- Base reached new TVL and stablecoin market cap highs as bullish excitement returned to the market.

- Performance metrics confirmed healthy improvements in trust and network utility

The tides shifted in favor of crypto bulls in September and Base is one of the networks that benefited from this shift. This is evident in the resurgence of robust network activity.

Base has positioned itself as one of the fastest growing Ethereum Layer 2s. The network’s recent performance is evidence that the network is likely to benefit greatly if the market continues to rise. That’s why it’s worth taking a look at how things have been going in key areas lately.

BASE sees an increase in network activity

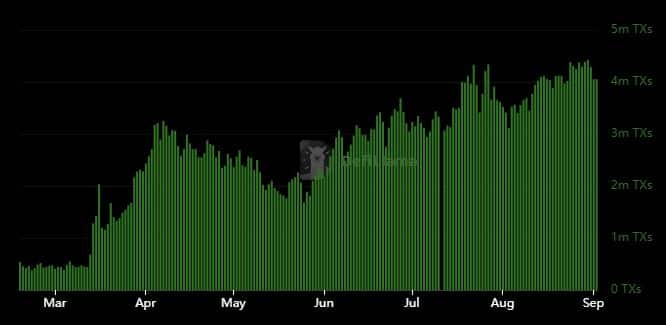

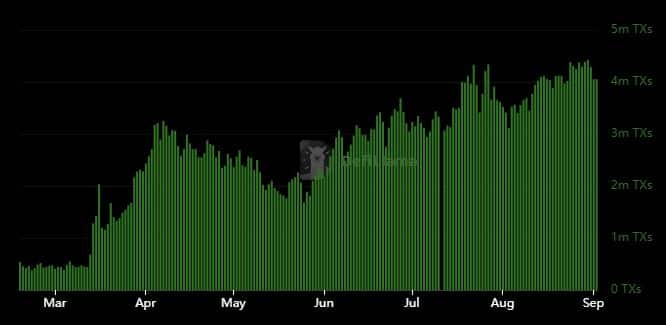

The number of basic transactions has been steadily growing in recent months, especially since March 2024. In fact, DeFiLlama revealed that the Ethereum Layer 2 network was averaging less than 500,000 transactions per day before mid-March.

However, that changed and transactions have grown steadily since then. Recently it reached new highs above 5 million transactions per day.

Source: DeFiLlama

The chart shows that basic trades have grown even in bearish times. However, the revival of bullish activity has boosted network activity. The impact of market fluctuations was more visible in the volume and stablecoin data.

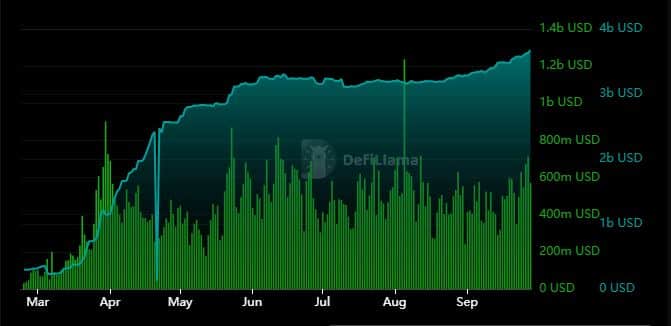

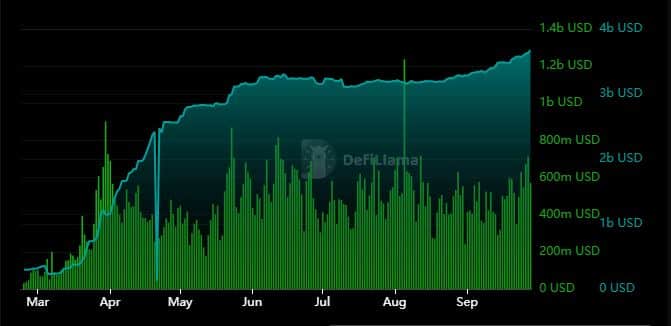

On-chain volume showed a significant correlation with stablecoin growth. For example, the volume and market capitalization of stablecoins grew exponentially between March and April. While stablecoins plateaued between May and August, their growth rate accelerated in September.

Source: DeFiLlama

The volume on the chain also fell significantly between August and mid-September. On the contrary, daily volume showed a significant jump from less than $400 million to over $700 million on September 27.

The network’s stablecoin market cap also reached a new high of $3.67 billion. To put this growth into perspective, the market cap of stablecoins hovered below $400 million before mid-March.

The robust TVL growth confirms user confidence

While the above figures highlight the growing network usefulness, there is one metric that underlines a strong increase in user confidence.

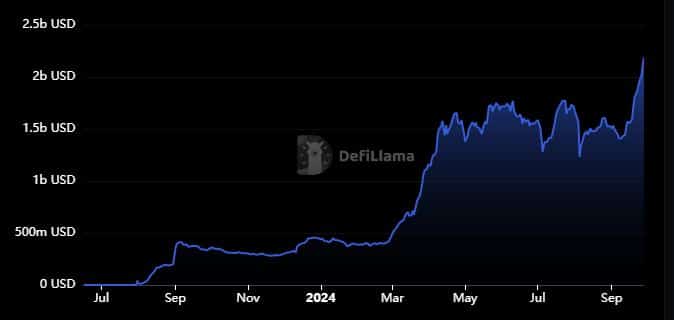

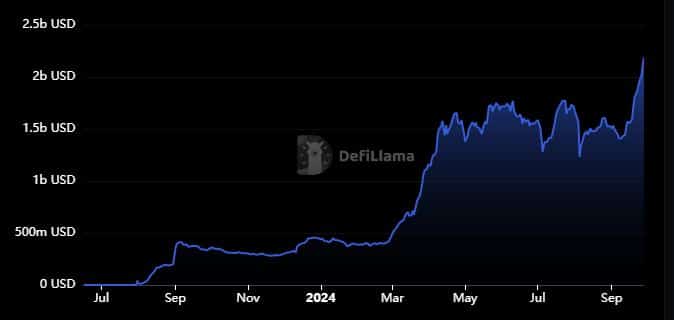

Base’s TVL recently rose to $2.19 billion – its highest historical level.

Source: DeFiLlama

Base had a TVL of $337 million exactly twelve months ago, meaning it is up over 548%. This is a sign of healthy liquidity, in which investors are willing to invest.

The network added $780 million to its TVL in the past three weeks. This is around the same time the market shifted in favor of the bulls. This outcome means that Base may experience more robust growth in the coming months. Especially if the market continues to heat up.