- The MVRV ratio of Cardano reversed negative, indicating that the average buyer is now a loss

- Will Hodlers remain firm in their conviction, or will Market Fud force them to reconsider?

Despite a sharp monthly decrease of 12.60%, Cardano [ADA] Remains 87% above the opening price of the election day, which performs better than a lot of assets with a high cap. This is a sign of strong conviction of the holder, where investors choose to sit on non -realized profit instead of leaving their positions.

Fundamentals on the chain, however, seemed to paint a contrasting image.

In fact, cardanos The total value locked (TVL) decreased under the levels for the elections, signaling lives outflows. At the same time, the number of whale -scanning actions (> 100k USD) fell to a cycle low – indicative of a decrease in institutional activity.

That is why Ada, to restore FOMO on the market, must confirm its support in the charts. Different with Weakening FundamentalsEven Hodlers can falter and opt for capitulation over conviction.

Which side will prevail?

At the time of writing, the price diagram of the Altcoin emphasized a real patience test.

Since February, the three consecutive lower lows has posted, breaking important support levels and signaling structural weakness.

Source: TradingView (ADA/USDT)

The last breakdown on April 6 saw Ada losing the $ 0.58 support that it had held after the elections. This was concerned about a deeper correction, while profit margins held together across the board.

This concern was reflected in the market value to realized value (MVRV) ratio, which reversed negative. It suggested that recent ADA buyers are now under water.

Here it is worth pointing out that the rapid recovery of Ada has reversed the sentiment of the market. Trade at $ 0.6283 at the time of the press, a 7% rebound can have restored confidence in a recovery.

However, is this rebound a result of a “market-wide” range of squeeze-a reliechy, perhaps? Or is Hodlers’ confidence in a bull rally that Cardano did not know all the win after the elections?

Structural weakness threatens the conviction of Hodlers

With every failed support, Ada holders are confronted with a critical decision – keep strong or exit before deeper losses unfold. If MVRV remains negative and the purchasing pressure weakens, the capitulation can be the following.

Simply put, the closer Cardano drives to the prize of election day, the more vulnerable the trust of investors becomes. Without strong basic principles to strengthen sentiment, a sale to break life levels could accelerate.

Encouraging, commercial volume On April 7, to $ 1.98 billion – from $ 941 million the previous day. Moreover, the Whale -Viscohort – with 100 million to 1 billion ADA – collected 250 million ADA on 10 April alone.

As a result, Binded Shalid Shallside Short-sellers, forcing $ 901K to liquidations. While Shorts were settled, a 7%rebound followed, which injected a new momentum.

Bullish reversal, right? Not so fast.

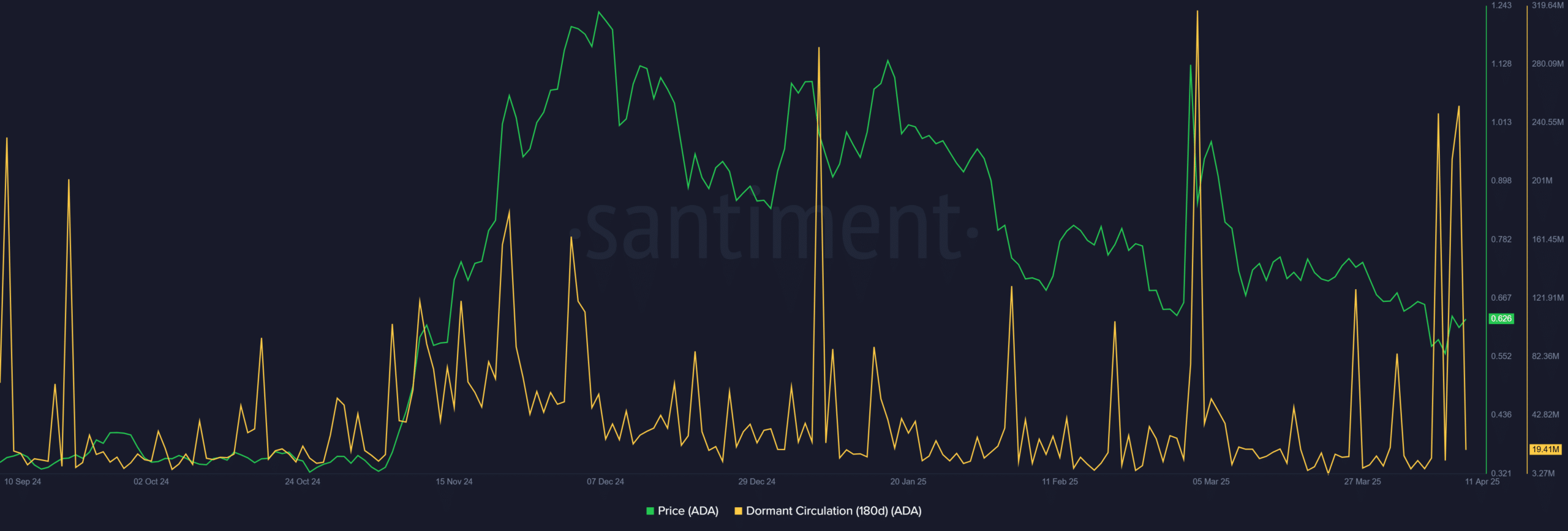

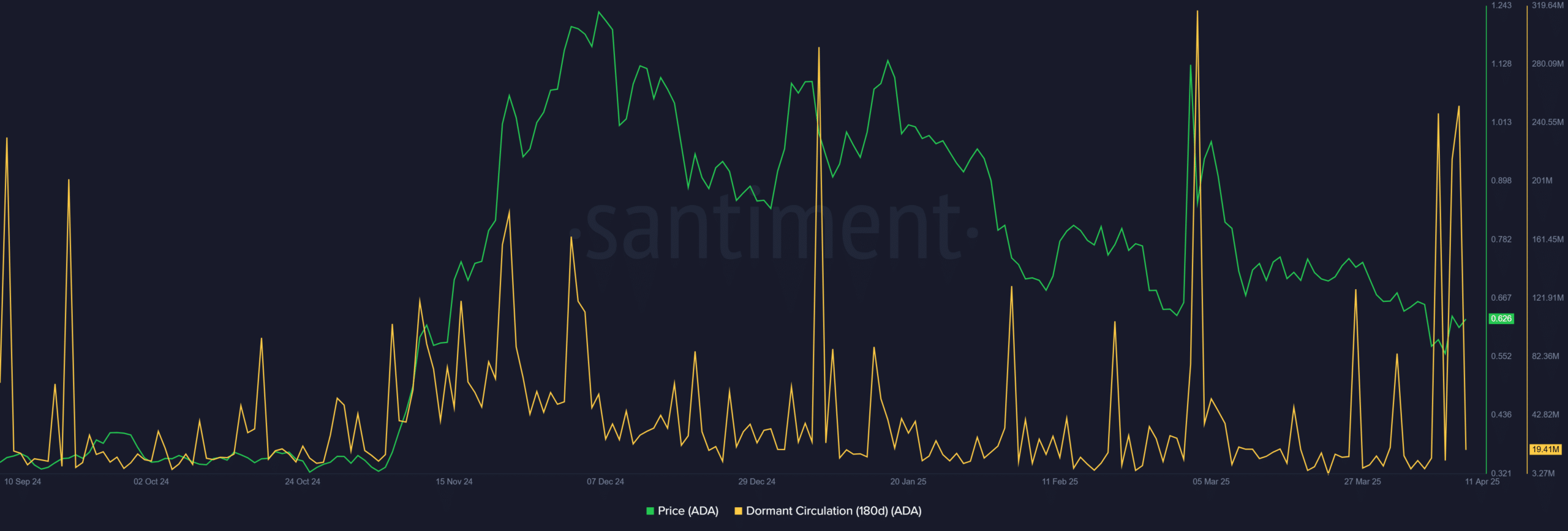

Well, the great whale (12.6b Ada) is sidelined and signaled caution. Plus, sleeping whale-circulation (180 days) spiked-a historical warning signal from market tops.

Source: Santiment

With rather inactive coins that enter the circulation and accumulation that remain weak, the sales pressure can intensify.

If Ada is not higher than $ 0.58, structural weakness can escalate in full capitulation.