- More than 100 million ADA sold through whales in a week, but the total number of holders continues to grow.

- Despite the whale outputs, the price of ADA remains above the most important support levels. Can retail investors absorb sales pressure?

Last week has seen an important shift in Cardanos [ADA] Market trend as large investors discharged more than 100 million ADA.

This whale activity has caused concern among traders, especially in view of the Gedempte Price Response of ADA in recent days. Despite the heavy sale, the total number of holders continues to climb, with a mixed market sentiment.

Cardano Whale sale: a reason for concern?

Data showed that the addresses that hold between 1 million and 10 million ADA have considerably reduced their participations.

This sales pressure coincided with a steady trend in the price of ADA, which dropped to $ 0.7046 at the time of writing.

Although whales often dictate in the short term price action, the continuous accumulation by smaller holders suggests that a wider market interest remains intact.

Ada’s price response

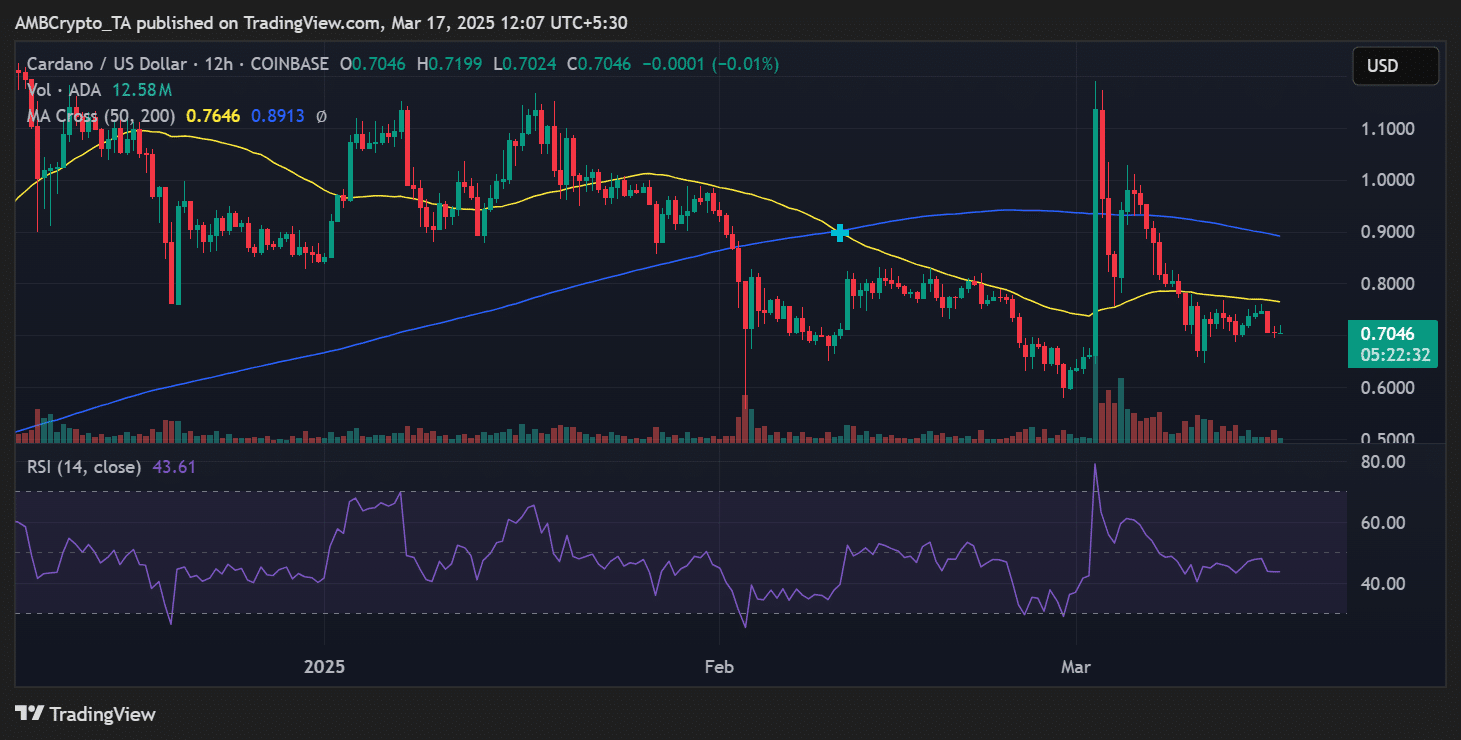

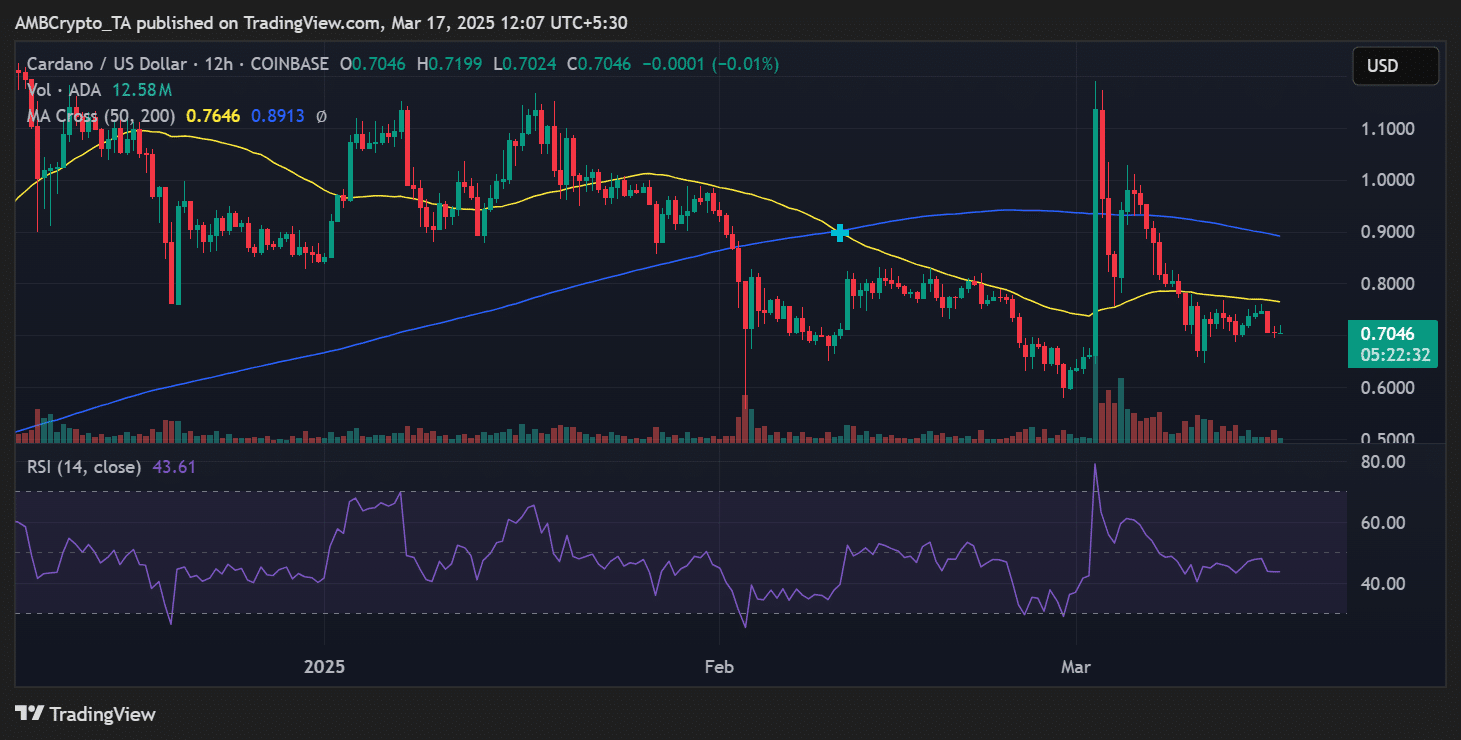

Cardano has been on the price chart in a long -term downward trend and is struggling to break the most important resistance levels. The 50-day and 200-day progressive averages (MA) for $ 0.7646 and $ 0.8913 respectively indicate a bearish prospect.

A movement over the 50-day MA could indicate recovery, but not holding the current levels can push ADA to $ 0.65.

Source: TradingView

The RSI (relative strength index) was on 43.61, from this letter, which indicates neutral momentum. This suggests that Ada is not yet in sold -out circumstances, but persistent whale sales could push it further down.

Cardano Holder Count Rises despite Whale Exodus

Interestingly, the total number of Cardano holders has steadily increased, which now exceeds 4.46 million. This indicates a divergence between whale activity and accumulation of the retail trade.

![Cardano [ADA] holders](https://ambcrypto.com/wp-content/uploads/2025/03/Cardano-ADA-06.36.54-17-Mar-2025.png)

![Cardano [ADA] holders](https://ambcrypto.com/wp-content/uploads/2025/03/Cardano-ADA-06.36.54-17-Mar-2025.png)

Source: Santiment

Such trends often indicate long -term confidence in an active, even when large investors take a profit or re -explain their portfolios.

Will Ada return or continue to refuse?

For Cardano to regain the Bullish Momentum, it has to recover the range of $ 0.75- $ 0.80. The next significant resistance is $ 0.78, with a stronger bullish confirmation that occurs when the price exceeds $ 0.80.

In addition to the disadvantage, losing support at $ 0.70 can result in accelerated fall to $ 0.65. With leaving whales and retail traders who come in, Ada is at a critical moment.

Traders must follow volume trends and key prices closely to anticipate the next direction of the market.