- The Bitcoin bear market has consolidated its price within a certain range, threatening the bulls’ chances of a recovery.

- If this dominance continues, BTC could drop to $40,000. What are the chances?

Bitcoin [BTC] was trading above $57,000 at the time of writing, a crucial level for a potential recovery. If the bulls manage to defend this position, BTC could rally towards the resistance at $68,000.

However, if the Bitcoin bear market takes control and BTC loses the $55,000 support, a decline to $50,000-$51,000 is likely. If this support fails, BTC could experience a deeper decline towards $40,000.

Historically, September has been the most bearish month for Bitcoin, with only four positive years out of the last thirteen years. Will this month follow the trend, or can bulls turn the tide?

BTC faces uncertain bearish outlook

Adding to the uncertainty are the analysts warning that the Bitcoin bear market could regain control.

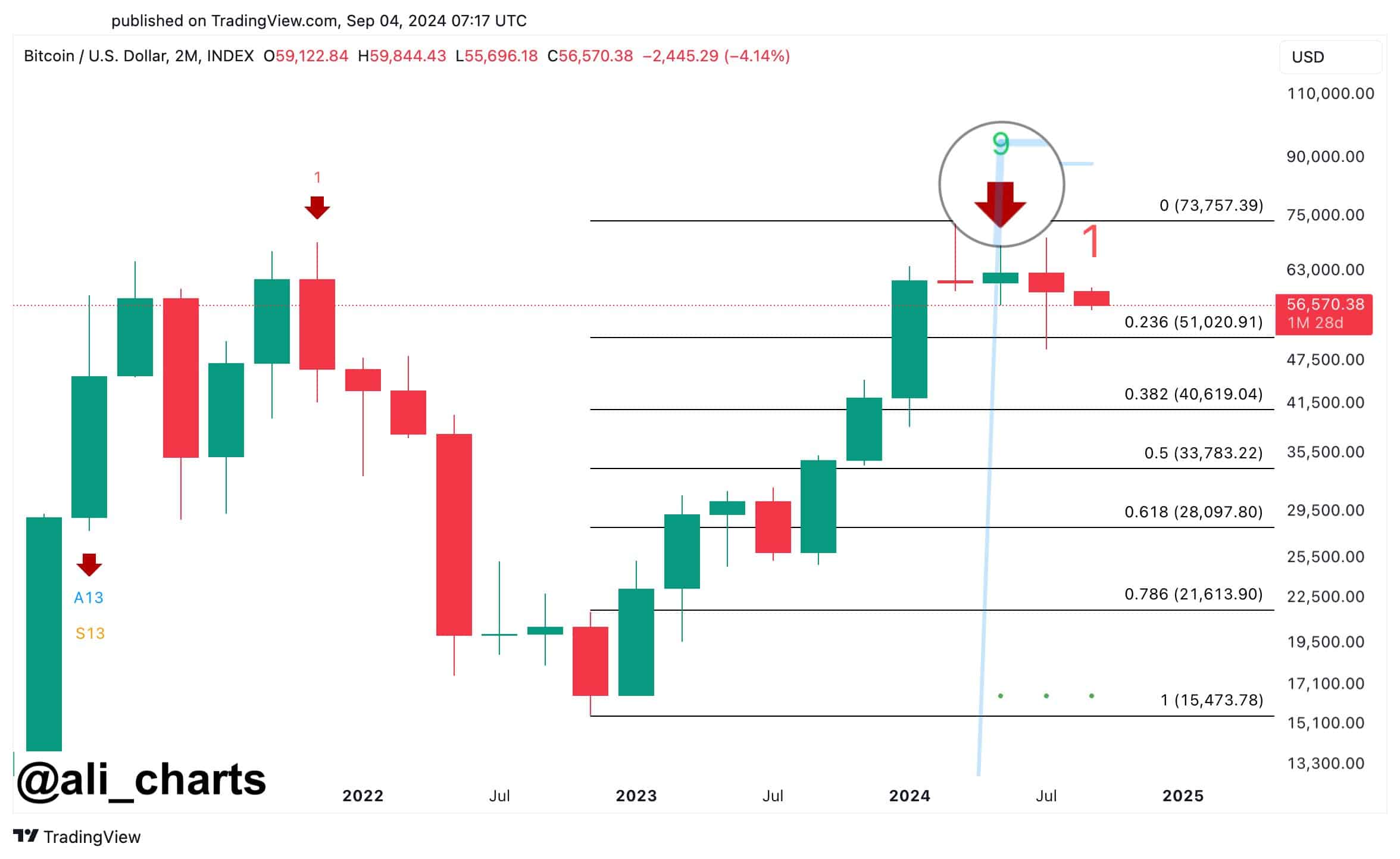

Source:

The TD sequential indicator on the Bitcoin 2-month chart is showing a sell signal, indicating a potential decline. If BTC falls below $51,000, it could drop to $40,600 – a scenario bulls would like to avoid.

To avoid this, it is crucial to hold the USD 57,000 support level. AMBCrypto believes that alleviating overcrowding in leveraged positions is critical.

Simply put, a 10% reduction in open interest could help prevent sudden, sharp price movements.

Furthermore, with less open interest, the market could stabilize, potentially resulting in a bear pullback or a bullish swing. So will there be a decline?

The Bitcoin bear market reigns supreme

Furthermore, the Bitcoin bear market has outperformed the bulls in early September, keeping the price within the $59,000 – $57,000 range.

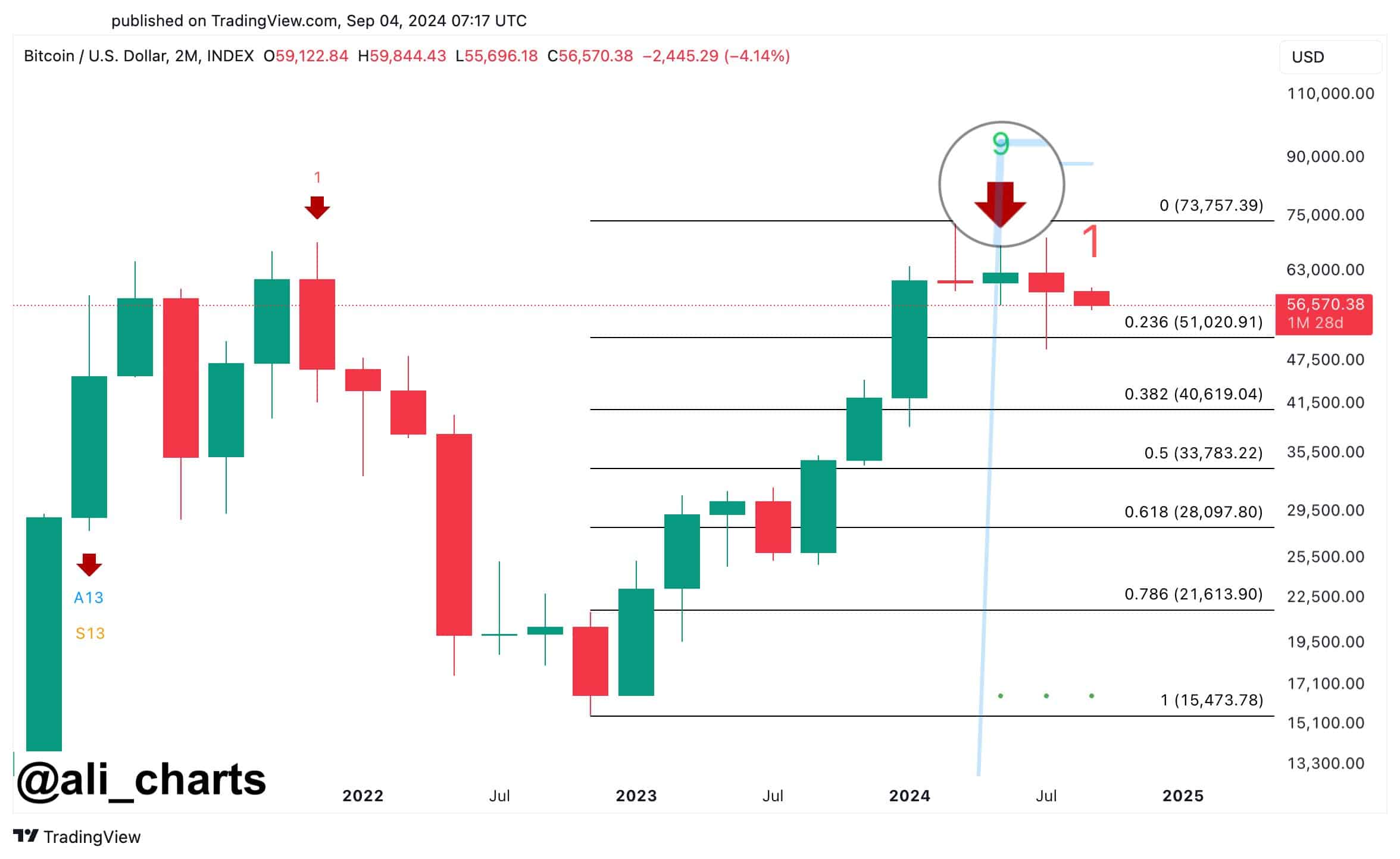

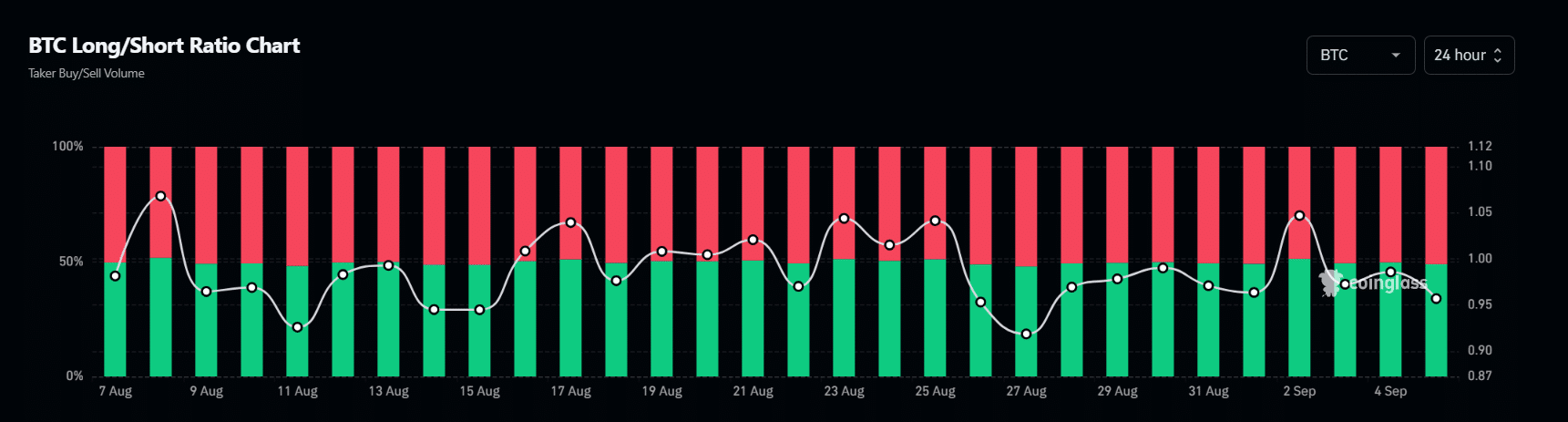

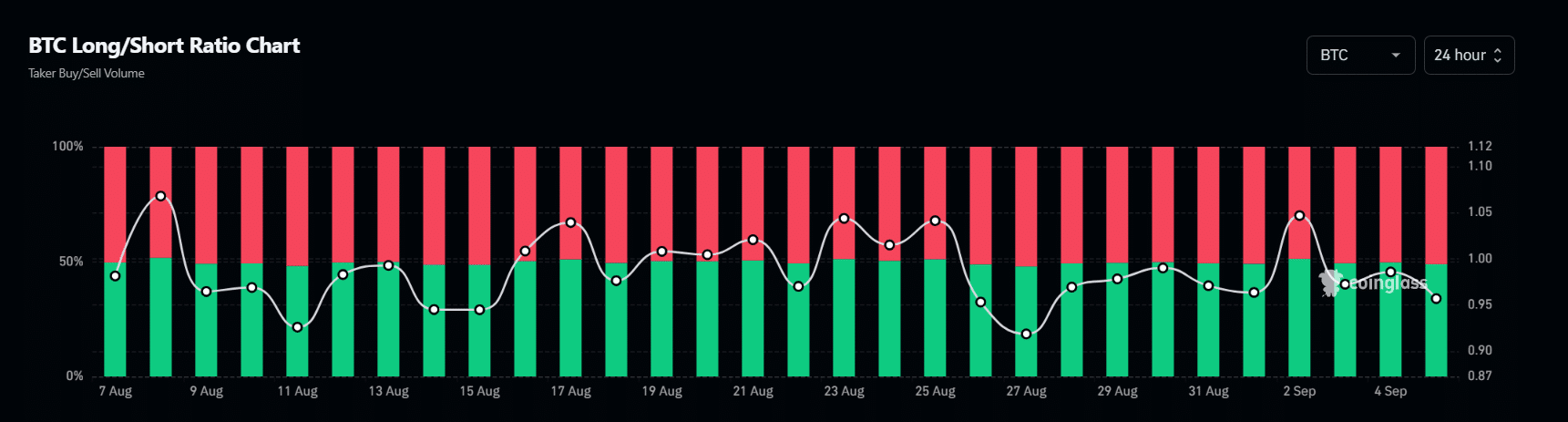

Source: Coinglass

According to AMBCrypto’s analysis, on August 26, when BTC tested the $64,000 ceiling, the OI was approximately $34.72 billion. Since then, both BTC and OI have fallen significantly, indicating that would-be traders have been aggressively locking in their profits.

However, re-approaching a zone of significant OI could increase volatility. If participants are close to breakeven and many exit, this could slow momentum and drive BTC prices down.

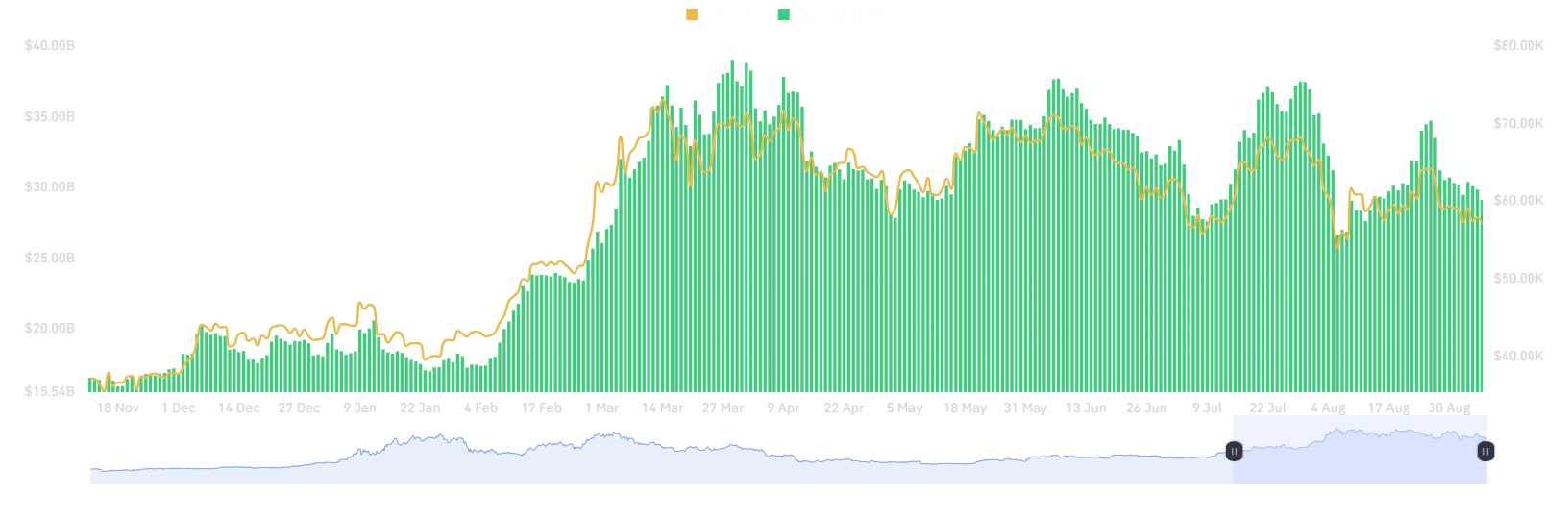

Source: Coinglass

Moreover, shorts have dominated longs over the past three days. Currently, shorts are still outperforming longs and represent 52% of the market.

If the Bitcoin bear market takes control and BTC tests the $56,572 price range, approximately $45 million in 100x leveraged positions could be liquidated, potentially pushing the price closer to $51,000.

Conversely, if BTC moves closer to $57,400, approximately $67 million worth of short positions could be liquidated.

Overall, high OI, with shorts dominating the derivatives landscape, could favor the Bitcoin bear market. Therefore, maintaining the support level at $56,000 – $57,000 is crucial for a possible breakout. What are the chances?

Bitcoin institutions are facing a bear threat

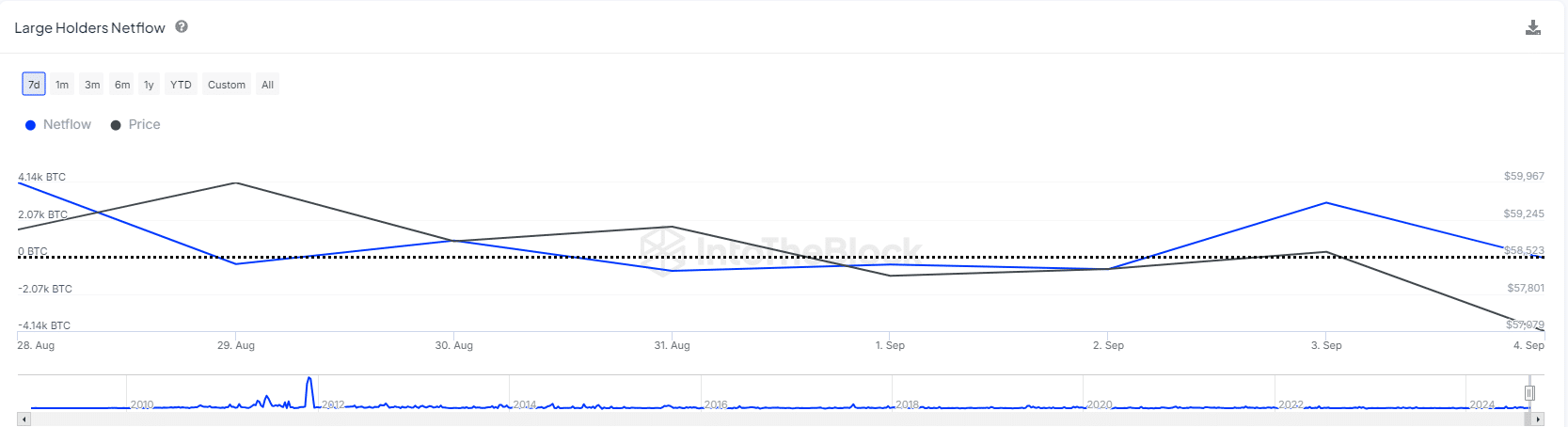

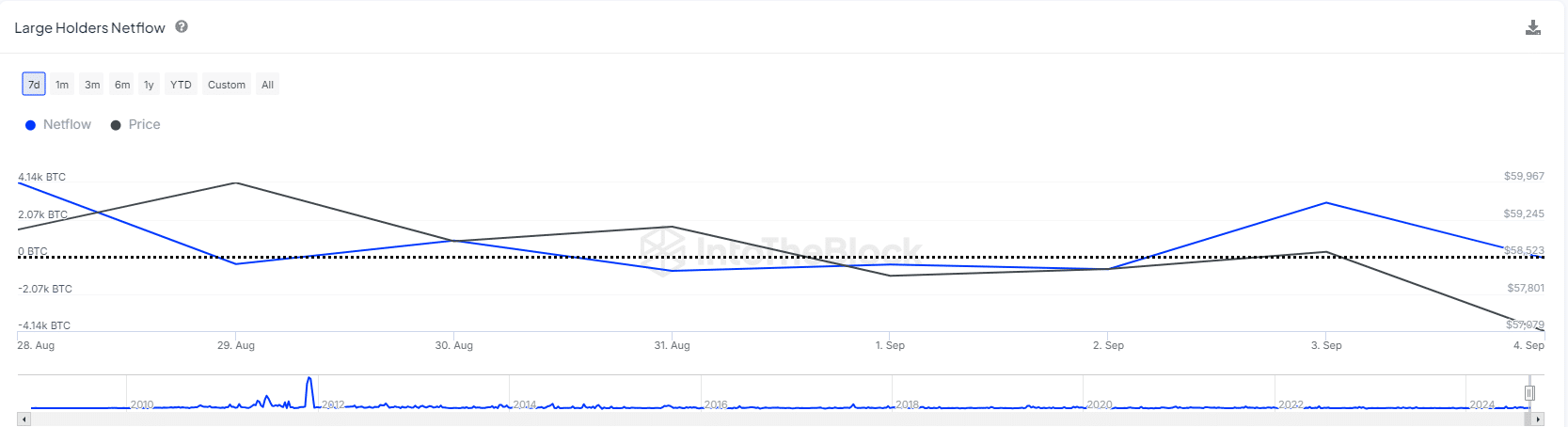

It looks like institutions are selling BTC. Since August 26, crypto asset management company Ceffu has deposited 3,063 BTC, worth $182 million, into Binance. On September 3, a significant positive net flow caused BTC to fall 3%.

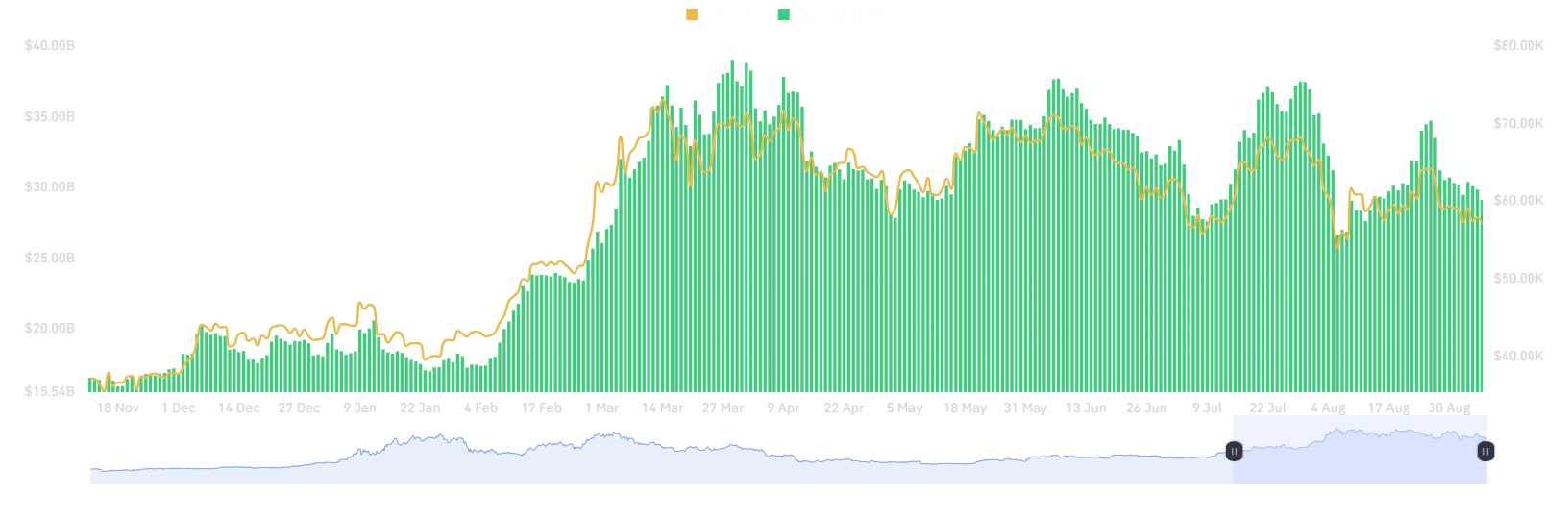

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

This chart indicates a lack of optimism among major investors. According to AMBCrypto, this could lead to panic in the market if this trend continues.

To defend the $57,000 support and target $68,000, long-term holders must avoid a sell-off. Otherwise, if the shorts dominate, BTC could fall to $51,000 and possibly even below $40,000.