- Bernstein Research advised investors to add exposure to cryptocurrencies, including Bitcoin

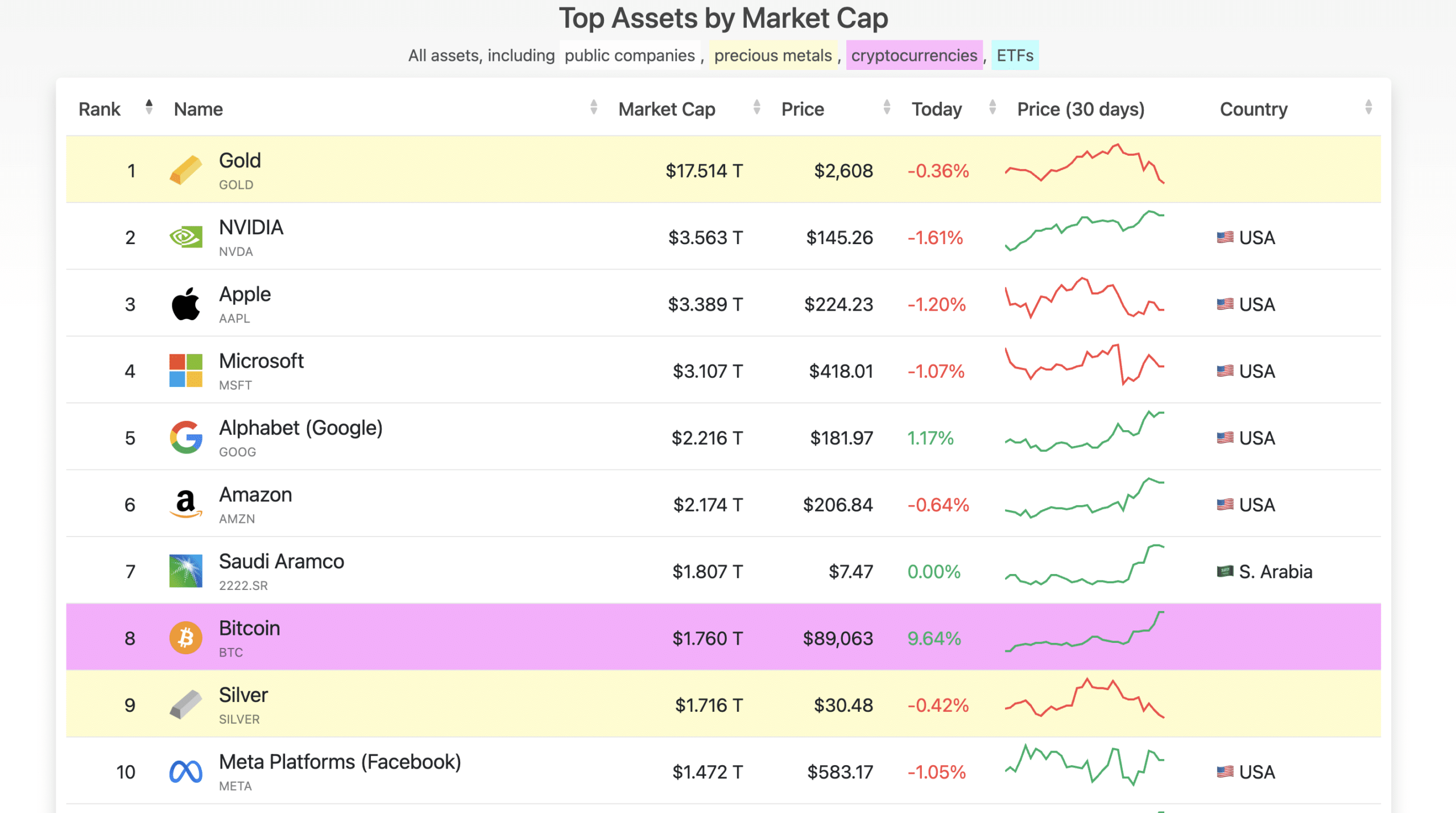

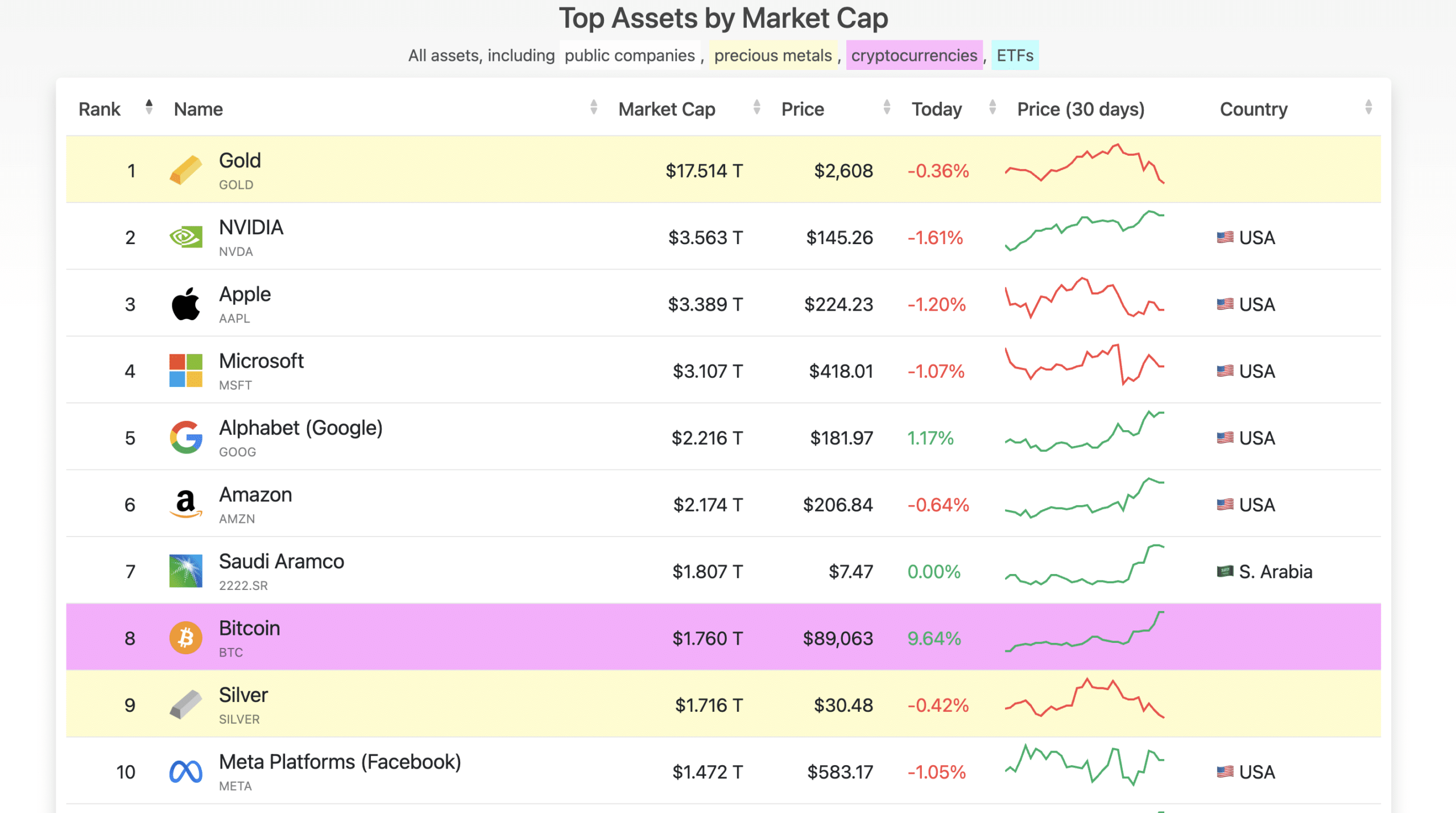

- Bitcoin is now the 8th largest asset in the world

The cryptocurrency market continues to register significant growth. The same was led by Bitcoin (BTC), with the cryptocurrency recently peaking at a new level record high from $89.6k.

Against this bullish backdrop, Bernstein Research issued a compelling advisory urging investors to embrace the rally and increase their exposure to cryptocurrency. They also warned against resistance to the trend. The notes, released Monday, stated:

“Welcome to the Crypto Bull Market. Buy everything you can.”

Bernstein’s analysts Gautam Chhugani, Mahika Sapra and Sanskar Chindalia highlighted a shift in the political climate in Washington as a crucial factor for the current bull run.

Bitcoin to $200,000

Chhugani claimed that investors who previously avoided crypto due to regulatory concerns should reconsider their stance after the US election results.

In fact, he expects a crypto-friendly regulatory environment under President Donald Trump, starting with a pro-crypto SEC.

AMBCrypto previously had that reported to a prediction from Bernstein who predicts that Bitcoin could reach an ambitious target of $200,000 next year. The analyst remains confident in this projection and states:

“Even at $81,000/bitcoin (+87% YTD), we believe the risk/reward ratio is favorable over the next twelve months.”

Peter Brandt’s bold end-of-year prediction

Veteran trader Peter Brandt shared a similarly bullish outlook. In a recent one after on X, Brandt explained that Bitcoin repeatedly offered buying opportunities during price breaks from March to October 2024.

This set the stage for a potential ‘mark-up’ phase: a strong upward rally that, based on historical patterns, may not reverse once it starts.

Using the January-March 2024 rally as a statistical model (or ‘Bayesian prior’), Brandt noted that there is a probabilistic expectation that:

“Price could reach $125,000 by New Year”

Bernstein’s altcoin predictions

In addition to Bitcoin, Bernstein’s bullish view also included a wide range of digital assets.

The analysts’ recommendations include notable selections such as Ethereum (ETH), Solana (SOL), Optimism (OP), Arbitrum (ARB), Polygon (POL), Uniswap (UNI), Aave (AAVE) and Chainlink (LINK).

Moreover, the analysts predicted a big increase in the number of altcoins and stated:

“As the regulatory environment around tokens relaxes, we expect Ethereum, Solana and other digital assets to outperform Bitcoin over the next twelve months.”

Bitcoin is overtaking silver

Meanwhile, after recently dethroning Meta, the king coin has now replaced silver as the 8th largest asset by market capitalization. According to CompaniesMarketCapBTC was strong with a market cap of $1.76 trillion at the time of writing, while silver lagged behind with a market cap of $1.71 trillion

Source: CompaniesMarketCap

Read Bitcoin (BTC) price prediction 2024-25

Should the price of Bitcoin continue to rise, it will likely overtake Saudi Aramco, the world’s largest oil giant. This marks another milestone in BTC’s rise among global assets.