- The co-founder of BitMEX predicted Bitcoin would rise to $1 million.

- Arthur Hayes believed that BTC’s deflationary nature made it an attractive hedge against inflation.

In the midst of the latest bull run, analysts have released a series of Bitcoin [BTC] price predictions. The latest prediction comes from Arthur Hayes, co-founder of BitMEX.

In his new one essay Titled ‘Black or White?’ the director delved into the factors that could drive the royal coin to a seven-figure valuation.

His prediction focused on the future economic landscape under the returning administration of Donald Trump and its potential impact on traditional financial markets, inflation and the US dollar.

Trump’s policies and economic impact

In the essay, Hayes suggested that the Trump administration will likely turn to quantitative easing (QE).

For the uninitiated, quantitative easing is the central bank’s policy where the bank buys government bonds to inject money into the economy, lowering interest rates and boosting credit and spending.

This credit creation strategy, aimed at strengthening US manufacturing and industrial sectors, is expected to have inflationary effects. This therefore leads to a depreciation of the dollar.

The co-founder of BitMEX compared this debt-driven model to aspects of China’s economic growth strategy, calling it:

“American Capitalism with Chinese Characteristics.”

Hayes’ Bitcoin Goal of $1 Million

But what impact will that have on BTC? Well, Hayes argued that if inflation exceeds traditional returns, investors could increasingly turn to assets like Bitcoin.

Unlike fiat currencies, which can be printed in response to economic pressures, Bitcoin has a limited supply of 21 million, making it inherently deflationary.

This scarcity and independence from central banks increases Bitcoin’s appeal as a store of value. He added:

“As the freely traded supply of bitcoin diminishes, most fiat money in history will seek a safe haven not only from Americans, but also from Chinese, Japanese and Western Europeans. Stay long and stay long.”

Hayes highlighted Bitcoin’s potential as a hedge against fiat devaluation, noting its impressive 400% growth since 2020.

He further explained that reducing the debt-to-GDP ratio from the current 132% to 115% would require about $4 trillion, while a return to pre-2008 levels (about 70%) would require $10.5 trillion.

Such credit expansion, the director suggested, would boost BTC’s growth, stating:

“This is how Bitcoin gets to $1 million.”

BTC market status

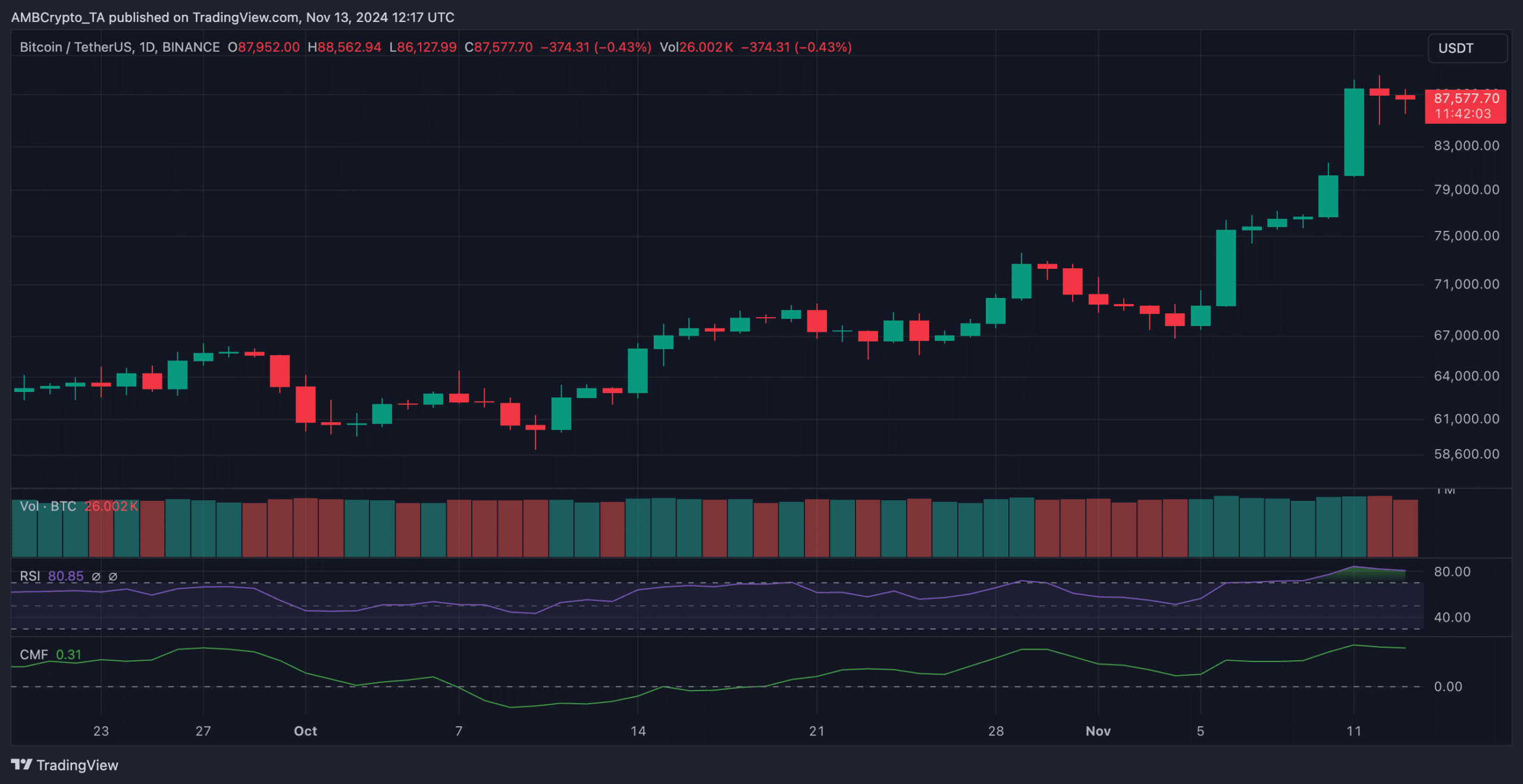

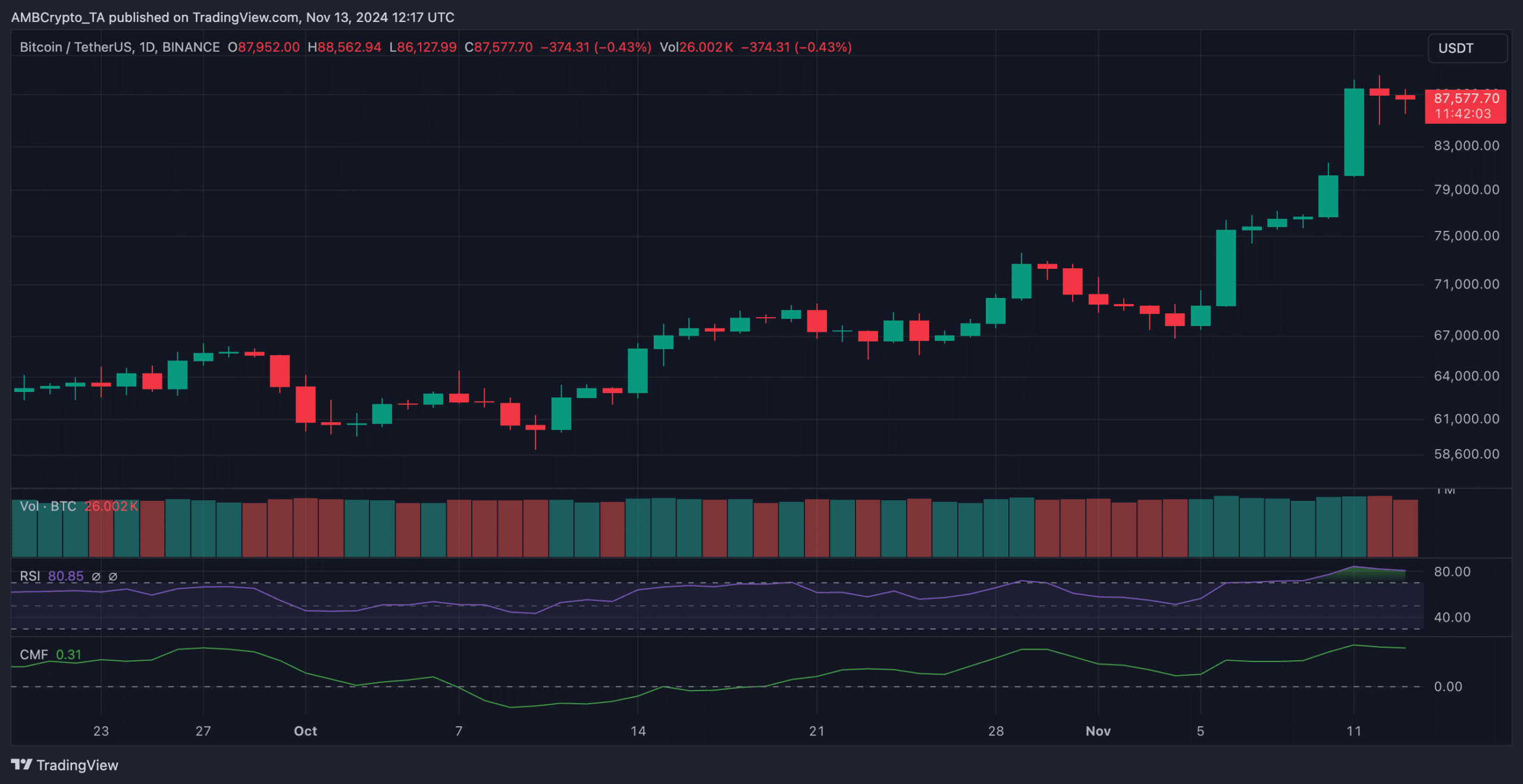

Meanwhile, after moving closer to $90,000, the king coin has fallen. At the time of writing, the stock was trading at $87,577. This represented a 2.63% depreciation from the last ATH of $89,940.

Data from CoinMarketCap showed a 0.17% increase in the price of BTC over the past 24 hours, with weekly gains remaining stable at around 17%.

However, technical indicators point to a possible slowdown. The RSI fell from the previous day’s high of 84.51 to 80.85, indicating that bullish momentum may be waning.

Source: TradingView

The CMF also fell, although it remained positive at 0.31, indicating reduced capital inflows compared to recent days.

Together, these indicators pointed to a possible slowdown or minor correction in the short term as some investors take profits after Bitcoin’s strong weekly rally. Nevertheless, the overall bullish trend for BTC appeared robust.