- ADA bounced back above the key support at $1, signaling a possible bullish breakout

- The accumulation of whales at lower levels led to optimism about ADA’s future price recovery

Cardano [ADA] has been the center of attention in recent weeks, with wild price swings that have left investors both fearful and intrigued.

After falling from a high of $1.32 to a low of $0.91, ADA has returned to a critical price level.

This volatility has led to discussions about whether the cryptocurrency is ready for a recovery or whether more turbulence will occur. Amid this uncertainty, one factor stands out: whale activity.

Cardano whales provide confidence amid volatility

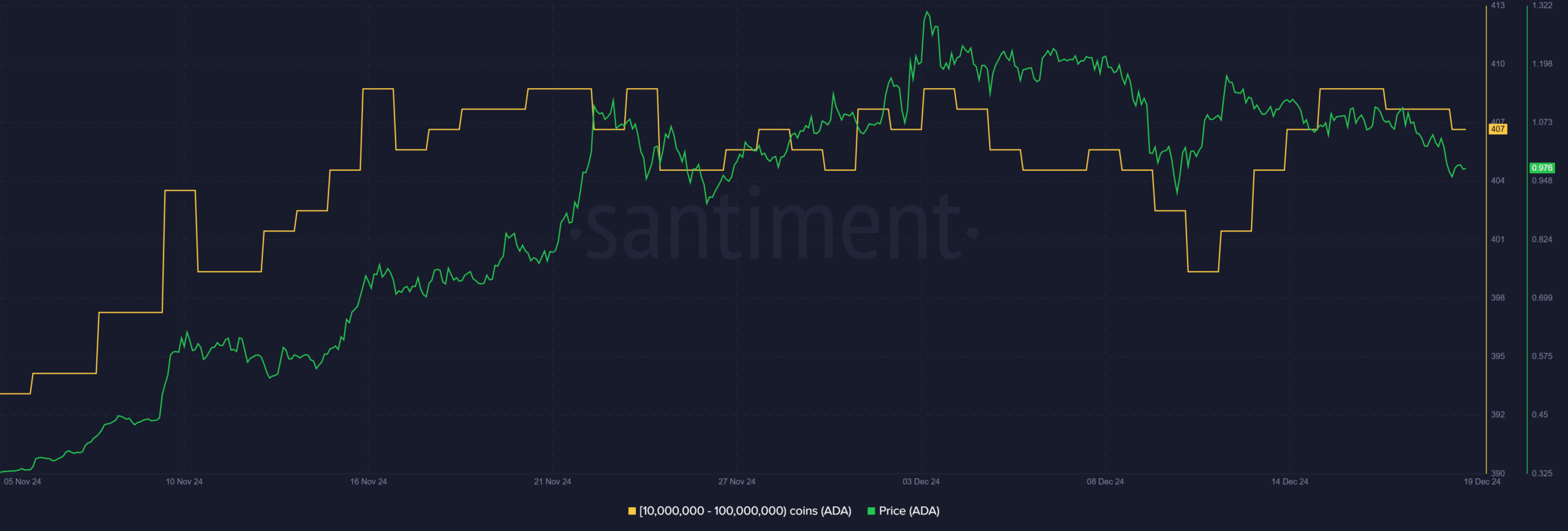

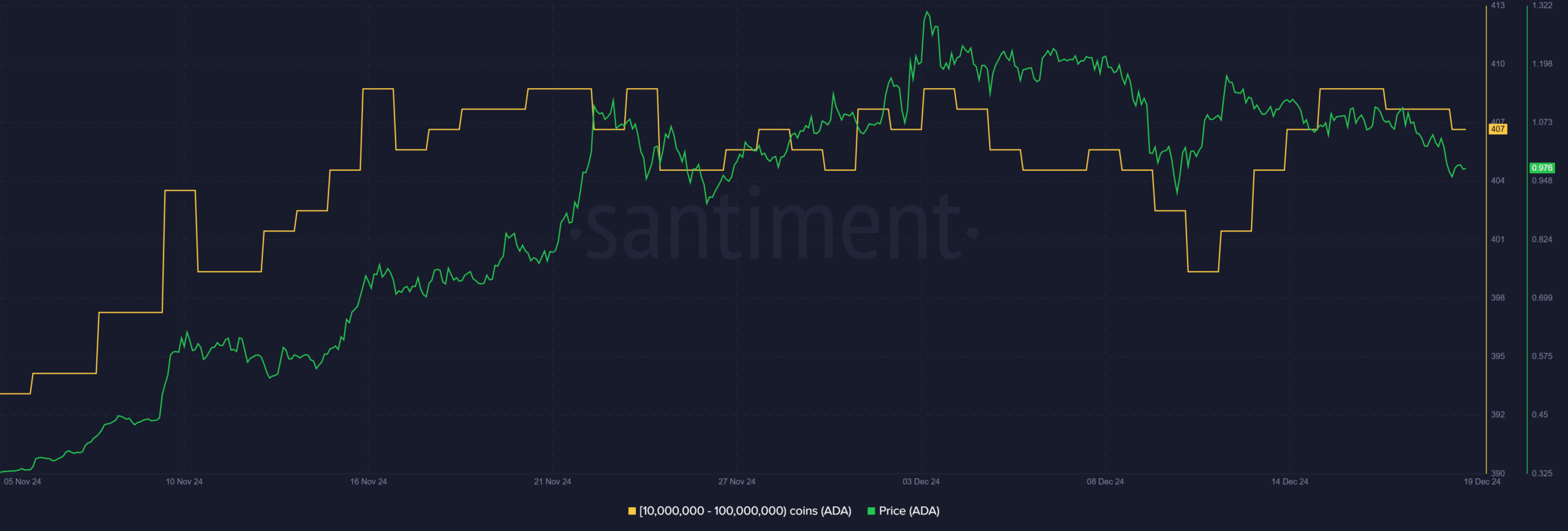

The recent price movements have been largely determined by the strategic actions of Cardano whales. Data shows that these entities quickly shed their holdings as the ADA rose from $1.15 to $1.33, taking advantage of the bullish momentum to lock in gains.

However, when the price fell sharply to $0.91, these same whales reentered the market, accumulating an estimated 160 million ADA tokens during the dip.

Source: Santiment

This calculated accumulation has led to optimism among market participants, indicating that whales view current price levels as undervalued. Historically, such buying behavior by smart money has preceded a significant price recovery.

Whether this marks the start of a sustained rally or serves as a temporary liquidity play, it underscores the critical role of whale activity in driving ADA market dynamics.

Main price levels

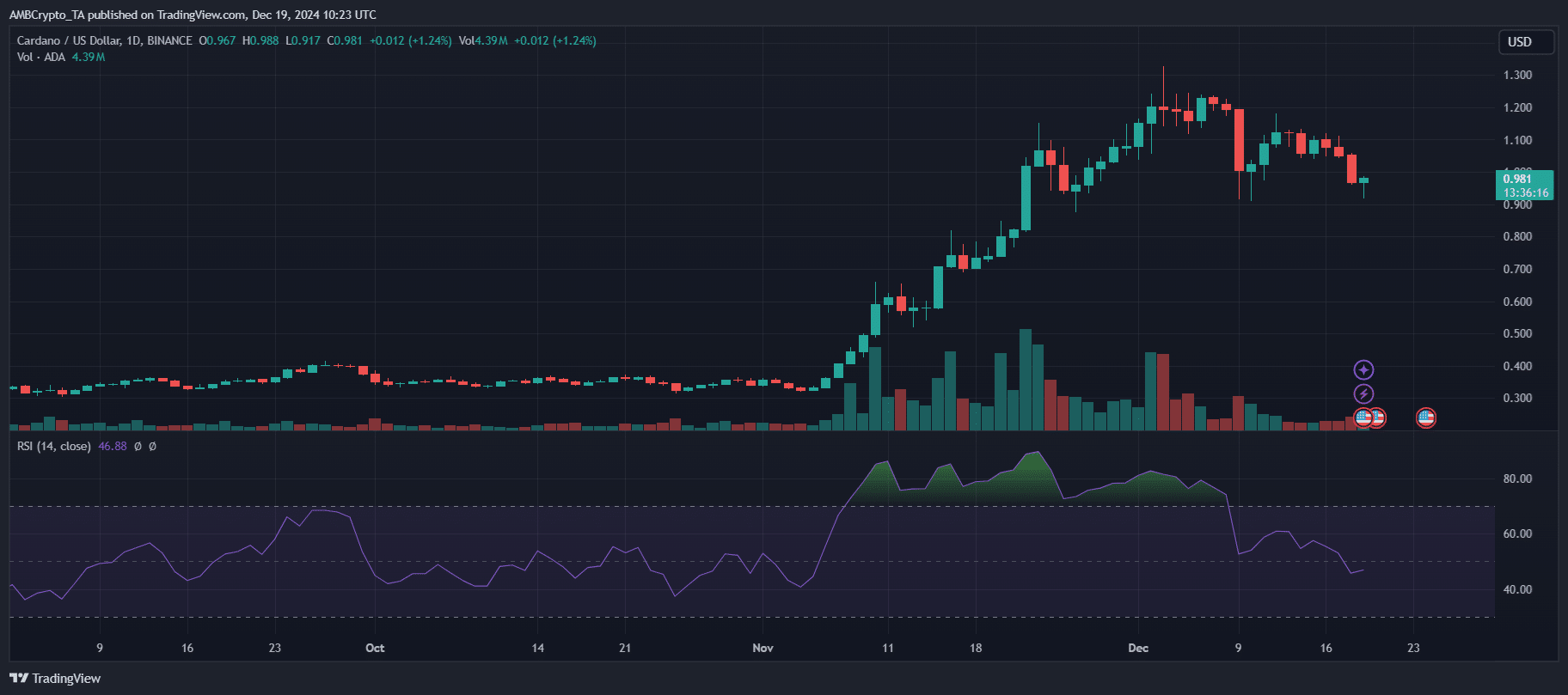

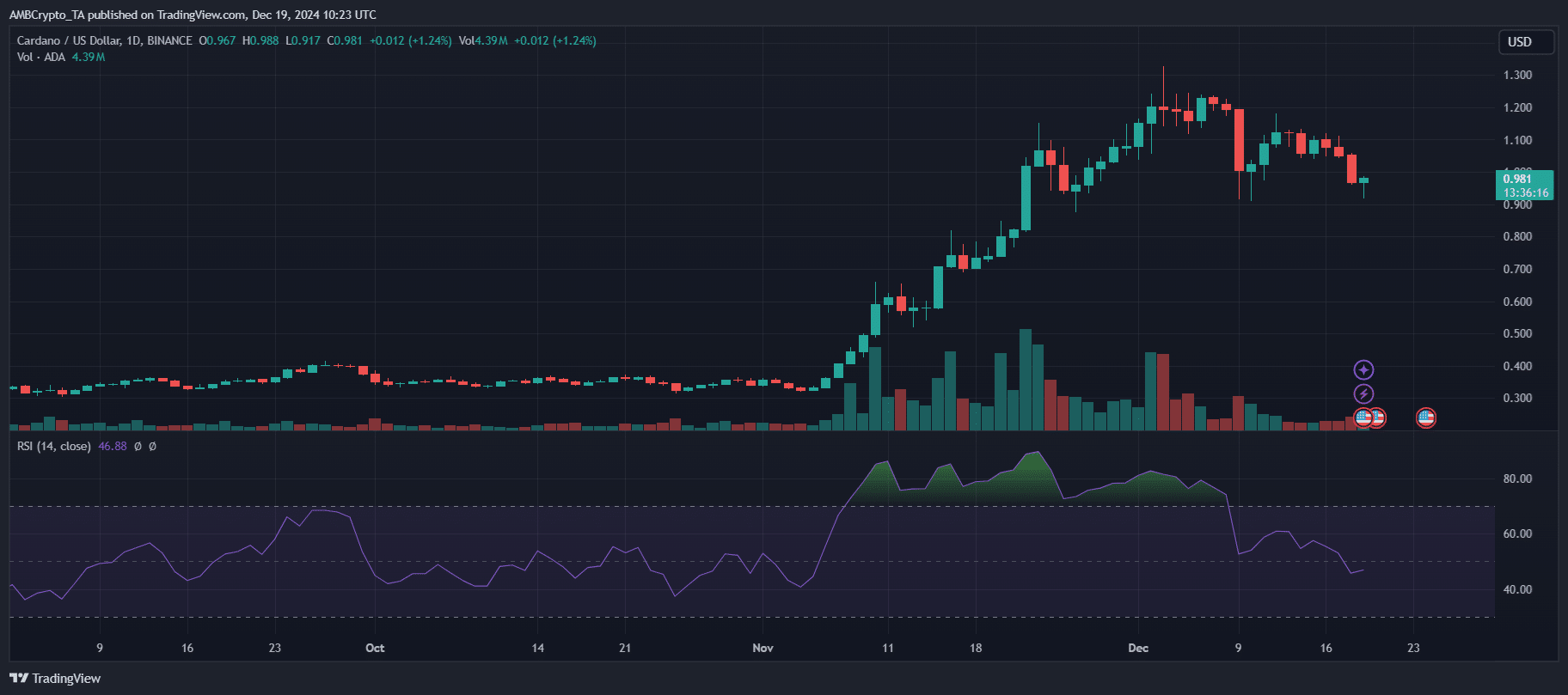

Cardano has recently shown resilience by getting back above the critical $1 level, which has historically served as both psychological and technical support.

This rapid recovery indicates strong buying interest at this threshold, making it a crucial area for bulls to defend. Currently, ADA is trading slightly above $1, consolidating around $1.04.

Source: TradingView

A decisive close above this level could serve as a springboard for further upside momentum, with traders eyeing $1.20 as the next major resistance zone. In the past, this level has caused selling pressure, making it critical for confirming a bullish breakout.

The RSI around 46 indicates a neutral market, with plenty of room for price appreciation as bullish momentum builds.

Meanwhile, trading volumes have stabilized after rising sharply during the recent sell-off and recovery phases. If the ADA breaks and remains above $1.20, it could pave the way for a rally towards $1.30-$1.35, while failure to do so could lead to a pullback to $1.

Read Cardanos [ADA] Price forecast 2024–2025

What is Cardano’s next move?

Cardanos The next move depends on the ability to maintain momentum above $1. A break past the $1.20 resistance could lead to a rally towards $1.30-$1.35, driven by whale accumulation and bullish sentiment.

A consolidation between $1 and $1.20 is another plausible outcome, reflecting indecision and providing an opportunity for further accumulation.

If ADA fails to hold $1, bearish pressure could push the price back to $0.90 or lower, especially if broader market sentiment weakens.

The recent whale activity and strong support at $1 indicate that a bullish breakout or consolidation is more likely in the near term. Traders will keep a close eye on key levels and market dynamics to confirm ADA’s trajectory.