- Bitcoin rose to over $64,000 after the Fed’s rate cut, marking a 2.8% increase in 24 hours.

- Analysts warn that despite bullish signals, certain indicators point to a possible future price reversal.

Bitcoin [BTC] has shifted its trajectory from a period of accumulation and decline to a noticeable recovery phase.

In the last 24 hours, the asset rose to $64,000 before rebounding slightly to $63,786 at the time of writing, marking a 2.8% increase.

This rally comes in the wake of the US Federal Reserve’s interest rate cut announcement, which has created positive market sentiment for risk assets including Bitcoin.

Is a turnaround on the horizon?

While this price surge has sparked optimism, analysts are cautiously examining Bitcoin’s fundamentals to determine the sustainability of this rally.

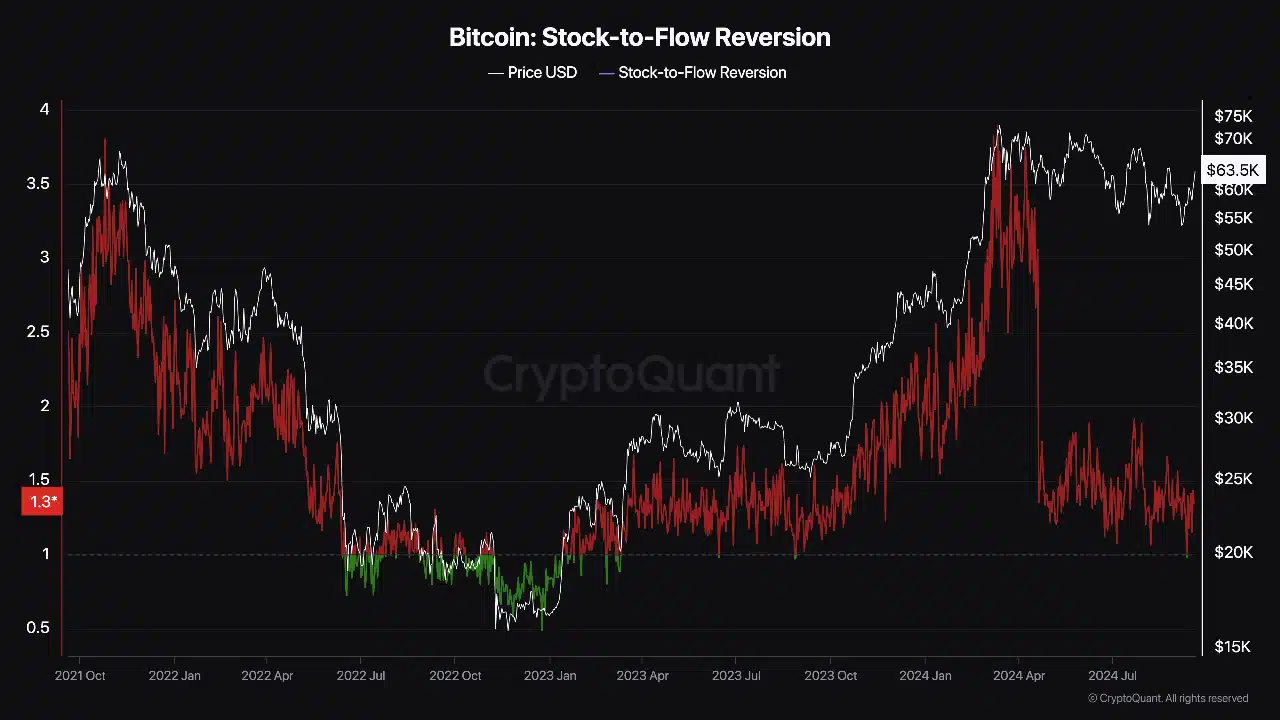

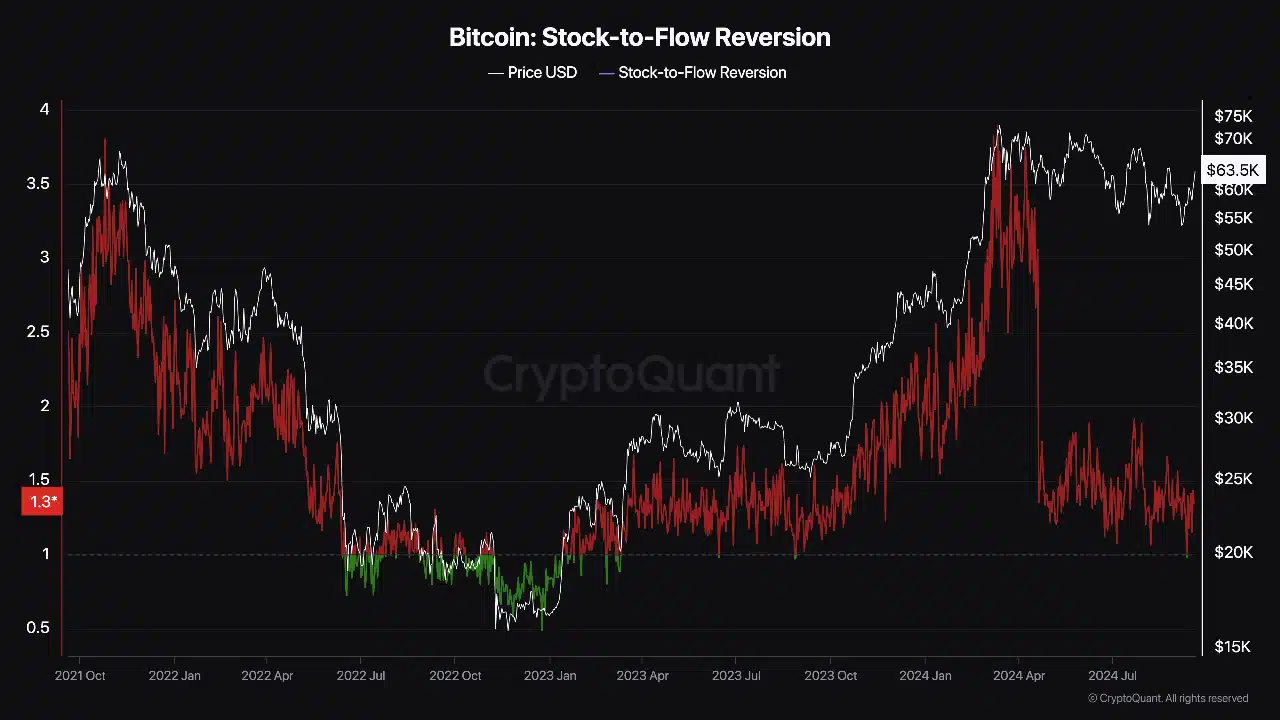

A CryptoQuant analyst, who uses the pseudonym ‘Darkfost’, marked a potential red flag. Darkfost pointed to the Stock-to-Flow (S2F) reversal chart, which signaled a possible reversal.

Source: CryptoQuant

The S2F model is often used to predict Bitcoin price movements by comparing the supply of new BTC entering the market (flow) with the total existing supply (stock).

According to Darkfost, the S2F ratio is currently in a green zone, indicating a buying opportunity as Bitcoin reached this threshold and began its recovery.

However, the analyst warned that the last time this happened, in September and June 2023, the asset saw a significant pullback.

This raises the question of whether the current rally has enough momentum to sustain itself, or if a new retracement is on the horizon.

Bitcoin’s fundamentals show strength

Despite concerns about a possible reversal, Bitcoin’s fundamentals are showing signs of strength that could support further upside.

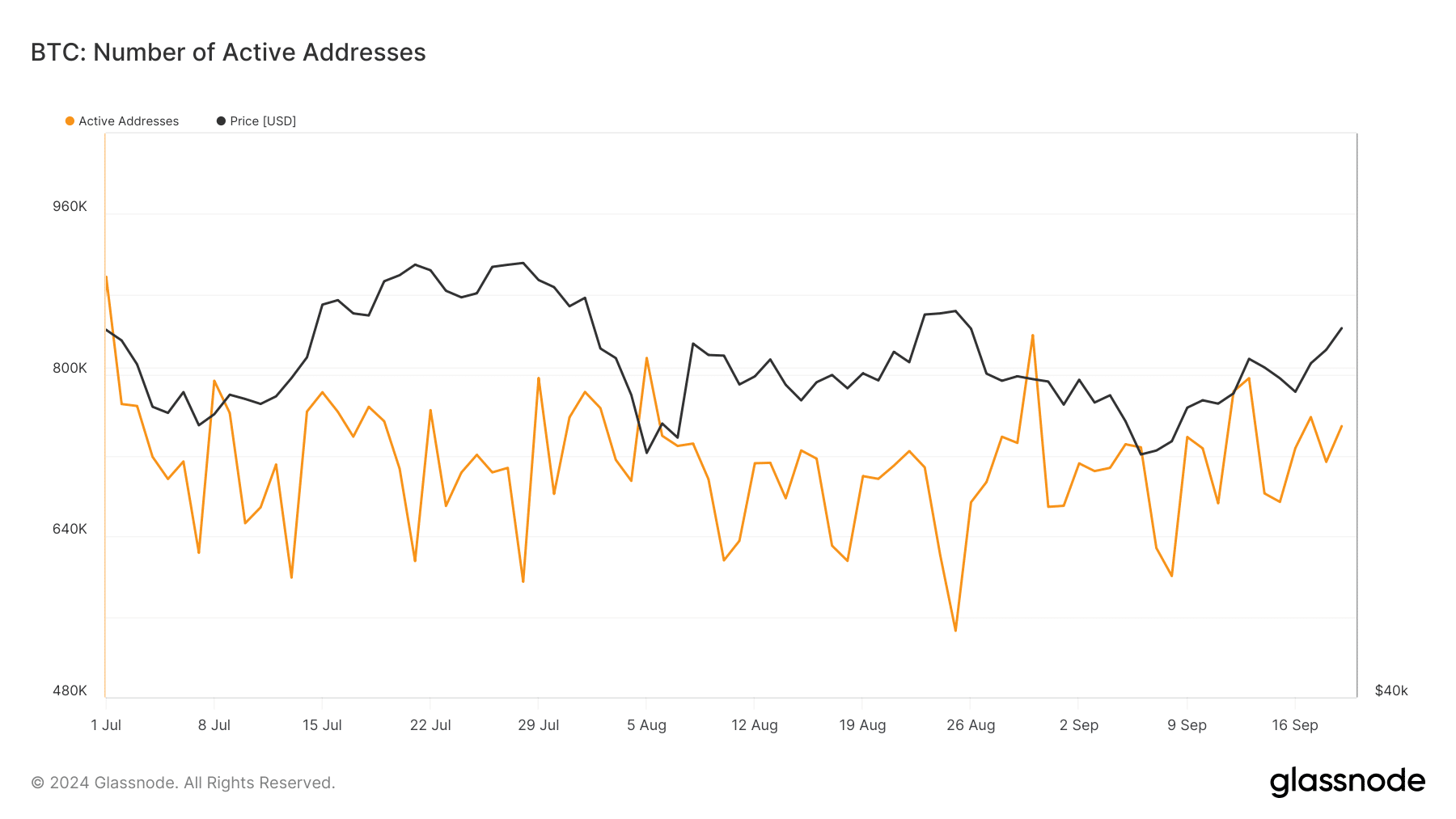

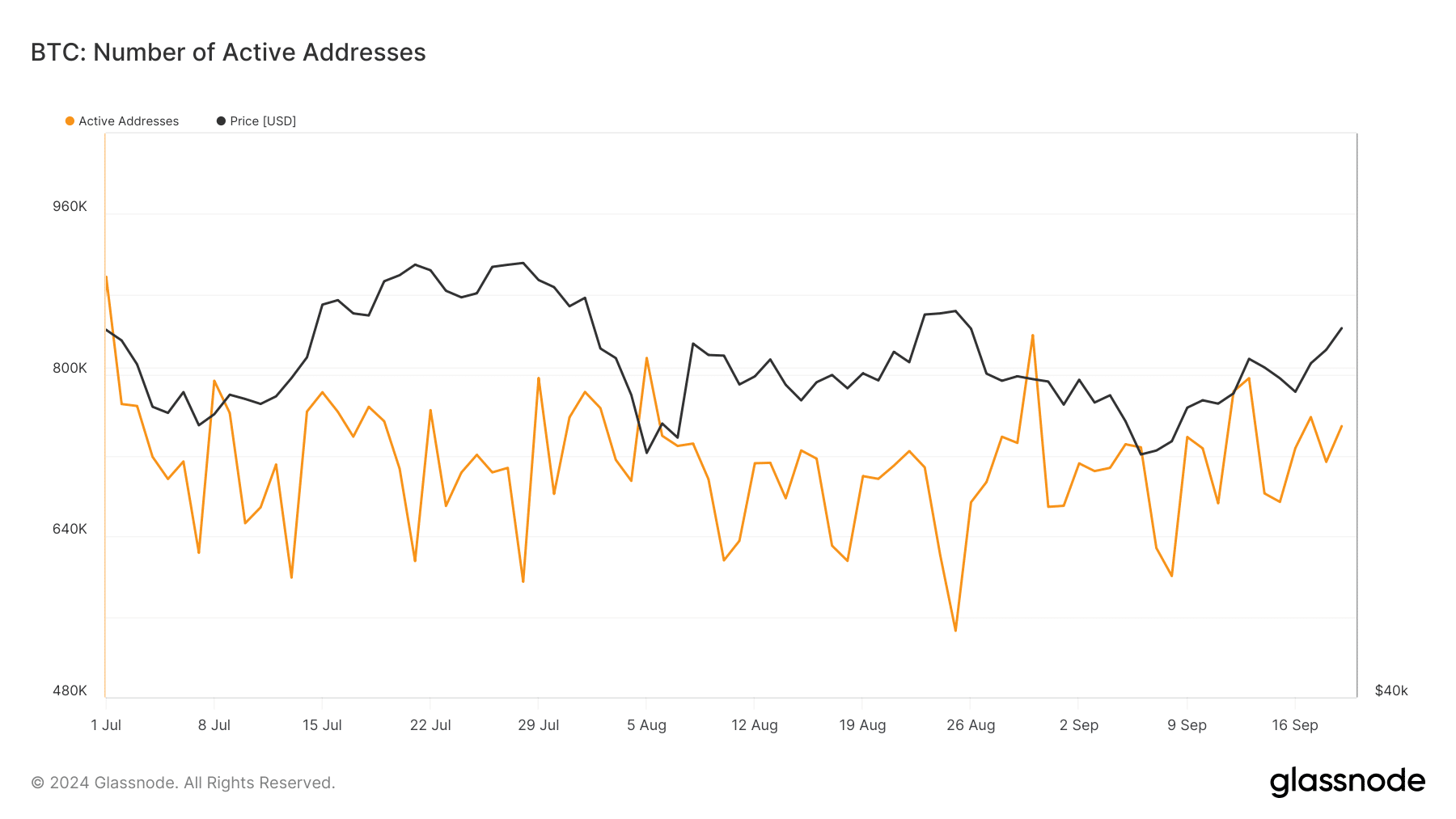

A key metric is the recovery of Bitcoin’s active addresses, which serves as an indicator of retail interest in the asset.

EEarlier this month, the number of active Bitcoin addresses dropped to around 600,000, facts from Glassnode shows.

Source: Glassnode

However, this figure has since risen to more than 700,000. The increase in the number of active addresses indicates that more users are engaging with the network, which is a positive sign for demand.

When retail interest increases, it typically reflects growing confidence in Bitcoin, which can strengthen price momentum.

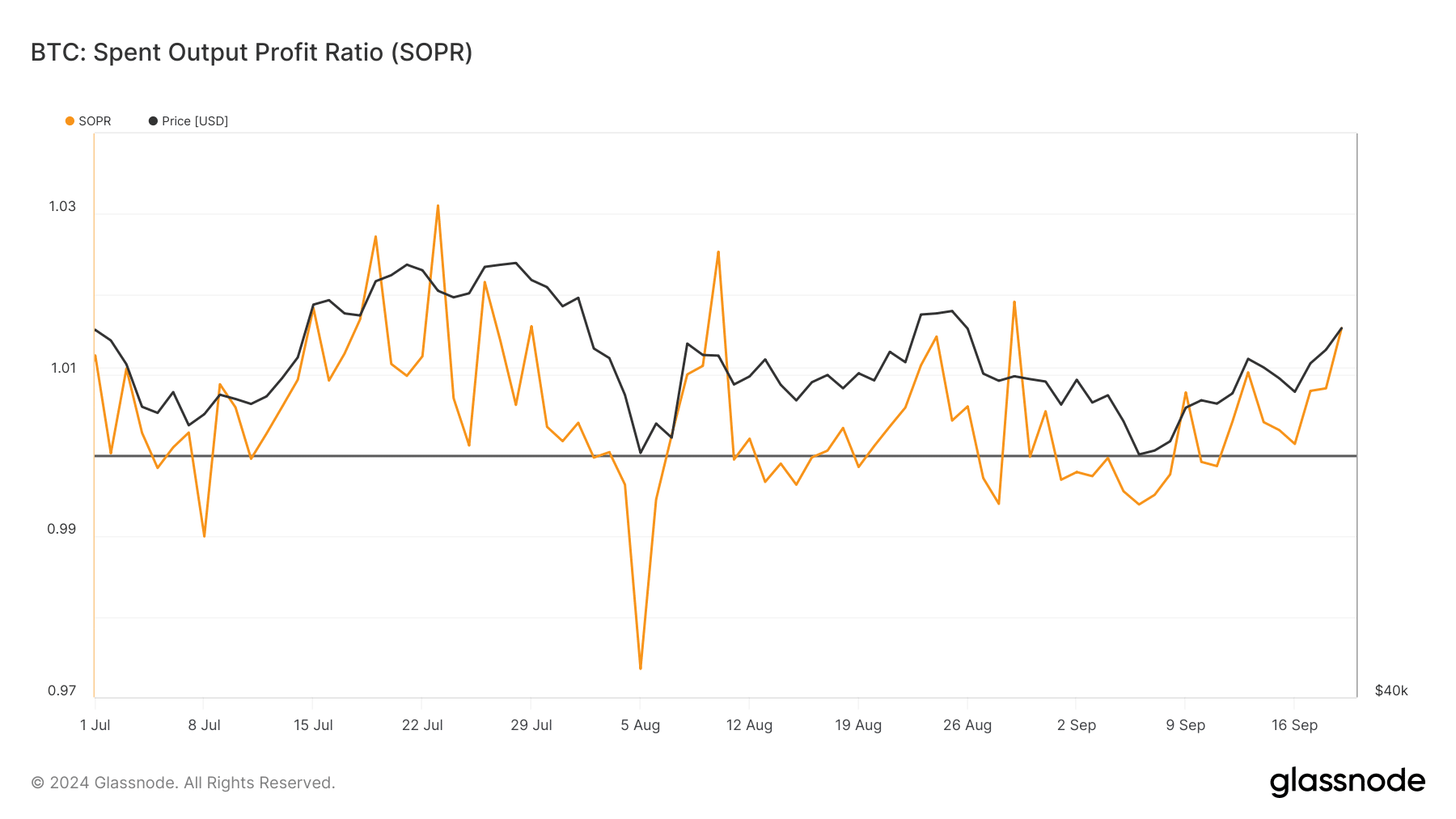

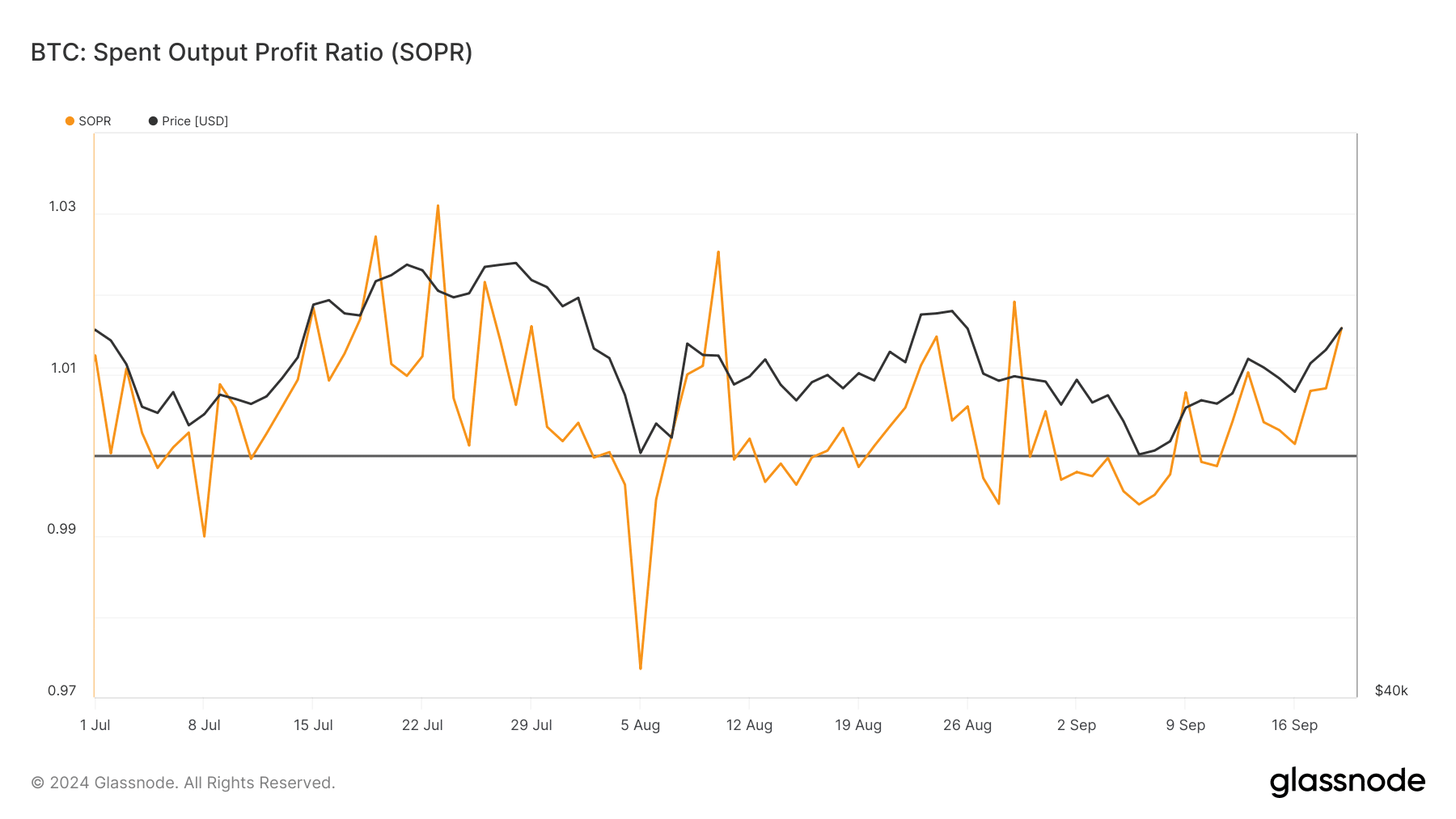

Another important metric to consider is Bitcoin’s Spent Output Profit Ratio (SOPR), which measures whether investors are selling their Bitcoin at a profit or a loss.

A SOPR value above 1 indicates that holders sell at a profit, while a value below 1 suggests they sell at a loss. As of today, Bitcoin’s SOPR stands at 1.01, up from 0.994 at the end of August.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2024–2025

This slight increase indicates that more investors are making profits on their Bitcoin holdings, indicating healthier market sentiment.

A rising SOPR often coincides with periods of upward price movement, as investors become more confident in the market and feel more inclined to take profits without fear of a sharp downturn.