- BTC miner inflows increased as mining costs rose

- Bitcoin’s price is up more than 8% in the last 24 hours and some metrics have been bullish

Bitcoins [BTC] price stayed below $28,000 for weeks, impacting miners’ earnings. According to the latest analysis, miners had to sell their BTC holdings to make ends meet.

However, the scenario as of June 21 was changing as BTC witnessed a price pump. But will this upward trend be enough to change the mindset of miners in the coming days?

Is your wallet green? Check the Bitcoin Profit Calculator

Why are the miners selling?

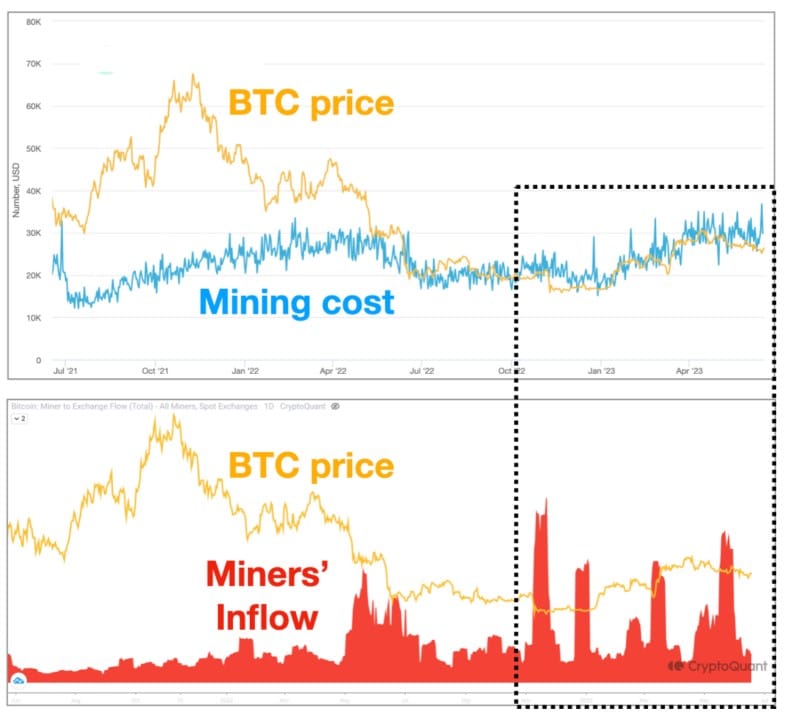

SignalQuant, an author and analyst at CryptoQuant, recently posted a analysis highlighting that miners sold their assets. According to the analysis, miners have increased their BTC inflows to exchanges.

This situation has been created by the price drop of BTC in recent weeks. Bitcoin’s price drop resulted in an increase in mining costs. To keep their operations going, miners were therefore forced to sell them BTC businesses.

Source: CryptoQuant

The fall in prices not only caused a rise in mining costs, but miners’ earnings also fell. This was evident from Glassnode’s chart, which pointed to a decline in the metric since early May 2023.

Source: Glassnode

Bitcoin’s latest uptrend looks promising

As miners ramped up selling pressure BTC, the price of the coin recently went the other way as it made gains. According to CoinMarketCapin the past 24 hours alone, the price of BTC shot up more than 8%.

At the time of writing, Bitcoin crossed the $28,000 mark and was trading at $28,966 with a market cap of over $562 billion.

Source: CoinMarketCap

The price increase of BTC could have a positive impact on the coin’s mining industry. It can increase miners’ profits, which can then change miners’ motives to sell BTC. Such an incident could lead to a further increase in the price of BTC in the coming days.

Read Bitcoin [BTC] Price Forecast 2023-24

Will BTC’s bull rally be here to stay?

A look at Bitcoin’s on-chain stats gave an idea of what the near-term future might look like. For example, the exchange rate reserve of BTC was decreasing. This suggested that the coin was not under selling pressure.

Further, BTCBinary’s CDD was green, meaning that long-term holders’ movements over the past seven days have been lower than the average. However, the buy/sell ratio of the taker was red.

The metric showed that selling pressure was dominant in the market. Moreover, despite the recent price pump, miners continued to sell their assets, as evidenced by the Miners’ Position Index (MPI).

Source: CryptoQuant