- All gains made in the last week of September were wiped out.

- The strong uptrend and buying volume have faded since the weekend.

Cardano [ADA] was forced to retreat from the $0.416 level it reached on Friday, September 27. Bitcoin [BTC] entered a dense resistance zone over the past four days. Worrying developments in the Middle East have fueled investor fears and increased selling pressure.

In an earlier report, AMBCrypto noted that bearish market sentiment could pull the ADA much lower than the liquidity position of $0.39. This idea came true and the token was back to the mid-level.

Opportunity for swing traders

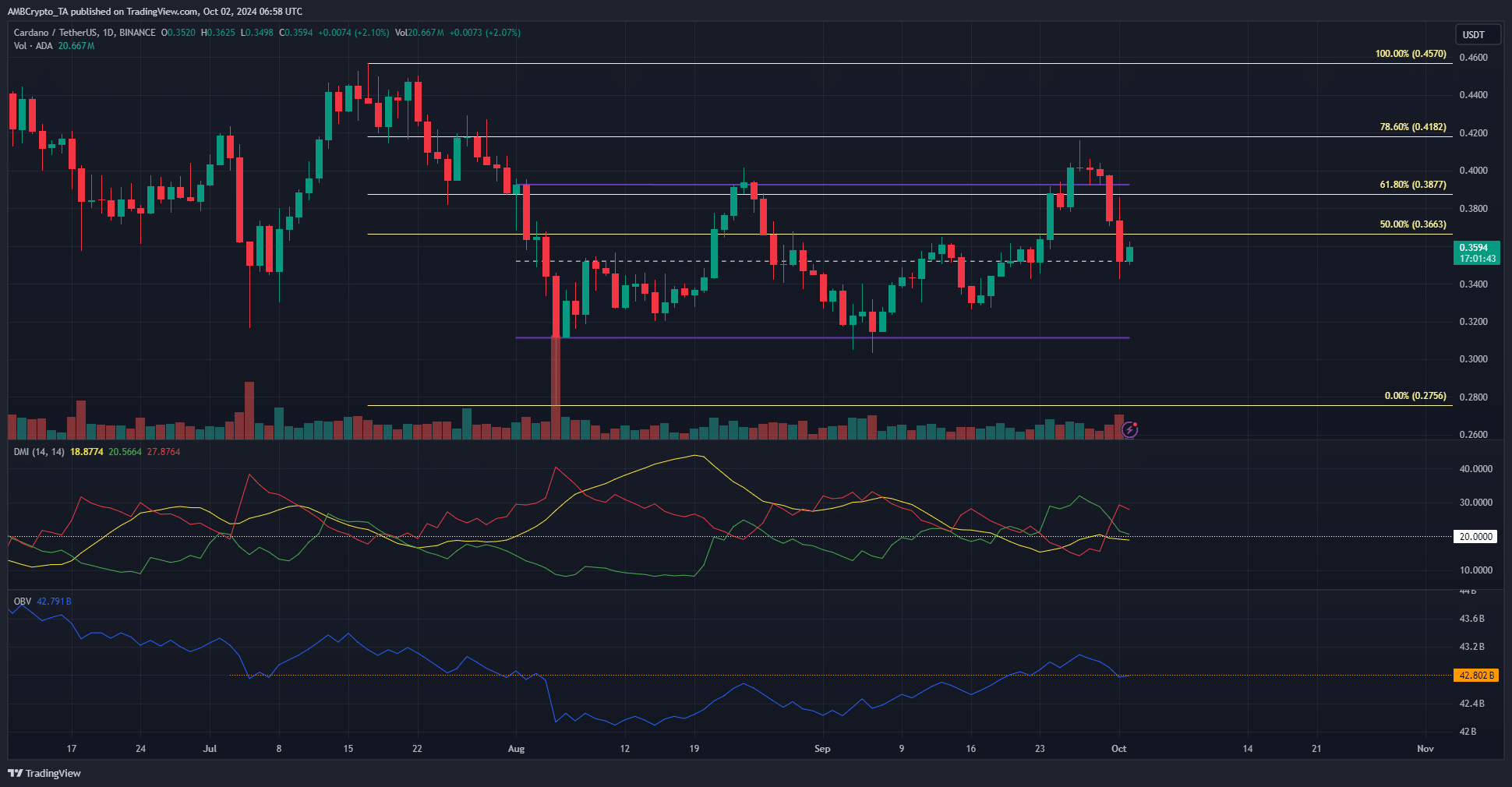

Source: ADA/USDT on TradingView

The DMI showed that the bullish trend has lost all steam, with the ADX (yellow) below 20 and the +DI (green) falling lower. The OBV fell to levels that had been supportive in previous months, demonstrating the seller’s dominance.

Cardano’s range (purple) extended until the end of July. The breakout attempt a few days ago had volume and momentum, but the rapid sentiment shift once again put the bulls in the back seat.

Still, this return to the mid-range offered a buying opportunity. The target is the range high at $392. The stop-loss can be set just below $0.342, the low was reached on October 1.

Cardano’s selling pressure could ease

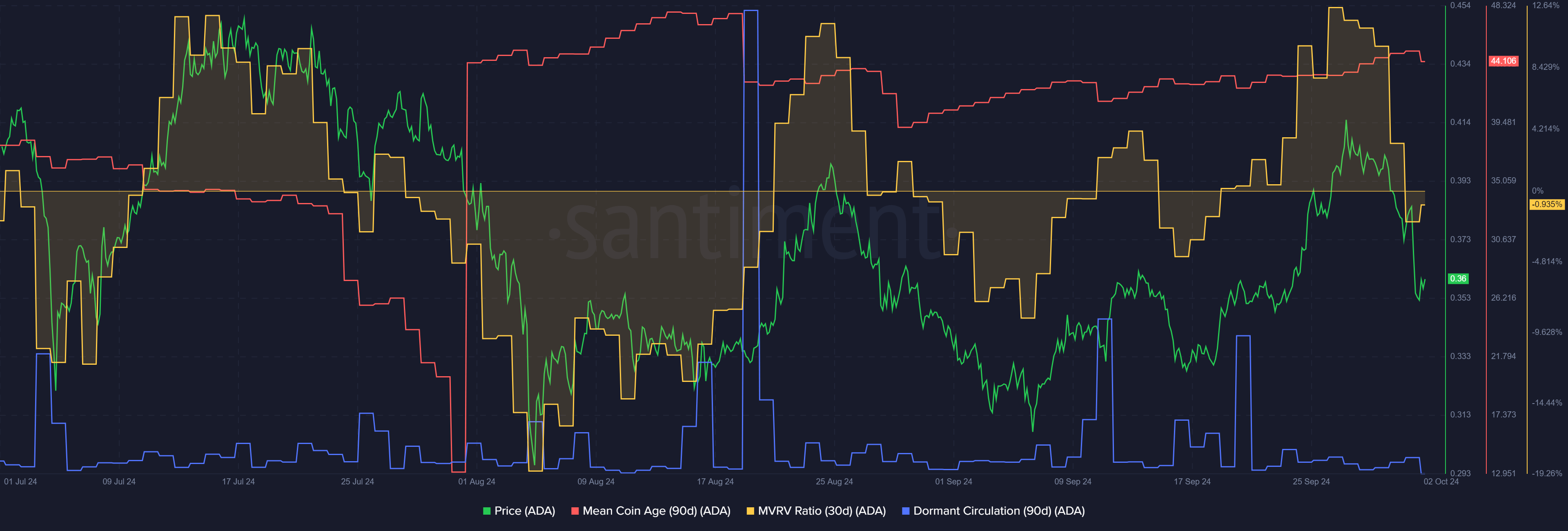

The dormant circulatory system has been dormant for the past two weeks. This was a good sign for the bulls as it showed that a sell-off was likely not imminent.

The 30-day MVRV also fell into negative territory. This meant that the recent selloff might be coming to an end as the number of short-term profitable holders dwindled.

Read Cardanos [ADA] Price forecast 2024-25

The retest and reaction at the $0.352 support level in the last few hours have been encouraging. The average coin age has slowly increased since August, indicating Cardano accumulation.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer