- Capmoney has accepted chain link price fairs to stabilize his CUSD and offer live price data in Defi -Platforms.

- Chainlink Oracles for decentralized verification tool for maintaining the dollar stability of CUSD, as well as automated smart contract options.

- Link Token continues to descend as the whales of whales unload, while active addresses decrease to undermine the market.

Capmoney has revealed that the Chainlink -Price Feeds on Ethereum will use to reach the Stablecoin -pin to the US dollar. The Stablecoin, tailor -made for cross -border payments and transfers, is intended to offer consistent price data and improved security in decentralized finance (Defi) environments.

. @Capmoney_ has integrated chain link price with @Ieneum to provide its decentralized, interest -bearing CUSD stablecoin.https: //t.co/w1qnpktgzwzwzwzwzwzwzwzwzwzwzwzwzwzwzzw with power

Supported by fully collateral and recovering assets, uses CUSD chain link to offer stronger guarantees that stablecoin mining and … pic.twitter.com/z7qagsrivt

– Chainlink (@chainlink) April 17, 2025

Currently, chain link price fairs are popular because of their decentralization and impossibility to become game. They extract data from more than 20 CEXS and DEXS aggregators and combine the data together with Volume Woogte averages. These prices are further validated by consensus by other parties known as security -built nodes.

In practice, the smart contracts of CUSD demand a market change or a new price update period when it is due. Oracle nodes collect and process price information of the external environment, excludes from bijters and report results. The chain link data is combined and the average value is published on-chain, so that CUSD remains securely linked and accessible, even in the case of volatility or extreme load.

Defi tool is expanding as CUSD gets new possibilities

By using Chainlink infrastructure, CUSD introduces itself for integration on a large number of Defi platforms. Automated market makers, loan platforms and yields of agricultural systems, which depend on reliable and reliable price data, can now integrate with CUSD.

With the programmable Oracle from Chainlink, practical events can occur to smart contract transactions. Capmoney plans to optimize the scheme and change the colland requirements, which extends even more the possibilities of the user cases of CUSD.

The integration is not only for CUSD by offering operational stability, but also by setting a benchmark that other stablecoin -mittenten should follow on Ethereum.

Chainlink is confronted with pressure despite strategic acceptance

However, the native token of Chainlink, link, has not maintained an upward route, even with the collaboration with Capmoney. LINK is currently $ 12.15, with a daily decrease of 0.74% and relatively bearish from the peak at around 30.86 $ included in December.

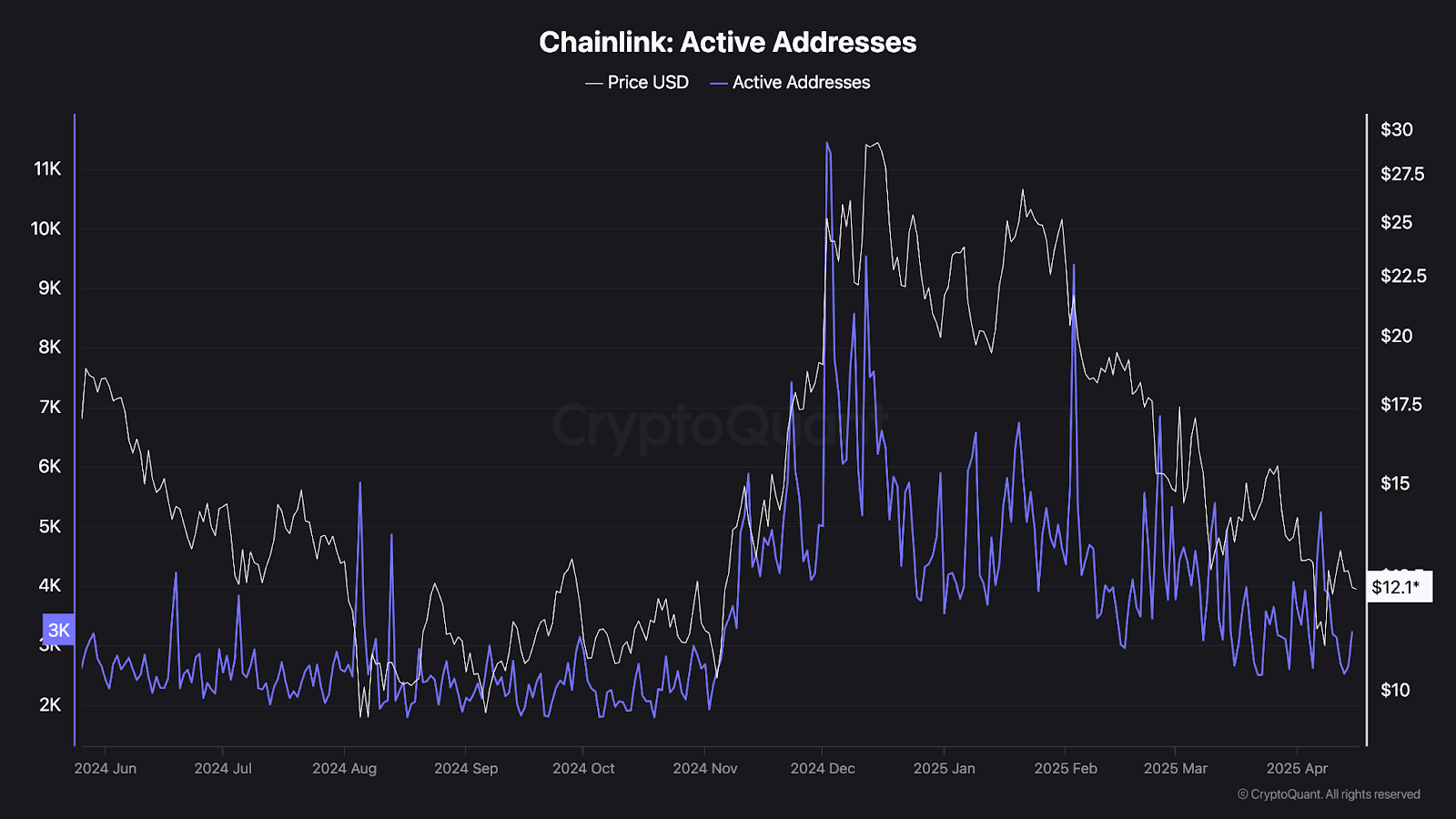

However, Onchain indicators point to a negative trend in the basic principles. Cryptoquant shows that active addresses for Chainlink have fallen to around 3,200 this week, which is 72% less than the 11,400 included in December.

Source: Cryptuquant

The active address statistics, which keeps track of the number of different portfolios that deals with the links, can also rise when the price does. Further decline implies decreasing user interest and reducing trust in prospect.

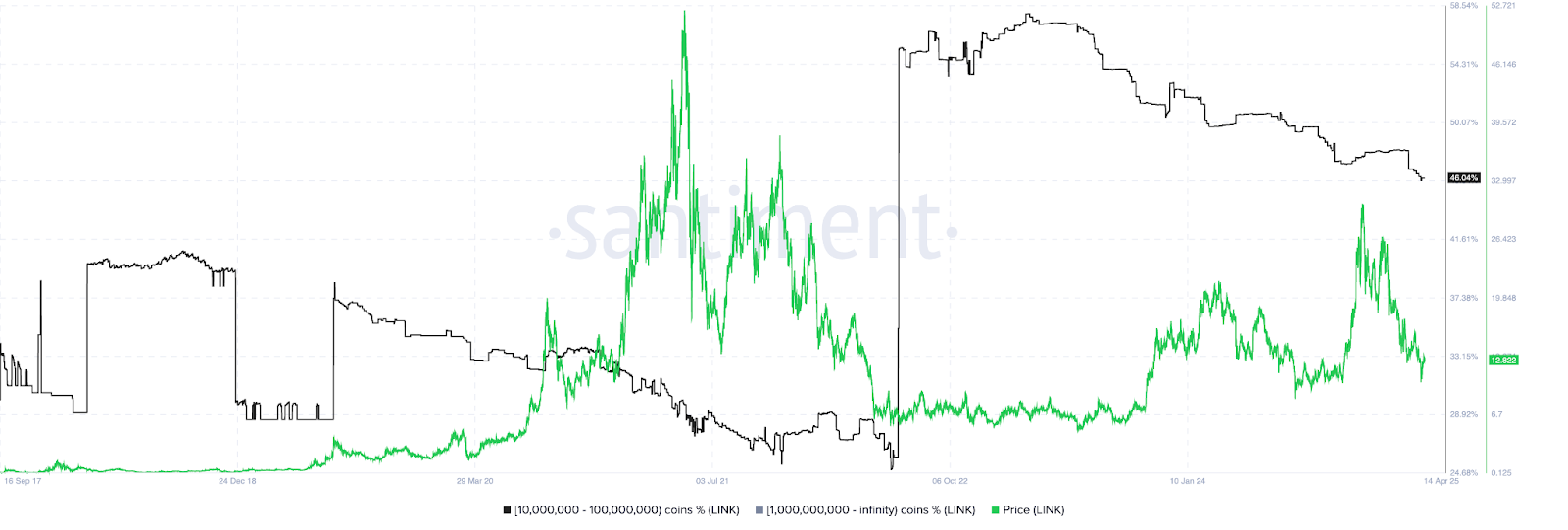

Santiment also shows that large holders have also started selling more. Many large addresses with between 10 million and 100 million links sold until mid -February and mid -April. These portfolios currently have 46% of all link tokens that are in circulation. After the exit activity, this has worn a downside in this whale group.

Link is close to the support level of $ 10. It is expected that it will break below this level and thereby bring more losses if Bearish Momentum persists. Traders are now waiting for a positive signal that could encourage the wishes of users and large whales to communicate with the platform.