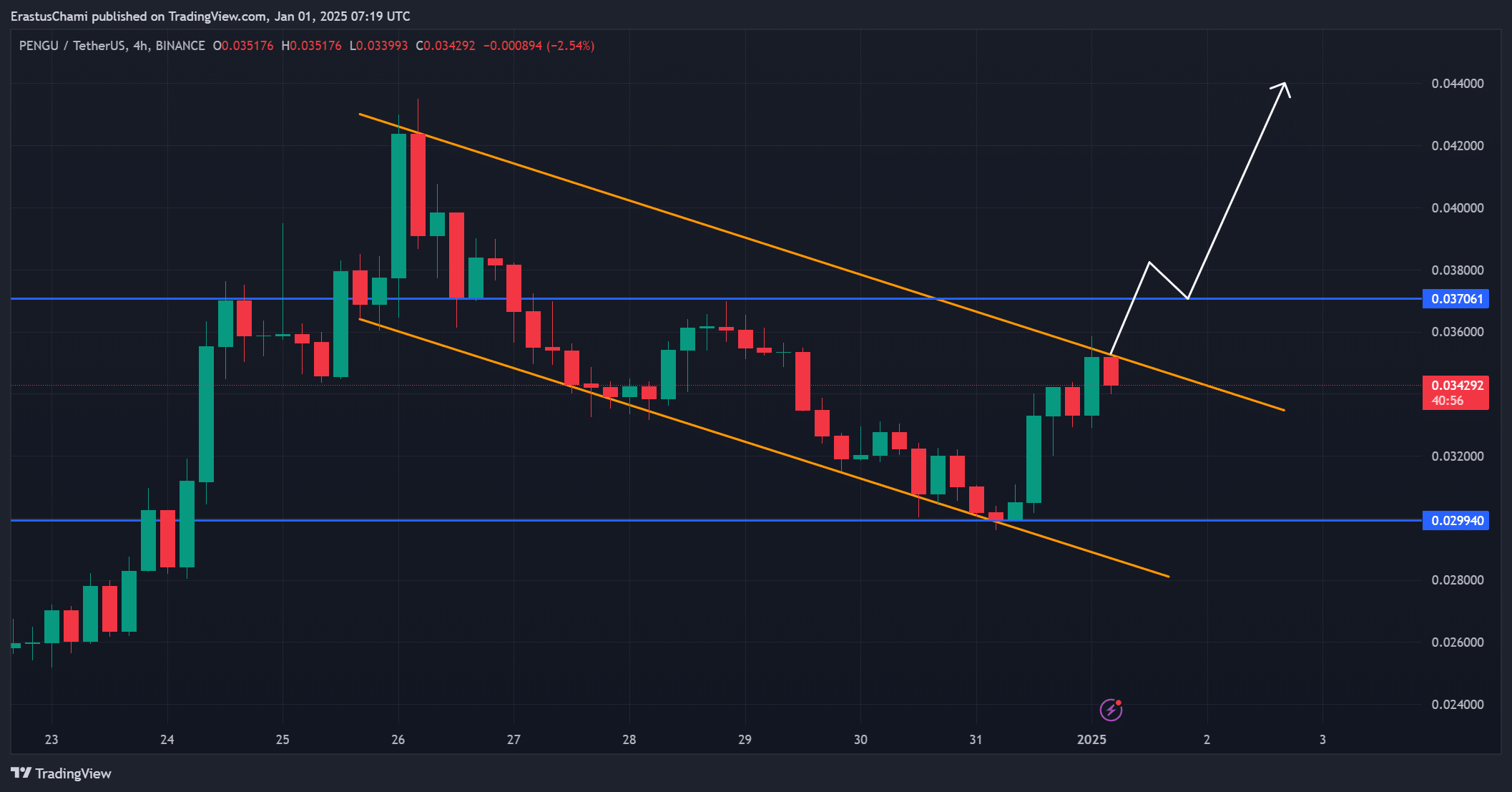

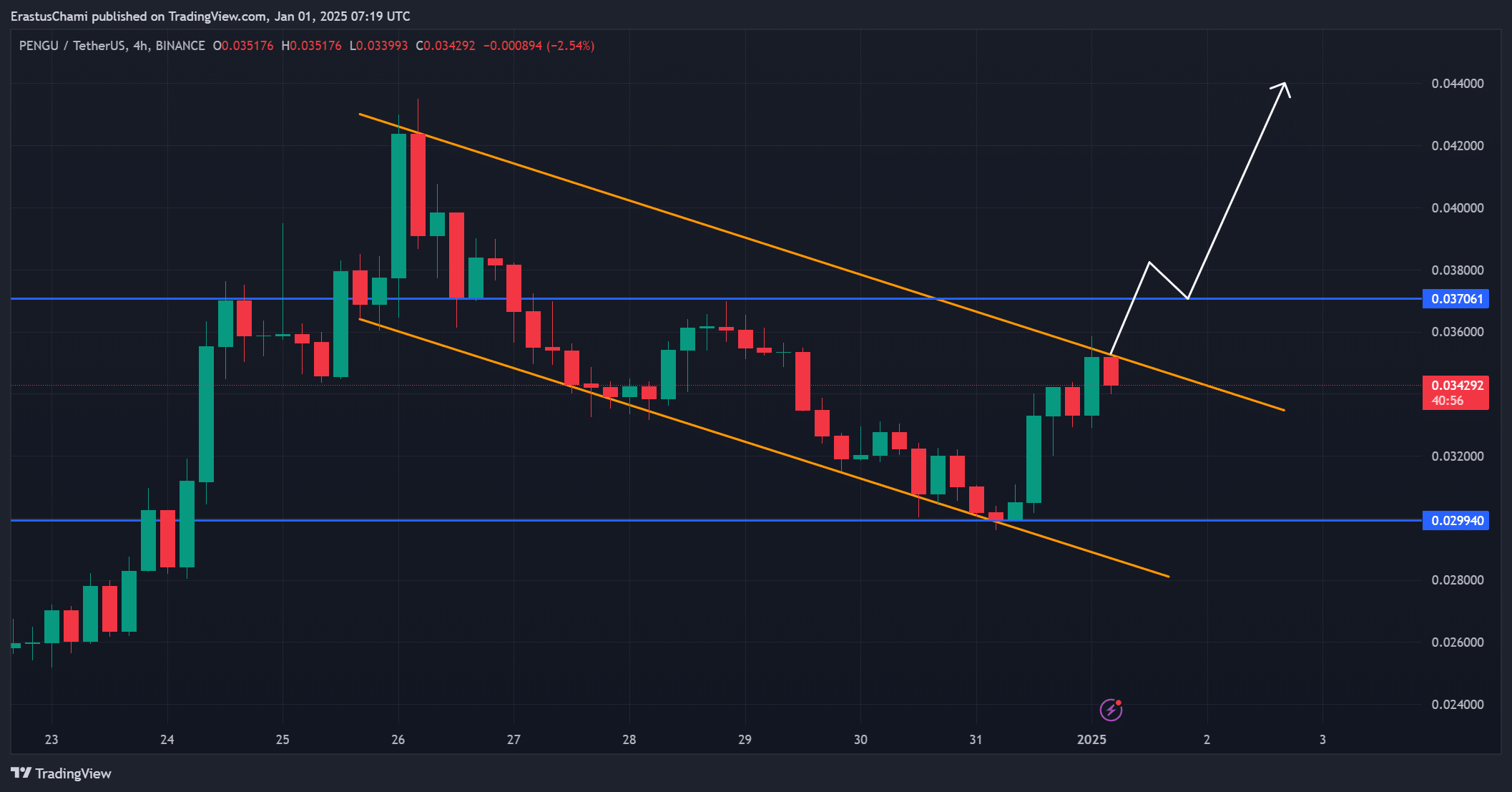

- PENGU faced key resistance at $0.0370, with support at $0.0299 ahead of a possible breakout.

- Market sentiment showed optimism, with rising Open Interest and balanced liquidation dynamics.

Whale activity has drawn attention in the Pudgy penguins [PENGU] market, when a newly created wallet transferred $3.13 million worth of tokens from Binance.

This key move coincided with a strong increase in momentum, sending PENGU’s price up 15.14% to $0.03435, while its 24-hour trading volume rose 113.43% to $734.47 million.

AAt the time of writing, PENGU had a market capitalization of $2.14 billion. With such explosive growth, many are wondering if PENGU can maintain its bullish momentum or if volatility lurks.

The critical levels of PENGU

PENGU’s recent price movements indicated key resistance and support levels that traders were watching closely. The token peaked at $0.0351 but faced significant resistance at $0.0370.

A breakout above this level could pave the way for further upside momentum, potentially reaching $0.04.

Conversely, the support level at $0.0299 is crucial; any decline below that could weaken the bullish narrative. Therefore, traders should keep a close eye on these levels as the market tests its next direction.

Source: TradingView

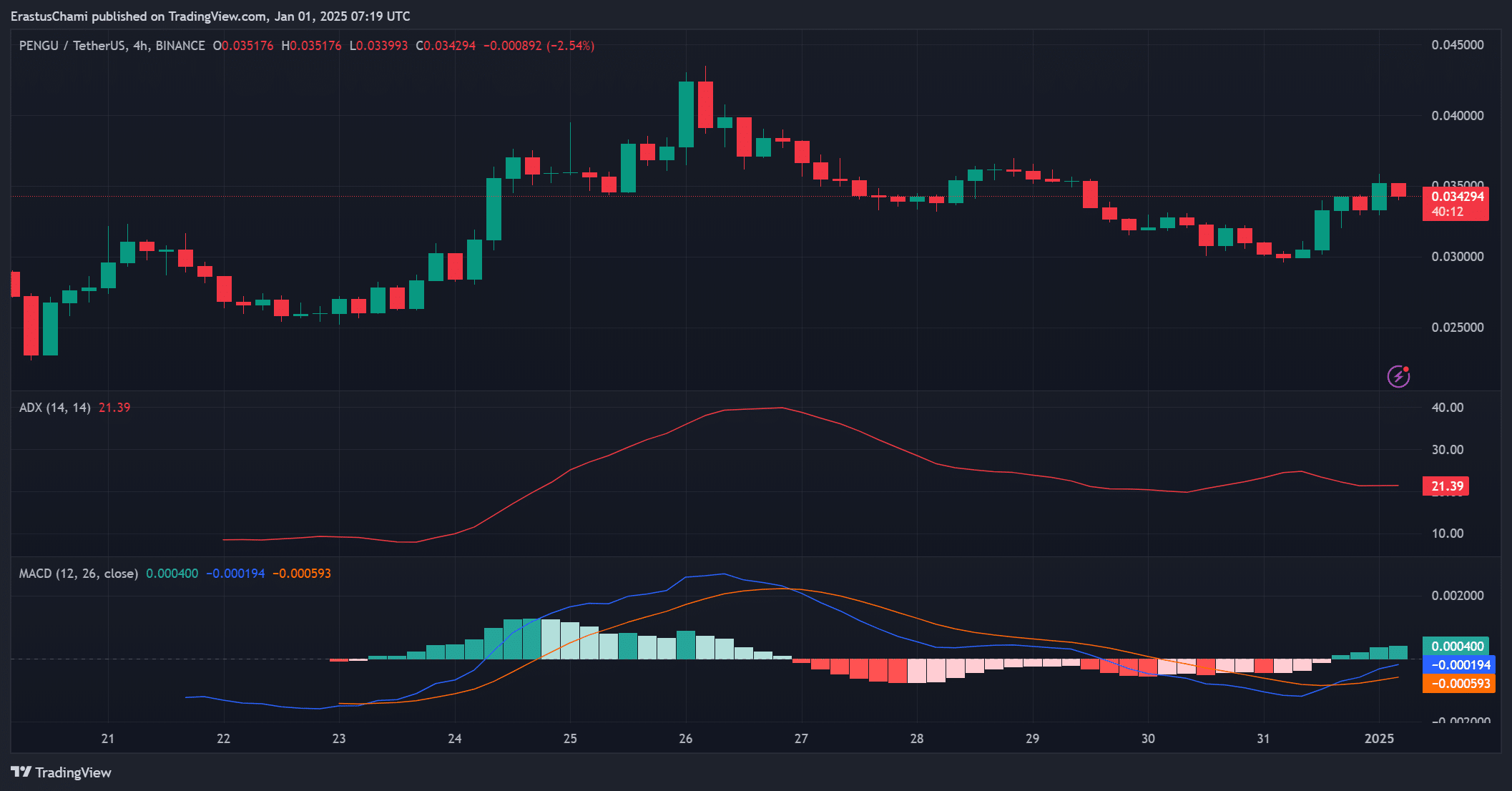

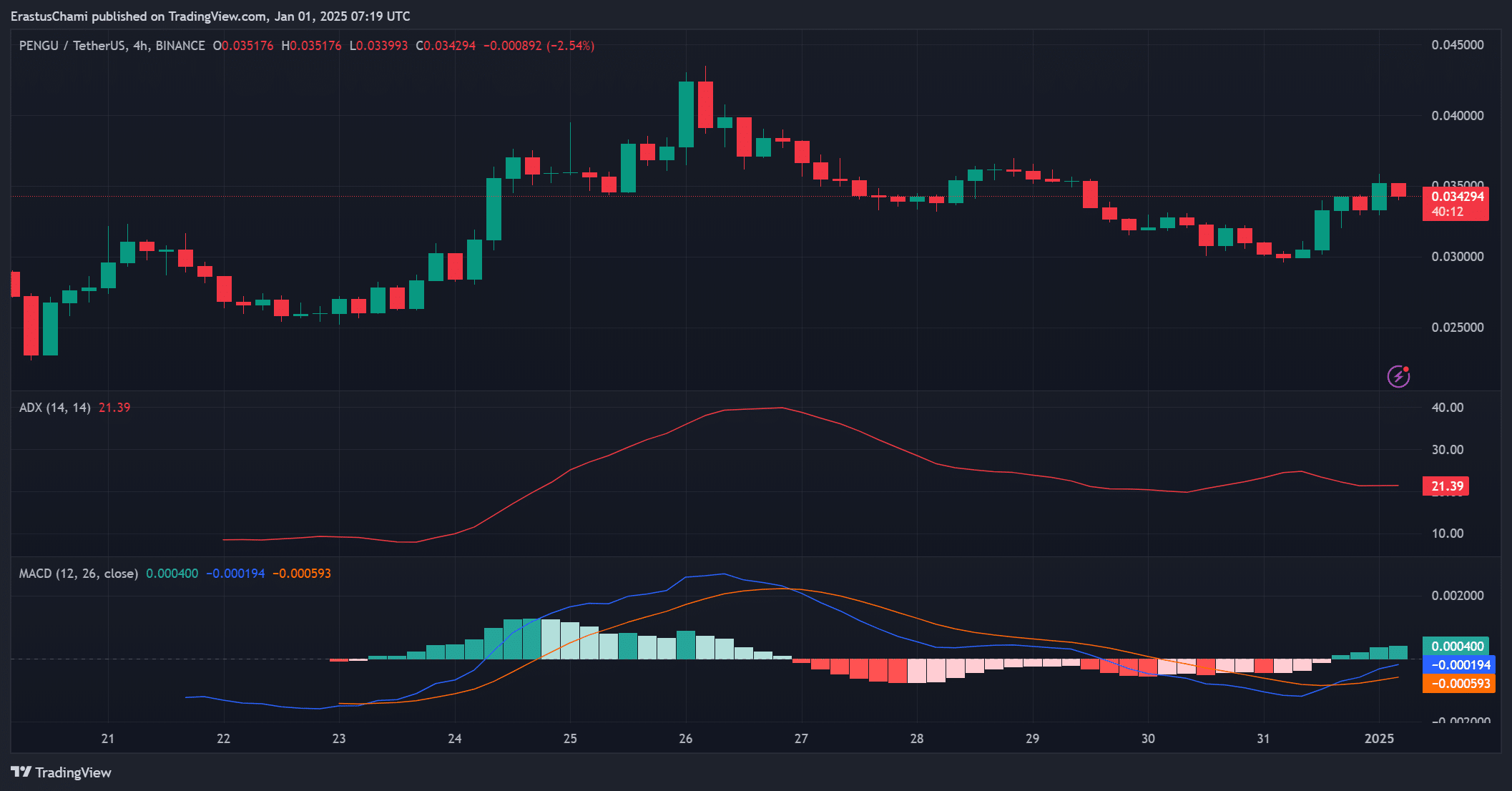

Technical indicators are showing mixed signals

Looking at technical indicators, the MACD signals growing bullish momentum as the histogram turns positive and the MACD line moves above the signal line.

This is consistent with recent price increases, indicating optimism.

However, the ADX, which measures trend strength, was at 21.39 at the time of writing, indicating weak trend strengthening.

This suggests that while the upward trend is clearly visible, it lacks the strong conviction needed for sustainable growth. Therefore, further confirmation of these indicators is necessary.

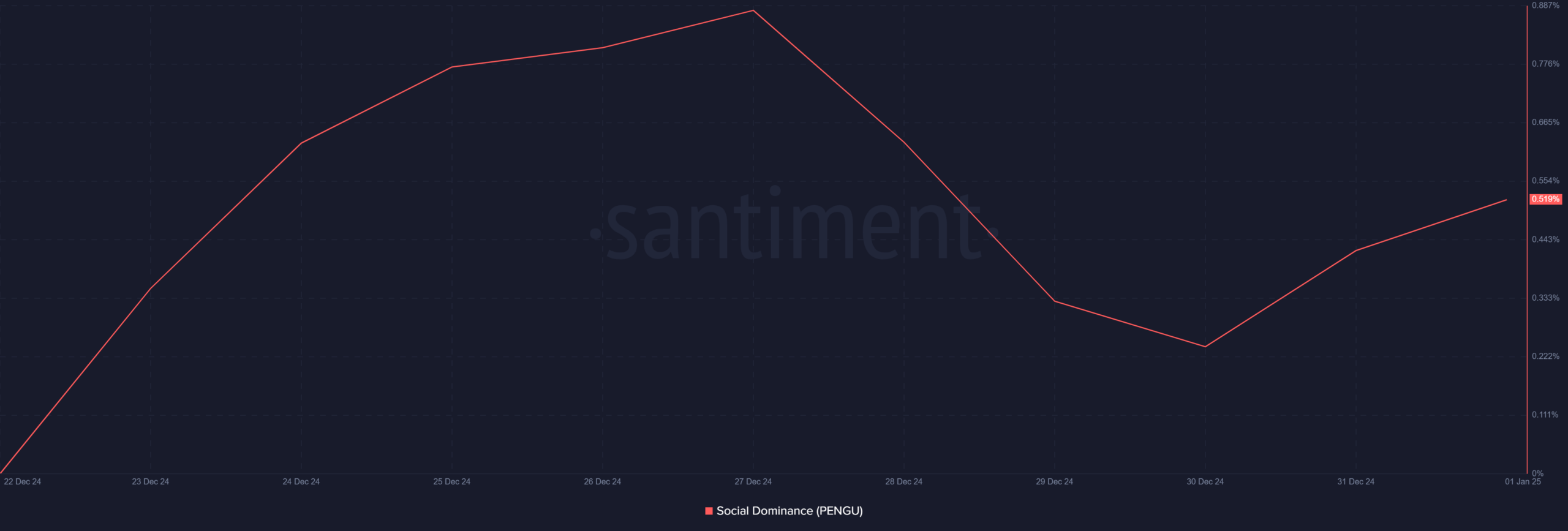

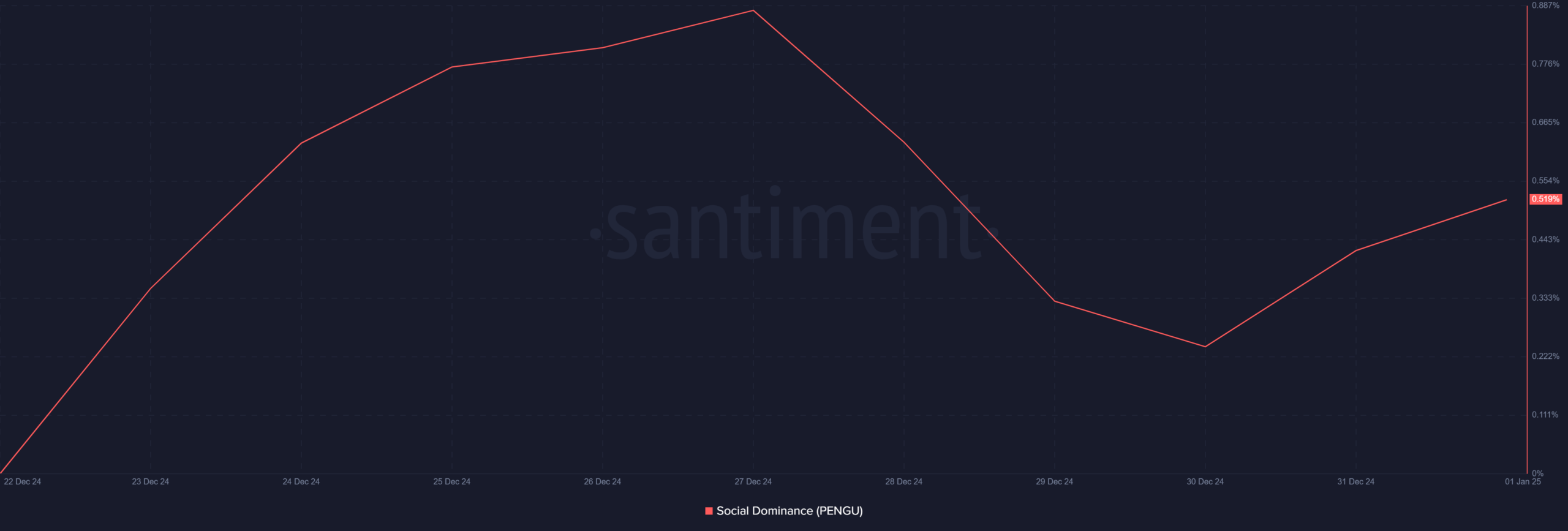

Social dominance emphasizes changing sentiment

Social dominance data showed fluctuating interest in PENGU, with dominance initially peaking at 0.88% before dropping to 0.51% and showing signs of recovery.

This trend reflected the varying influence between whales and retailers. However, increasing talk about PENGU could reignite retail interest, which could support further upside.

Source: Santiment

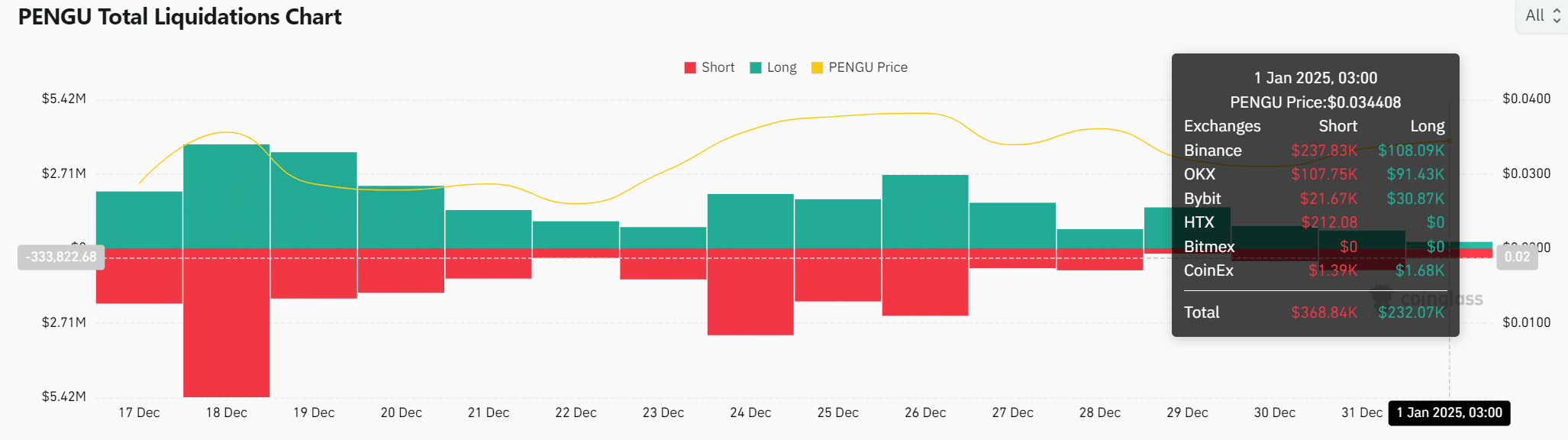

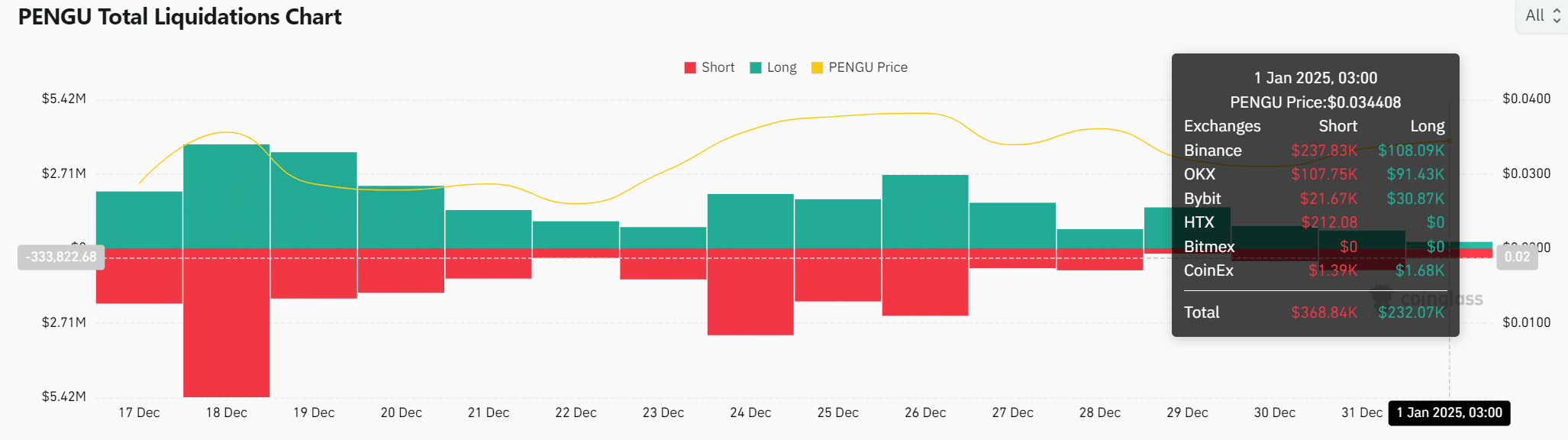

Market sentiment and liquidation data

Open interest rose 31.59% to $190.22 million, reflecting growing speculative activity around PENGU. Coinglass analysis.

However, the liquidation chart showed balanced dynamics, with short liquidations of $368.84K versus $232.07K in longs.

This suggests that while the market is heating up, it remains relatively stable, leaving room for a potentially sustainable rally.

Source: Coinglass

Read Pudgy Penguins’ [PENGU] Price forecast 2024–2025

PENGU’s whale-driven rally, coupled with strong trading activity, signals potential for further growth. However, mixed technical signals and key resistance levels point to challenges ahead.

For now, PENGU’s rally appears to be continuing, but traders should remain vigilant as volatility remains a possibility.