This article is available in Spanish.

Cardano (ADA) is currently trading just below a critical resistance level of $0.33, after a week of intense fear and uncertainty in the market. However, on-chain data from IntoTheBlock shows that some investors are seeing this as a potential buying opportunity, anticipating a market recovery in the near future.

Related reading

Despite the broader downturn, some numbers indicate growing optimism as part of the market appears to be accumulating ADA at these levels. This suggests that investors can expect a turnaround soon.

As the market continues to change, these numbers could provide important insights for those wondering whether Cardano is worth buying right now or if a deeper correction is likely. With ADA at a critical juncture, investors are closely monitoring price action and data to determine if this could be a turning point for the asset.

Cardano investors getting ready to buy?

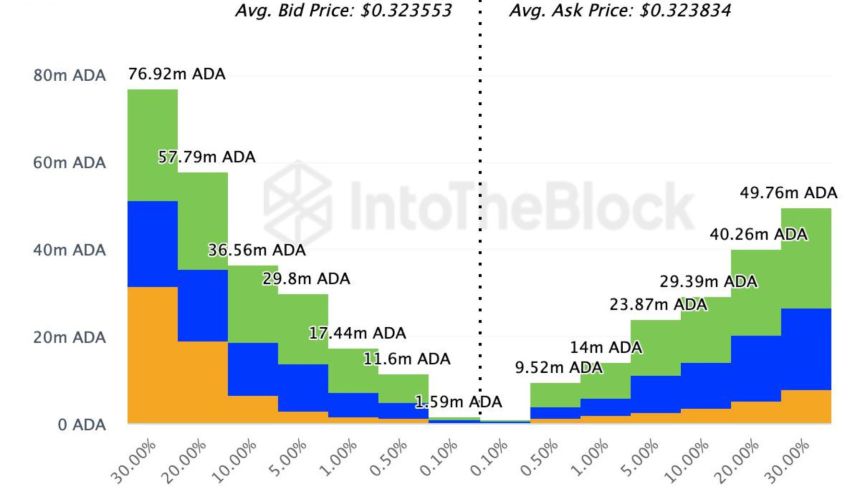

Data from IntoTheBlock shows that some investors see Cardano (ADA) as a promising buying opportunity ahead of a possible market recovery. An important indicator that supports this is the Exchange On-Chain Market Depth, which tracks the order books of the top 20 exchanges. This data shows that participants placed purchase orders for 220 million ADA tokens, which equates to more than $70 million at the current market price. In contrast, bearish traders have placed sell orders for less than 170 million ADA tokens, worth about $52 million.

This disparity between buying and selling volume suggests that Cardano’s price could be poised for an upward move. When buy orders are significantly larger than sell orders, it is often a signal that investor sentiment is becoming more positive, which can contribute to a price increase. As long as this trend continues and buying pressure dominates, Cardano could see a near-term rally.

Related reading

However, despite the bullish outlook from some investors, the broader market remains filled with uncertainty and Cardano still faces resistance at the $0.33 level. Overall market sentiment and external factors will play a crucial role in determining whether ADA can break through this resistance and enter a more sustainable uptrend. Still, current data suggests a favorable environment for a potential recovery if positive sentiment continues.

ADA price promotion

ADA is currently trading at $0.32 and is facing indecision as it tries to break the $0.33 resistance, which previously acted as support in early August.

The asset remains under pressure and is trading below the 4-hour 200 moving average (MA) at $0.3446. This is a crucial indicator of short-term strength, and the current position signals weakness. To get the bulls moving again, ADA needs to break the $0.33 resistance and reclaim the 4-hour 200 MA as support. If achieved, this would reinforce the bullish situation, potentially leading to a rally.

However, if ADA fails to clear these resistance levels, the outlook could turn bearish. The next major support is at $0.30, and a break below this level would indicate further downside potential.

Related reading

Traders are closely watching how the price action around the $0.33 resistance and 200 MA will determine whether ADA can recover or undergo a deeper correction. The uncertainty in the market makes these levels crucial for ADA’s near-term stock price.

Featured image of Dall-E, chart from TradingView