- Weekly altcoin trading volume soared as Cardano saw a shift in dynamics.

- Despite the price increase, most active addresses with ADA were ‘At the Money’.

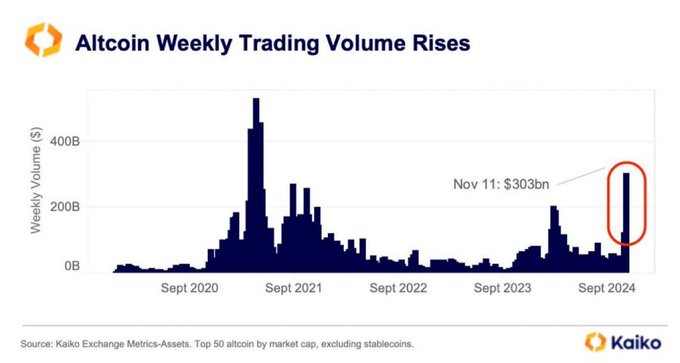

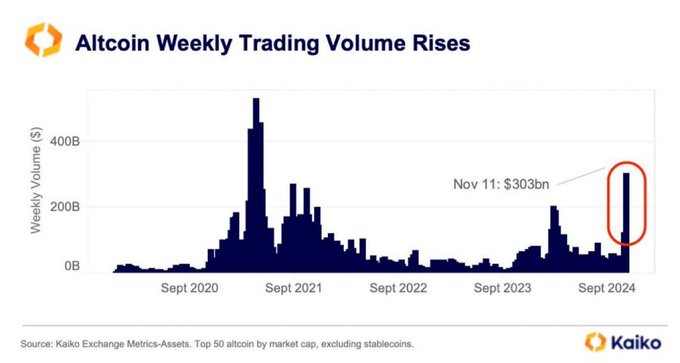

Weekly altcoin trading volume rose to the highest since 2021, marking a major milestone.

In November, weekly trading volumes reached more than $303 billion, indicating a resurgence of investor interest in altcoins.

This increase not only reflected growing liquidity, but also coincided with a notable increase in the prices of altcoins such as Ethereum. [ETH]Cardano [ADA] and Ripple [XRP].

Source: Kaiko

Investors are diversifying their portfolios beyond Bitcoin [BTC]attracted by promising technological advancements and potentially high returns among the top altcoins.

This increased activity suggested that the altcoin market was gaining significant traction, positioning it as a vibrant part of the broader cryptocurrency landscape.

ADA volume peak and price prediction

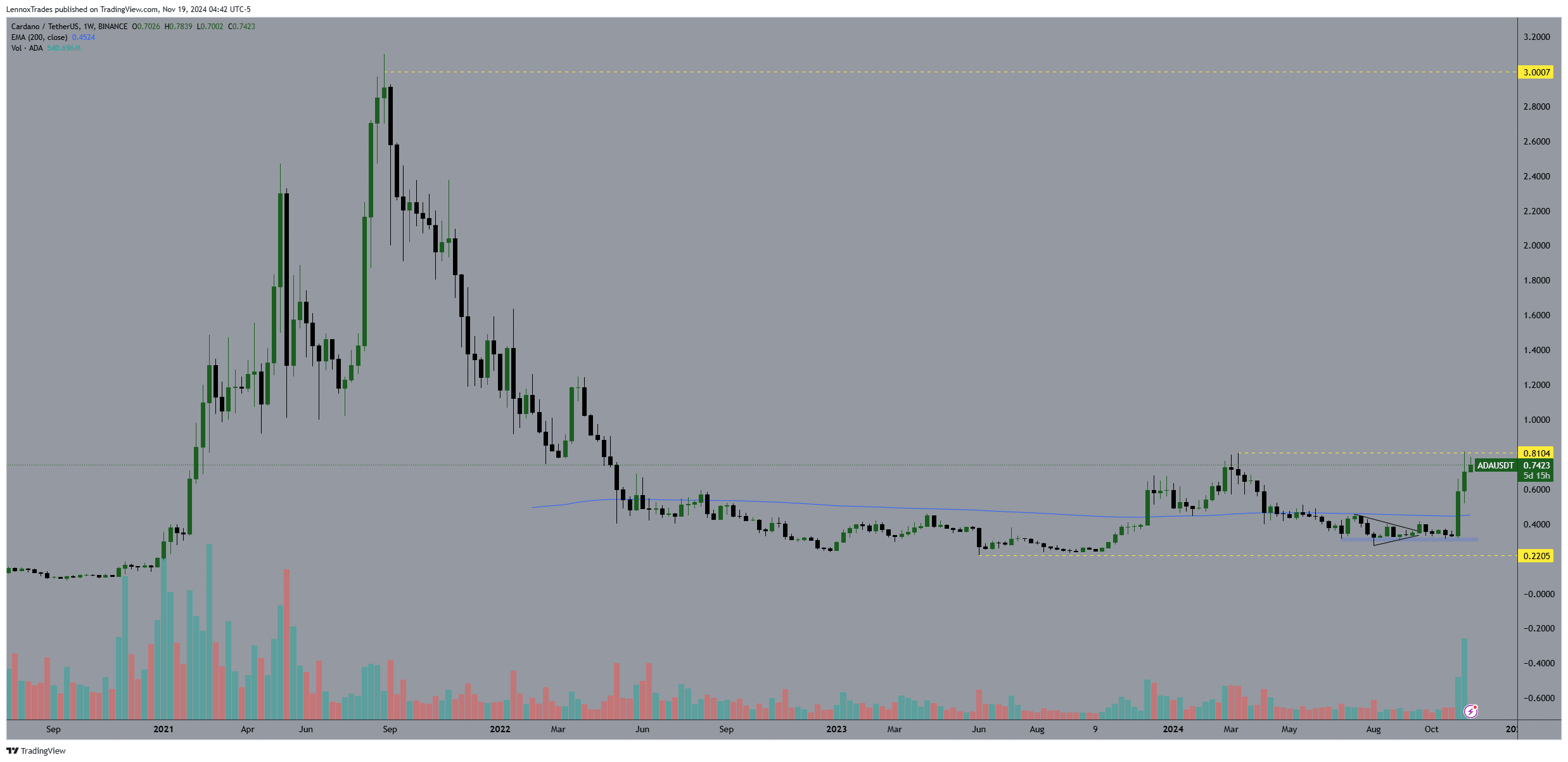

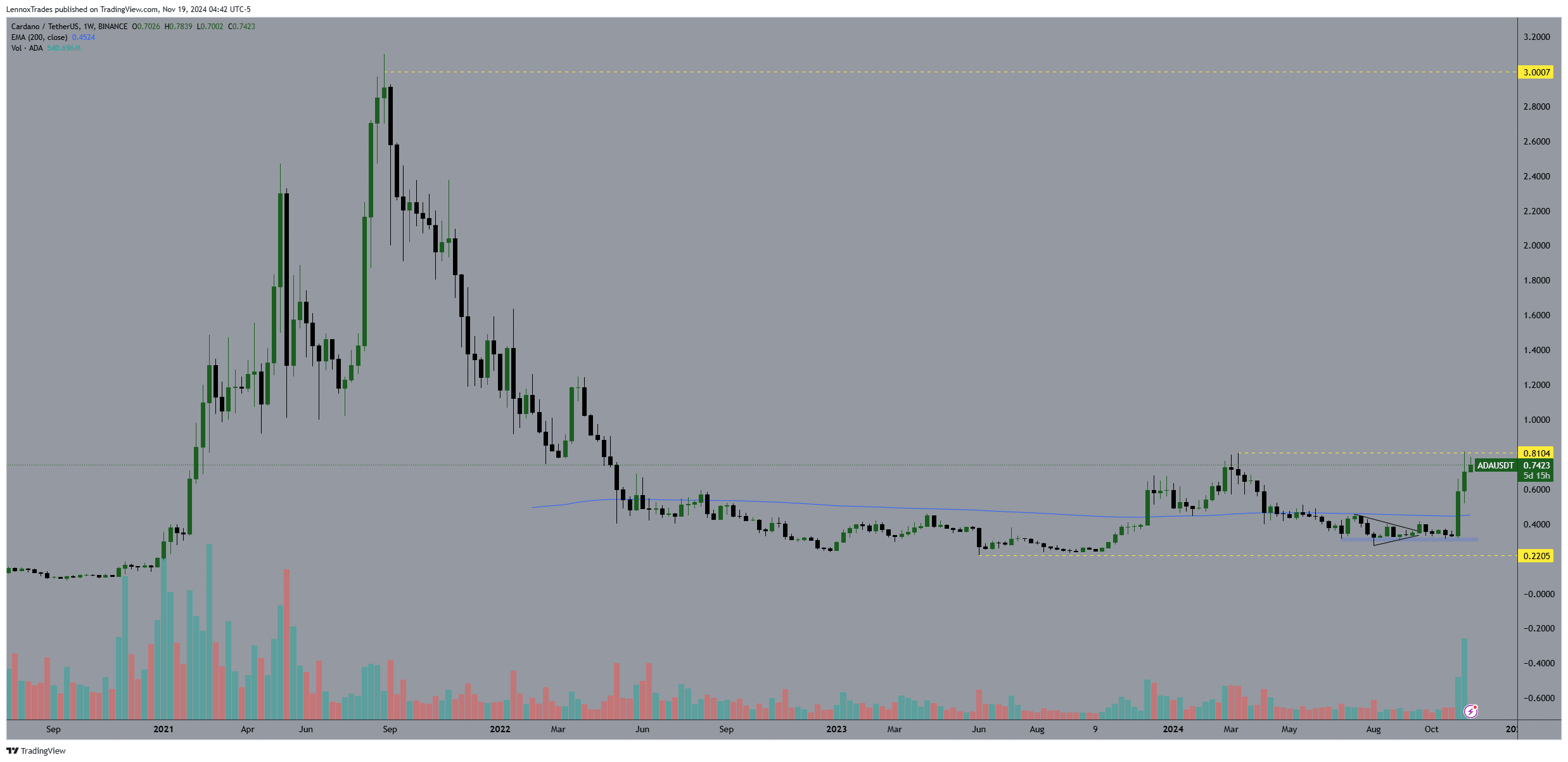

Cardano trading volume has increased alongside the broader altcoin market, following similar momentum last seen during the 2021 bull market. This weekly volume spike reflected increased investor interest and trading activity.

The increase signaled a broader shift in market dynamics, signaling a shift in speculation in the altcoin space.

Investors appear to be regaining confidence in altcoins like ADA, which could herald further gains as the price action indicated.

Source: TradingView

The wave of ADA has recently regained a critical resistance level. The weekly price action of the ADA/USDT showed a breakout from the consolidation phase, signaling strong upside momentum.

With ADA’s price approaching the previous resistance at $0.8, a break and hold above could see Cardano target the next level around $3, a price last seen during the 2021 peak.

This recent breakout suggested potential for further gains if ADA can continue its current trajectory, supported by fundamental improvements within the Cardano network and higher adoption rates.

As ADA approaches the $1 mark, the focus shifts to continued volume and market support to fuel the rise towards $3.

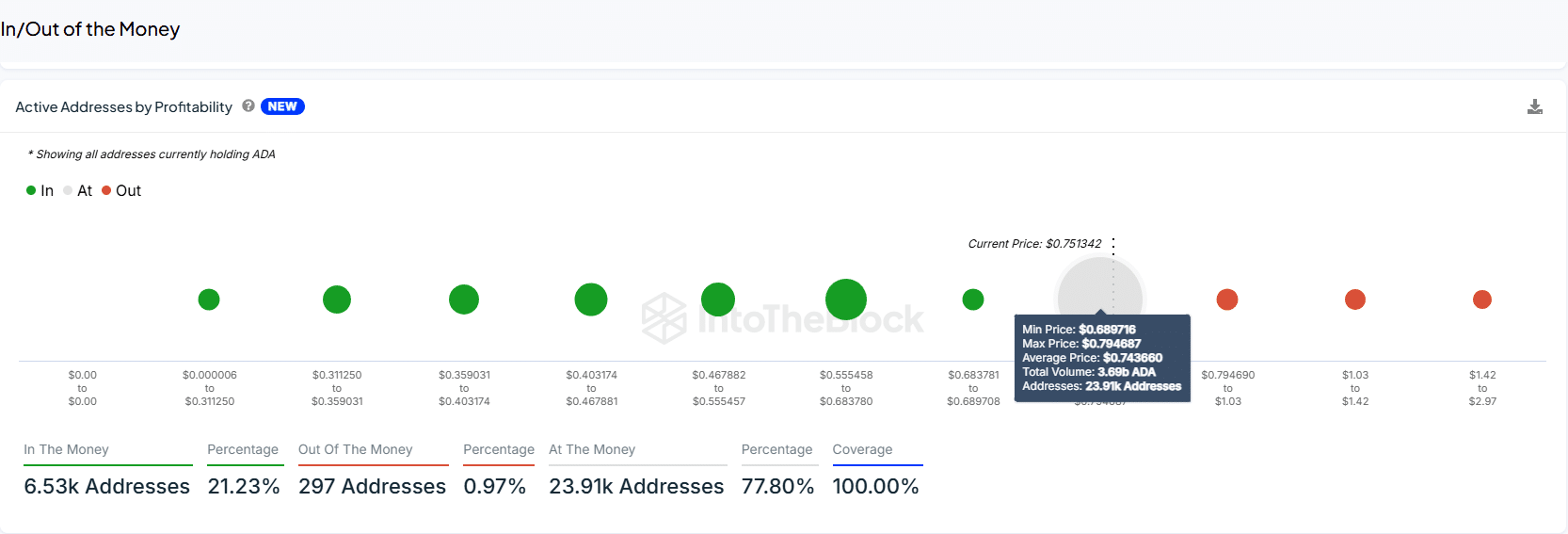

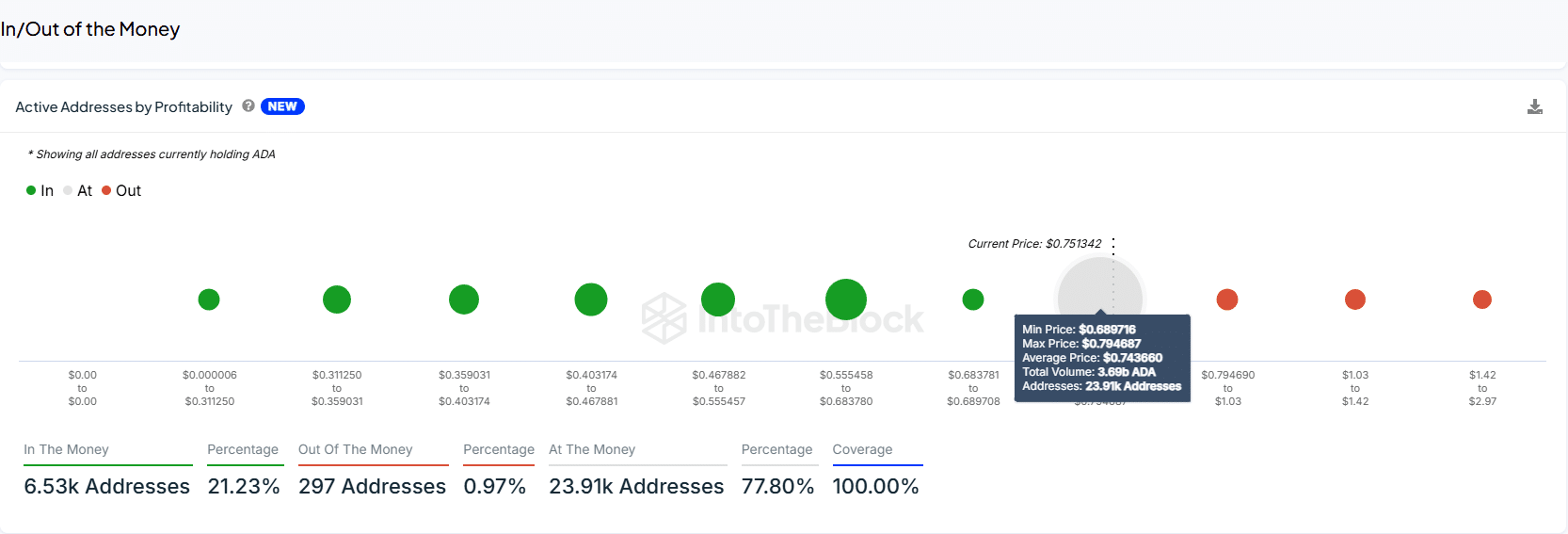

Profitability of active addresses

An assessment of the profitability of ADA holders showed that the majority shareholders were currently around the break-even point. The addresses were 23.91K, accounting for 77.80% of the total.

The addresses were largely clustered around the $0.689 to $0.795 price range. This reflected a substantial accumulation zone that corresponded to the current ADA price of $0.751342.

Only 297 addresses, representing less than 1% of the total addresses of active ADA holders, were defunded.

Source: IntoTheBlock

Read Cardanos [ADA] Price forecast 2024–2025

Additionally, 21.23% of addresses were in the money, indicating that a small portion of active addresses were making a profit.

This distribution showed a prevailing sentiment of profitability within the Cardano market.