Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The dollar weakens this year. As reported, the American dollar index fell by 7% years to date, one of the worst openings in recent history.

The Dollar Index measures the value of the dollar against six other large foreign currencies. Since tensions between the US and different countries have increased on the trade front, the worries with regard to the long -term power of the dollar are starting to arise.

Related lecture

Bitcoin receives more attention from investors

As the dollar weakens, more investors turn to Bitcoin as a potential hedge. Daring capitalist Tim Draper indicated that Bitcoin can serve as an insurance policy against the failure of Fiat currencies.

He thinks that the digital currency will continue to appreciate in terms of the US dollar, in particular because international trust in Fiat -Malutas is faltering.

In a comment he made on the X platform, he said Bitcoin “may be worth an infinite amount of USD.”

Bitcoin may be worth an infinite amount of USD.

During the civil war, the southern dollar of the south went through hyperinflation.

After starting 1: 1 with USD it ended the war from more than 10 million to 1.

People lost confidence and clambed to exchange their money for USD.

But now … pic.twitter.com/qrtekl4vku

– Tim Draper (@timdraper) May 1, 2025

Draper compared the current increase in Bitcoin with a change in monetary behavior. He pointed out that individuals will shift their money to the assets during uncertain times, making them feel safer.

Although Gold had previously played that function, Draper stated that Bitcoin is starting to fill the position because of the digital size and convenience.

An analogy from the Civil War era occurs eyebrows

To illustrate his argument, Draper referred to American history. He mentioned the southern states of America, who had printed his own paper money during the civil war in 1861.

Initially it was linked to a 1: 1 ratio with the US dollar. But towards the end of the war, the southern dollar had fallen apart and exchanged by more than 10 million to 1 compared to the US dollar.

Draper has explained that this illustrates how quickly a currency can fall apart when trust is lost. He warned that such a thing can happen again if individuals, companies and even governments lose confidence in the stability of the current system. In his opinion, Bitcoin is extracting from that change.

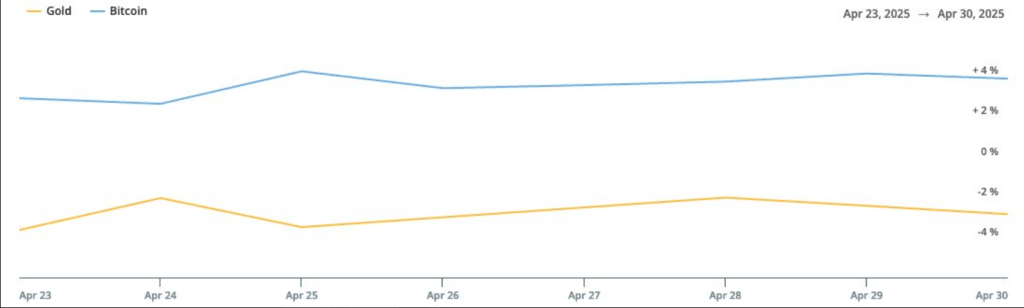

Bitcoin versus gold in a changing market

Gold will usually be the first safe haven if there is financial pressure, but Draper believes that it is no longer number one. He noted that gold has problems such as enormous storage costs and physical movement. Bitcoin, however, is a pure online existence and can easily transfer quickly across the borders.

Related lecture

He also stated that Bitcoin has special strengths – such as limited delivery and autonomy of central banks – that make it more attractive than conventional assets.

These characteristics, Draper explains, are becoming increasingly difficult to see when the global financial system becomes more stress.

Governments are starting to become acquainted

Draper claims that even some governments try to find out if they should keep Bitcoin reserves. This marks a shifting sentiment about how cryptocurrencies are observed, not only with private investors, but also public institutions.

Featured image of Unsplash, graph of TradingView