- SUI has remained bullish despite two bearish cycles.

- Can it repeat this success again?

Positioned among this week’s top losers, Sui [SUI] is down more than 13%, returning to $1.70 with a daily dip of almost 10%. This pullback follows a strong rally in September that pushed SUI past $2.30.

As weak hands disappear, some investors may view the current price as an attractive entry point. But with market-wide volatility increasing, can SUI defy expectations and engineer a recovery?

History may repeat itself

After a six-month slump, SUI staged a significant rally in early August thanks to Grayscale support, which offered traders indirect exposure to the asset.

This increased visibility highlighted SUI’s high transaction speeds and smart contract capabilities, allowing investors to appreciate its true utility.

As a result, the token enjoyed a remarkable upward move for two consecutive months, reaching a staggering 360% rise to an all-time high of $2.30, even amid two bearish cycles during this period.

A similar pattern is now occurring. On X (formerly Twitter), the developers announced the integration of MemeFi, the largest game on Telegram, into the Sui network. This once again showed his impressive throughput.

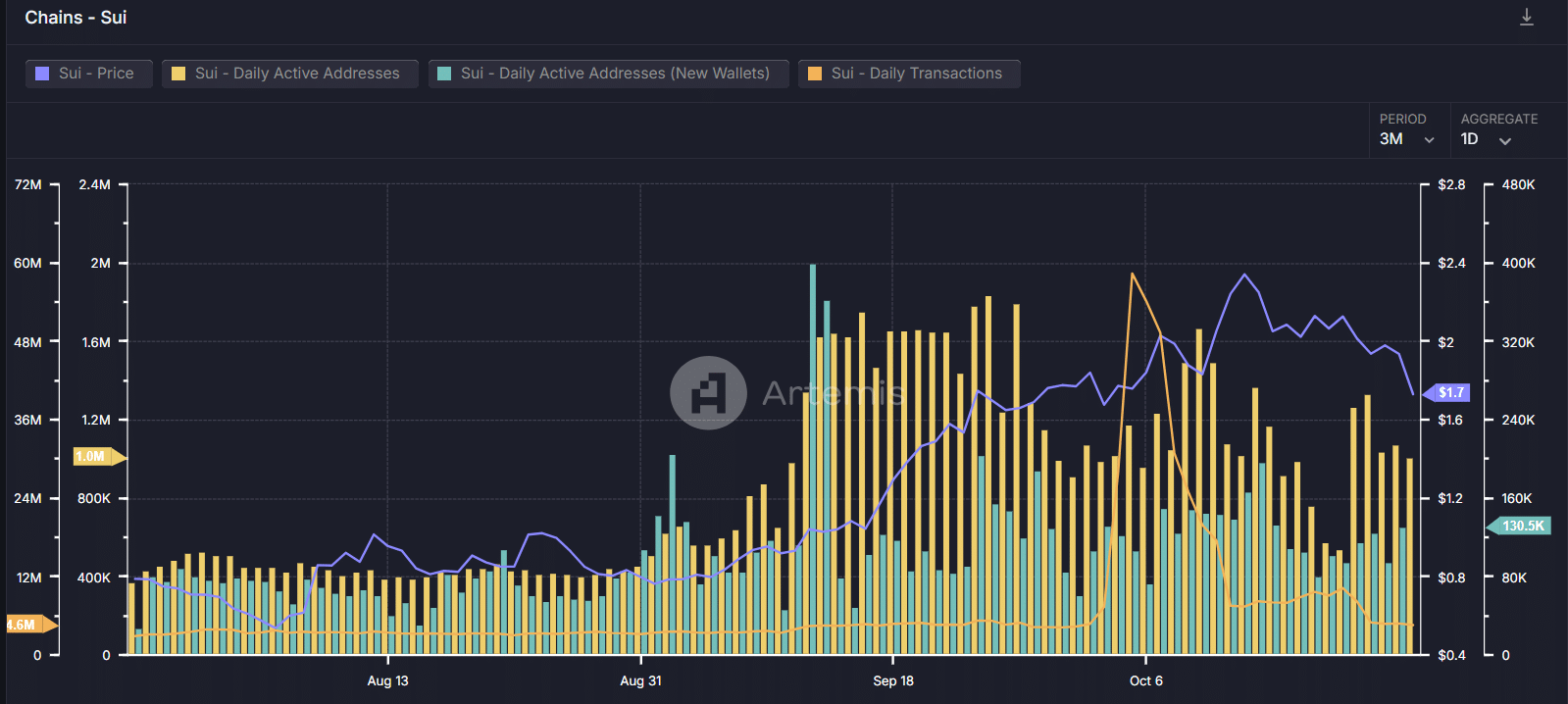

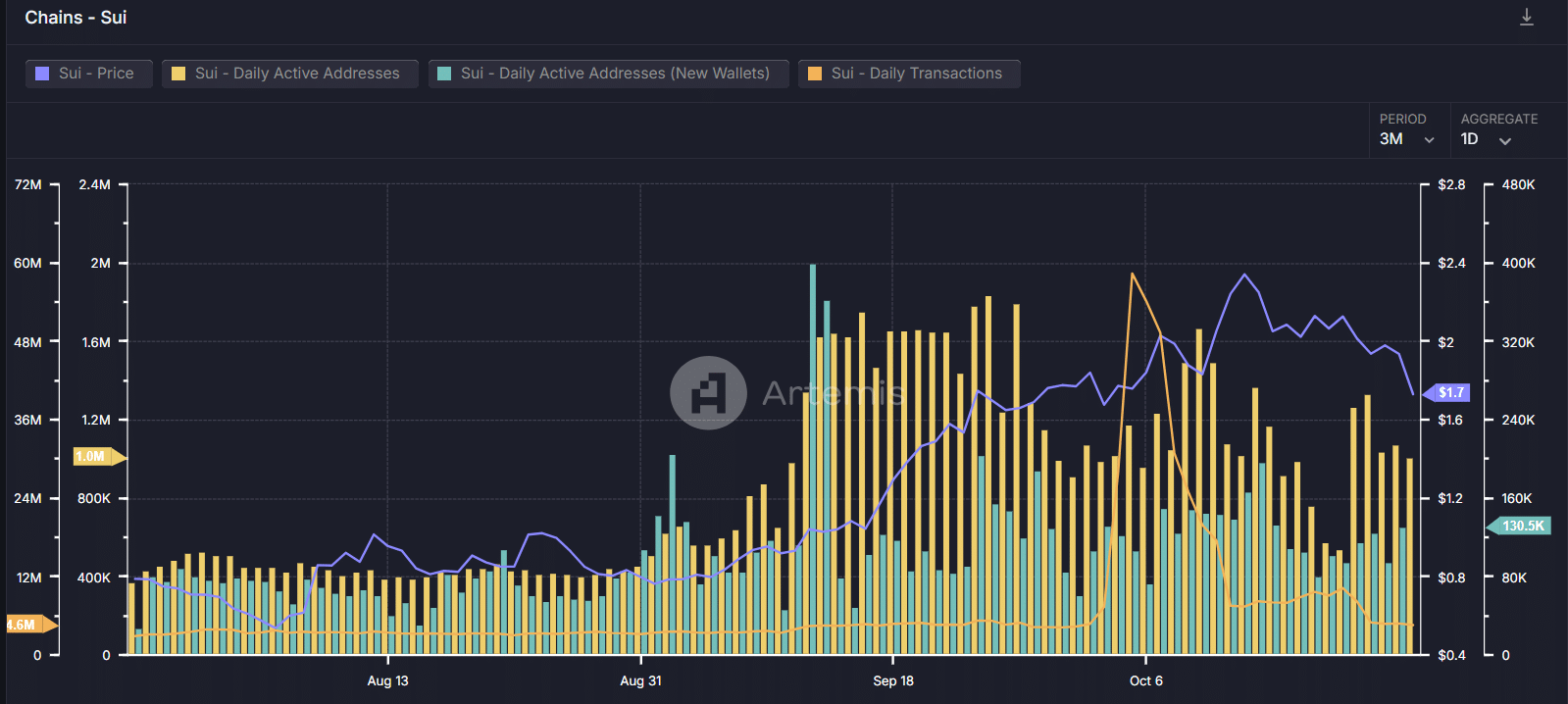

Source: Artemis Terminal

While this is certainly an encouraging sign to maintain momentum, the impact on the token’s daily transactions – its main USP – has been minimal.

The number of daily transactions fell from 4.8 million to 4.6 million, along with other important figures.

However, there has been a notable increase in the number of new wallets entering the ecosystem, from 90,000 to 130,000. This peak indicates new interest in the market.

This development is important for two reasons: new buyers view the current price as a market bottom, and it signals growing optimism about SUI’s future potential – a bullish sign.

SUI may be strategizing DIT for a recovery

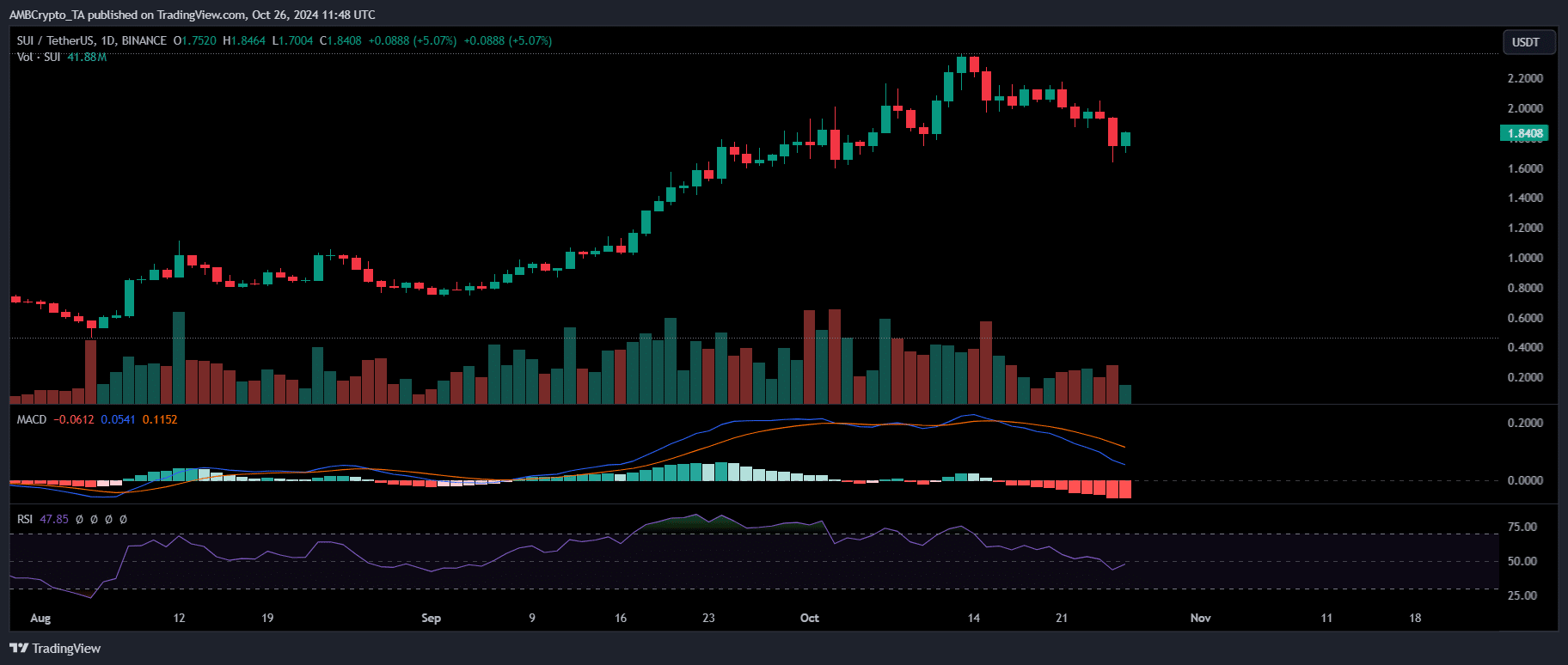

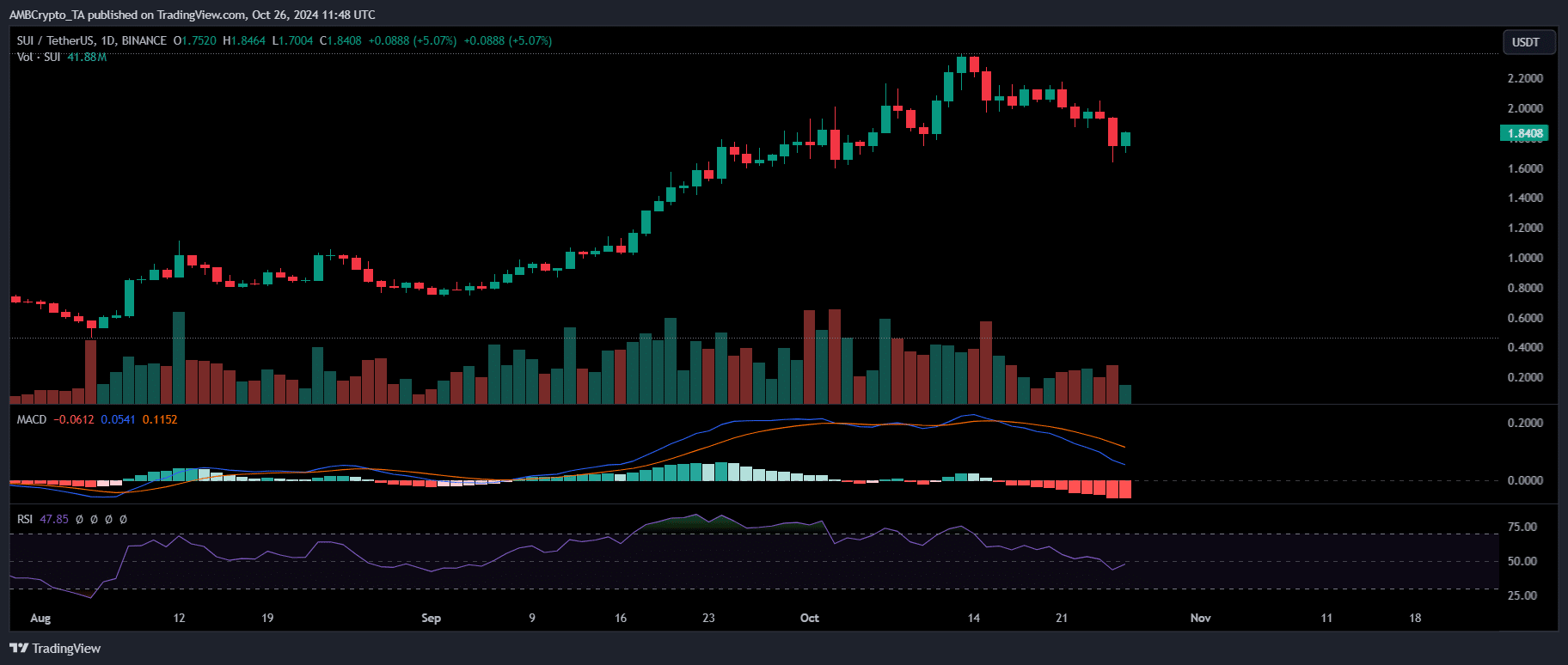

Unlike the previous cycle, where the RSI rose above the 70 threshold – indicating an overheated market – SUI is currently at a more comfortable level, with buying interest remaining subdued.

Source: TradingView

While this may sound bearish, the current position could actually encourage continued buying interest as no significant selling pressure looms.

Combined with the emergence of new wallets, there is a solid chance that the token will rebound. This could be done by taking advantage of the ongoing market volatility to attract capital from high-cap altcoins to more affordable alternatives.

Read Sui’s [SUI] Price forecast 2024-25

So it may not be too optimistic to expect SUI to once again defy expectations and possibly see an upward move back to $2. If overall market sentiment remains bearish, SUI could even set a new all-time high.

However, consistent monitoring of two key metrics – new interest and the performance of other altcoins – will be essential.