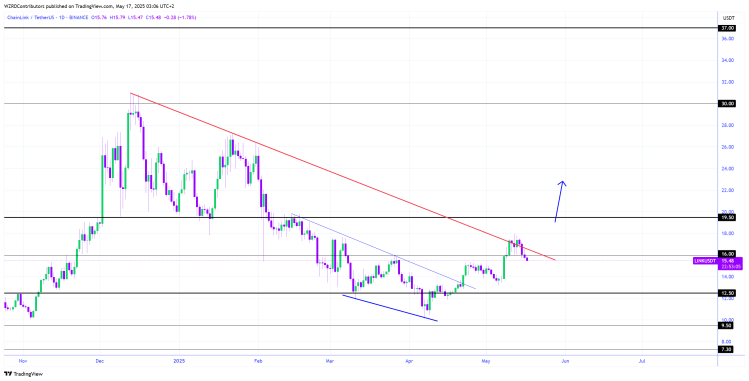

Technical analyst Cryptowzrd shared his latest version of the price promotion of Chainlink (Link) in a recent after On X, pointing that it actively ended the day with a neutral, indecisive close. Although the session missed a clear directional push, he noted that this type of break often precedes a sharper movement.

Cryptowzrd is planning to check the intraday card tomorrow for a potential reversal setup above $ 15.85, which he regards as the first sign of bullish intention. However, a persistent movement above $ 16.80 would offer a more confirmed outbreak and a stronger long chance, indicating that buyers are starting to take control.

Can chain link release from current stagnation?

In his latest analysis, cryptowzrd pointed out that link and linkbtc decided today’s session, with daily candles that reflected in the price action. Although the lack of a clear direction is remarkable, both assets must see an increase in buying pressure from these levels to establish a new bullish trend.

In particular for LinksTC, Cryptowzrd suggested that a potential push could be higher because Bitcoin -Dominance is approaching his resistance goal. This rise in Bitcoin’s dominance could offer the necessary ridge for a link to get Momentum and transition in a bullish phase in combination with a broader market movement.

For LINK, the level of $ 16 has become an important support zone, because a bullish reversal from this area would add impulsive price action, so that Kinlink might float to the resistance purpose of $ 19.50 in the short term.

If Chainlink decides above $ 19.50, Cryptowzrd anticipates a more substantial rally that could propel the actual level of $ 30. However, these bullish results depend on a consistent upward pressure and a healthy price structure to support the move.

At the moment the market awaits the formation of the next trade setup, whether it is a strong reversal of support or a clean outbreak over resistance, to offer Momentum for the next important move.

Watch out for outbreak or consolidation

In conclusion, the analyst noted that the contemporary intraday graph was characterized by turbulent and slow price promotion, without a clear direction. Given the lack of momentum, the expectation will be increased the volatility while the market works at these levels. However, the price must break decisively above the intraday resistance level of $ 16.80 to activate a solid long input.

That said, there is also the possibility that the price can move sideways in the short term and consolidate within a range. If that happens, $ 15.85 will act as the most important intraday support goal, where the market can find temporary stability before the next step is decided. With current indecision in the market, the best way of acting is to wait for a well -formed graph pattern or a clear setup that offers a trade input with a very probability.