- The cost basis of Bitcoin shows the possibility for a market trally with a new highest close of all time if the momentum is maintained.

- A fractal pattern and accumulation of bitcoin can influence the movement of actively up.

Bitcoin [BTC] Has maintained a bullish market momentum and remained six days above the $ 90,000 region. In the past week it went up digital active by 11.41%, with potential to continue.

Ambcrypto analysis looks at the performance of Bitcoin and sees that a rally is nearby, which shows how it can be actively possible to go to the top, and this is how it could play.

Will the cost basis of Bitcoin or fall?

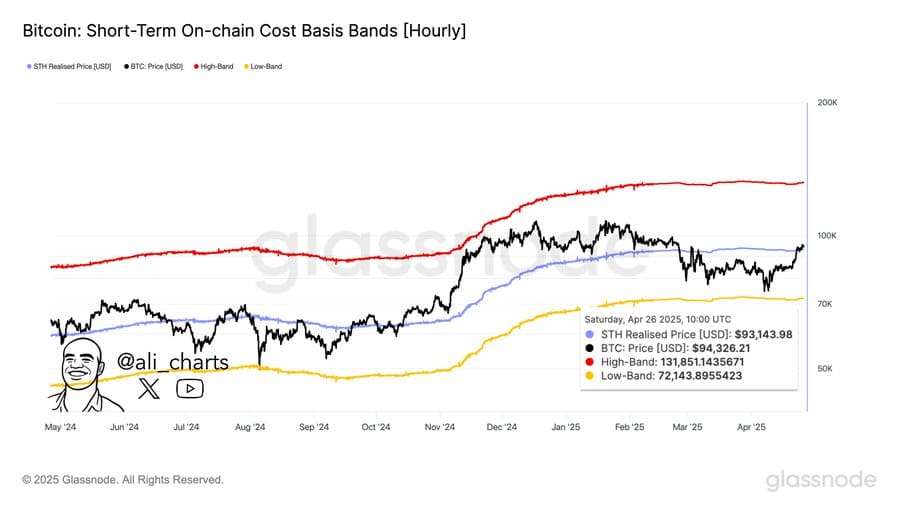

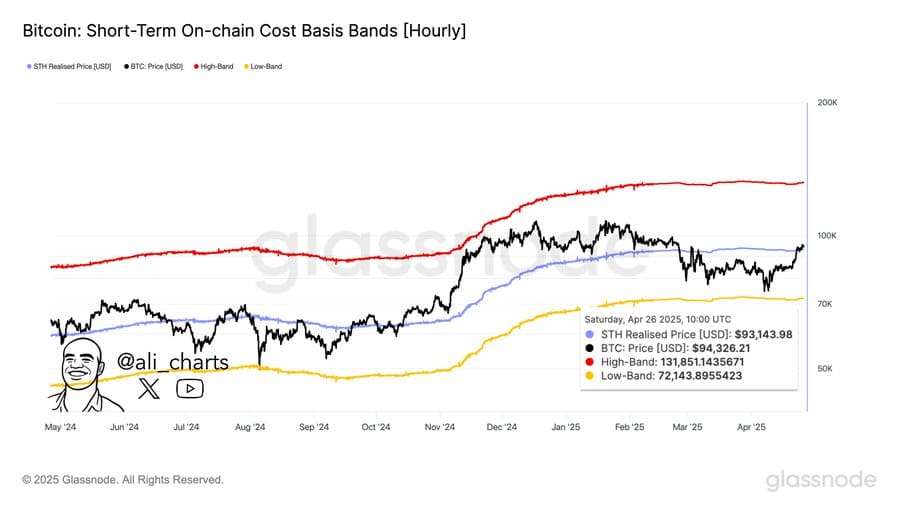

Analysis of the cost basis of Bitcoin’s short -term holder (STH), used to determine the potential market trend and activity, shown that it is active at a critical moment.

In fact, Bitcoin crossed on the map per hour are STH -cost basis at $ 93,145. Of course, maintaining above this level remained crucial for maintaining Bullish Momentum and the pursuit of new all-time highlights.

Source: Glassnode

The pattern consists of two key levels: the upper band at $ 131,800 and the lower tire at $ 71,150.

When it is active above the middle range (STH costs base), as it is currently, it indicates a bullish indicator of a potential rally, but it also requires a momentum to support this run to the upper region.

Further analysis shown That bitcoin will probably retain that momentum, trending to the advantage.

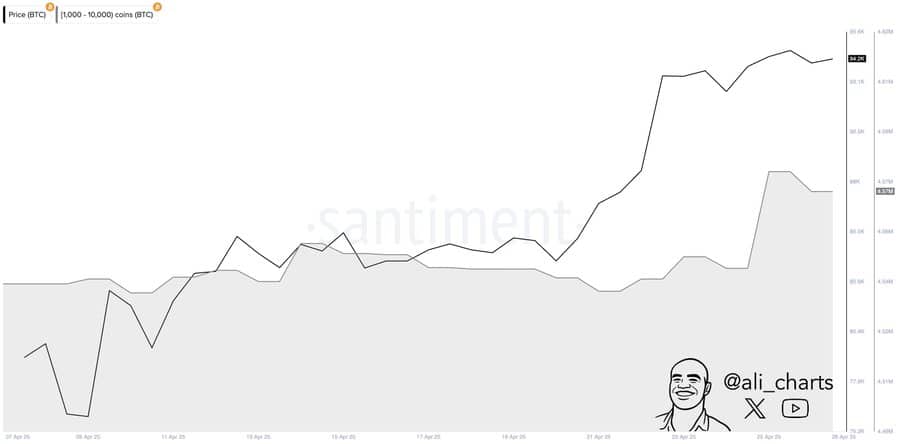

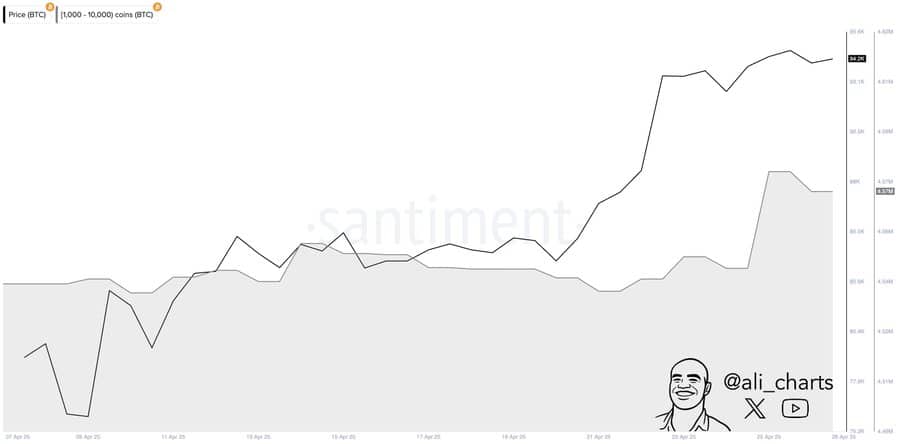

Source: Santiment

In addition, further analysis revealed strong accumulation trends.

In the last 48 hours alone, Santiment -Data 20,000 BTC, worth $ 1.86 billion, showed from the market.

An important purchase such as this tends to support Bitcoin’s price movement, which contributes to his momentum and price rally potential.

What does this fractal pattern mean?

It is interesting that analysis by Alfractaal shown That Bitcoin indicated a similar phase of a pattern that it has repeated since 2015, in all four cycles.

For the analysis, which helped to mark the market tops and bottoms of Bitcoin exactly on determined dates, Bitcoin is still in the Markup phase.

Source: Alfractaal

A Markup phase is a period in the market in which an asset continues to gather after a period of accumulation. This current phase shows that it will continue to collect actively until it touches the Cyclustop.

It is predicted that the market top will be reached between 12 and 16 October and followed by a year of deterioration.

If this analysis applies in the previous four-year cycles, this suggests that Bitcoin will probably act in the STH costs base top at the $ 131,800 region on the graph.

What is the next step for Bitcoin

Analysis of the monthly time frame suggests that Bitcoin is Bullish. The market has just responded to an important rising support line that has led to a market trally since 2018.

This rally would be Bullisher as soon as the resistance level has been violated at the $ 102,000 area, so that new highlights are established.

Source: TradingView

This pattern is important because it took place serious times and, when it was violated to the bottom, was recovered.

With this possibility at hand, it would be active to continue rally streak and continue to rise in value.