- Bitcoin’s leverage ratio climbed to a two-year high, fueling fears of excessive leverage

- On the price charts, BTC has risen 10.21% over the past week

Over the past seven days, Bitcoin rose to a new ATH on the price charts. As expected, the new ATH of $77,270 created significant market euphoria, resulting in an increase in leverage across the board.

A different kind of high

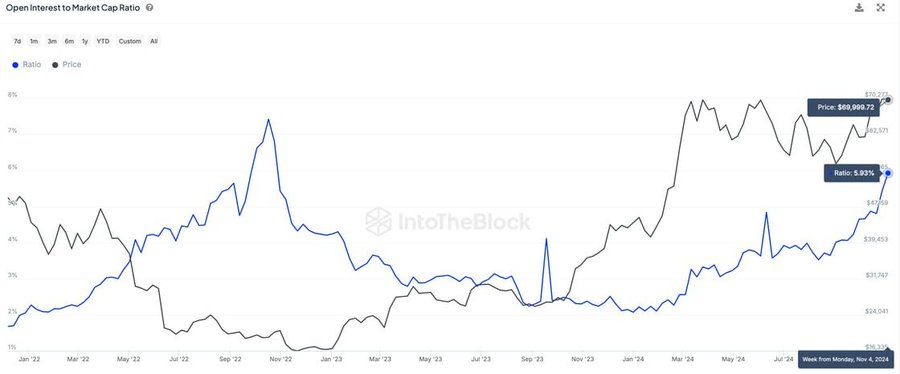

According to an analysis from IntoTheBlock, BTC’s leverage ratio recently rose to a two-year high.

Source: IntoTheBlock

According to the same, the Open Interest in BTC perpetual swaps relative to market cap has reached levels unseen since the collapse of FTX in 2022.

If we say that BTC leverage has reached its highest level in the past two years, it means that more traders are using borrowed money to trade BTC than in the past two years. This ratio compares the amount of Open Interest to the market capitalization of the crypto.

A higher leverage ratio results from this, as it indicates that investors are increasingly confident in their bets on Bitcoin’s price movement. This usually leads to volatility when leverage is high. In fact, even a small price movement can trigger liquidations, resulting in larger price swings.

It is worth noting that when the leverage ratio peaked in 2021 due to deleveraging, a market correction followed. This is mainly because a small move results in higher liquidations, which then lead to a larger market decline.

Simply put, an increase in the leverage ratio signals a potential market pullback to sustainable levels.

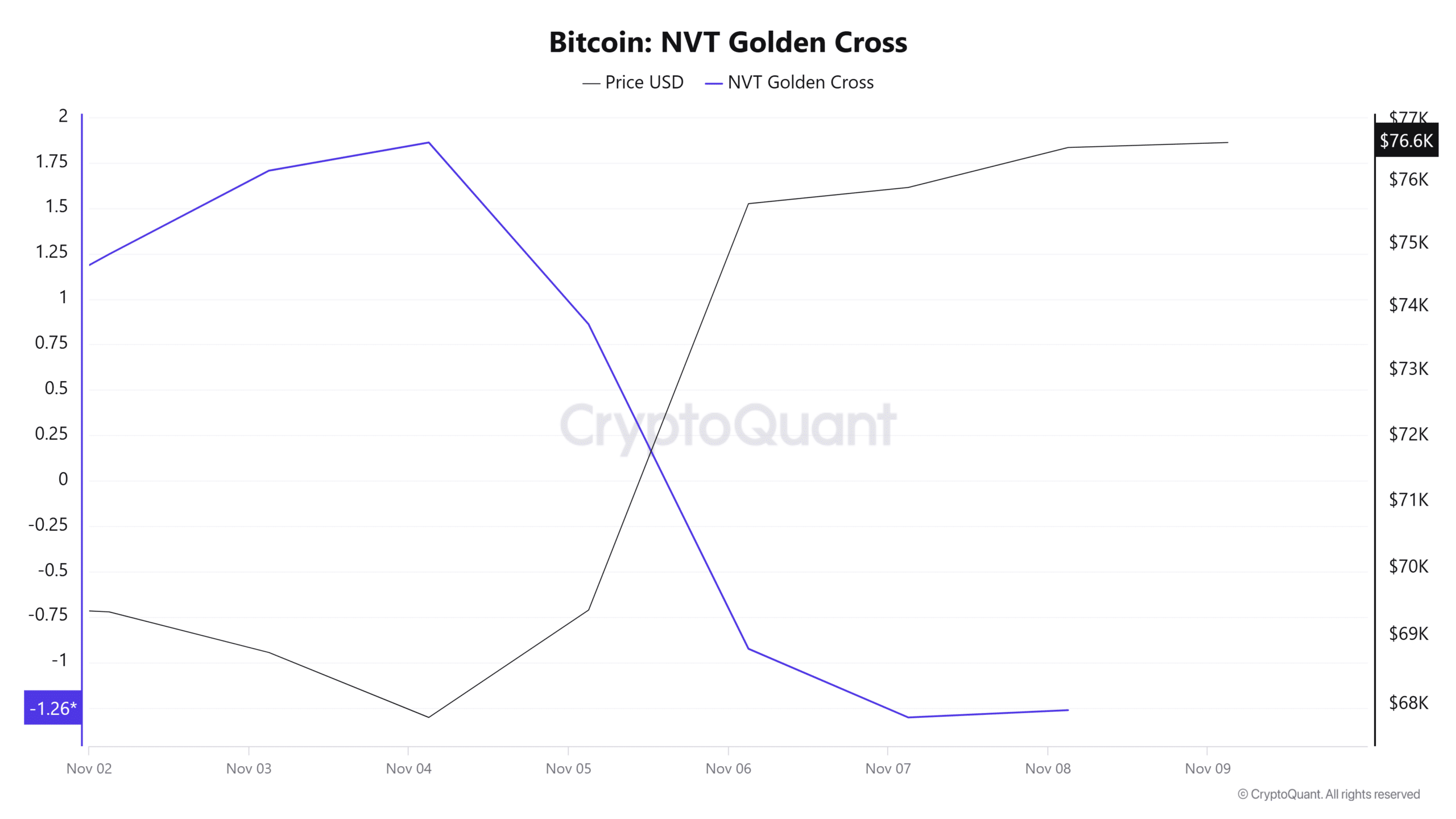

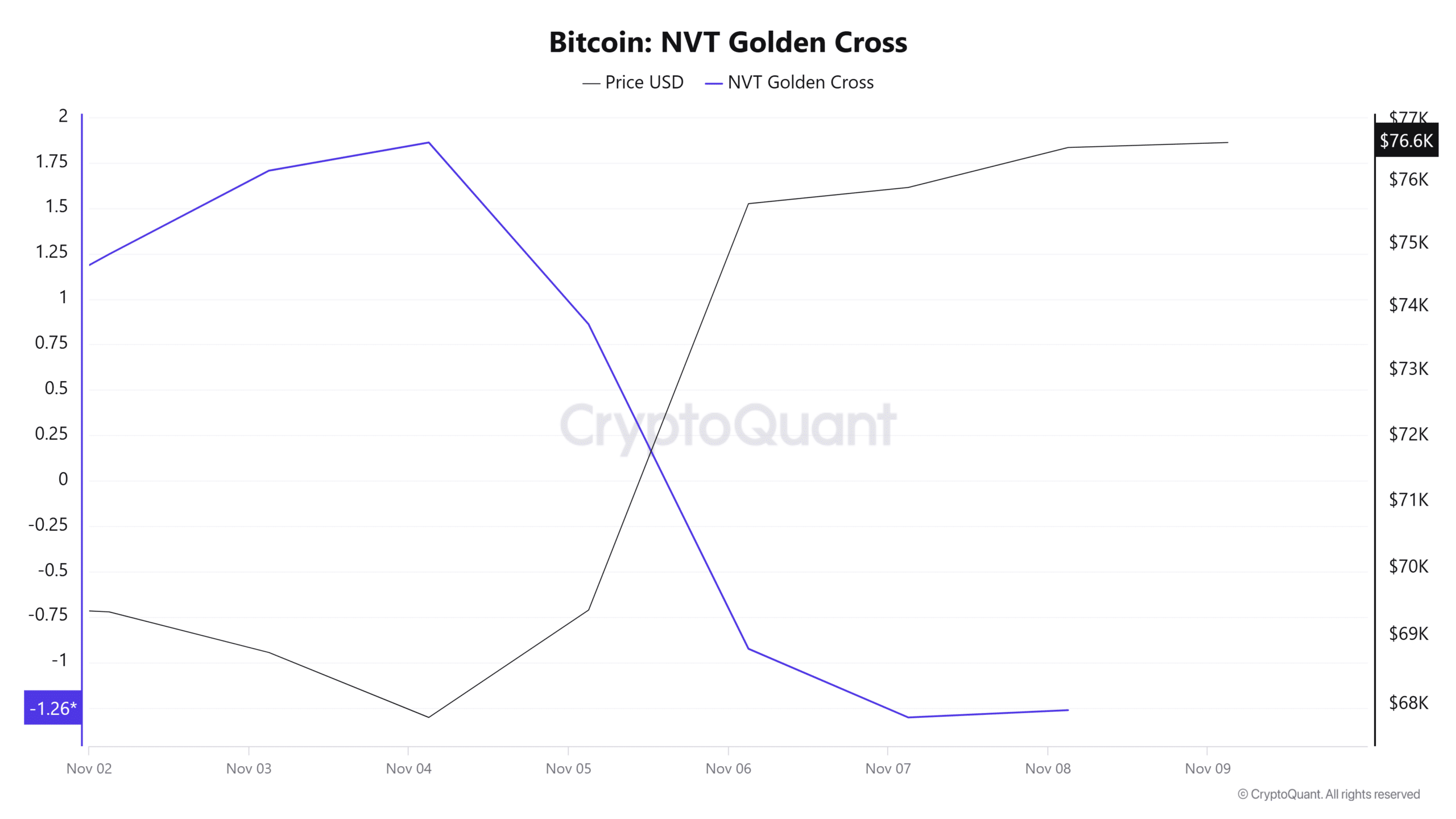

Source: Cryptoquant

This potential unsustainability of the rally seemed to be supported by a declining NVT Golden Cross.

While a golden cross is a bullish signal, a falling NVT Golden cross means that the continued price increase may be driven by speculative investments, rather than strong network usage. So the asset may be overvalued based on network usage.

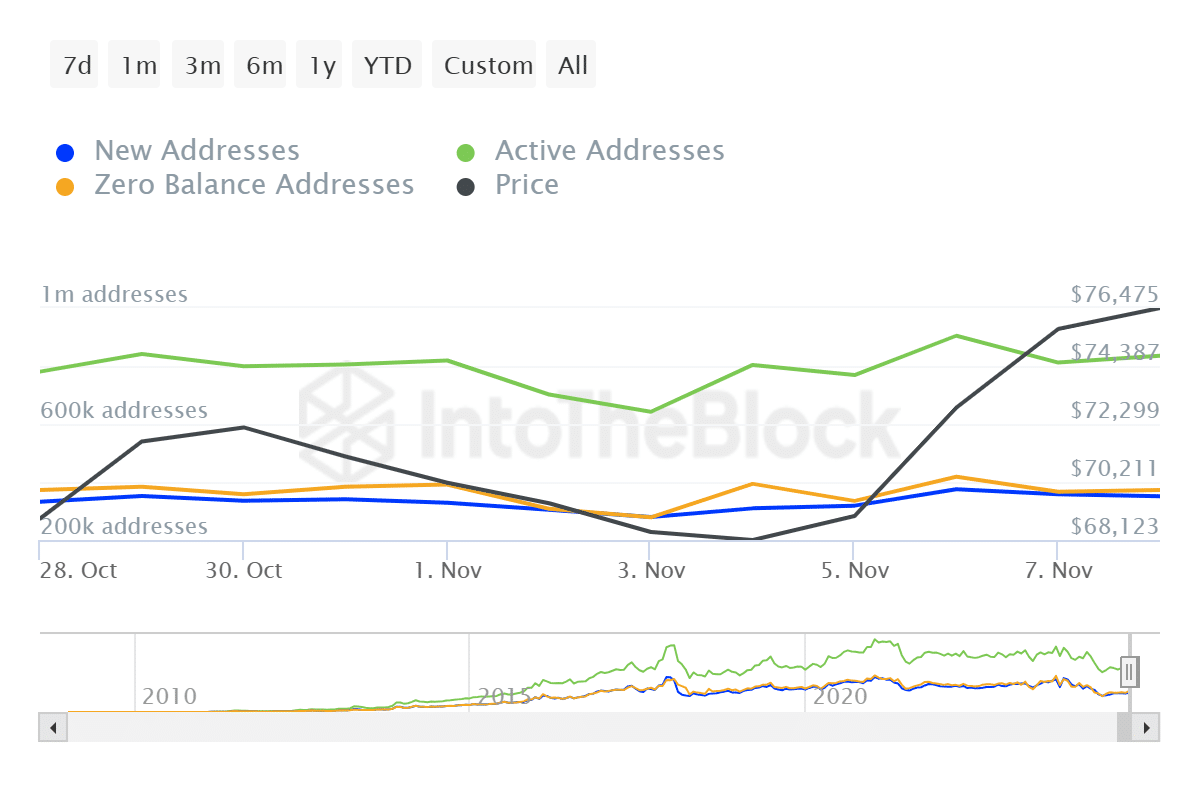

Source: IntoTheBlock

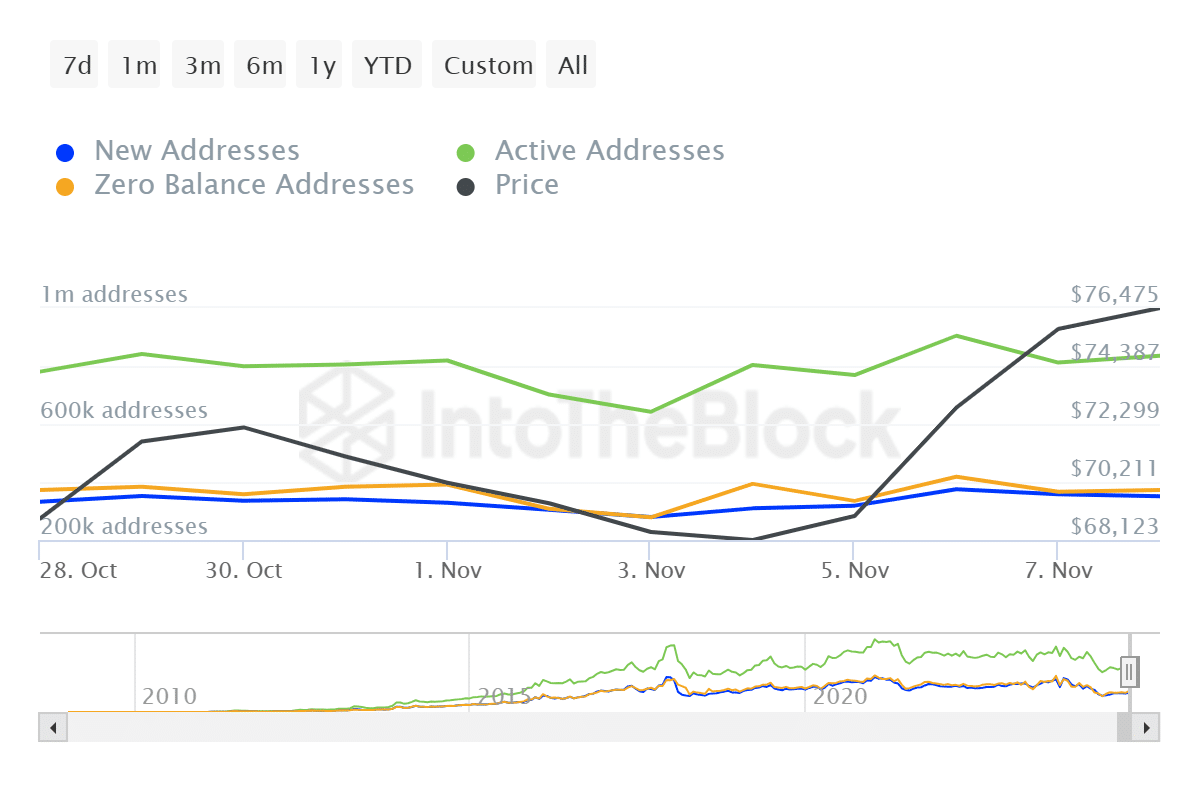

This phenomenon can be further supported by a decrease in the number of active addresses. According to IntoTheBlock, active addresses have dropped to 835k since the peak of 901k.

A decrease in the number of active addresses implies lower usage and lower network participation.

What it means for BTC price charts

Excessive use tends to make the market more sensitive to price changes.

When much of the market is overloaded, even small price drops can trigger a wave of liquidations, leading to sharp sell-offs and high volatility. When this happens, Bitcoin’s price will register a decline to find support around $73,600.