- Despite Bitcoin’s recent rally, 5.1 million addresses remain underwater.

- BTC is up 9.99% in the past week.

Bitcoin [BTC] has experienced a strong rise on the price charts over the past week. Although BTC started September on a negative note, recent gains have offset monthly losses.

At the time of writing, BTC was trading as high as $63,668. This marked an increase of 9.99% in the past week.

It has also made significant gains on the monthly charts, up 6.99%. Since lower lows of $52546 on September 6, the price has recovered from all previous losses.

Despite the recent rebound, Bitcoin still remains significantly below its recent high of $70016 on July 29. That’s why the sudden price move has got analysts talking.

To that extent, IntoTheBlock analysts remain skeptical of the recent rally, citing 5.1 million addresses that remain underwater.

5.1 million BTC addresses remain underwater

Source:

According to In the block, Although BTC is making a strong attempt to break the USD 63,000 resistance, many investors remain at a loss. Based on this analysis, there are 5.1 million addresses that are making a loss at the current market price.

What this simply means is that 5.1 million wallets are holding BTC at a loss, indicating that they purchased at a higher price than current rates. This implies that investments have not yet recovered.

Such a scenario suggests that a significant number of investors are waiting for prices to rise further before breaking even or making a profit. When the market looks like this, investors can either sell at a loss to avoid further losses or hold until they realize the profit.

If they decide to sell, these addresses can create selling pressure. It is possible to sell once they recover their losses, slowing the upward momentum. They can then further anticipate more profits.

The prevailing market sentiment

While the metric highlighted by IntoTheBlock offers reasons to worry about the recent rally, the broader market has shown resilience over the past week.

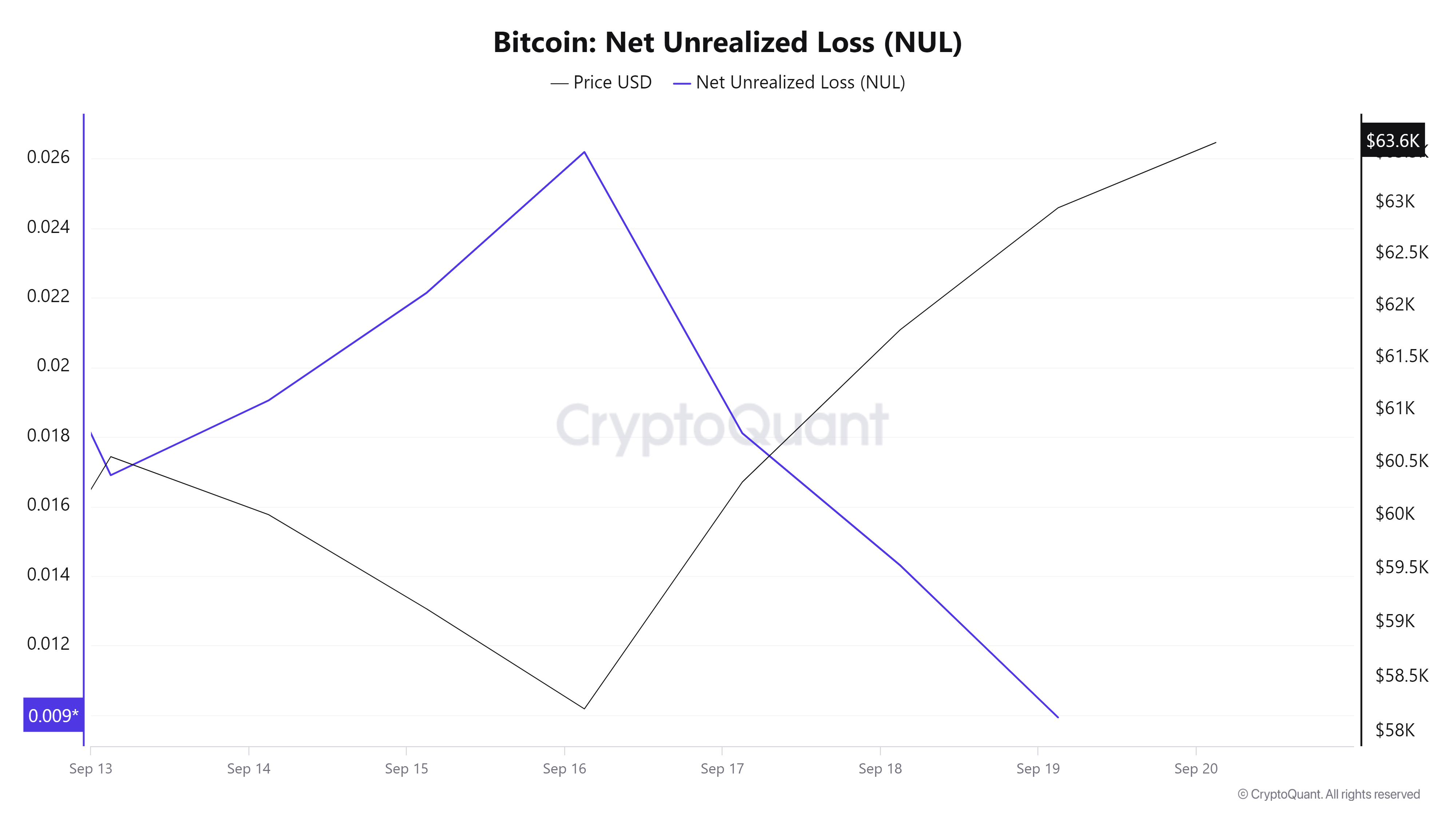

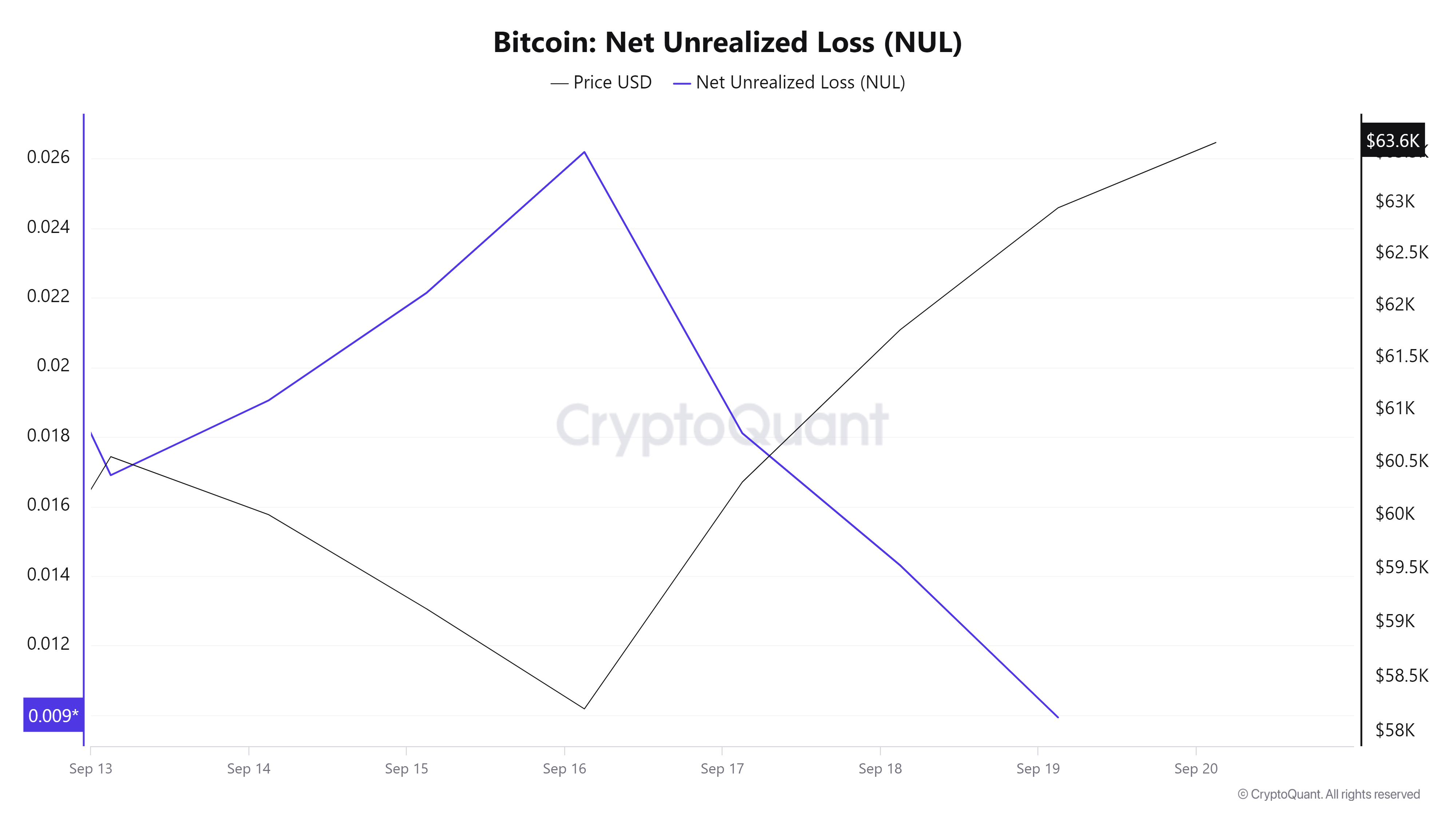

Source: Cryptoquant

During this period, Bitcoin has experienced a significant drop in net unrealized loss. The ZERO has fallen from 0.026 to 0.009. This indicates that the market is recovering and many participants are seeing their positions approaching breakeven or becoming profitable.

This is a bullish sign because the market is shifting from a period of downturn to a period of price recovery, narrowing the gap between current interest rates and purchase prices.

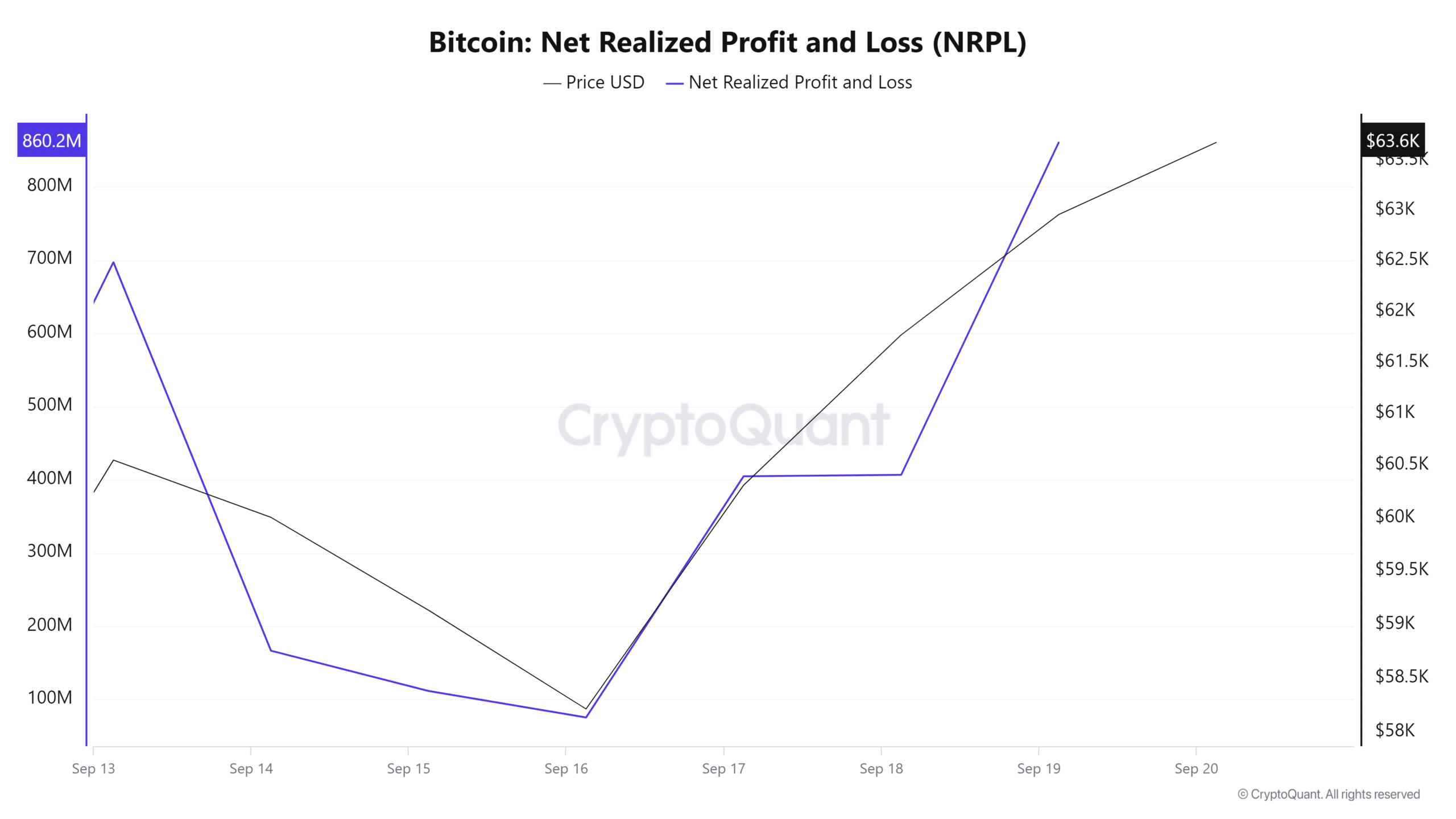

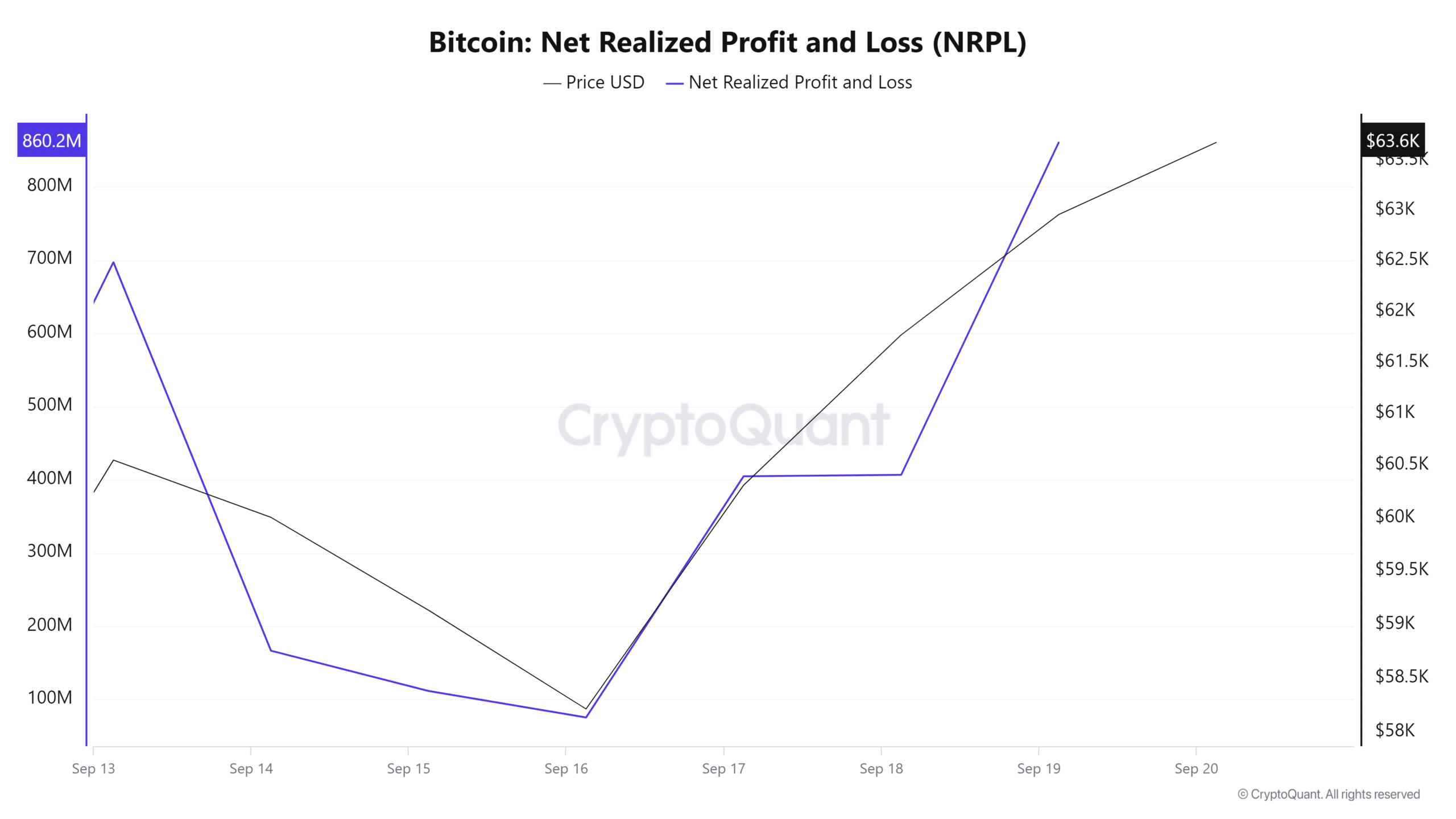

Source: Cryptoquant

Furthermore, Bitcoin’s net realized gain/loss rose from a low of $75.5 million to $860.2 million over the past week.

When the NRPL rises, it reflects positive market sentiment, with a significant number of participants realizing profits. This further strengthens confidence that prices will continue to rise, attracting more buyers.

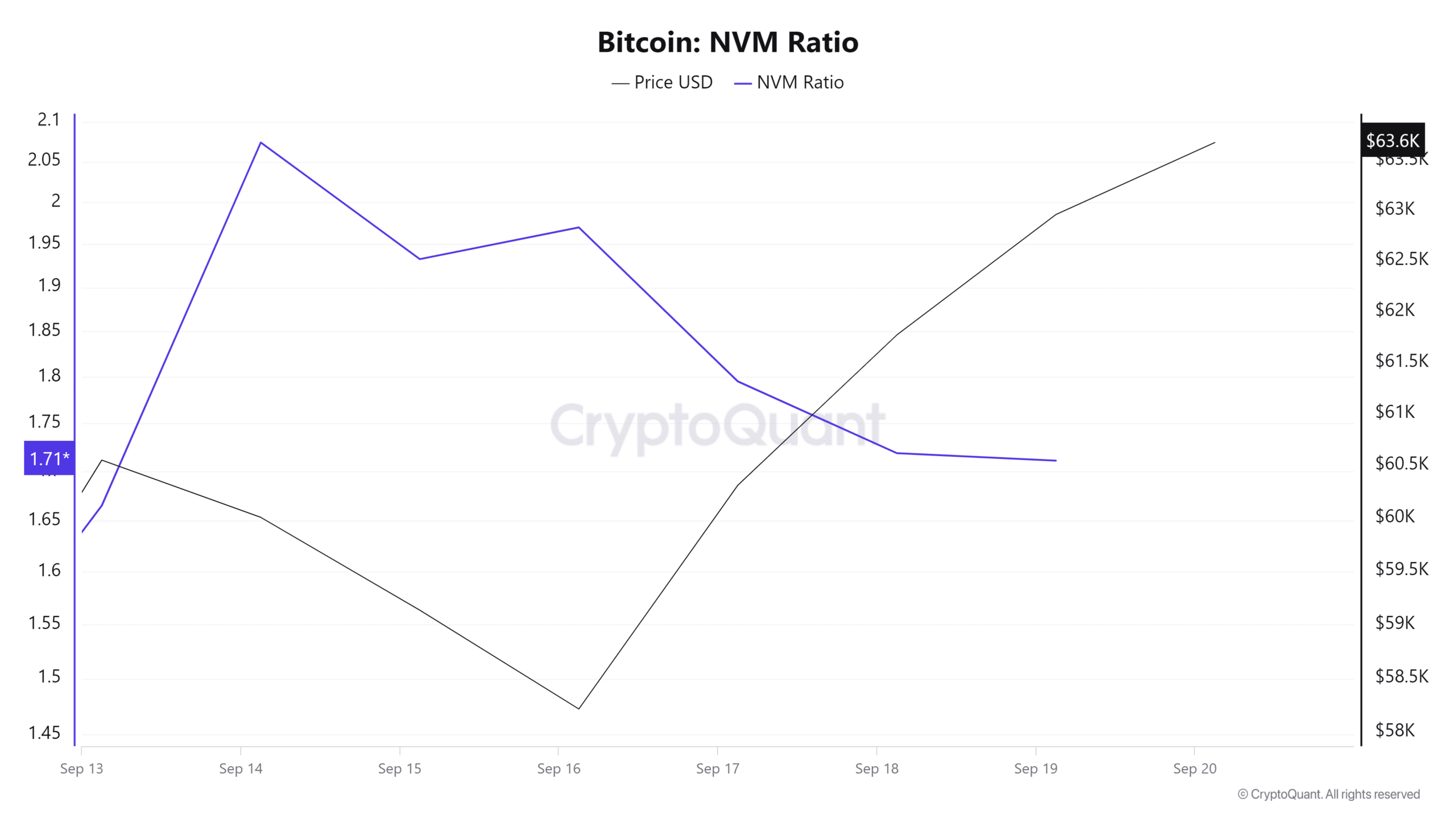

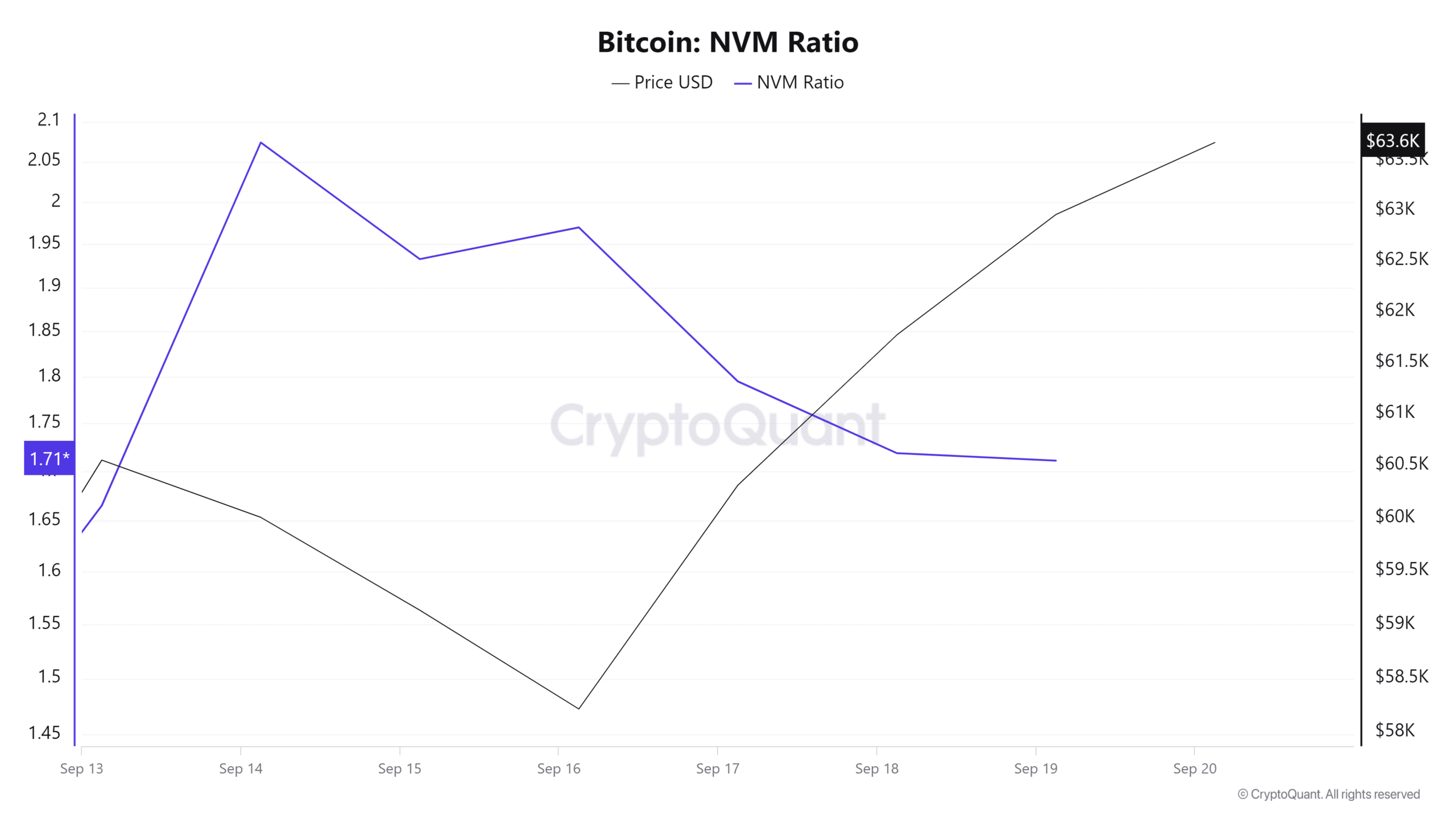

Source: CryptoQuant

Finally, Bitcoin’s NVM ratio has been declining in recent days. This shows that the network is enjoying greater involvement, while the market still has to catch up. This implies that prices have the potential for future price growth.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Simply put, while 5.1 million addresses are still in loss, as observed by IntoTheBlock, BTC market sentiment has shifted from bearish to positive. Therefore, the current market sentiment pushed Bitcoin to make further gains.

Therefore, if prevailing market sentiment holds, BTC will attempt a resistance level at $64727 in the near term.