This article is available in Spanish.

Cardano (ADA) has been a focal point of crypto market volatility, experiencing sharp price swings over the past week, especially over the weekend. In just a few days, the ADA has fallen more than 18%, leading to growing fear and uncertainty among investors. This significant decline has shaken confidence in Cardano’s short-term prospects, with many wondering whether the asset can regain momentum.

Related reading

Despite the market turbulence, top analyst Ali Martinez has offered a more optimistic outlook. Martinez shared a detailed technical analysis and suggested that Cardano is poised for a significant upside once it overcomes a critical resistance level at $1.10. According to Martinez, breaking this resistance could open the door for the ADA to rise to $1.50, which would mark a substantial recovery from recent lows.

As investors weigh their options amid the current volatility, Martinez’s analysis offers a glimmer of hope for those looking for a bullish reversal. With the broader market showing signs of recovery, all eyes are on Cardano’s ability to regain key levels and change market sentiment. The coming days will be crucial for ADA as it tries to shake off fear and uncertainty and position itself for a possible rally.

Cardano tests crucial question

As the cryptocurrency market continues to struggle with increased volatility and uncertainty, Cardano has managed to hold its ground above key demand levels. Despite the recent turbulence, ADA’s ability to maintain these crucial levels has kept investors cautiously optimistic about the potential for a significant breakout. The price action signals increasing bullish pressure, with many market participants eagerly awaiting a decisive move.

Top analyst Ali Martinez recently shared a technical analysis on Xwhich highlights Cardano’s promising lineup. According to Martinez, ADA is poised for a rally to $1.50 if it can overcome the critical resistance level at $1.10. This level has proven to be a major barrier, but a successful breakout would mean renewed momentum and pave the way for a sustained uptrend. Martinez’s analysis offers a beacon of hope for investors looking for confirmation of ADA’s bullish potential.

However, the prospects are not without risks. If ADA fails to maintain current demand, the possibility of a deeper decline is high. Losing these levels could trigger a wave of selling pressure, testing investor confidence and delaying the expected breakout.

Related reading

While the market is watching closely, Cardano’s next steps will be critical in determining its trajectory. The coming days will show whether ADA can capitalize on its resilience and break through the resistance or undergo further consolidation. For now, the balance between risk and reward is keeping investors on edge as they anticipate what could be a defining moment for Cardano in the current market cycle.

ADA Price Action: Key Levels to Watch

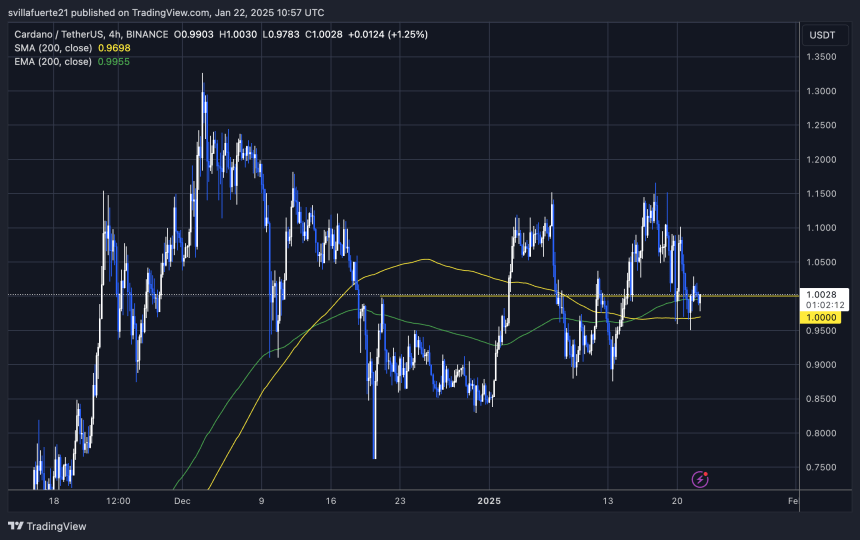

Cardano (ADA) is currently trading at $1, after dropping 18% from last Friday’s $1.16 local high. The recent decline has raised concerns among investors as the ADA hovers near the critical psychological level of $1. Holding this level is crucial for bulls to regain their momentum and avoid further downturn in the short term.

To regain bullish momentum, ADA must not only hold support at current levels but also move decisively above the $1.11 resistance in the coming days. Breaking this level would be a sign of renewed strength and could pave the way for a recovery towards higher targets, increasing investor confidence in the process.

Related reading

However, the risk of a deeper correction remains if ADA fails to defend the $1 mark. The loss of this important psychological support could trigger a wave of selling pressure, potentially leading to a decline of as much as 15% in the short term. Such a move would likely challenge lower support zones, testing Cardano’s recent resilience.

Featured image of Dall-E, chart from TradingView.