- NEIRO’s recent gains marked the start of what could be a major rally in the coming trading sessions

- Several technical indicators and market charts pointed to the possibility of a 151.18% price increase

Over the past 24 hours, NEIRO has been one of the standout performers on the market, with gains of 33.02% on the charts. This increase highlighted the market’s growing interest, while also positioning NEIRO as the second largest asset in terms of percentage gains over the aforementioned time frame.

According to an analysis by AMBCrypto, this bullish momentum is likely to continue, pushing the price to even higher levels.

Symmetrical triangle strengthens bullish momentum

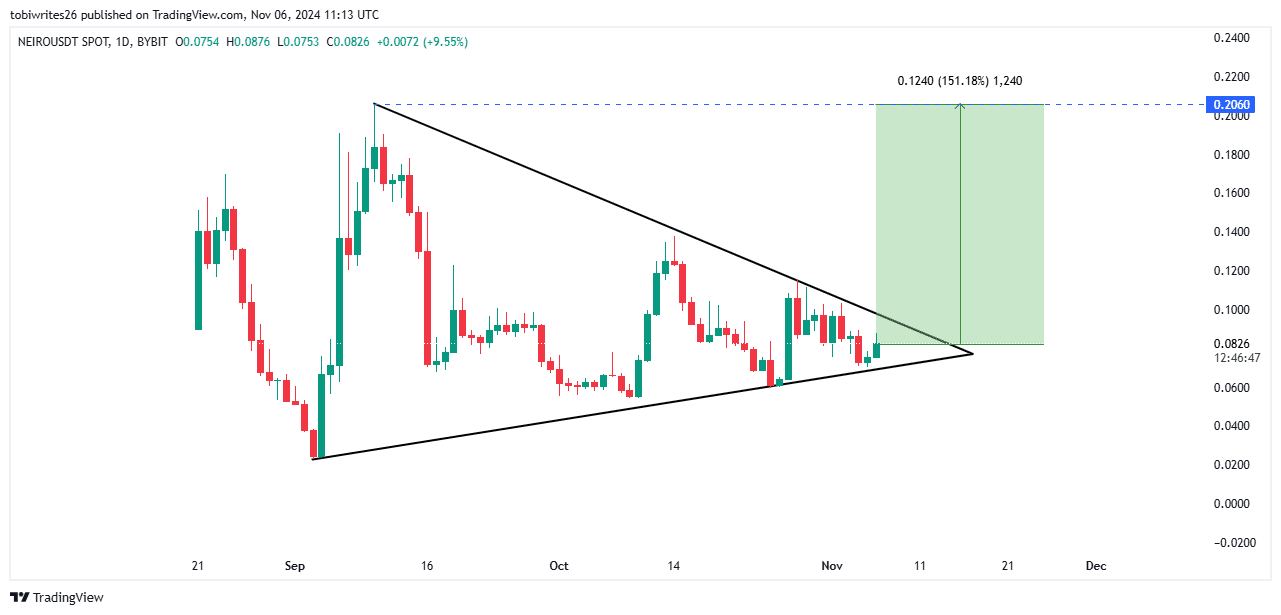

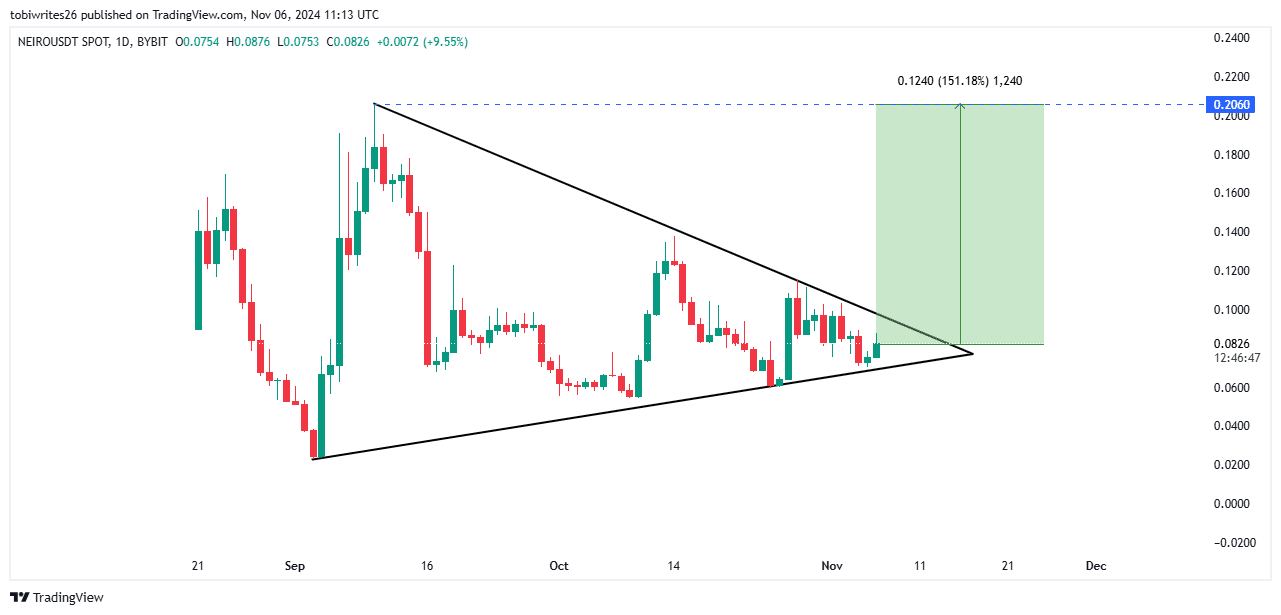

NEIRO, at the time of writing, was trading within a symmetrical triangle pattern, characterized by converging support and resistance lines. This pattern is often a precursor to a breakout, where the price moves to the top of the formation.

If this pattern is broken, NEIRO could see a significant rally, with the potential for an upside of 151.18%. This could push the price towards $0.2060 – the channel’s peak.

Source: trading view

Thanks to a remarkable one Increase of 251.62% in terms of trading volume over the past 24 hours, there is a good chance of an impending rally. Especially now that NEIRO is breaking this bullish pattern.

AMBCrypto’s analysis of other market metrics further confirmed that bullish sentiment continues to dominate. What this means is that the upward momentum is likely to continue, at least in the short term.

Additional bullish indicators appear for NEIRO

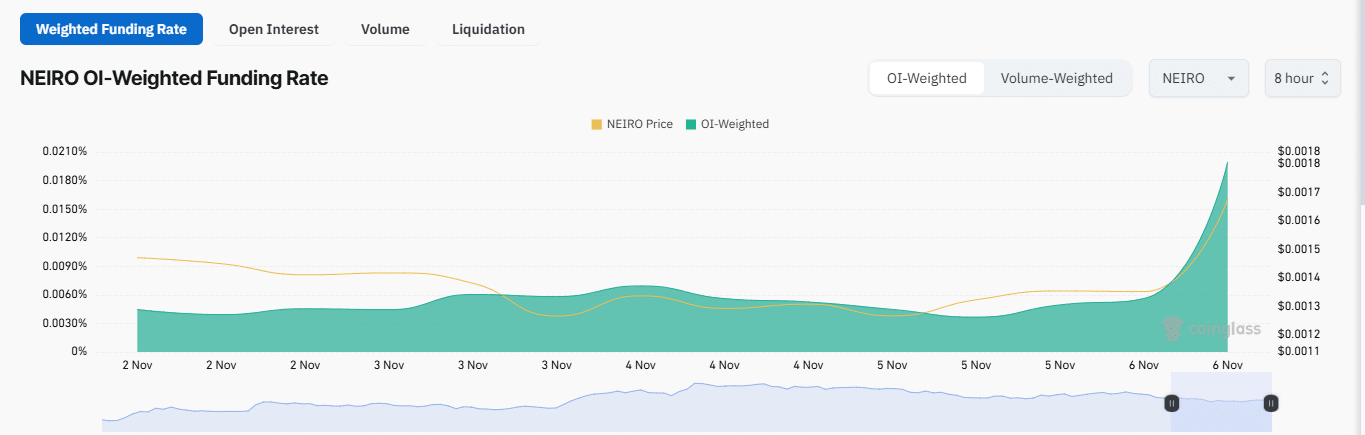

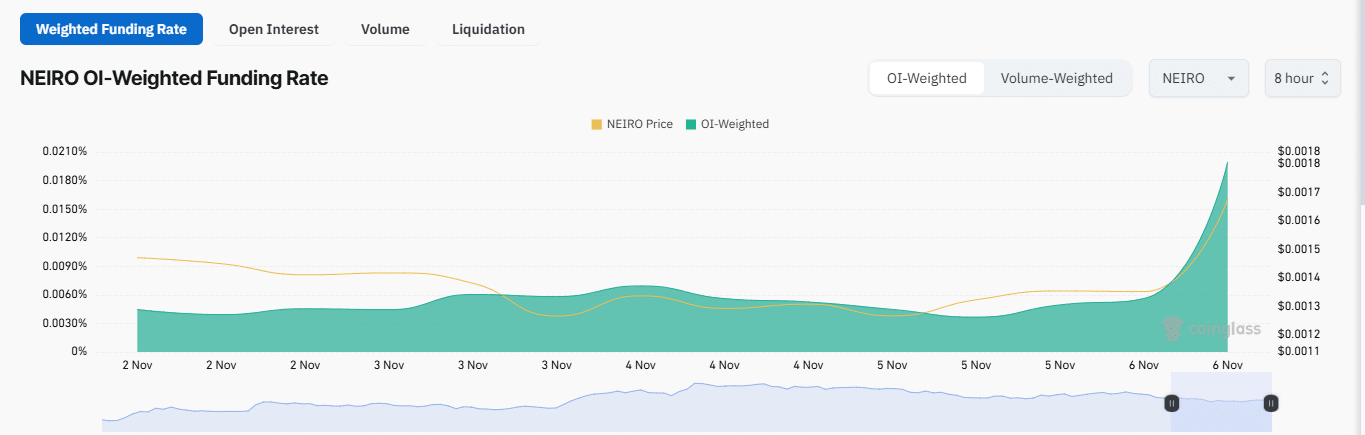

NEIRO also recorded a sharp increase in the weighted funding rate. According to Mint glassinterest rates have risen by 0.0199% – a sign of strong bullish sentiment in the market.

Here it is worth noting that the weighted funding rate represents the average funding rate across multiple exchanges, adjusted for each exchange’s trading volume or open interest. This more accurately reflects market sentiment for perpetual futures contracts.

Source: Coinglass

In addition, Open Interest, which measures the total value of unsettled derivative contracts for an asset, rose 52.30% to reach $131.89 million. A rise of this magnitude underlined the strength of the market, especially among long traders.

If this trend continues, NEIRO could break the press-time pattern and continue its upward trajectory.

Huge drawdowns indicate positive sentiment for NEIRO

Finally, the market has seen significant outflows over the past seven days, causing NEIRO’s currency balances to become negative. Another sign of bullish sentiment among investors.

With $30.07 million of NEIRO withdrawn during this period and the asset moved to more secure wallets, the impact on NEIRO’s price trajectory is clear.