- Capybara Nation spiked 348% and reached an all-time high of $0.00002041 before a sharp pullback.

- Trading volume increased by 371%, indicating growing market interest in Capybara Nation (BARA).

Capybara Nation [BARA] has experienced a price increase of 348.90% in the last 24 hours, causing the price to rise value Unpleasant $0.0000114, at press time.

Notably, this rally saw a 24-hour trading volume of $17,902,498, an increase of 371.80% compared to the previous day.

BARA’s recent performance stands out compared to the broader market. BARA has underperformed the global crypto market, which is up 9.30% over the same period.

However, it has surpassed similar coins within the Cronos ecosystemwhich together fell by 0.60%.

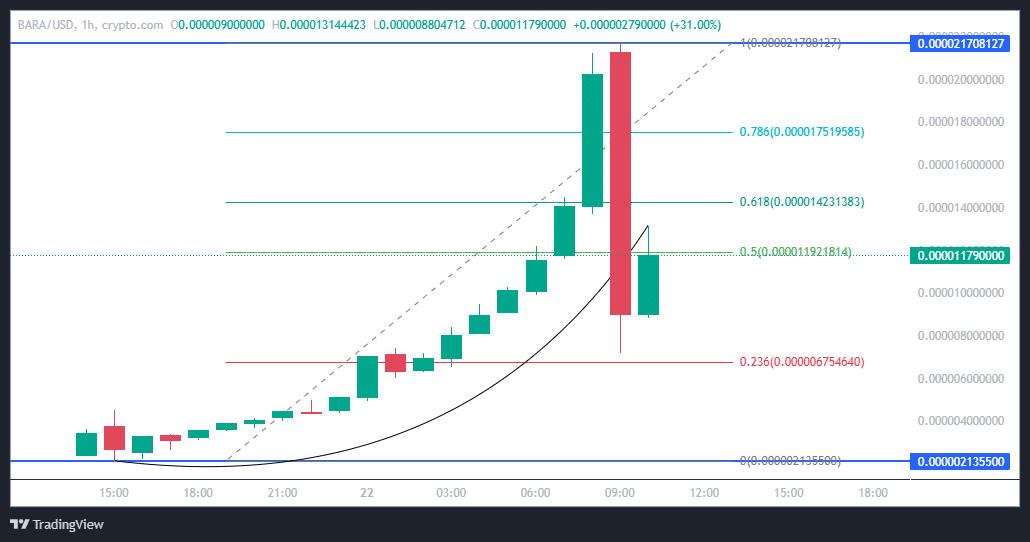

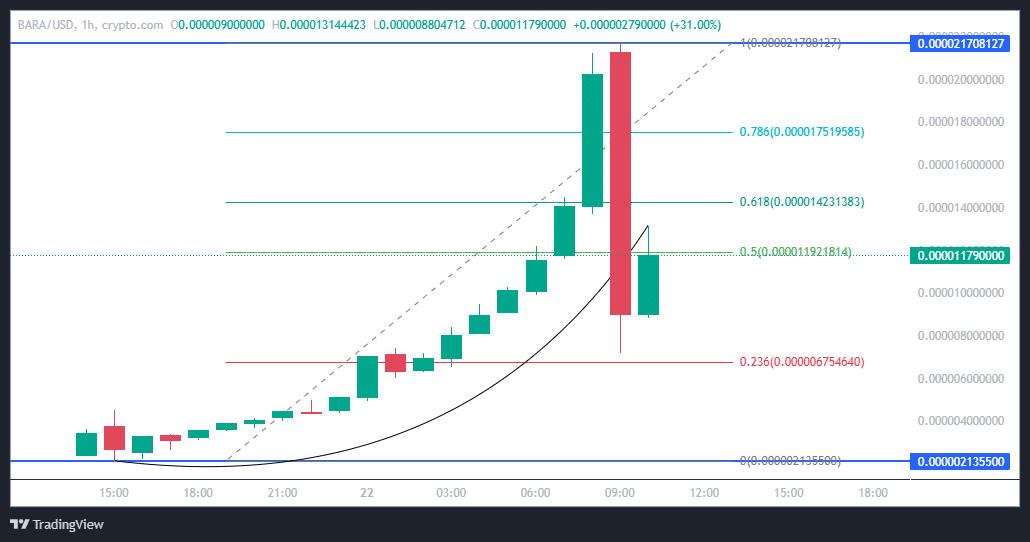

The price peaks before retreating

BARA hit an all-time high of $0.00002041 before returning to the 0.5 Fibonacci retracement level at $0.000011921814. This indicates a correction after the strong increase.

The current resistance levels were at $0.000014231383 (0.618 Fibonacci) and $0.000017515985 (0.786 Fibonacci). Support was established at $0.000006754640 (0.236 Fibonacci).

Source: TradingView

The sharp pullback was visible by the large red candle on the hourly chart, indicating selling pressure after the recent spike. If the price falls below the Fibonacci level of 0.5, the 0.236 level can be tested. Conversely, a recovery above 0.618 could indicate renewed bullish momentum.

Technical indicators point to mixed momentum

The Bollinger Bands suggested increased volatility during the recent price action as the price spiked to $0.00001864999 before settling near $0.00001155000, close to the middle band.

The upper band at $0.000012581307 now acted as resistance, while the lower band at $0.000006512615 offered potential support.

BARA’s price is consolidating around its 20-period moving average (MA), indicating uncertainty about its next move. Traders are likely to keep a close eye on these levels for signs of a further breakout or collapse.

Source: TradingView

The Relative Strength Index (RSI) stood at 50.66, deviating from the overbought environment above 70 that we saw earlier during the rally. This neutral reading suggests that the coin is not currently overbought or oversold. A move above 60 on the RSI could indicate renewed bullish momentum.

Meanwhile, the MACD indicator reflected a bearish crossover, with the MACD line at 0.00000639789 crossing below the signal line at 0.000006384189.

Although the momentum appears to be weakening, the histogram remained near zero, indicating that the trend could quickly reverse if buying volume rises again.

BARA’s price increase and associated trading volume highlighted the increased interest in the cryptocurrency.