In a not-so-unexpected turn of events, Bitcoin (BTC) has soared to new heights. breaking the $57,000 barrier during the early hours of Tuesday at the Asian market. This price level, not seen since November 2021, marks a significant rebound for the leading cryptocurrency.

Bitcoin ETFs are experiencing unprecedented activity

It is remarkable that the rise in the price of Bitcoin has led to substantial activity in US-based spot Bitcoin ETFs, with the exception of Grayscale’s GBTC. According to Bloomberg, these ETFs recorded a record high of $2.4 billion in trading volume on Monday. This increase in trading activity underlines the increasing interest and involvement of institutional investors in the cryptocurrency market.

At the time of publication, there was a slight increase in Bitcoin dropped to $56,437, but it was still about 10% higher than the day before. Since the start of the year, the price of bitcoin has risen more than 30%, continuing a long-term rise that has also fueled interest among speculators in smaller currencies like Ether and Solana.

The demand for Bitcoin is not just limited to spot trading; Substantial inflows of approximately $5.6 billion have flowed into newly launched Bitcoin ETFs in the US, which began trading on January 11. This influx of investment signals a growing interest in Bitcoin that extends beyond its traditional base of digital asset enthusiasts.

It’s official…the New Nine Bitcoin ETFs broke the volume record today with $2.4 billion, barely better than day one, but about double their recent daily average. $IBIT went wild, earning $1.3 billion, breaking the record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin’s Rally Outpaces Traditional Assets

Surprisingly, Bitcoin’s rally this year has outpaced traditional assets like stocks and gold. The ratio of Bitcoin’s price to that of the precious metal has reached its highest level in more than two years, signaling a changing preference among investors for digital assets.

The total value of digital assets, including several cryptocurrencies, now stands at a whopping $2.2 trillion, a substantial increase from the low point during the 2022 bear market, when the market value fell to around $820 billion. This resurgence shows the resilience and growing prominence of digital assets in the financial landscape.

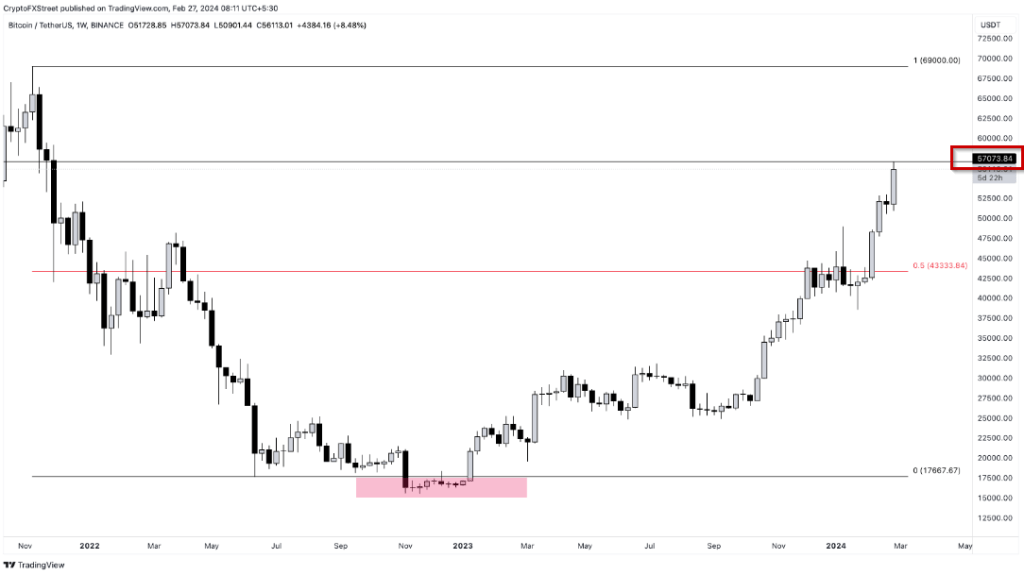

BTCUSD trading at $55,799 on the daily chart: TradingView.com

Contradictory market indicators cannot deter crypto momentum

Despite a rise in US Treasury yields, which typically signals expectations for tighter monetary policy, the bullish momentum in the cryptocurrency market remains an intriguing development. Digital tokens like Bitcoin are experiencing remarkable upward movements and defying conventional market indicators.

Sean Farrell, Head of Digital-Asset Strategy at Fundstrat Global Advisors, noted in a recent statement that the “bullish momentum in crypto is unfolding despite a rise in prices,” highlighting the unique dynamics impacting the cryptocurrency market.

MicroStrategy Expands Corporate Bitcoin Holdings

Amid this ongoing rally, MicroStrategy, a notable software company recognized for incorporating Bitcoin into its business strategy, has announced a significant addition to its cryptocurrency holdings.

The company revealed that it had purchased an additional 3,000 Bitcoin tokens this month, bringing its total Bitcoin holdings to approximately $10 billion. This strategic move by MicroStrategy highlights the growing acceptance of cryptocurrencies as a valuable asset by business entities.

Featured image of, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.