- Hyperliquid has made strong profit in the last two weeks, but retained a bearish bias for swing traders

- Liquidity at $ 16.4 served as a magnetic zone and attracted hype higher

The Dex -Toks hyperliquid [HYPE] Registered profits of 35% in the last ten days. At the time of the press, the support of $ 12 had returned and it seemed to go to the resistance zone of $ 18.5- $ 20. Bitcoin’s [BTC] Slowly going up from $ 78k to $ 84k in the same period certainly helped the hype.

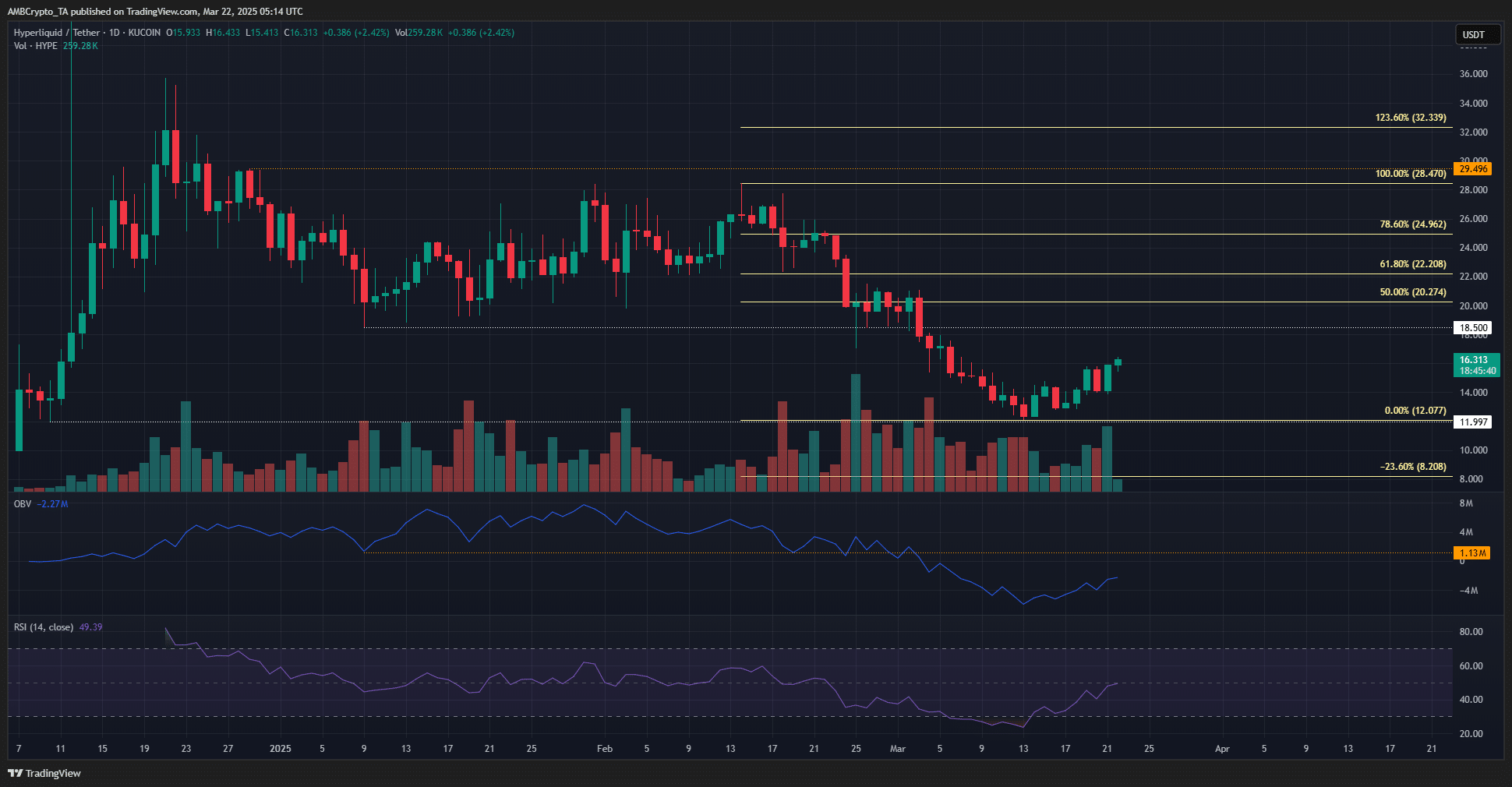

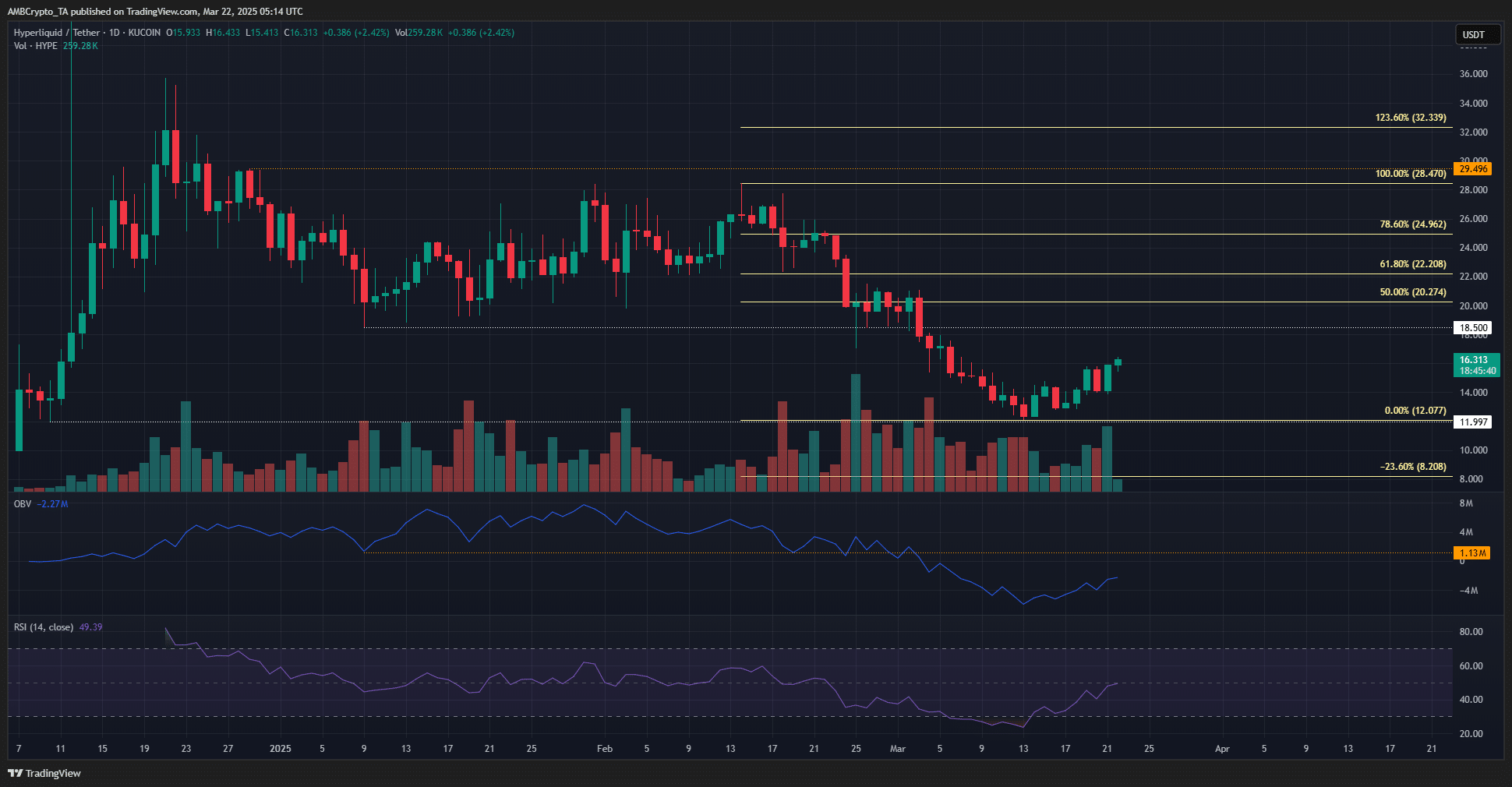

In the charts, the technical indicators flashed a lower period of time. Nevertheless, the Bearish front views on the 1-day graph remained unchanged. A movement then $ 21.25 would be needed to mark a bullish structural shift.

Can hype continue from here to $ 21?

Source: Hype/USDT on TradingView

On the 1-day graph, the structure was strong bearish. The newest lower high high seemed to be $ 21.25 – a zone of local resistance at the end of February. The $ 18.5- $ 21 region is expected to serve as a resistance to hyperliquid token prices.

That is why an outbreak outside this region can take time to materialize. Until that time, investors and swing traders can remain in a rigorous biased. The OBV has climbed higher, but has to beat the level of support of the first two months of 2025.

At the time of writing, the RSI was about to climb over neutral 50 to signal bullish momentum. However, the profit of the Altcoin in recent days was encouraging, as well as the trade volume.

The Fibonacci racement levels revealed that the $ 20.74 level was the 50% retracement level. The $ 22.2 level can also be seen as a resistance. In the south, the continuation of the bearish -trend could bring the price to $ 8.2.

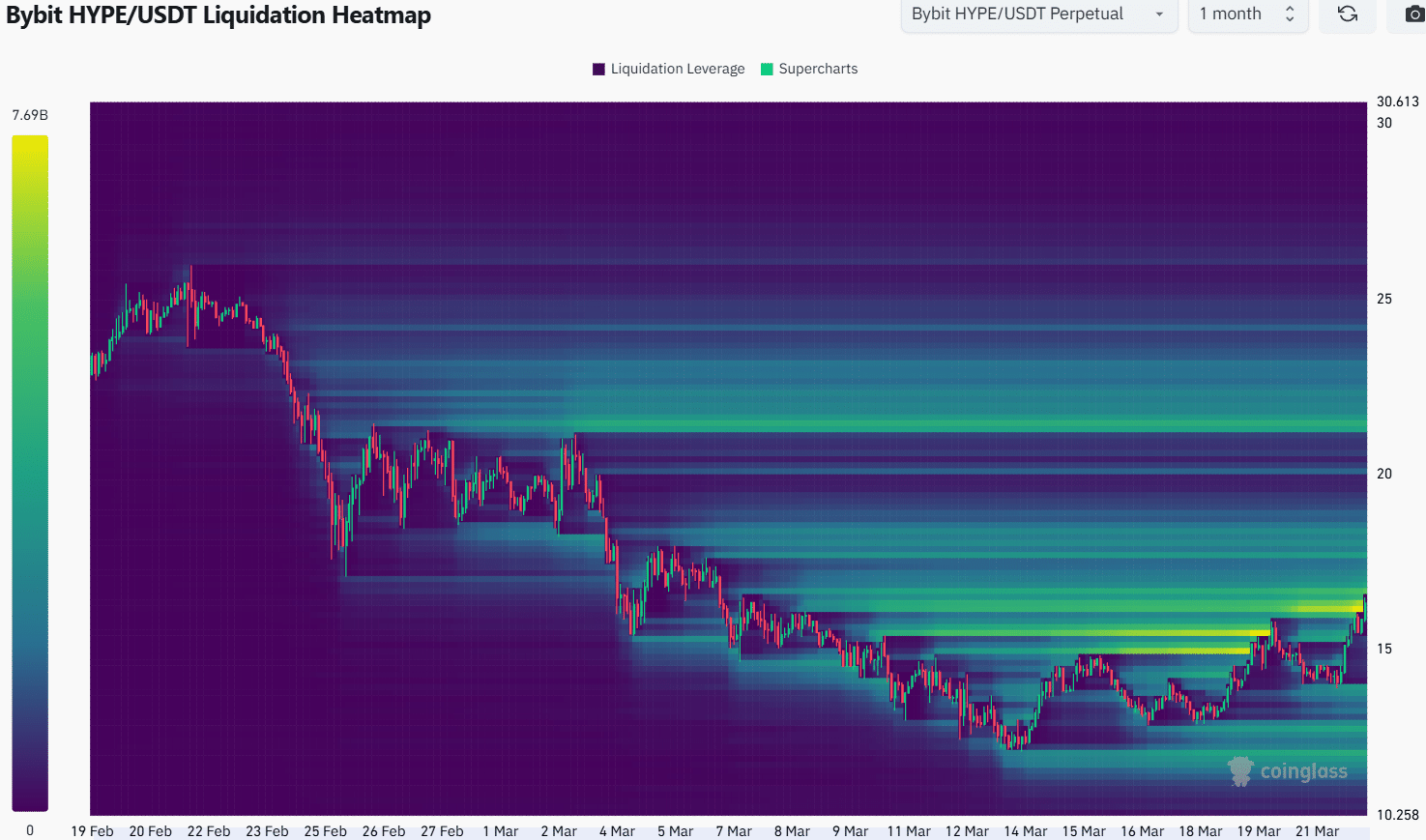

The 1-month liquidation Heatmap emphasized that the hype had just eliminated a bag of liquidity at $ 16.1- $ 16.4. It seemed ripe for a bearish reversing to $ 13.7. The liquidity of up to $ 18.3 could, however, continue to attract prices.

In general, the chances of a persistent movement seemed higher good for hyperliquid. It is probably possible to push $ 20- $ 21, but Bulls must be on their guard for the price of BTC in the coming days.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer