- At the time of writing, traders were over-indebted: $0.339 at the low end and $0.361 at the high end.

- XLM’s Open Interest (OI) is up 18% in the last 24 hours.

Stellar [XLM] seemed to catch the attention of traders and investors due to its impressive performance over the past 24 hours.

The possible reason for XLM’s strong performance today could be the price action and support from traders.

At the time of writing, XLM was trading around $0.355, having risen more than 8.5% in the past 24 hours. The asset’s trading volume highlighted the increased interest from investors and traders as it rose by 55%.

XLM technical analysis and upcoming levels

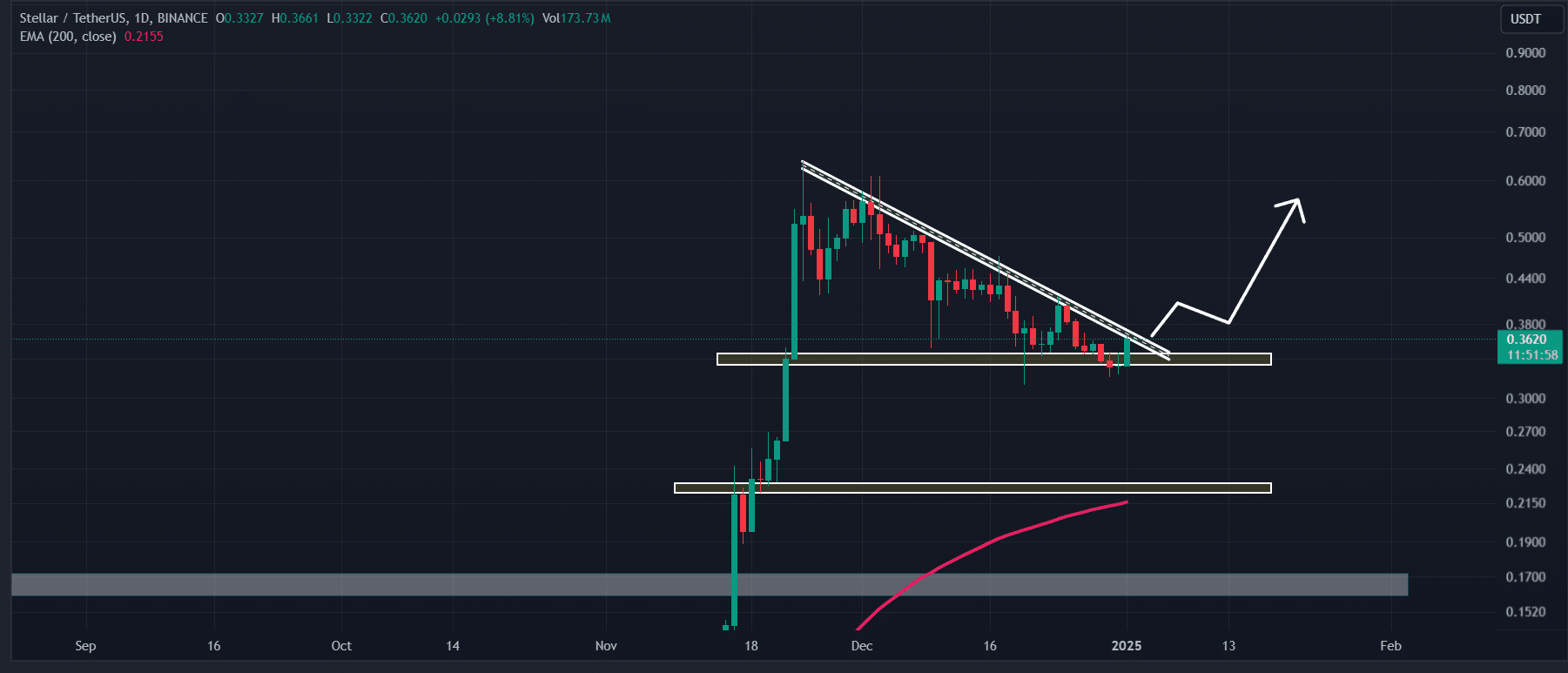

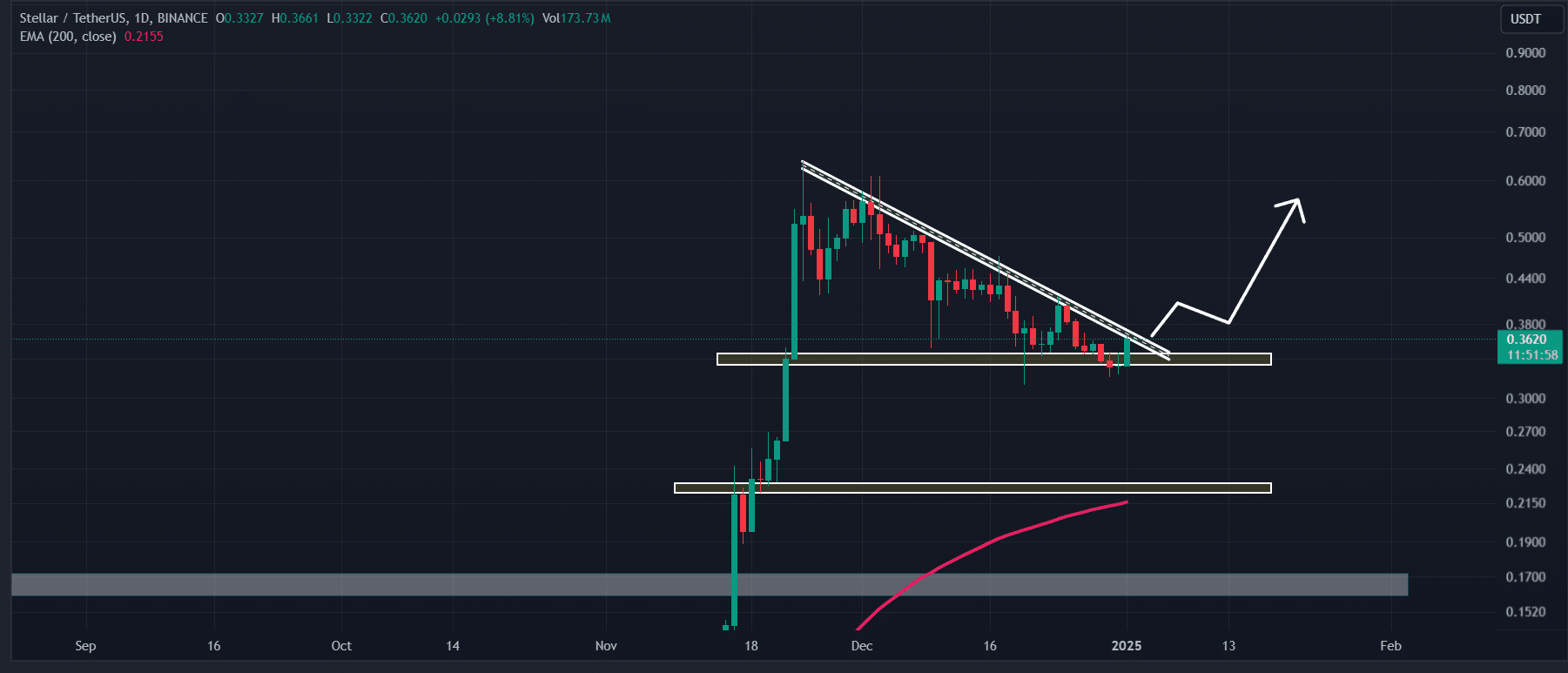

According to AMBCrypto’s technical analysis, XLM had formed a descending triangle pattern on the daily time frame. The price seems to be on the verge of breaking this pattern as it has entered a narrow consolidation zone.

Additionally, the altcoin had formed a bullish pin-bar candlestick pattern near the bottom of the support level, signaling a potential price reversal.

Source: TradingView

Recent price action and historical momentum suggest that if

Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating that XLM remains in an uptrend.

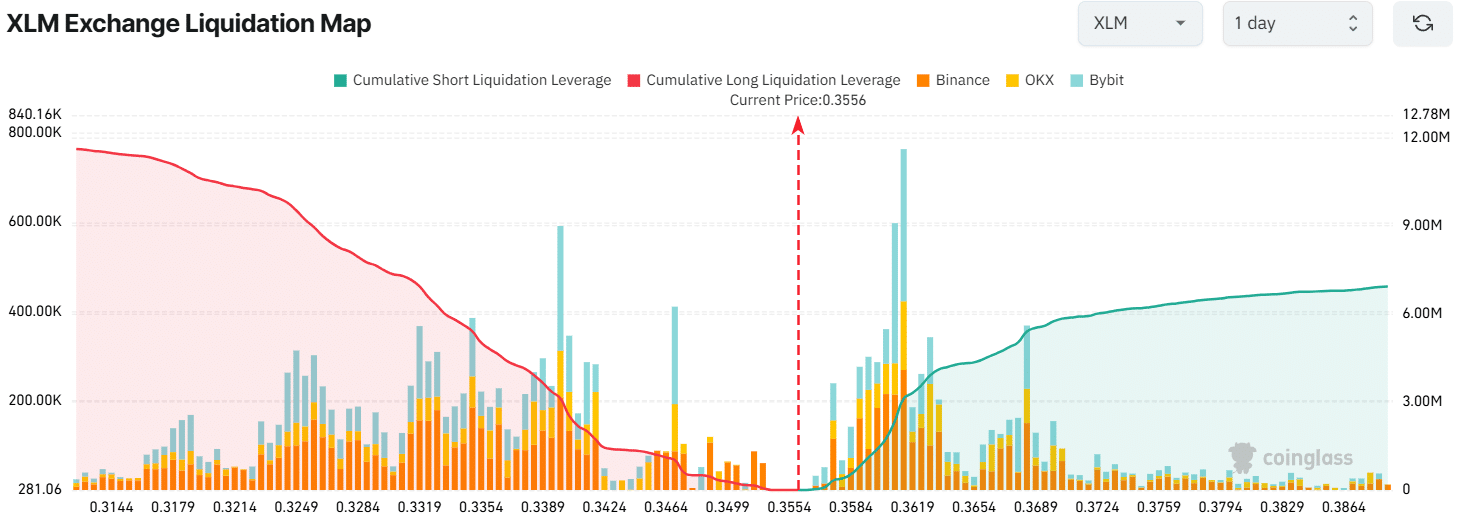

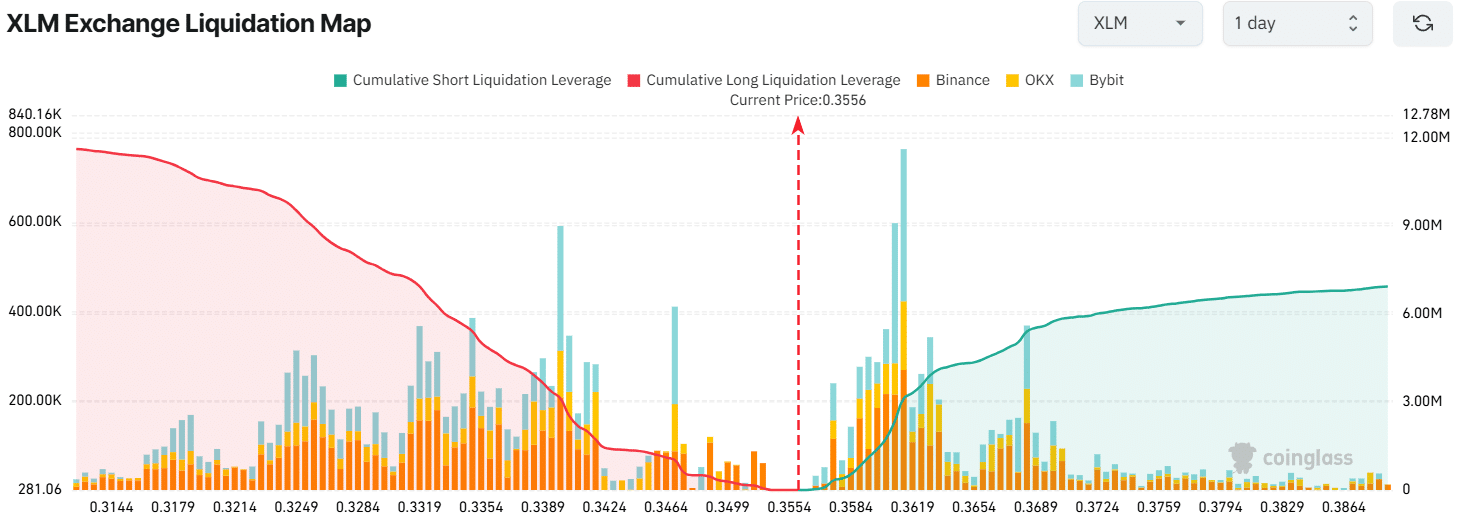

Rising OI and large liquidation areas

Data from on-chain analytics firm Coinglass shows that XLM’s Open Interest (OI) increased by 18% over the past 24 hours. This showed that traders were forming new positions as sentiment around XLM began to shift.

At the time of writing, the key liquidation areas were near $0.339 on the downside and $0.361 on the upside, with traders at these levels over-indebted, according to Coinglass.

Source: Coinglass

Read Stellar’s [XLM] Price forecast 2025–2026

Also, traders at these levels appeared to have formed an equal number of long and short positions. If the XLM price moves to this level, short and long positions worth $3.12 million could be liquidated.

So, sentiment for XLM has been bullish, but the price needs to cross the USD 0.361 mark to witness significant upside momentum.

![Can Stellar [XLM] Reach $0.60? Assessing key levels](https://free.cc/wp-content/uploads/2025/01/a-cartoon-character-pointing-at-a-large-xlm-coin-i_11zon-1000x600.jpg)