- Cardano completed the upgrade on the first day of the month.

- The ADA’s response has been quite muted as it has remained below moving averages.

The long-awaited Cardano [ADA] hard fork has finally been implemented after some technical delays forced rescheduling of the update.

This upgrade introduced changes to the network design, marking a major milestone for blockchain infrastructure.

However, despite this progress, the situation for ADA remains challenging as more and more crypto whales begin to free up their holdings.

Crypto whales dump ADA

The recent Chang hard fork, which was expected to improve the network’s functionality, has not yet resulted in any positive movement from ADA. Instead, there has been a notable trend of crypto whales reducing their ADA holdings.

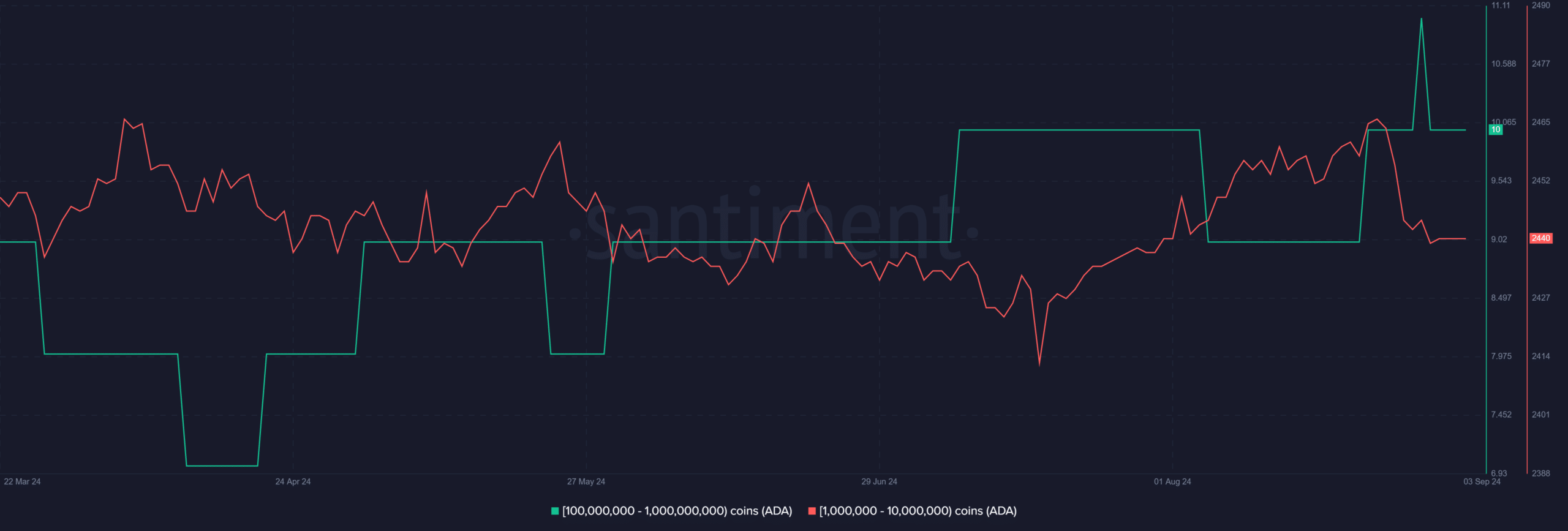

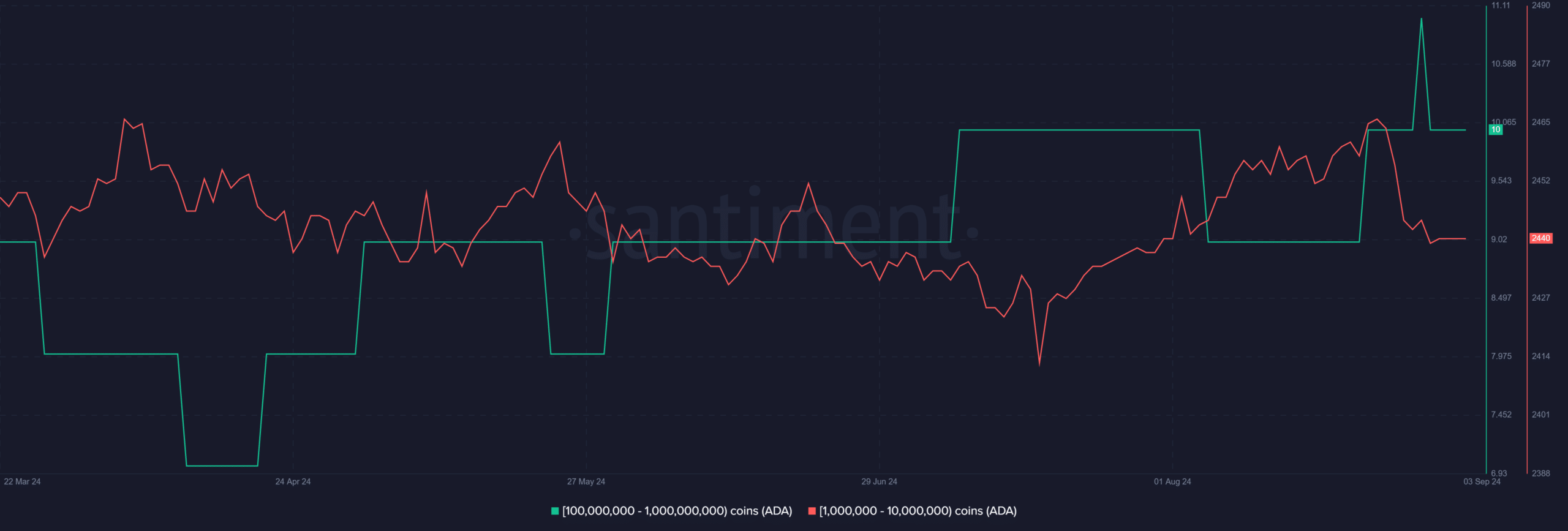

Data from Santiment shows that these whale addresses, especially those with between 1 million and 1 billion ADA tokens, have recently reduced their positions.

This reduction suggested that these addresses sold a significant portion of their assets as the upgrade approached.

Source: Santiment

Further analysis revealed that these whale addresses collectively drained more than $326 million in ADA, representing approximately 15% of their total holdings.

This significant sell-off highlighted a potential lack of confidence among major investors in ADA’s near-term price prospects, despite the technical advances brought about by the hard fork.

The behavior of these whales is a critical indicator of market sentiment, as their actions often reflect broader concerns or expectations.

The decision to dump such a significant amount of ADA before or shortly after the upgrade could imply that these investors are either uncertain about the immediate benefits of the hard fork or are taking a cautious approach due to broader market conditions.

Cardano is still stuck in a bear trend

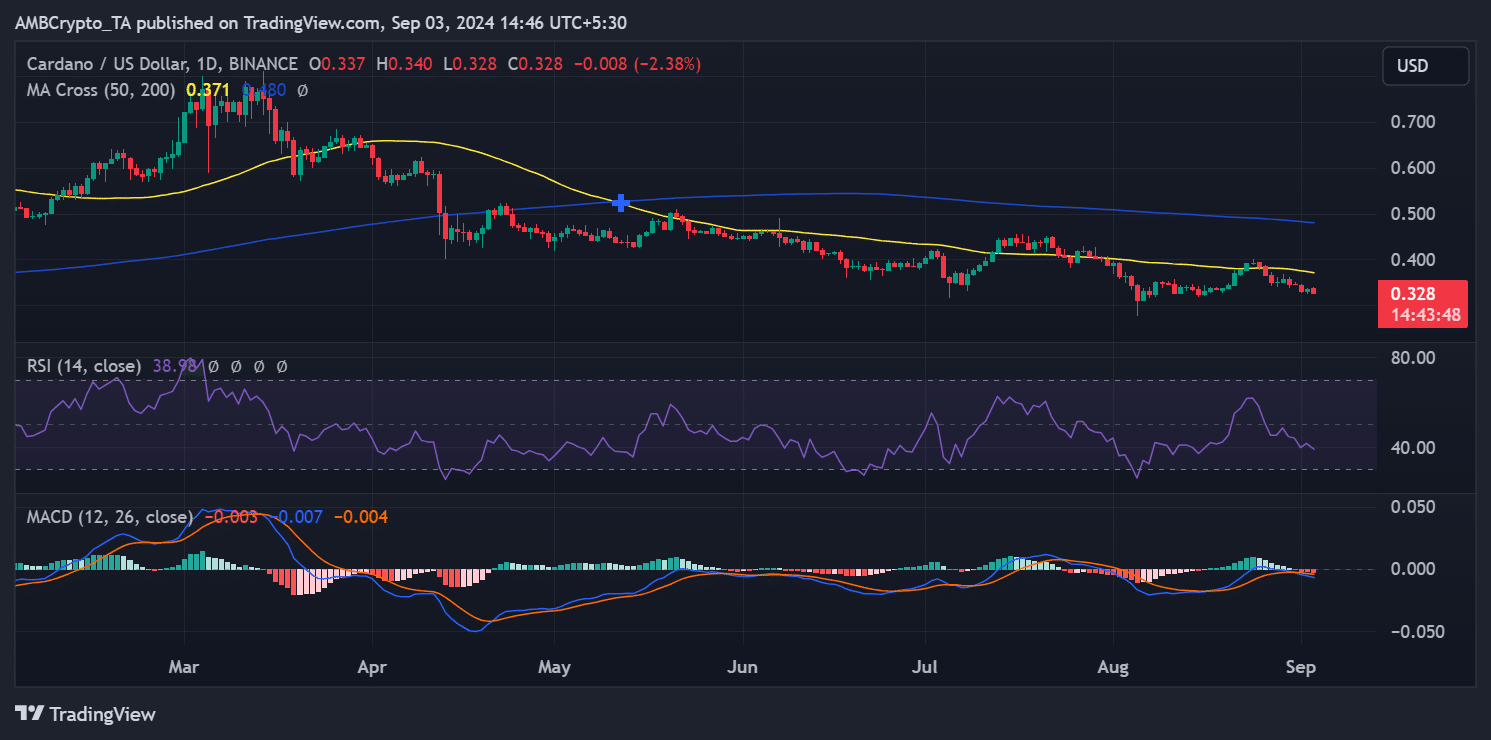

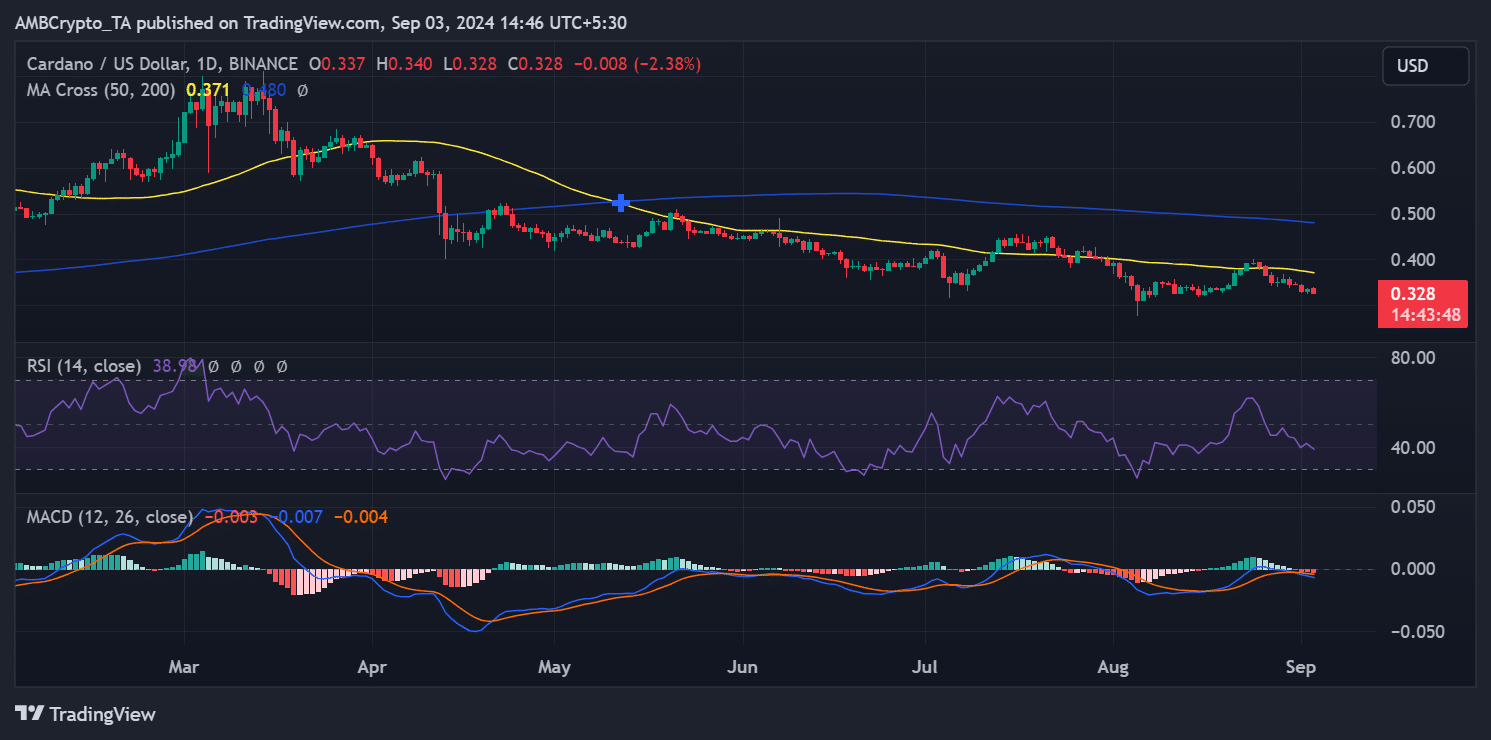

AMBCrypto’s analysis of ADA on the daily price chart revealed a notable shift in momentum leading up to and following the recent network upgrade.

Initially, ADA had a positive build-up and peaked on August 24, when it successfully broke through a key resistance level.

However, as the upgrade approached, this upward momentum reversed and the ADA began to decline.

Source: TradingView

The price fell below the short-term moving average (yellow line), which previously served as a support level but now acts as resistance.

At the time of writing, ADA was trading around $0.32, reflecting a decline of over 2%. The modest gains of more than 1% made in the previous trading session have been wiped out by this latest downturn.

Further analysis of the ADA’s Relative Strength Index (RSI) suggested continued bearish momentum. The RSI was almost below 40 at the time of writing.

If the RSI falls below 40, it could indicate that ADA is entering the oversold zone. This level is often associated with increased selling pressure and further declines.

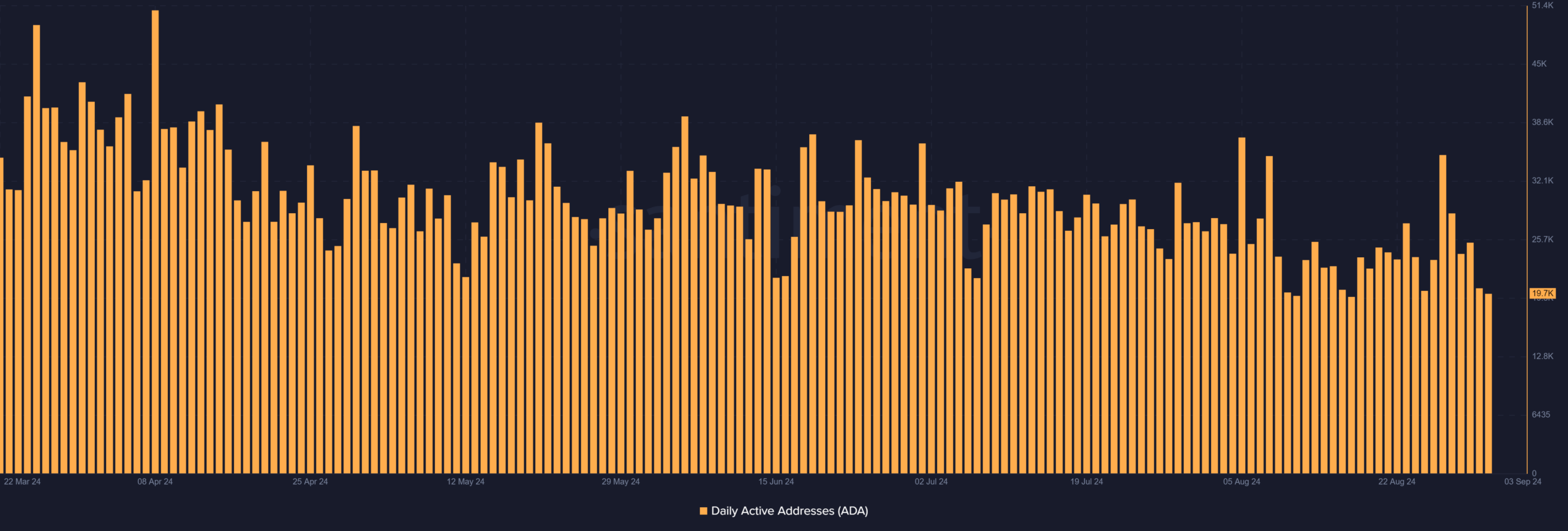

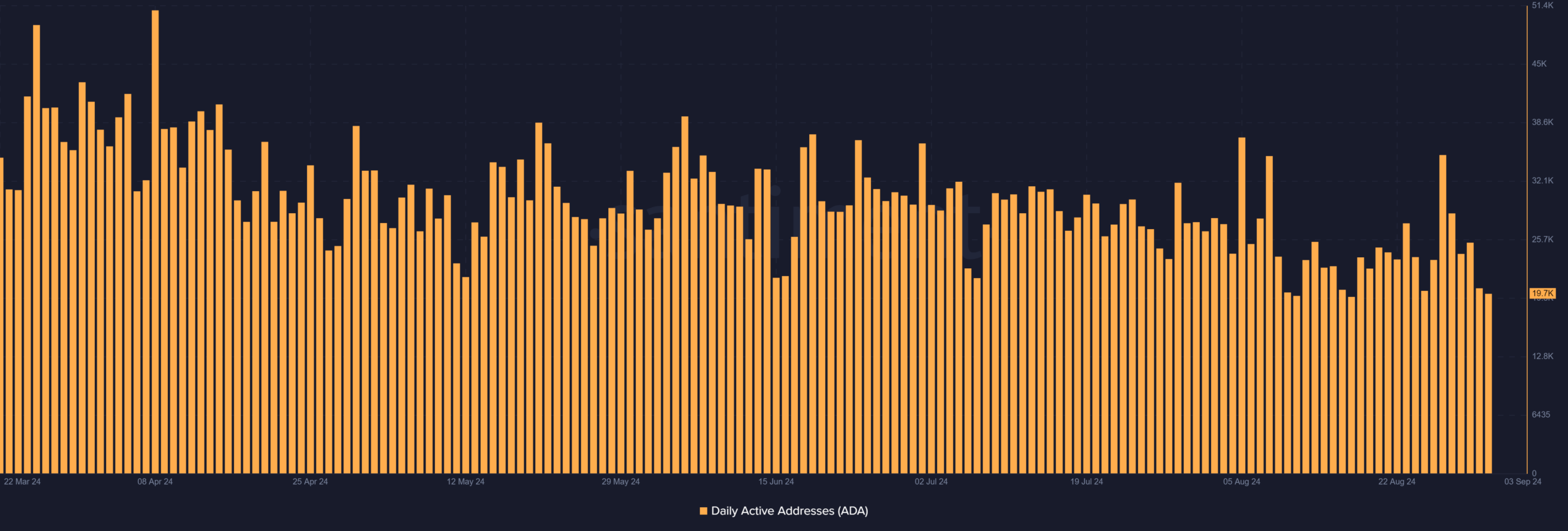

Fewer addresses become active

Cardano’s recent analysis of daily active addresses shows that network activity has decreased significantly over the past seven days.

Santiment data shows that the number of active addresses peaked around August 27 and reached more than 35,000. The spike is likely due to increased interest in the run-up to the network upgrade.

However, this activity level dropped rapidly in the days that followed.

Source: Santiment

Is your portfolio green? Check out the ADA profit calculator

At the time of writing, the number of daily active addresses has dropped to approximately 19,700. This sharp drop in the number of active addresses highlighted a noticeable reduction in network participation.

It confirmed that the crypto whales and other holders of Cardano have become less active during this period.