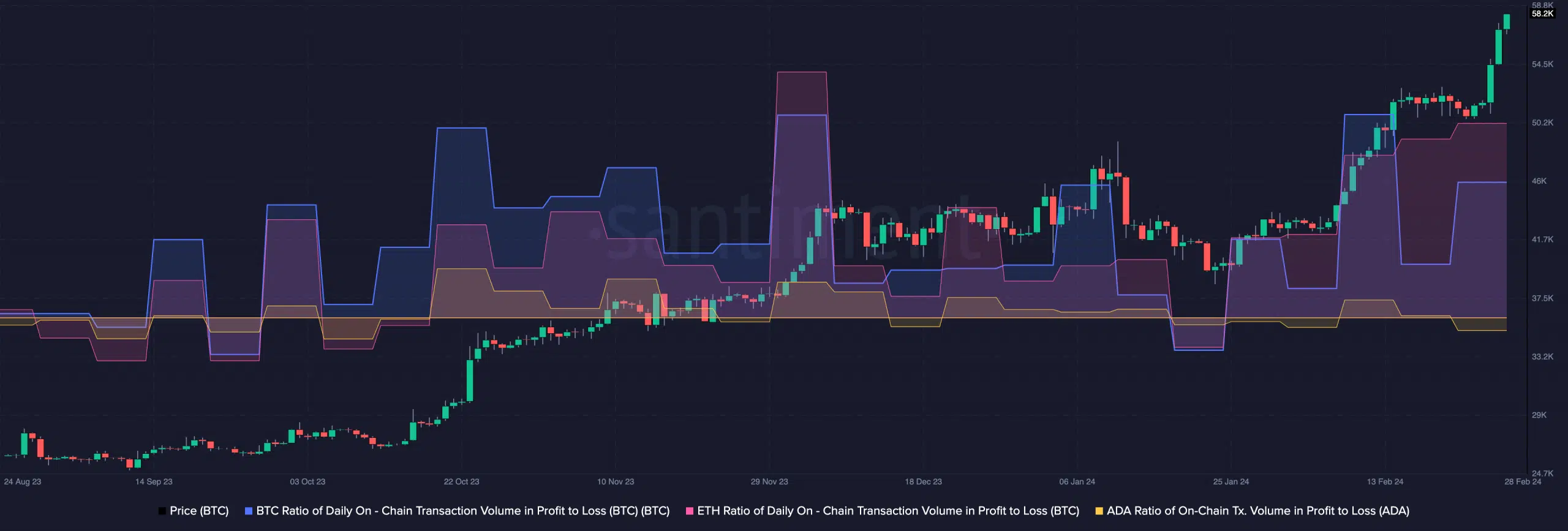

- Transactions on Cardano were less profitable than Bitcoin and Ethereum.

- The price of ADA could increase as circulation decreases in a single day.

AMBCrypto discovered that it belonged to Cardano [ADA] The price increase in recent days hasn’t really changed many things on the network.

Using on-chain data from Santiment, we noticed that the ratio of ADA transactions to profit and loss was negative. However, this was in contrast to what Bitcoin did [BTC] and ether [ETH] had.

The profit-to-loss ratio of on-chain transactions shows the extent to which transfers are profitable or not. If the ratio is positive, it means that more traders are making a profit.

A negative ratio implies that losses outweigh gains, and that was the case with ADA.

Haunted by the past

At the time of writing, Ethereum’s profit-loss ratio was 2.3. Bitcoin’s was 1.8. When it came to Cardano’s network, it was a completely different story, as the metric was -0.38.

This decline can be attributed to ADA’s performance through most of 2023. Over the past 30 days, Cardano’s price has risen 29.78%.

But in the first few quarters of 2023, as Bitcoin and Ethereum prices rose, ADA struggled. This was why the 365-day performance of BTC and ETH surpassed that of ADA.

If Cardano maintains the momentum of recent weeks, the situation could change. Recently, in addition to its symbolic status, the project has faced criticism for its performance.

But AMBCrypto also reported that the token’s potential when the altcoin season starts could be huge.

A rise towards $0.70 could see more ADA trades yield profits. But if the price falls below $0.62, the on-chain loss-making ADA trades could increase.

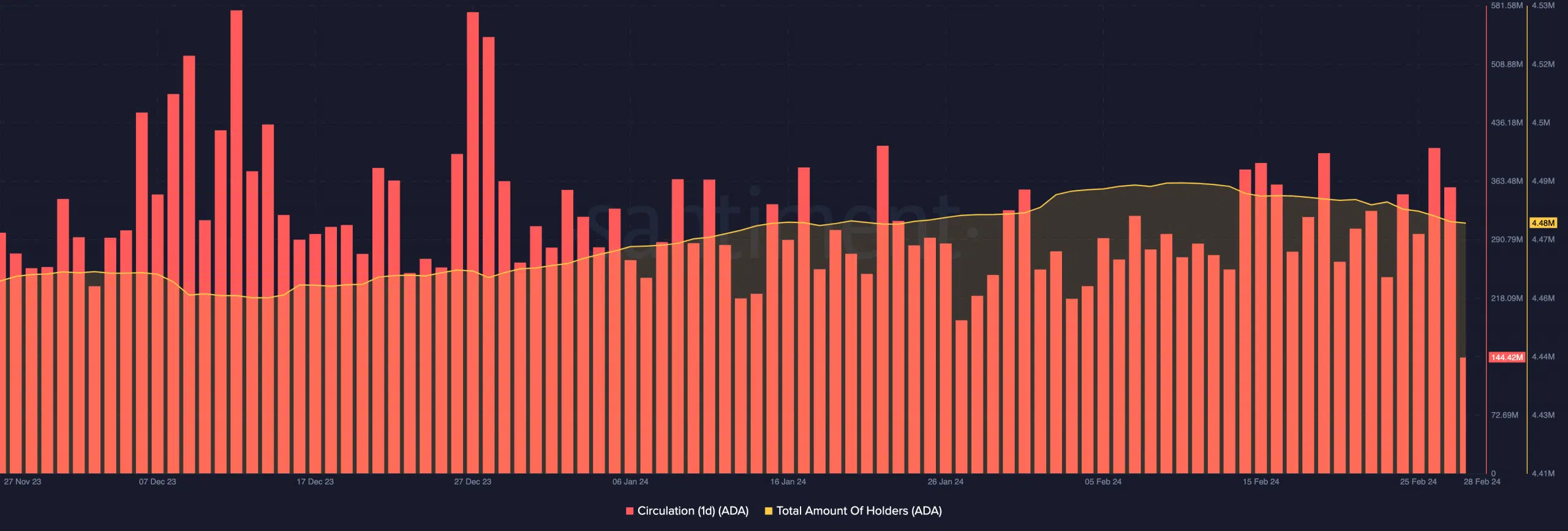

However, it is also important to look at other aspects of the Cardano network. One area we considered critical was ADA circulation.

The time of ADA is not over yet

Circulation shows the number of tokens used in transactions within a period. At the time of writing, Cardano’s single-day circulation had fallen to 144.42 million.

As for the price action, this drop could be profitable for ADA holders. This is because a high circulation would have implied sales pressure.

Furthermore, the decline in circulation suggested that sales pressure could be low in the future. If this is the case, ADA’s price could rise further and the $1 forecast could become feasible in the short to medium term.

However, data on the chain showed that there have been some changes in the number of holders. According to Santiment, the total number of ADA holders dropped from 4.49 million to 4.48 million.

Although this difference could be considered negligible, it was evidence that some holders had liquidated the Cardano part of their portfolio.

Is your portfolio green? Check out the ADA profit calculator

Despite the decline, it cannot be concluded that confidence in ADA has eroded. In some cases, the participants involved may have transferred their beliefs onto other tokens.

But in the long run, ADA could provide relief to holders who have suffered a 91.74% drop from all-time highs.