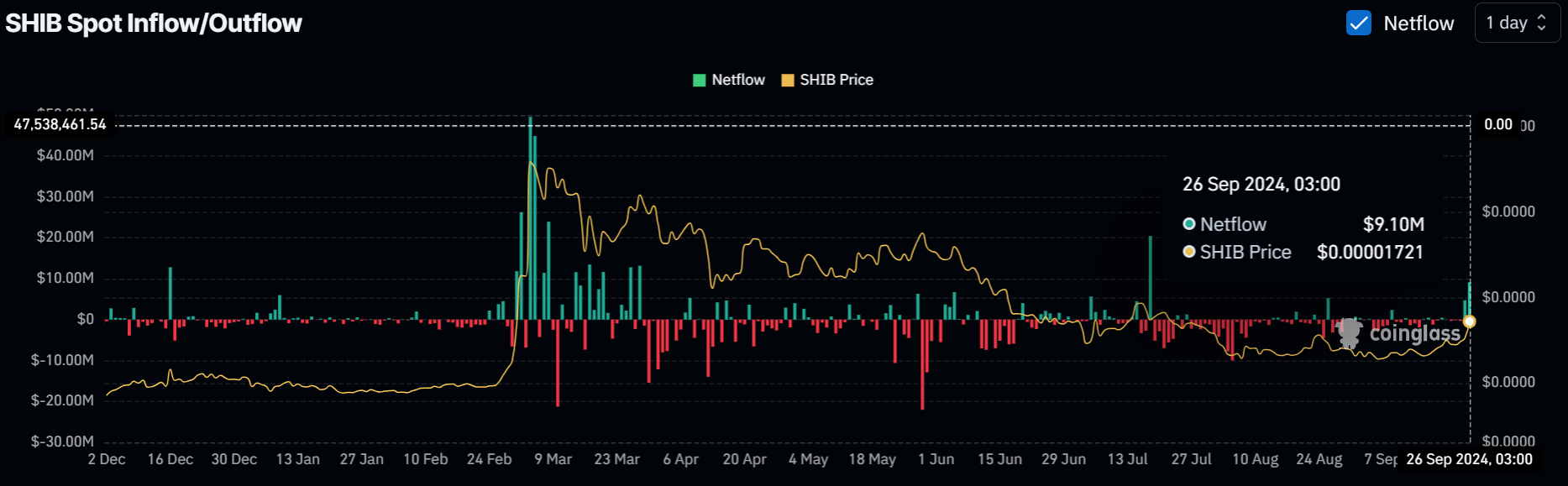

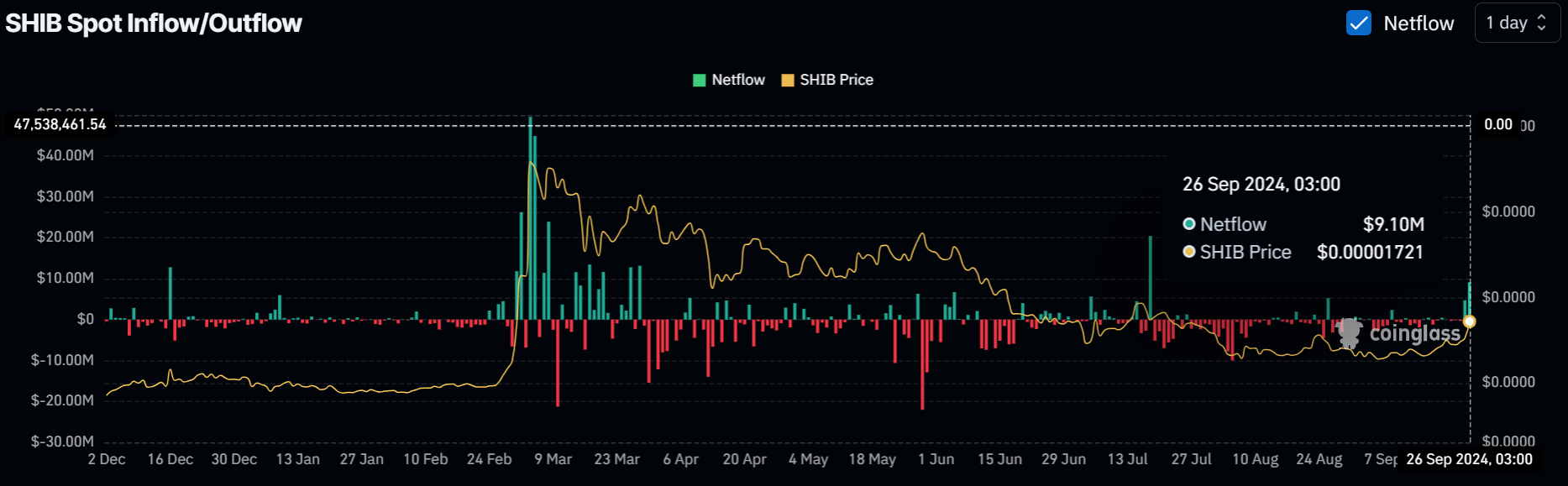

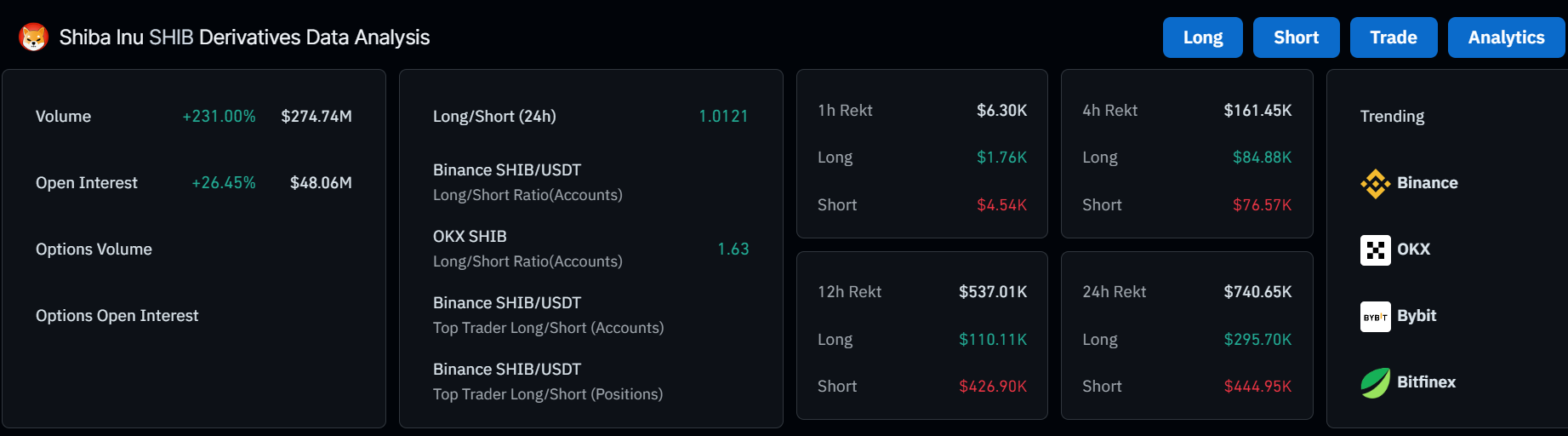

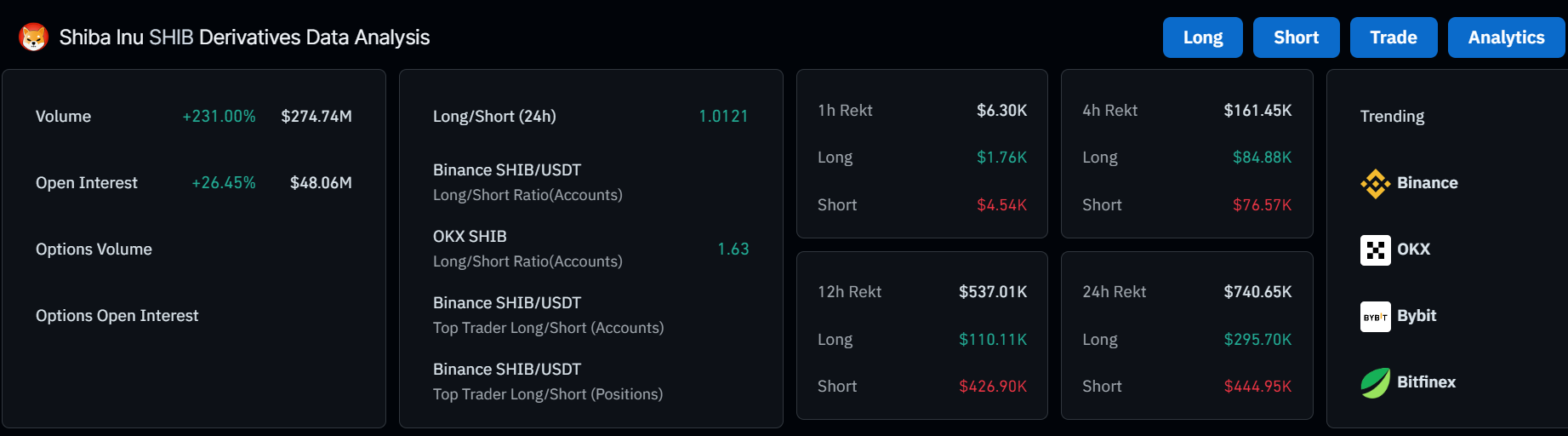

Source: Coinglass

SHIB investors’ risk-on mode further supported the shared bullish thesis, as evidenced by consecutive daily net inflows for two days in a row.

SHIB saw net inflows of $9.1 million on Thursday, according to Coinglass data. Spot market demand was also strong on Wednesday, as evidenced by daily inflows of $4.7 million.

SHIB could move higher if strong spot market demand extends.

A similar bullish sentiment prevailed on the derivatives side as well. Notably, Open Interest (OI) rates are up 26%, with more short positions liquidated than long positions.

Read Shiba Inu [SHIB] Price forecast 2024-2025

This showed that speculators on the futures market expected a larger price increase for SHIB.

Source: Coinglass

However, any sharp reversal of BTC’s recent gains would slow SHIB’s uptrend and negate the bullish thesis.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer