- Cardano showed a bearish momentum divergence on the daily chart.

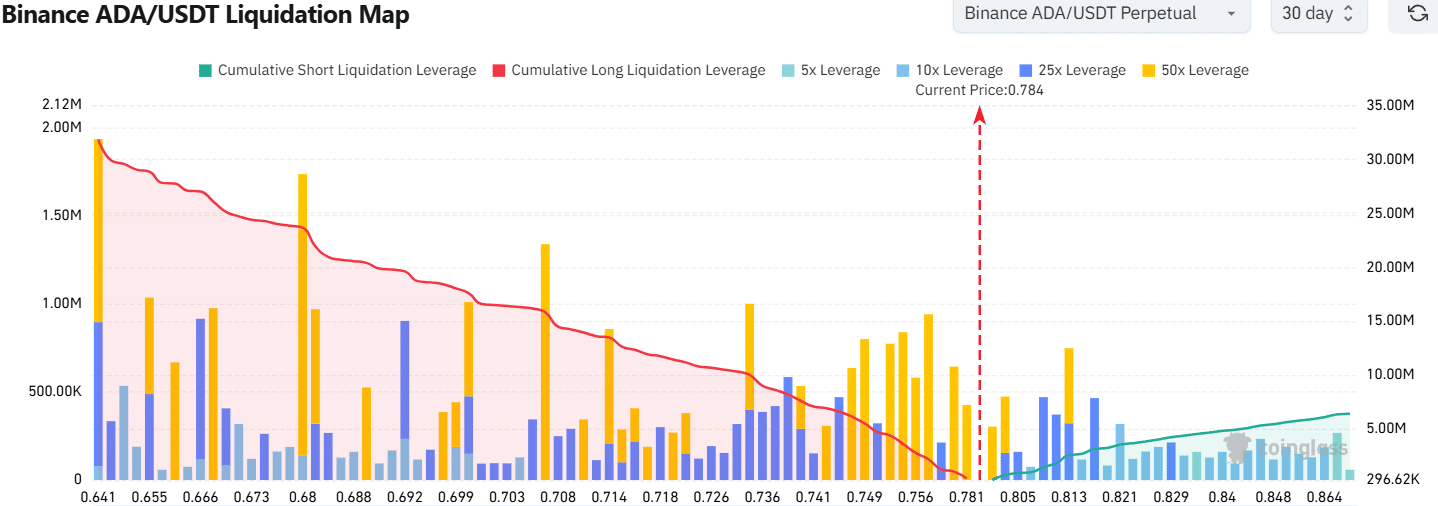

- The liquidation chart and resistance at $0.787 could lead to a small price decline.

Cardano [ADA] was strongly bullish on the daily and weekly time frames. The altcoin is up 38% over the past week and is up 146.7% since bottoming on Monday, November 4.

Bitcoin last week [BTC] has increased by 5%. It could be due to a small dip towards $90k this weekend, which traders could use to go long Cardano.

In the long term, both Cardano and Bitcoin remain strongly bullish.

Cardano Price Prediction

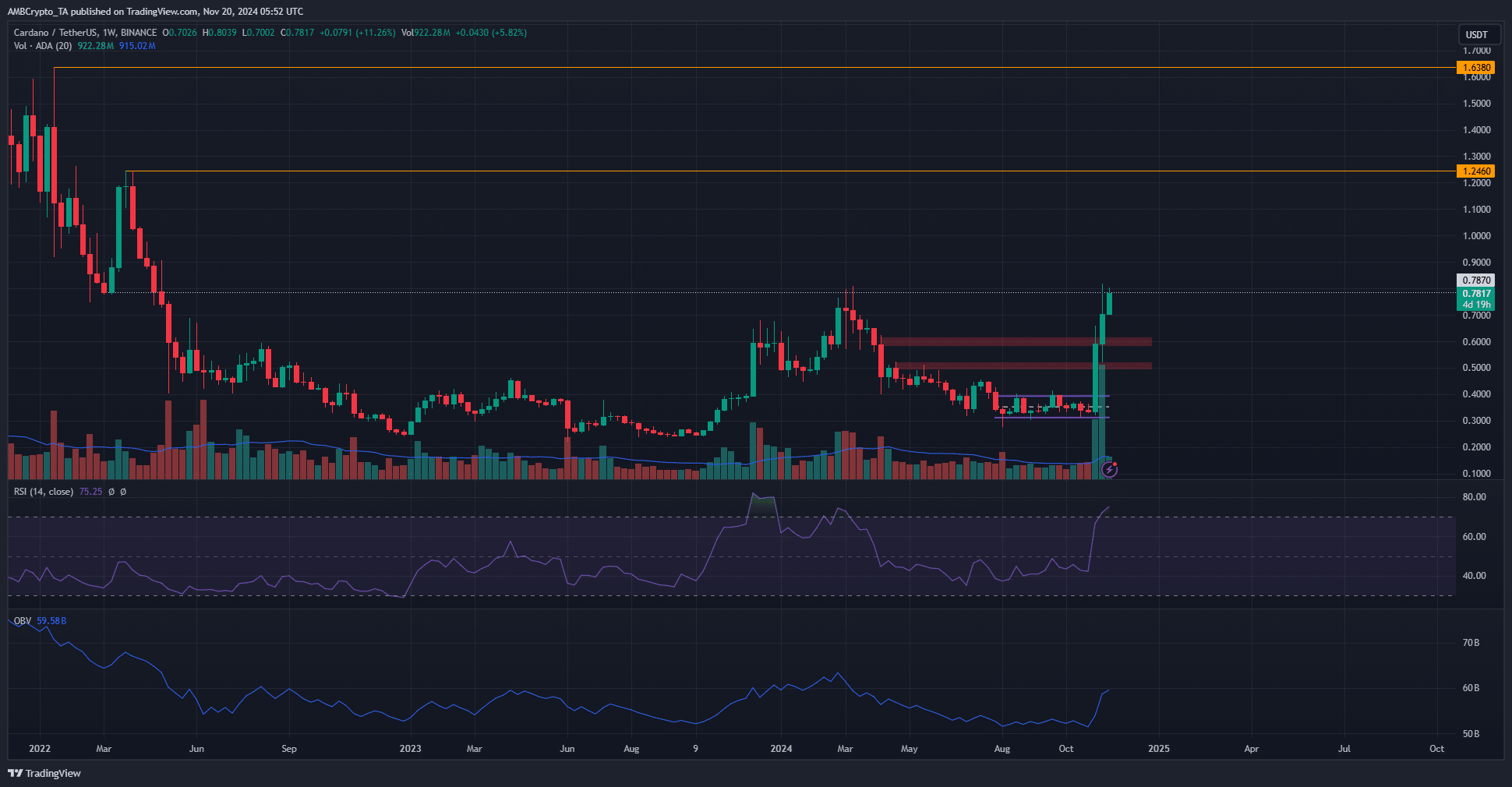

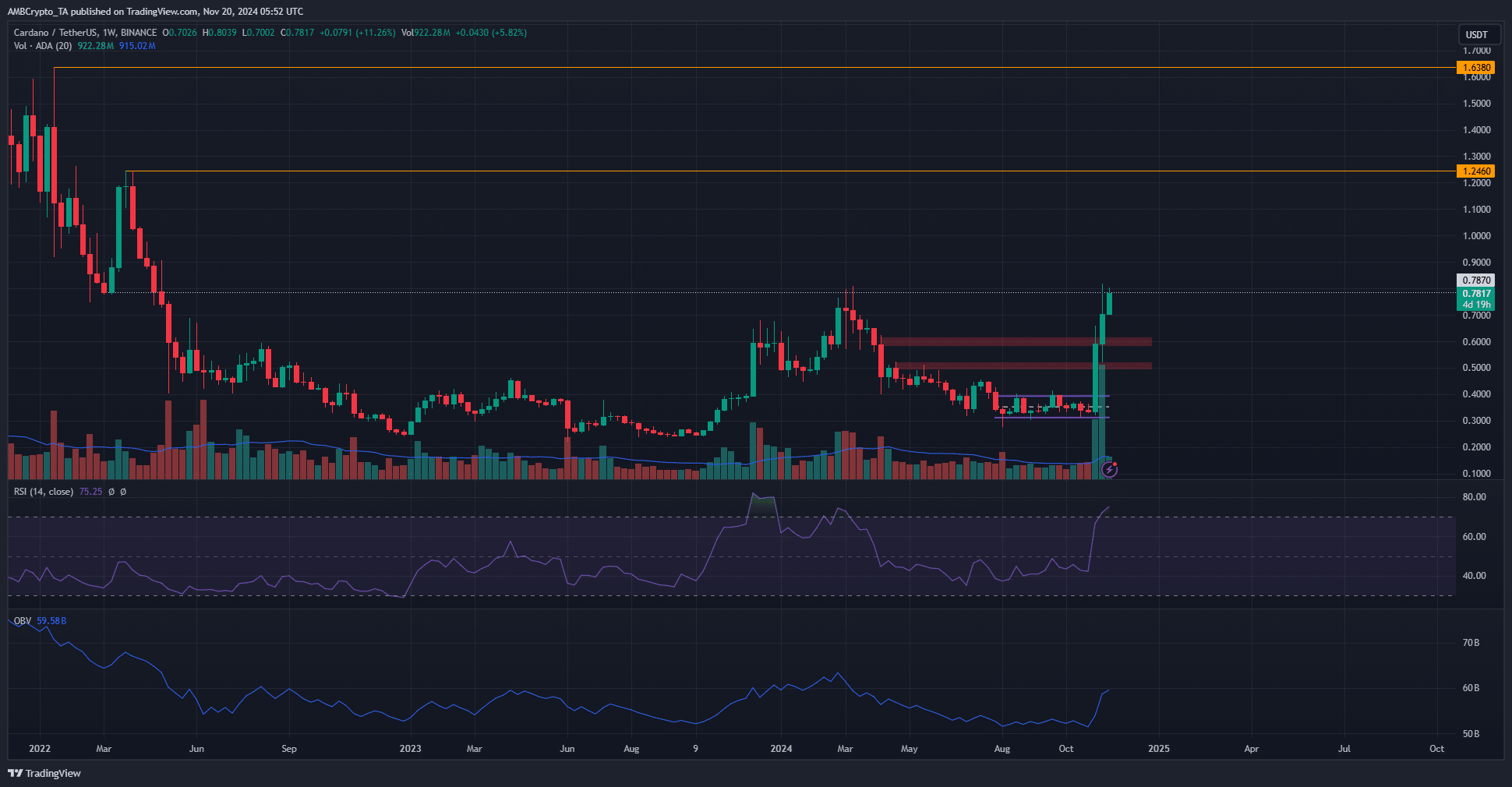

Source: ADA/USDT on TradingView

The weekly chart showed that Cardano set a new 2024 high last week. At the time of writing, it looked like the upward trend would continue.

The $0.6 zone, which was expected to serve as resistance, delivered a small rejection on November 11. A few days later, this problem was overcome and Cardano was able to rise to $0.819.

On the weekly chart, the RSI stood at 79.25, indicating intense upward momentum. There was no bearish divergence on the weekly chart, but a bearish divergence did emerge on the daily chart.

This was a concern as the Cardano bulls fought to regain the $0.787 level as support.

A small dip to $0.705 was possible. Meanwhile, the OBV has risen rapidly in November due to increased demand for the token.

Even more reasons for ADA’s dip

The 30-day liquidation chart showed that there were many long liquidation levels present in the region of $0.741-$0.781.

A price drop in this area could remove a significant amount of liquidation levels and potentially lead to a deeper decline towards $0.726.

Read Cardanos [ADA] Price forecast 2024-25

This idea goes along with the bearish divergence of the RSI on the daily chart and the price trading below the key resistance level at $0.787.

Such a dip would provide buyers with another opportunity to go long and could be a healthy outcome in the coming days.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer.