- Transactions on the Bitcoin network are rising to new highs and attracting more mining income.

- Miner earnings also rose to their highest level in six months from May 1.

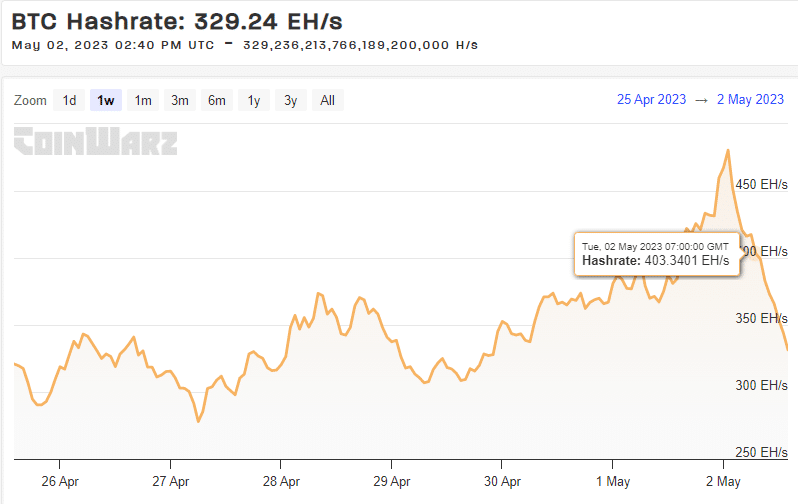

While the world waits for the crypto market to regain some price excitement, something interesting is happening on Bitcoin [BTC] block chain. The hash rate experienced a notable increase that may have something to do with the Bitcoin ordinal numbers.

Is your wallet green? Check out the Bitcoin Profit Calculator

At the time of writing, Bitcoin’s hash rate stood at 473.87 EH/s and has witnessed an increase over the past 24 hours. This observation was significant because it was not only the highest weekly hash rate level, but also the highest on record. The main significance of this observation was that it revealed an increase in miner participation in the market.

Source: CoinWarz

The spike in hash rate was likely due to rising Bitcoin ordinal inscriptions. They have been a major driver of organic transactions on the network other than BTC trading activity. This reflected a recent surge in daily Bitcoin transactions that also hit a new ATH on May 1.

#Bitcoin daily transactions reached an all-time high of 682,281 yesterday.

With ordinal inscriptions emerging, they are likely to play a large part in this increased use. pic.twitter.com/ftutJKSGsD

— Binance (@binance) May 2, 2023

More daily transactions translate into higher miner income. This explains why Bitcoin’s hash rate increased as miners added more hash rate to take advantage of the revenue generating opportunities. Glassnode’s miner income stat confirmed the same.

Source: Glassnode

Assessment of the potential impact on Bitcoin’s price performance

Miner earnings rose to a new six-month high on May 1. If you are like most, you are probably wondering if the Bitcoin ordinal numbers will have an impact on BTC price action. First, the ordinal inscriptions have no direct impact on Bitcoin demand, even though transactions are on the rise. However, they would likely have an impact if Bitcoin miner reserves went up.

A closer look at Bitcoin’s on-chain data confirmed that the number of transactions has increased in recent days. However, the situation is different for mining reserves, which, at the time of writing, had fallen to their lowest level in the past three months.

Source: CryptoQuant

Dwindling miner reserves are usually not considered a healthy sign for the market. This is because it shows a lack of incentive for miners to hold, which aligns with the prevailing market sentiment. The dwindling miner reserves explain the decoupling in the rising demand for Bitcoin ordinal numbers and Bitcoin’s price performance.

How much are 1,10,100 BTC worth today

BTC crashed more than 3% on May 1, the same day the number of transactions and hash rate to new ATHs increased. Bitcoin changed hands at $28,592 at the time of writing after securing some bullish volumes. The price action did not share the same enthusiasm as the hash rate or transactions on the network.