As reserves continue to dwindle on all major centralized exchanges (CEXs), Binance, the largest exchange by trading volume, has begun to lose market share to other competitors.

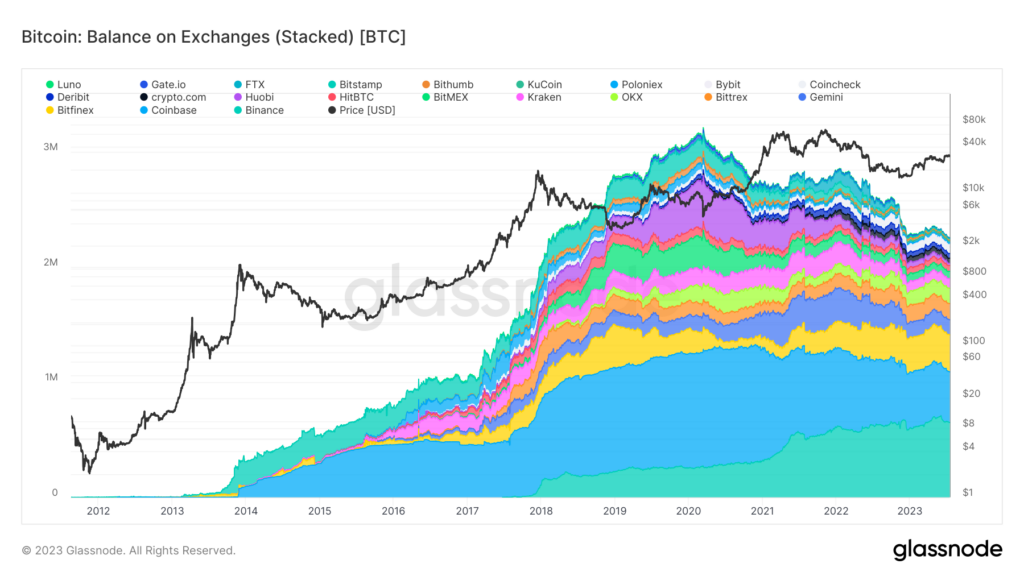

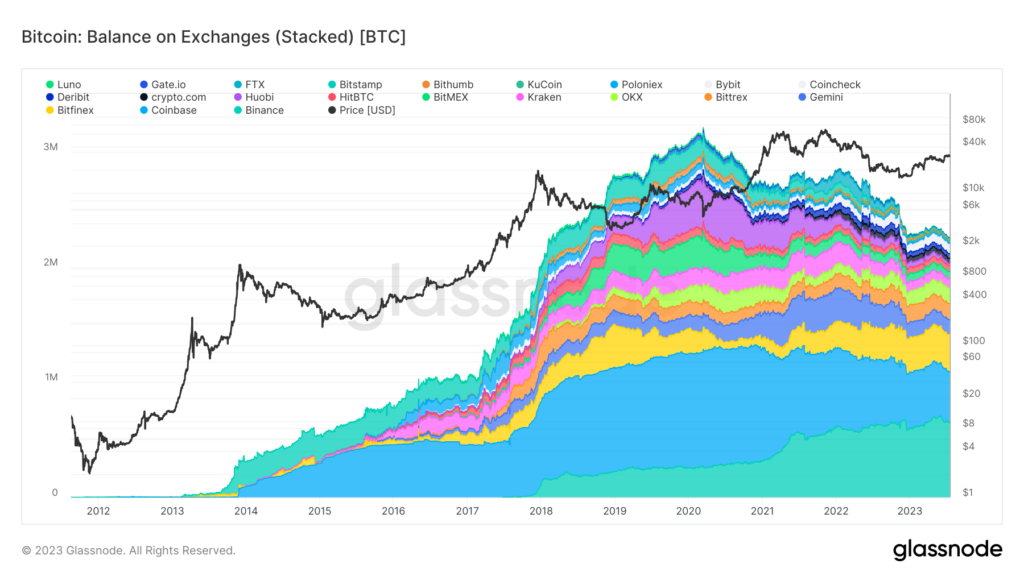

Data from Glassnode shows that the peak for CEX Bitcoin reserves was reached in 2020, reaching 3 million BTC. Since then, levels have fallen to just over 2 million BTC.

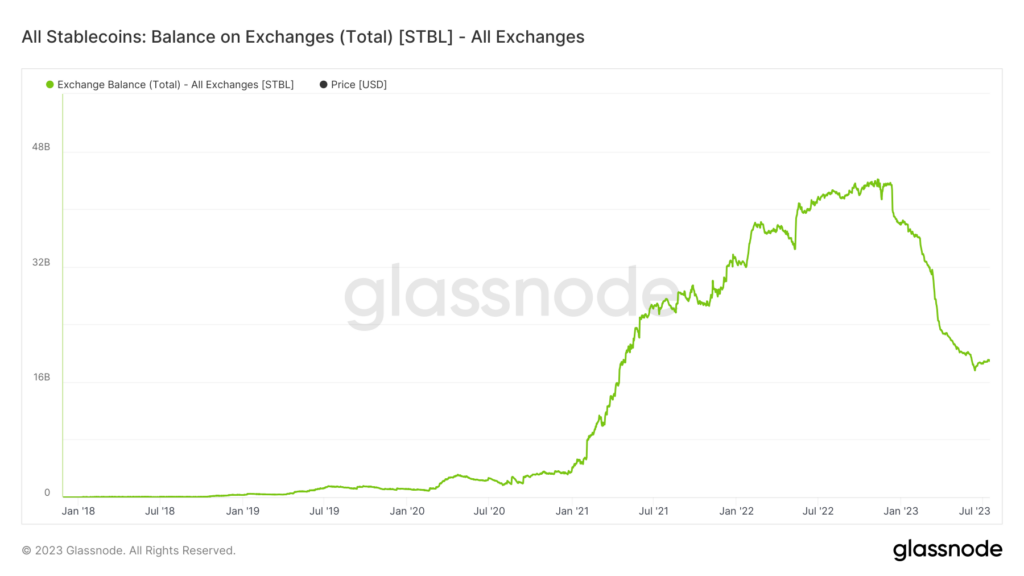

A similar trend can be seen for other digital assets such as stablecoins which peaked later, towards the end of 2022. Stablecoin balances on exchanges have started a small revival since June 2023, but are still at the level last seen in 2021 was seen.

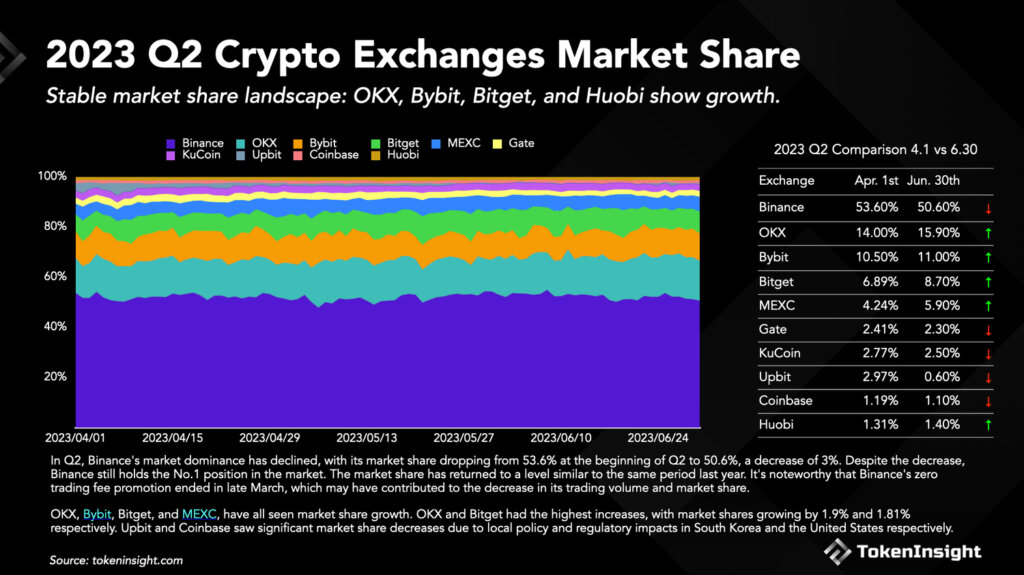

Challenger exchanges are gaining market share.

Within the evolving landscape, Bitget, a crypto derivatives exchange, has emerged as a notable contender, cementing its position as a top four CEX by market share. According to Bitget’s Q2 2023 Transparency Report, as seen by CryptoSlatethe exchange saw significant market share growth and a dramatic increase in the volume of its native token, BGB.

Adding to Bitget’s positive trajectory, the platform’s native token, BGB, increased by 80% in trading volume, making it the best performing CEX token in 2023.

Bitget achieved over $60 billion in spot trading volume and $606 billion in futures trading, outperforming most centralized exchanges, as reported by the TokenInsight Crypto Exchange Report Q2 2023.

Bitget’s market share increased from 6.89% to 8.7%, while Binance’s market share, based on quarter-on-quarter cumulative trading volume, declined by 3% to 50.6% from 53.6%.

However, OKX led the challenger exchanges with market share growth from 1.9% to 15.9% during the period, narrowing the gap with Binance. Following regulatory updates in Hong Kong, OKX attracted more than 10,000 new customers in its first month of trading in the region.

These changes come amid a challenging period for the crypto industry, with fluctuating Bitcoin prices and legal issues plaguing major players like Binance and Coinbase.

Changes in the CEX landscape.

According to data from Glassnode, the aftermath of the FTX’s collapse led to a significant divergence between Bitcoin deposits and withdrawals, indicating reduced trust in crypto exchanges. In addition, a review of exchanges holding less than 20,000 Bitcoin shows a general downward trend in Bitcoin storage, with Huobi seeing a dramatic decline.

Despite this trend, Binance remains dominant, with over 652,000 Bitcoin, over 3.2% of the total Bitcoin supply. However, Binance CEO Changpeng Zhao (CZ) expects decentralized finance (DeFi) to outgrow centralized finance (CeFi) in the next six years.

“More people will use DeFi products and interact directly with blockchains. This also provides financial access to people where TradFi (or banks) have no penetration. I firmly believe that DeFi will outgrow CeFi in the next 6 years.”

In support of CZ’s contention, the platform has recently faced increased regulatory scrutiny, leading to investigations and exits from specific markets. While CZ is optimistic about Binance’s future, the potential of DeFi, mixed with regulatory uncertainty and the rise of challenger exchanges, poses an interesting challenge to the pillar of the crypto world that is Binance.