- ADA has continued its positive trend with an increase of 6% at the time of writing.

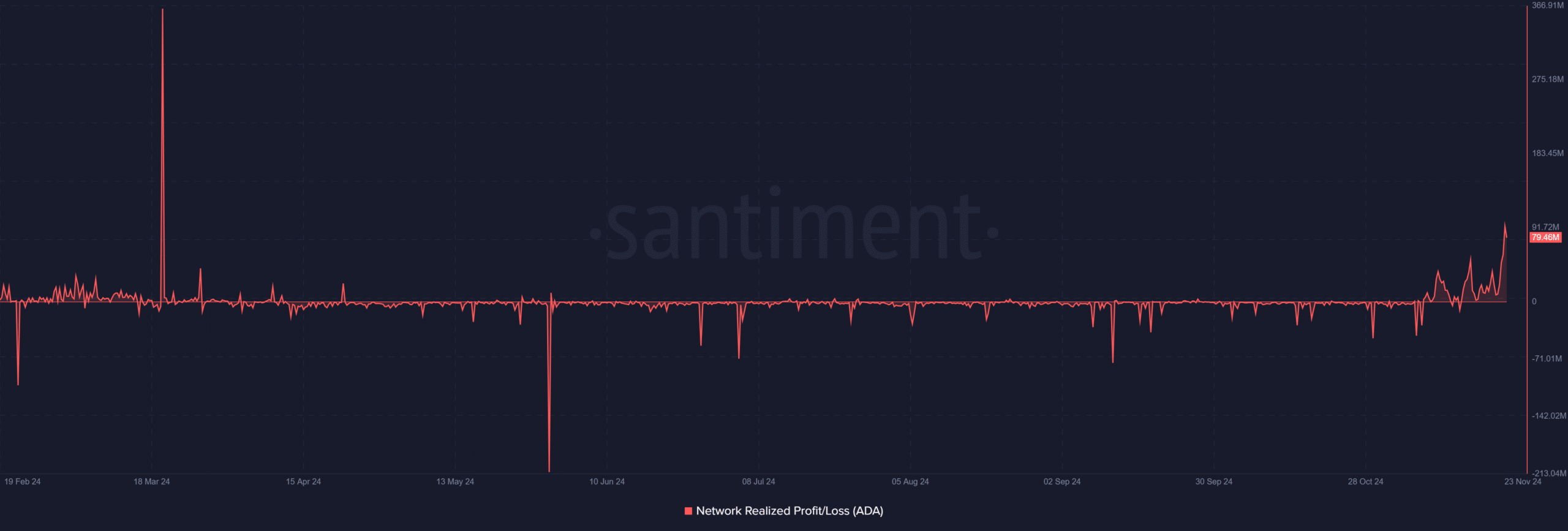

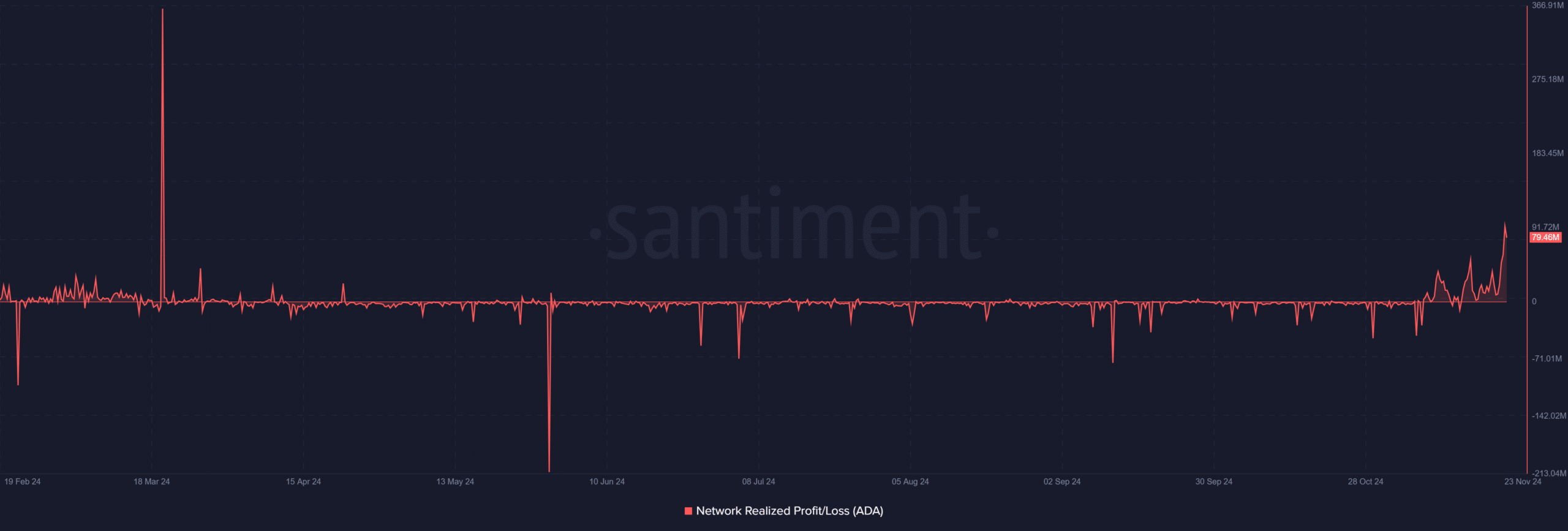

- The unrealized profit/loss volume increased for the first time since 2023.

Cardano [ADA] has made headlines by crossing the $1 significant mark, a level not seen in more than a year. This milestone was supported by a combination of in-chain activities, social engagement and price momentum.

With bullish sentiment growing, can Cardano maintain its upward trajectory?

On-chain metrics support price action

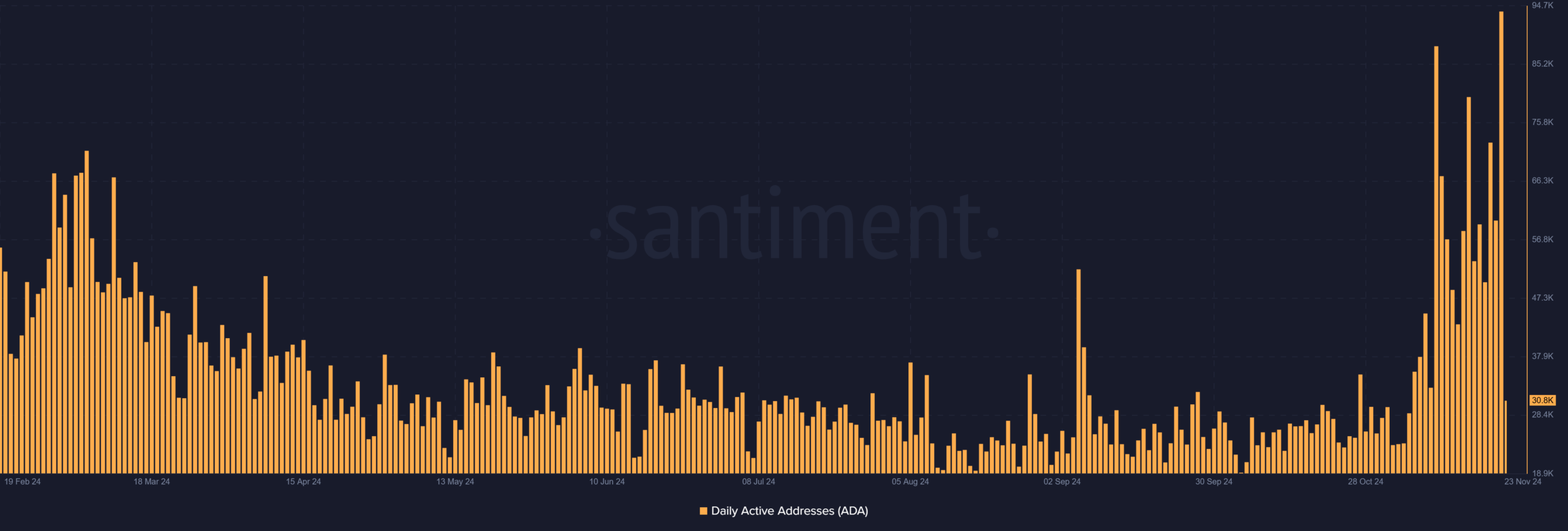

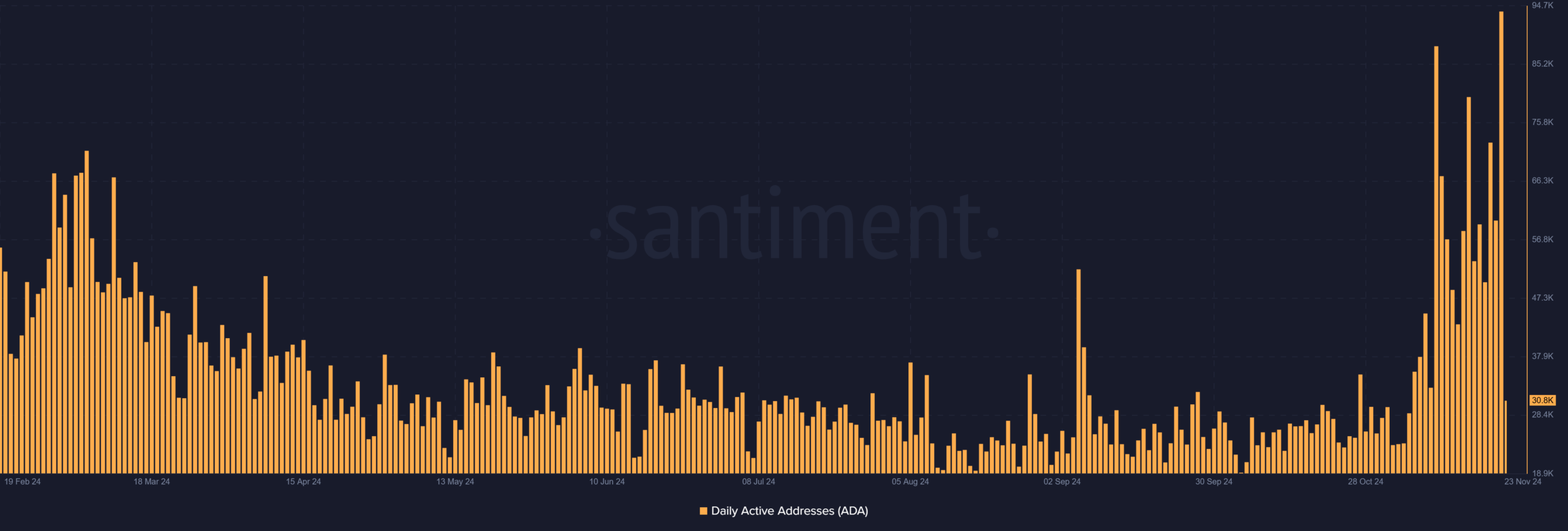

According to AMBCrypto’s analysis of Santiment data, Cardano’s daily active addresses have skyrocketed, indicating increased user activity.

In recent weeks, the number of active wallets and interactions within the ecosystem has increased dramatically, coinciding with the ADA price increase.

At the end of trading on November 22, the number of active addresses was almost 94,000. This was the first time in months that such a number had been recorded.

This increase in activity reflected growing confidence among utilities and investors.

Source: Santiment

Furthermore, Cardano’s network realized profit/loss spiked to nearly $94 million during the last trading session, indicating that many investors have benefited from the recent price movements.

This was in line with broader market sentiment, with ADA consistently posting gains in recent weeks.

Source: Santiment

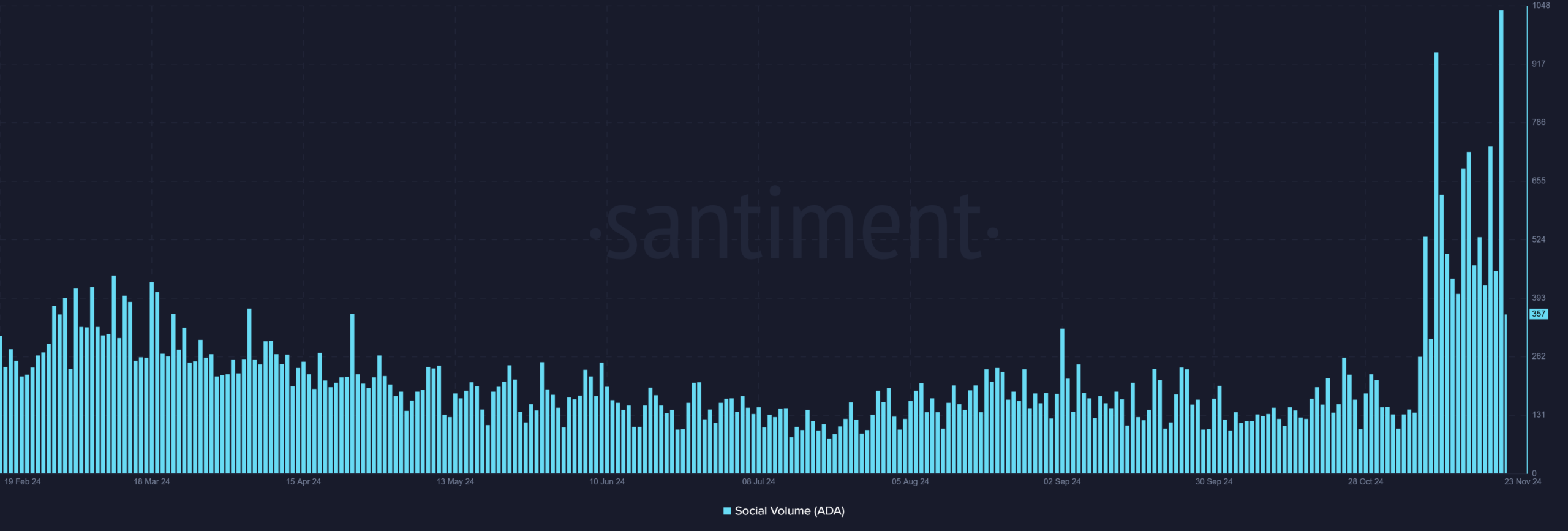

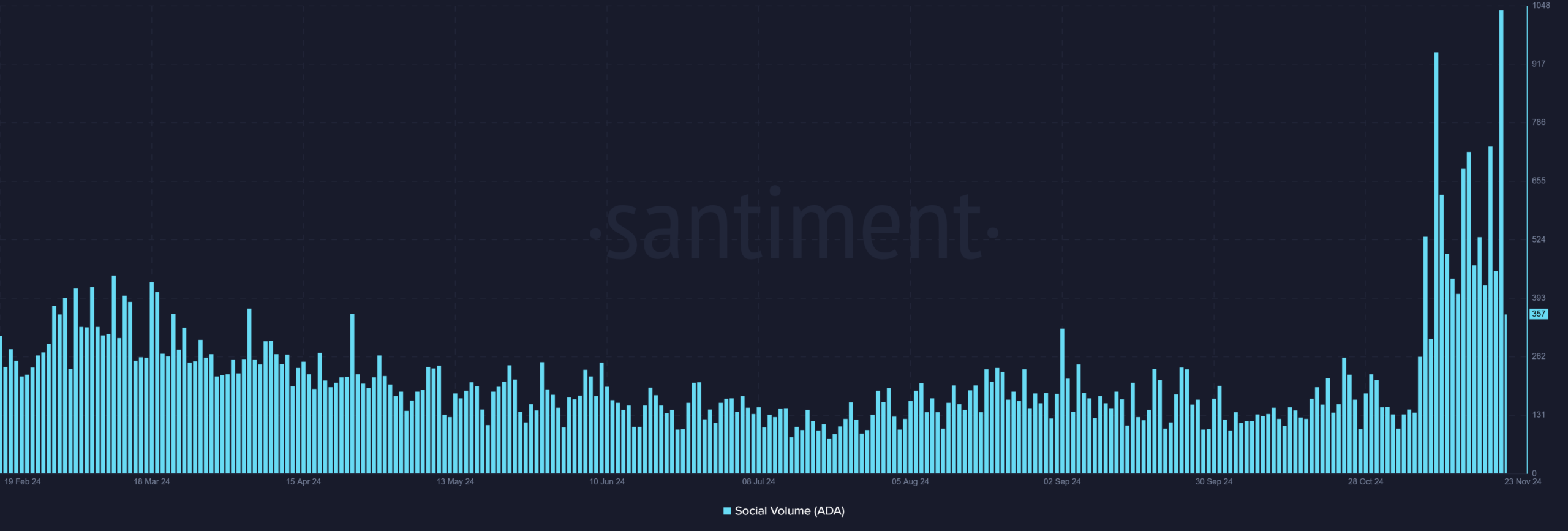

Social volume, sentiment boost Cardano

Cardano’s social volume explosion underscored its growing prominence in the crypto space.

Social volume tracks the number of mentions and discussions around ADA on social media platforms, and recent spikes indicated an increase in community interest.

Source: Santiment

According to AMBCrypto’s analysis, social volume spiked to over 1,000 during the last trading session on November 22, a level not seen in months.

Historically, increased social activity has correlated with price movements, attracting new investors and reinforcing bullish sentiment.

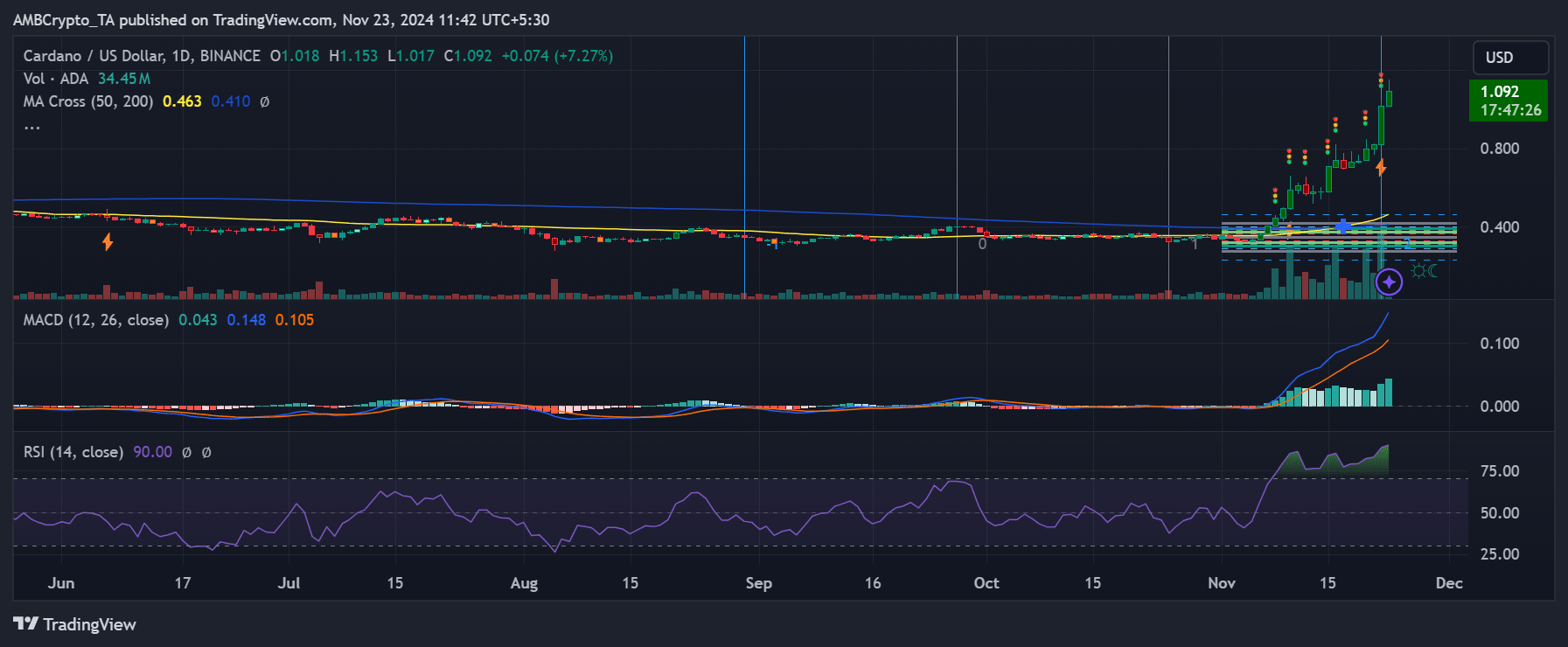

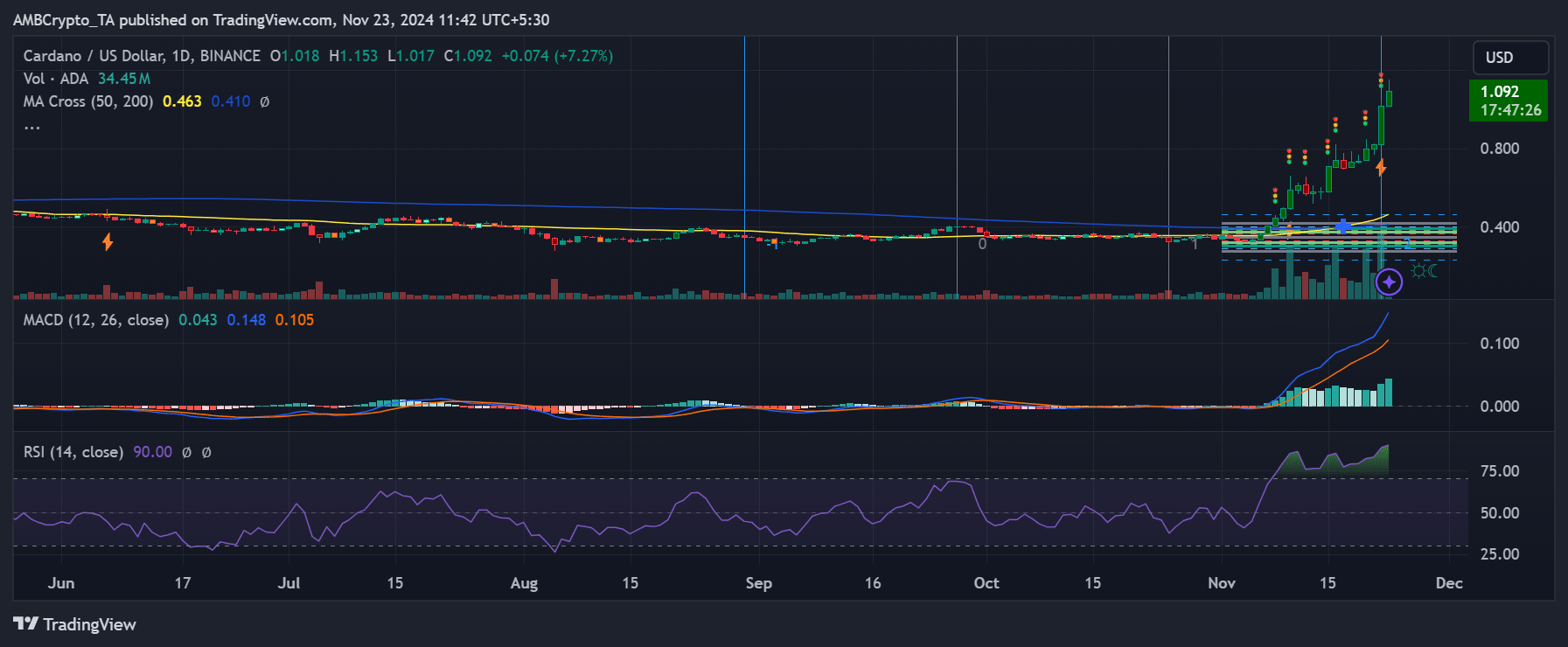

Cardano’s technical indicators indicate strength

From a technical perspective, Cardano’s move above the $1 threshold was supported by strong indicators.

Notably, the RSI (Relative Strength Index) showed that ADA was in overbought territory at the time of writing, reflecting strong buying pressure.

The MACD (Moving Average Convergence Divergence) confirmed this bullish momentum, with the lines diverging upwards, indicating continued positive sentiment.

The price chart also highlighted the crucial role of ADA in breaking the 200-day moving average, which was a strong resistance level.

With this level acting as support, ADA appeared well positioned to maintain its bullish stance, provided broader market conditions remained favorable.

Source: TradingView

The Fibonacci retracement tool provided more perspective on ADA’s price action.

After breaking through critical resistance levels, ADA has surpassed the 61.8% retracement level of its previous downtrend – a major bullish signal.

The next critical Fibonacci target is near $1.10, which ADA is approaching with strong momentum.

Additionally, the 78.6% retracement level at around $1.20 could serve as the next major resistance, giving investors a clear roadmap for potential profit-taking or further accumulation.

Realistic or not, here is the market cap of ADA in terms of BTC

The break of the 61.8% retracement and the approach to higher levels suggest that ADA is on track to reach new highs.

While market conditions remain volatile, the bullish signals and numbers indicate that Cardano’s upward journey is on solid footing and may have more milestones ahead.