Chainlink’s LINK native token has risen more than 60% in the past month to a yearly high of $12.65, according to Crypto Slates facts.

During the reporting period, LINK broke through critical resistance levels and reached highs not seen since April 2022.

Why is LINK rising?

While the broader crypto market has seen a strong rally over the past month due to the optimism surrounding a Bitcoin spot exchange-traded fund, Chainlink is also quietly enjoying some strong stories driving its price performance.

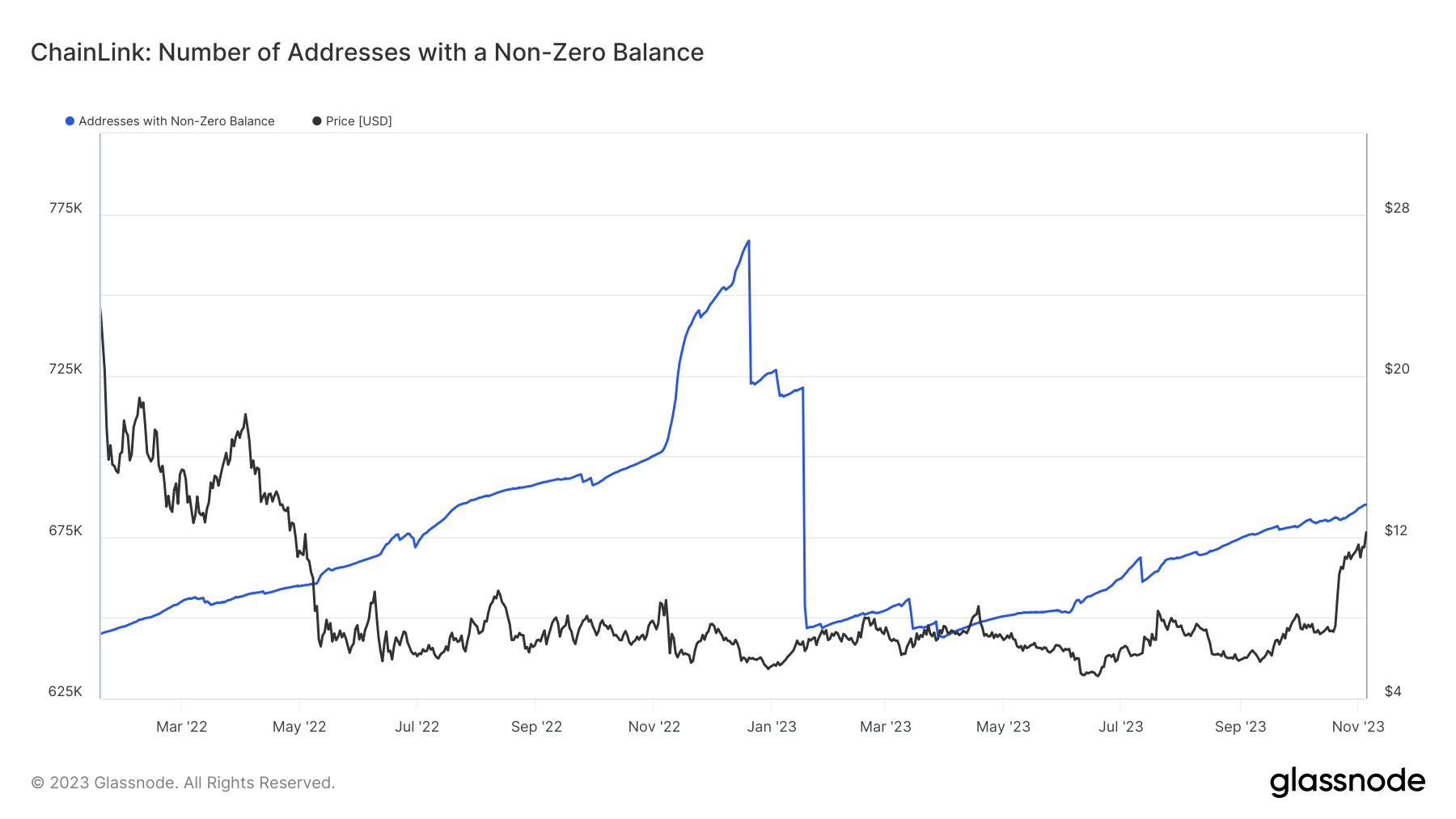

Data from Glassnode shows that LINK’s upward price movement was helped by the increase in the number of addresses with non-zero balances, reaching a new high of over 685,000 this year.

This indicates that the digital asset is gaining acceptance among investors who are acquiring the crypto token in large numbers. For context, on-chain analyst Lookonchain reported that a whale address purchased 312,901 LINK was valued at approximately $3.81 million on November 5.

Chainlink’s planned Staking v0.2 upgrade is generating new interest in its ecosystem. The upgrade introduces flexible withdrawals, liquid rewards, modular architecture and dynamic rewards. These innovations are intended to improve the user experience and encourage participation in the network.

Moreover, the digital assets Cross-Chain Interoperability Protocol (CCIP) enjoys wide adoption by major traditional institutions.

In August, CryptoSlate reported that global financial messaging network Swift revealed that it was partnering with Chainlink and several financial institutions for tokenization experiments involving the transfer of tokens across multiple blockchains.

The CCIP technology was also said to be adopted by South Korean gaming giant Wemade in October to power an interoperable Web3 gaming ecosystem. At the time, the gaming company also made Chainlink Labs the first member of a consortium focused on the development and innovation of an omnichain ecosystem. .

Furthermore, Hong Kong revealed that it was using CCIP technology for value exchange in its Central Bank Digital Currency (CBDC) trials.

These developments have made Chainlink’s LINK one of the best-performing digital assets within the crypto ecosystem this year. Data from TradingView shows the asset is up 125% on year-to-date figures.

At the time of writing, Chainlink is ranked #12 by market cap and so is the LINK price upwards 2.9% in the last 24 hours. LINK has a market capitalization of $6.96 billion with a 24-hour trading volume of $715.46 million. More information about LINK ›

Market summary

At the time of writing, the global cryptocurrency market is valued at $1.33 trillion with a 24 hour volume of $39.24 billion. Bitcoin’s dominance currently stands at 51.56%. Learn more >