- Whales gathered more than 180 million ADA, which signaled an upward pressure on the price of Cardano.

- The price of Cardano was confronted with liquidation resistance around $ 0.75, with open interest and daily involvement with caution.

In the past week, whales gathered more than 180 million ADA, which indicates a major shift in the market behavior of Cardano. This increase in large -scale buying has increased speculation on its potential impact on Cardanos [ADA] Price promotion.

With whales that make their movement, the question remains whether this purchasing power will push Ada higher or whether the price will have difficulty keeping its land.

Ada Price Action – Is the level of support strong enough?

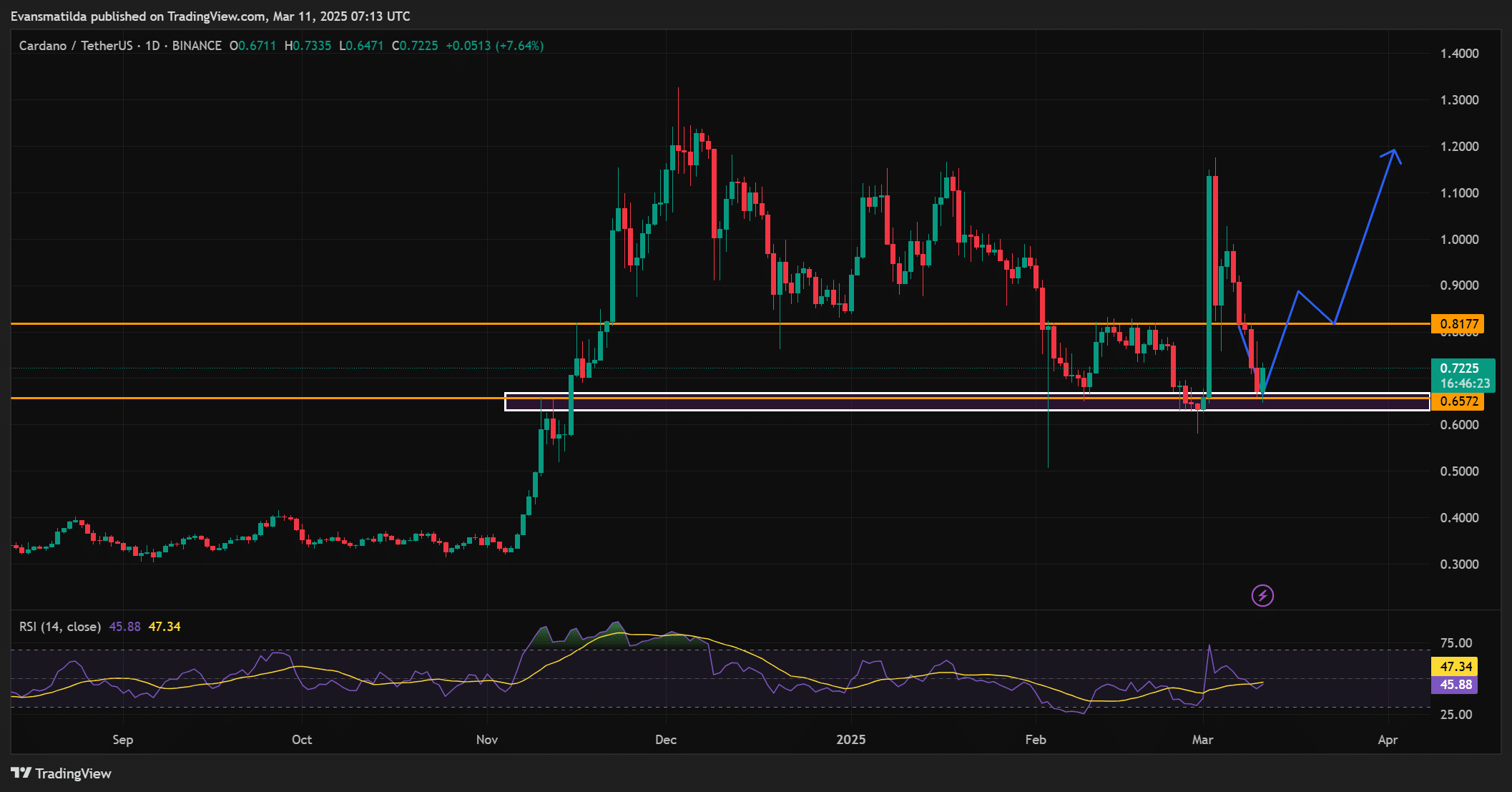

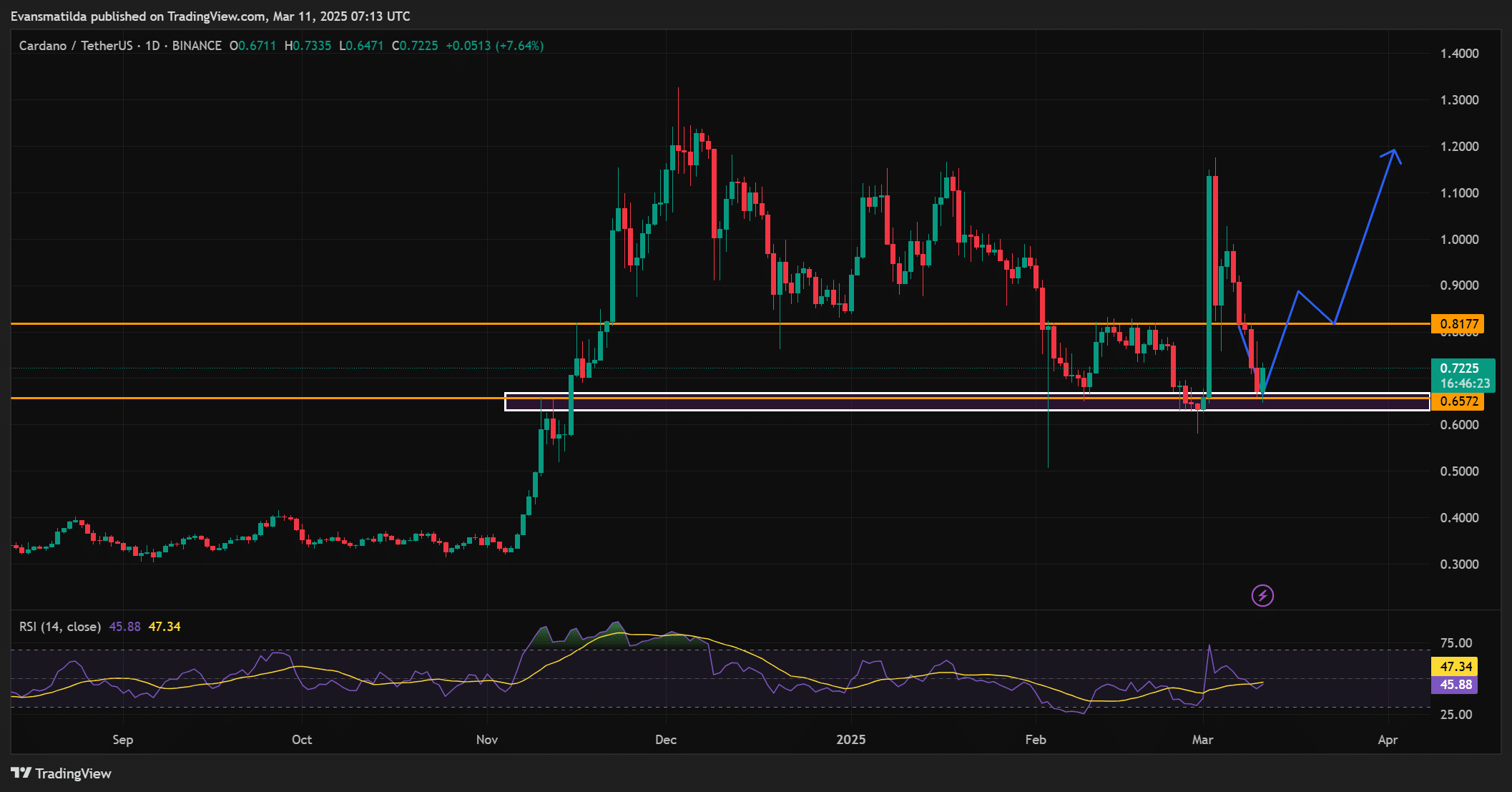

Cardano recently recovered from an important support zone for $ 0.65, suggesting that this level offers stability. The price has since risen to the region of $ 0.72, which points to potential for recovery.

At the time of the press, ADA traded at $ 0.7217, which marked a decrease of 2.93% in the last 24 hours. THe was RSI on 47.34 and reflected neutral market conditions without being overbough or sold over.

Although the rebound of support is encouraging, Cardano remains within a range. Without a stronger purchasing pressure, it is uncertain whether the price can break through resistance or whether it will receive a different withdrawal.

Source: TradingView

Liquidation Heatmap – Where are the pressure points?

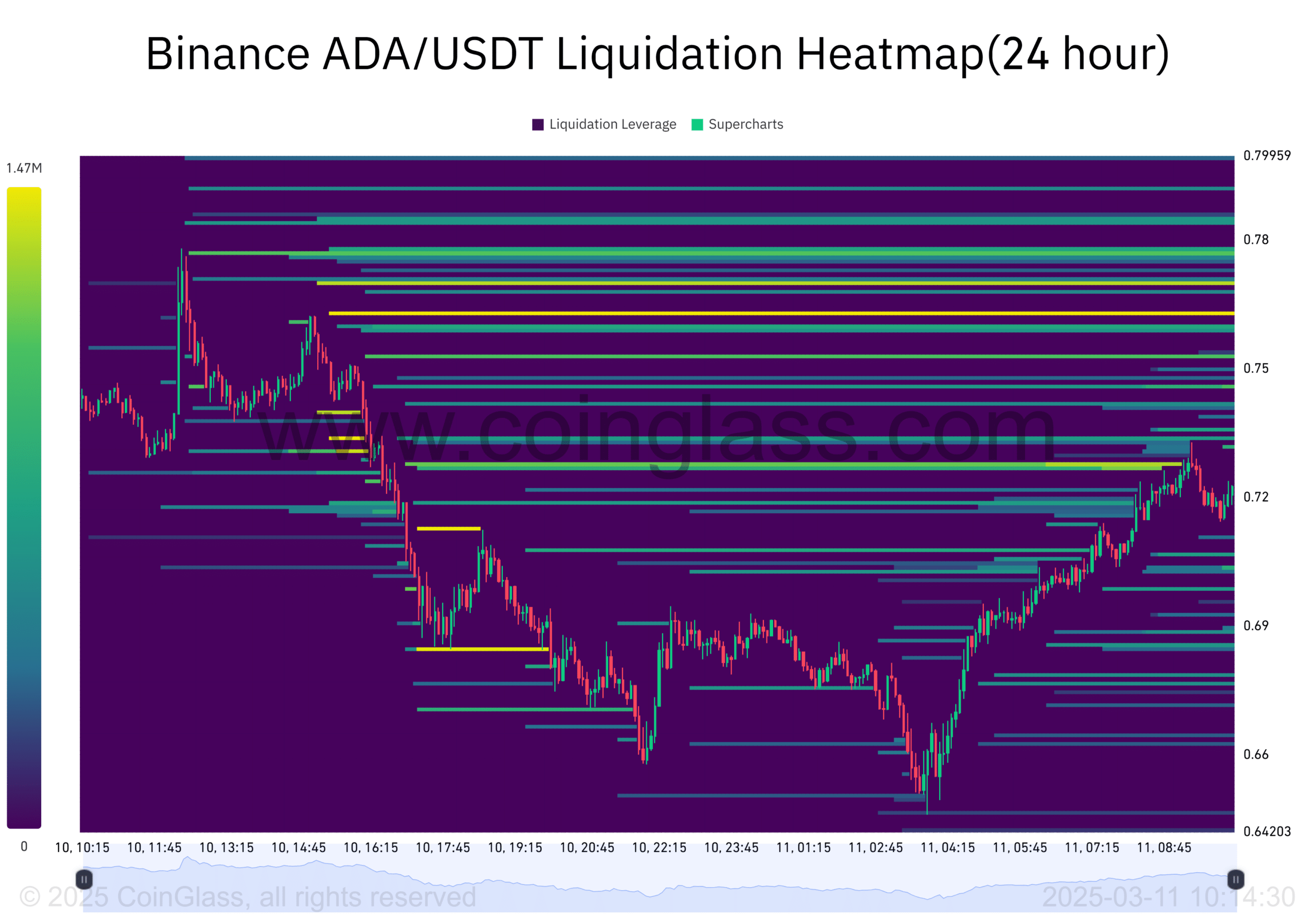

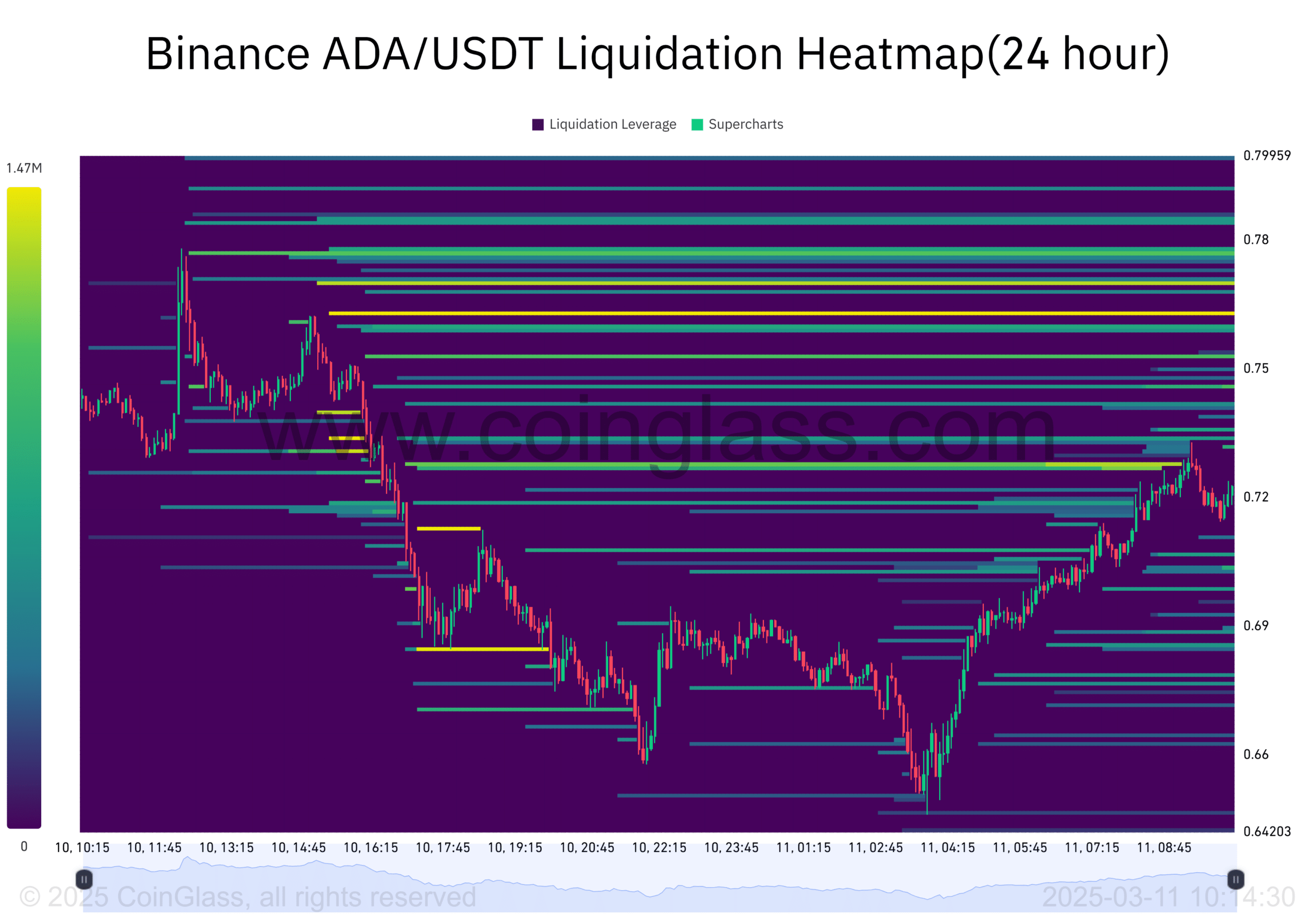

The Ada -Liquidatie Heatmap emphasizes the most important price zones that can lead to increased volatility. The range from $ 0.72 to $ 0.75 has experienced a considerable liquidation activity, indicating that the price of ADA is still susceptible to sharp movements.

While whales collect ADA steadily, this resistance zone can either get stuck or cause a wave of liquidations, which means that prices are lower.

However, if Ada succeeds in breaking above this range, this can initiate a rally, supported by the accumulation of large positions.

Source: Coinglass

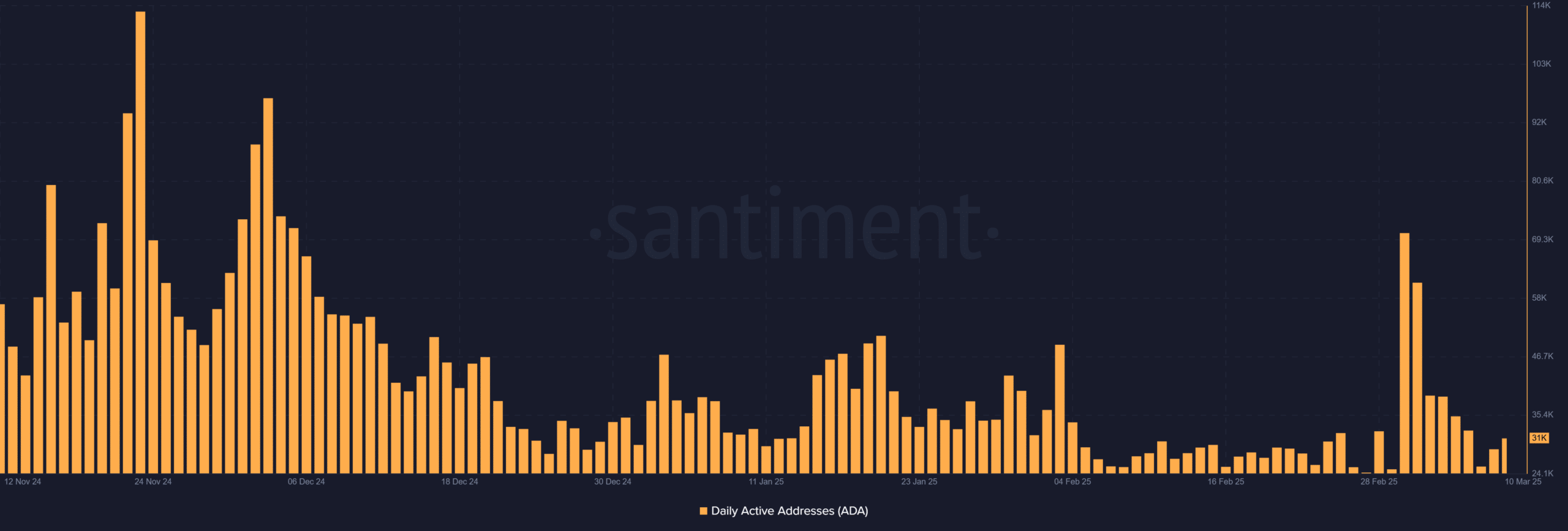

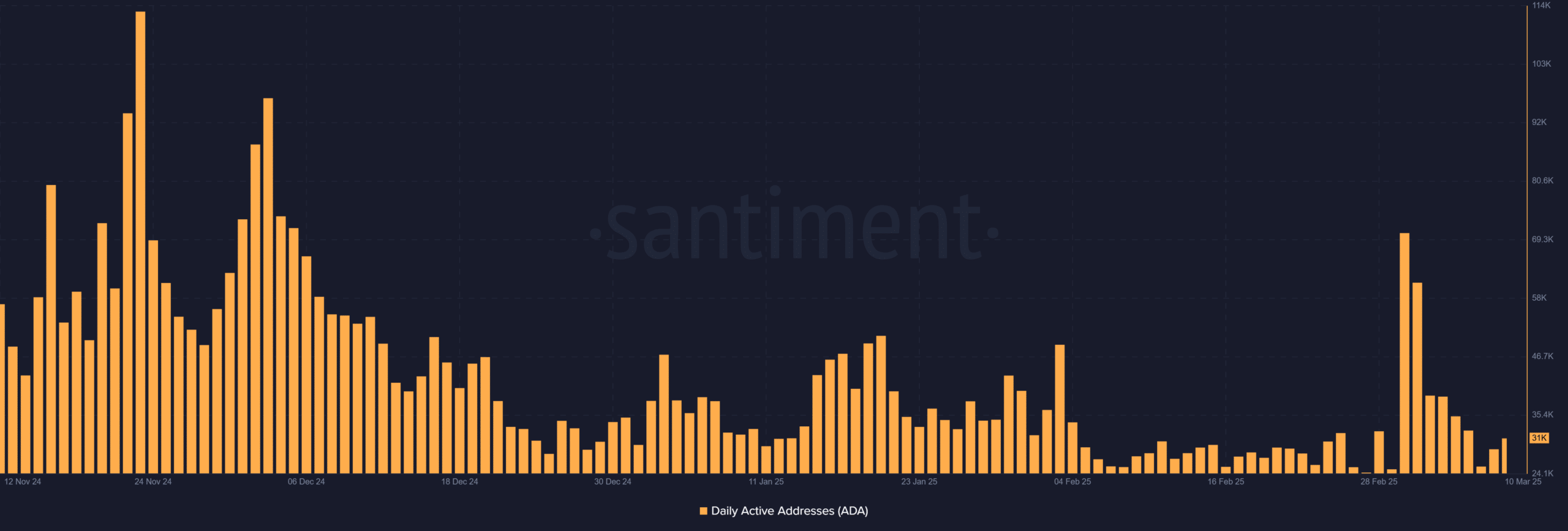

Daily active addresses – moderate involvement or hidden power?

The daily active addresses of Cardano showed a steady but moderate level of user involvement, registered with 31,005 active addresses at the time of writing.

Although this reflects consistent participation, it does not indicate that the sharp increase is often associated with a bullish trend. The moderate activity suggests carefully optimism in users, although confidence remains measured.

If the involvement remains stable and whales keep accumulating, Ada could see a gradual upward movement over time.

Source: Santiment

In addition, Cardano’s Open Interest (OI) decreased With 11.52% to $ 738.11 million, which is careful with traders. The decline suggests that many market participants take a step back, possibly because of the uncertainty around the ADA price action.

While fewer traders occupy lifting tree positions, this caution can prevent Ada from making strong movements in both directions.

Until the confidence in the market builds up, Ada can continue to see consolidation instead of competitive price fluctuations.

What for Ada now

Although whale activity has certainly increased the purchasing pressure, the Ada in the short term remains uncertain. The struiting of support is encouraging, but a neutral RSI and decreasing Oi suggest a limited momentum.

Moreover, important liquidation levels are obstacles for every strong price increase. Although whales have a significant influence, the price of ADA can remain accessible, unless the market sentiment improves or the purchasing pressure of the purchase is further improved.